Market Overview

The USA Exhaust Systems Market is valued at close to USD ~ billion in the latest base year, with leading research also reporting recent annual revenues around USD ~ billion depending on scope and methodology. This positioning reflects robust recovery in light-vehicle sales, which climbed to about ~ million units nationally, alongside strong hybrid uptake of nearly ~ million vehicles, both of which sustain demand for advanced catalytic converters, DPFs, GPFs and muffler systems under increasingly stringent EPA and state emission standards.

The market is anchored by a dense automotive manufacturing belt in Michigan, Ohio and Tennessee, where major OEM assembly plants and Tier-1 suppliers concentrate exhaust system sourcing, engineering and validation activities. The West region, led by California, exerts outsized influence because California’s LEV III and Advanced Clean Cars regulations impose some of the world’s toughest tailpipe and durability norms, forcing rapid adoption of high-loading three-way catalysts, SCR and GPF technologies. Together, these regions drive both OEM fitment volumes and premium content per vehicle in the USA Exhaust Systems Market.

Market Segmentation

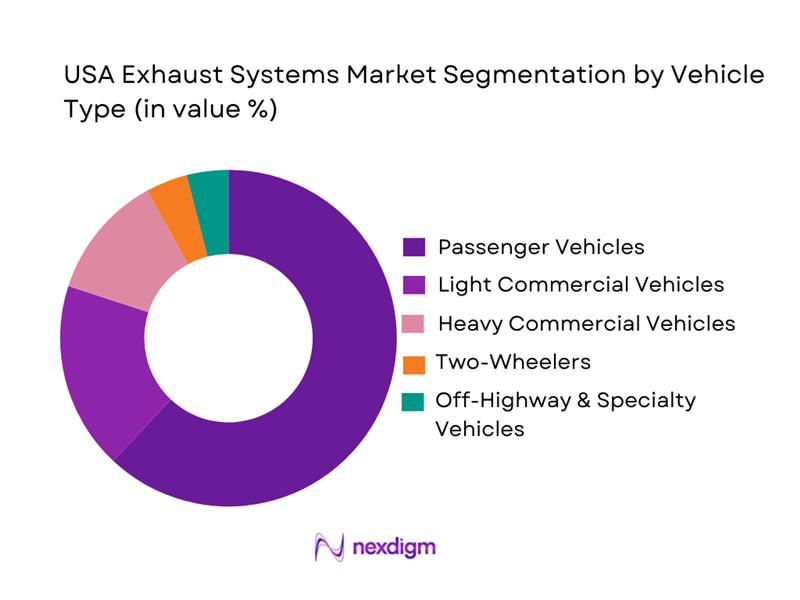

By Vehicle Type

The USA Exhaust Systems Market is segmented by vehicle type into passenger vehicles, light commercial vehicles, heavy commercial vehicles, two-wheelers, and off-highway & specialty vehicles. Passenger vehicles currently dominate revenue in the USA Exhaust Systems Market because they account for the bulk of new light-duty sales—around 15–16 million units annually—supported by strong SUV and crossover penetration. Many of these models still rely on gasoline engines that must comply with Tier 3 and California LEV III exhaust and fuel-sulfur limits, driving high per-vehicle content in catalytic converters, GPFs and mufflers. Rapid growth in hybrid powertrains, which retain internal-combustion engines and thus full exhaust systems, further consolidates passenger vehicles’ leadership within the USA Exhaust Systems Market, even as battery-electric models start to erode long-term ICE volumes.

