Market Overview

The USA EV Charging Software market is poised for rapid growth, with a significant increase in electric vehicle (EV) adoption. As of 2025, the market size is estimated to be valued at USD ~ billion, driven by the expansion of electric vehicle infrastructure, government incentives, and technological advancements in software platforms for charging management. The growth is propelled by the increasing demand for efficient, scalable charging solutions that integrate renewable energy, enable real-time billing, and support smart grid functionalities. This surge in adoption of EVs is anticipated to continue, with software solutions becoming central to managing large-scale charging networks, ensuring uptime, and optimizing energy consumption.

The USA remains a dominant force in the EV charging software market, particularly in cities such as San Francisco, Los Angeles, and New York, which are leading the transition towards electric vehicles and smart city infrastructures. California, with its aggressive environmental policies and initiatives like the Zero Emission Vehicle Program, has a heavy concentration of EVs, thus fostering the growth of charging stations and related software. Additionally, states like Texas and Florida are witnessing increasing EV adoption, driven by incentives, expanding charging networks, and favorable government regulations that encourage infrastructure development. These regions are expected to remain dominant due to their progressive adoption of electric vehicles and the continued push for sustainable energy solutions.

Market Segmentation

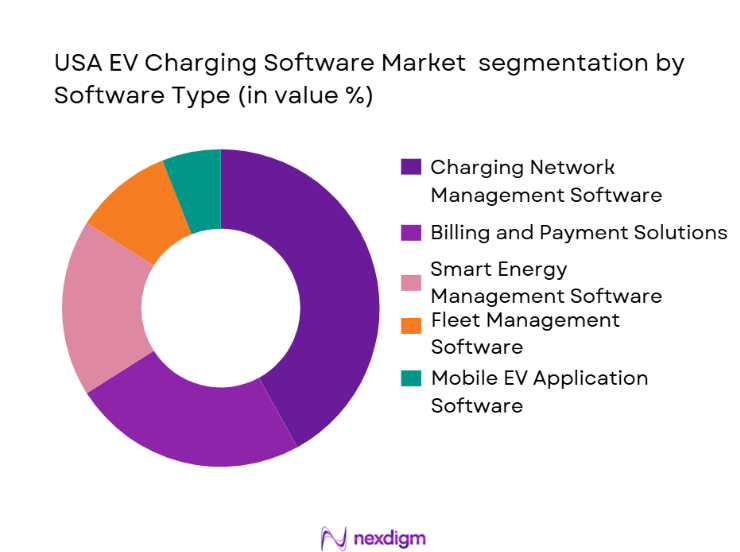

By Software Type

The USA EV Charging Software market is segmented by software type into several key categories: Charging Network Management, Billing & Payment Solutions, Smart Energy Management, Fleet Management, and Mobile EV Application Software. Among these, Charging Network Management Software has emerged as the dominant segment in 2024. This software type allows for real-time monitoring, performance analysis, and remote management of charging stations. As the number of EVs on the road increases, the demand for reliable and scalable charging infrastructure has driven the adoption of network management solutions. These solutions are crucial for ensuring that charging stations operate efficiently, remain online, and handle large volumes of transactions. Companies like ChargePoint and Tesla have significantly bolstered their offerings in this domain, driving the dominance of network management software.

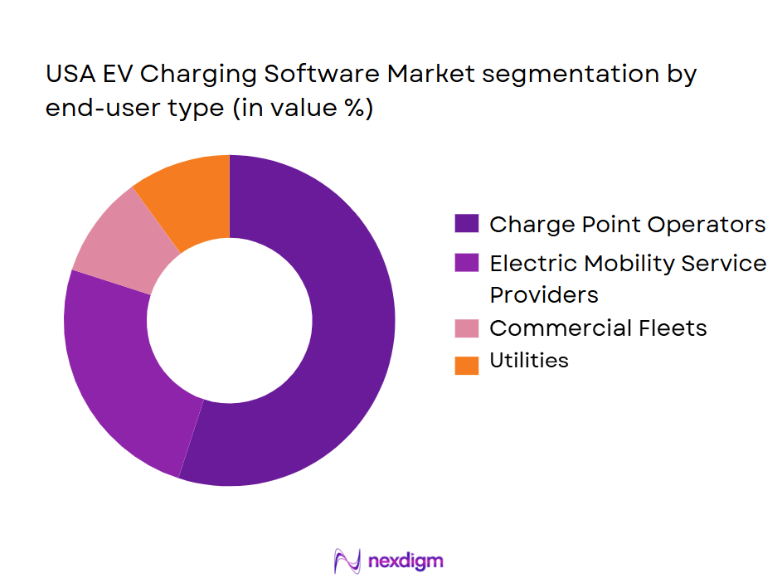

By End-User Type

The USA EV Charging Software market is also segmented by end-user type, which includes Charge Point Operators (CPOs), Electric Mobility Service Providers (EMSPs), Commercial Fleets, and Utilities. Among these, Charge Point Operators (CPOs) represent the largest and fastest-growing segment. As EV infrastructure expands, CPOs are increasingly seeking advanced software solutions to efficiently manage multiple charging stations across various locations. This segment’s dominance is fueled by the growing number of public and private charging stations, which require robust software systems for operations such as load balancing, data tracking, and customer management. CPOs are leveraging these software solutions to provide reliable service and improve user experience, ensuring they stay competitive in the growing EV market.

Competitive Landscape

The USA EV Charging Software market is characterized by significant competition from both established global players and emerging local firms. Dominant players include ChargePoint, Tesla, and EVgo, each offering comprehensive software solutions to manage charging stations and optimize the charging experience. These companies compete primarily based on features like real-time monitoring, user-friendly interfaces, and integration with smart grid technologies.

In addition to these major players, regional firms and startups are making strides by providing tailored solutions for specific industries, such as fleet management and public charging stations. The competition is driven by the need for innovative features, strong customer service, and integration with other smart city infrastructure solutions.

| Company Name | Year Established | Headquarters | Software Type Focus | Market Strategy | Number of Charging Points Managed | Innovation |

| ChargePoint | 2007 | California, USA | ~ | ~ | ~ | ~ |

| Tesla | 2003 | California, USA | ~ | ~ | ~ | ~ |

| EVgo | 2010 | California, USA | ~ | ~ | ~ | ~ |

| Greenlots | 2008 | California, USA | ~ | ~ | ~ | ~ |

| Blink Charging | 2009 | Florida, USA | ~ | ~ | ~ | ~ |

USA EV Charging Software Market Analysis

Growth Drivers

Government Support and Incentives

The U.S. government has been actively supporting the adoption of electric vehicles (EVs) and the expansion of charging infrastructure through various incentives, grants, and policies. Programs like the National Electric Vehicle Infrastructure (NEVI) program and federal tax credits have significantly bolstered the growth of the EV charging software market, making it more attractive for businesses and consumers alike.

Increased EV Adoption

The rapid growth of electric vehicle sales, driven by both consumer demand for eco-friendly alternatives and increasing environmental concerns, is a key driver for the EV charging software market. As the number of EVs on the road grows, so does the need for scalable, reliable, and efficient charging solutions, which directly impacts the demand for software to manage these networks.

Market Challenges

Fragmentation of Charging Networks

The U.S. market faces challenges with a fragmented network of EV chargers, where multiple charging stations are not always compatible with one another. This lack of standardization complicates the software management and integration processes for consumers and businesses alike, hindering overall market growth.

High Capital and Operational Costs

The cost of installing and maintaining EV charging stations, coupled with the ongoing development of charging management software, represents a significant financial burden for many operators. The high initial investment costs, along with ongoing operational expenses, remain a challenge for many businesses trying to expand their charging infrastructure.

Opportunities

Integration with Smart Grid Technology

The integration of EV charging stations with smart grid systems presents a significant opportunity for the software market. By leveraging smart energy management and vehicle-to-grid (V2G) technologies, EV charging software can play a critical role in balancing grid demand, supporting renewable energy sources, and enhancing overall grid efficiency.

Fleet Electrification

The electrification of commercial fleets presents a rapidly growing opportunity for EV charging software. With businesses transitioning to electric fleets for environmental and cost-saving benefits, there is an increasing need for software solutions to manage large-scale charging operations, optimize energy use, and ensure the seamless operation of fleet charging networks.

Future Outlook

Over the next 5 years, the USA EV Charging Software market is expected to witness substantial growth, driven by the ongoing expansion of electric vehicle adoption and increasing demand for charging infrastructure. Government incentives, coupled with technological advancements in EV charging software, will continue to enhance the market’s evolution. The rise of electric mobility fleets, growing integration with smart grid systems, and the shift towards sustainable energy solutions will provide a strong foundation for the market’s future growth. Additionally, the development of high-speed, ultra-fast charging networks is likely to become a focal point for software developers, who will need to ensure that charging stations are efficient, user-friendly, and seamlessly integrated into larger urban infrastructure systems.

Major Players

- ChargePoint

- Tesla

- EVgo

- Greenlots

- Blink Charging

- Siemens AG

- ABB Ltd.

- Shell Recharge Solutions

- Enel X

- Ionity

- Volta Charging

- Driivz

- Monta

- Flow

- Allego

Key Target Audience

- Electric Vehicle Manufacturers

- Charge Point Operators (CPOs)

- Electric Mobility Service Providers (EMSPs)

- Commercial Fleet Operators

- Energy and Utility Companies

- Government and Regulatory Bodies (e.g., U.S. Department of Energy, Federal Energy Regulatory Commission)

- Investments and Venture Capitalist Firms

- Automotive Dealerships and OEMs

Research Methodology

Step 1: Identification of Key Variables

The initial step involves creating an ecosystem map of the key stakeholders in the USA EV Charging Software market. This is achieved by gathering information through secondary research, including industry reports, regulatory publications, and financial disclosures. The goal is to identify critical factors influencing market dynamics, including technological advancements, consumer demand, and government regulations.

Step 2: Market Analysis and Construction

In this phase, historical data on EV adoption, charging infrastructure, and software adoption trends are analyzed to assess current and future market conditions. Market penetration, service providers, and revenue generation models are evaluated to construct a reliable market projection.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts via surveys and interviews. These consultations will provide insights into operational challenges, adoption barriers, and technological innovations, which will refine the preliminary market estimates.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data gathered through the previous steps and cross-referencing with real-time data obtained from EV charging software vendors and end-users. This process ensures a complete, validated understanding of the USA EV Charging Software market, incorporating both quantitative and qualitative insights.

- Executive Summary

- Research Methodology (Market Definitions & Taxonomy, Data Sources & Validation Approach, TAM/SAM/SOM Calibration Method, Forecasting Models, Assumptions and Limitations)

- Definition and Scope

- Industry Genesis & Evolution

- DemandSupply Dynamics

- Charging Ecosystem Architecture

- Value Chain & Stakeholder Map

- Technology Stack Overview

- Growth Drivers

EV Penetration & Federal Incentives

Network Efficiency & Uptime Requirements

Smart Grid Integration Demand

Monetization Imperatives

Standardization & Interoperability Pull - Market Restraints

Heterogeneous Protocols & Legacy Integrations

Data Security & User Privacy Concerns

Cost of Integration & Customization

Fragmented CPO & EMSP Landscape - Market Opportunities

Fleet Electrification & Depot Solutions

AI Predictive Maintenance & Usage Forecasting

Distributed Energy Resources & V2G Enablement

Subscription & SaaS Monetization Models - Market Trends & Technological Shifts

AI & Machine Learning for Load Optimization

CloudNative Platforms & Edge Computing

API Ecosystems & Open Protocol Adoption

Dynamic Pricing & RealTime Billing

Data Analytics for Utilization & Forecasting - Regulatory, Standards & Policy Landscape

Federal EV Charging Policy Impact

State EV Tariff & Net Metering Policies

Cybersecurity & Data Governance

Compliance

- Market Size — Revenue by Software Type 2019-2025

- Installed Base 2019-2025

- Average Software ASP & Subscription Metrics 2019-2025

- Market Growth Trajectory 2019-2025

- Software Type (In Value%)

Charging Network Management Software

Billing and Payment Management Software

Smart Energy Management Software

Fleet and Depot Management Software

Mobile EV Application Software - Deployment Model (In Value%)

CloudHosted Software

OnPremise Software

Hybrid Software Deployment - End User (In Value%)

Charge Point Operators

Electric Mobility Service Providers

Commercial Fleets

Utilities

Residential Portfolio Owners - Charging Level Supported (In Value%)

Level 2 (AC) Charging

DC Fast Charging

Ultra-Fast Charging (350kW and above) - Feature Functionality (In Value%)

Remote Diagnostics

Dynamic Load Balancing

Vehicle-to-Grid (V2G) Integration

Roaming and Interoperability (Cross-Network Charging)

Real-Time Billing and Pricing

- Market Share by Value Managed

- Competitive Intensity & Maturity Mapping

- Innovation Index (Feature Depth, AI Integration, Roaming Support)

- CrossComparison Parameters (Software Revenue & Growth Rate, Annual Recurring Revenue, Platform Modules, Charging Points Connected / Managed, Cloud vs OnPremise Footprint, API & Protocol Support, Strategic Partnerships, Unique Value Proposition / Differentiators)

- Major Players

ChargePoint

EV Connect

AMPECO

Driivz

Greenlots (Shell)

Virta

Blink Charging

FLO Services USA

ChargeLab

NovaCHARGE

Monta

Siemens eMobility Software

ABB EV Charging Software

Tesla Charging / App Software

Eaton / PredictEV - Pricing & Commercial Models

Pricing Tiers & Bundling

UsageBased vs Subscription Models

Enterprise Contracts & SLA Terms

Value Metrics for Customers - Integration & Deployment Case Studies

MultiSite CPO Implementation

Fleet Electrification Management

UtilityIntegrated Smart Charging

Public FastCharging Network Orchestration

- EV Driver Charging Preferences & Frequency

- Willingness to Pay & Pricing Elasticity

- Enterprise Buyer Needs

- Decision Process for Site Hosts

- Market Revenue Forecast 2026-2030

- Fleet & Commercial Segment Forecast 2026-2030

- Residential & Small Business Segment Forecast 2026-2030

- Feature & Module Adoption Forecast 2026-2030