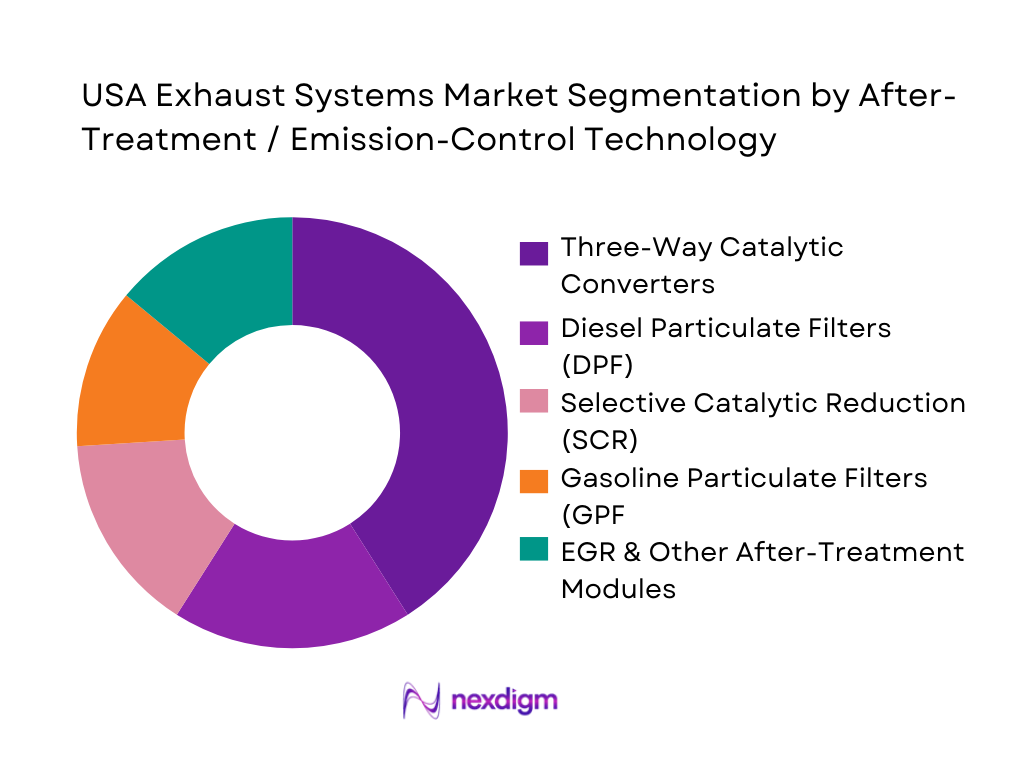

By After-Treatment / Emission-Control Technology

The USA Exhaust Systems Market is led by three-way catalytic converters, followed by DPF, SCR, GPF and EGR-linked modules. Catalytic converters alone account for about 41% of exhaust revenue in the country, reflecting universal fitment on gasoline cars and light trucks to meet federal and California criteria pollutant standards. The spread of Tier 3 and LEV III frameworks, which tighten NOx, NMOG and particulate limits while extending durability to 150,000 miles, forces higher precious-metal loadings, more complex substrates and closer-coupled converter designs, lifting value per system. Meanwhile, DPF and SCR remain critical in heavy-duty and diesel segments, and GPF adoption rises in turbocharged gasoline direct-injection models, but none yet match the sheer installed base of three-way converters in the USA Exhaust Systems Market.

Competitive Landscape

The USA Exhaust Systems Market is moderately concentrated, with a handful of global Tier-1 suppliers and specialized after-treatment players dominating OEM fitment and premium aftermarket channels. Companies such as Tenneco, FORVIA / Faurecia, Purem by Eberspächer, BOSAL and Sejong Industrial leverage deep relationships with Detroit-based and transplant OEMs, broad North American manufacturing footprints, and strong portfolios in SCR, DPF, GPF and acoustic systems. Competitive intensity is shaped by the need to meet EPA and CARB regulations, manage platinum-group metal cost volatility, and support bespoke exhaust architectures for SUVs, pickups and hybrid platforms.

| Company | Establishment Year | Headquarters City / Country | Core US Exhaust Portfolio Focus | Key US OEM / Channel Focus | US Footprint / Capability Highlights | After-Treatment / Technology Strength | Recent Strategic Themes in Exhaust & Emissions |

| Tenneco Inc. | 1940s | Lake Forest, USA | ~ | ~ | ~ | ~ | ~ |

| FORVIA / Faurecia | 1990s (group) | Nanterre, France | ~ | ~ | ~ | ~ | ~ |

| Purem by Eberspächer | 1865 | Esslingen, Germany | ~ | ~ | ~ | ~ | ~ |

| BOSAL Group | 1923 | Brussels, Belgium | ~ | ~ | ~ | ~ | ~ |

| Sejong Industrial / Sejong Georgia | 1976 | Gyeongsangbuk-do, South Korea | ~ | ~ | ~ | ~ | ~ |

USA Exhaust Systems Market Analysis

Growth Drivers

Vehicle Parc Expansion

The USA exhaust systems market is anchored by a large and growing internal-combustion vehicle parc. Federal Highway Administration data show 282,174,766 registered motor vehicles in the country, rising to 284,614,269 in the next year, including over 259 million automobiles and trucks that rely on exhaust and after-treatment hardware for daily operation. Robust macroeconomic activity also sustains vehicle usage, with U.S. GDP reaching USD ~ trillion in current terms. High ICE utilisation is reflected in fuel demand: Americans consumed ~ billion gallons of motor gasoline in one recent year, averaging about 369 million gallons per day and increasing to around 376 million gallons per day the following year. This combination of nearly 285 million vehicles, strong economic output, and sustained gasoline demand directly translates into replacement, upgrade, and compliance opportunities for exhaust system suppliers across OEM and aftermarket channels.

Fleet Aging, Miles Driven

An aging vehicle parc and high annual travel intensify demand for exhaust maintenance and replacement. According to federal travel statistics cited by the Eno Center for Transportation, U.S. drivers logged about ~ trillion vehicle-miles of travel in one recent year, with U.S. Department of Transportation preliminary data showing 3.28 trillion miles the following year—both above pre-pandemic levels (Eno/BTS; Reuters citing DOT). At the same time, the average age of light vehicles on U.S. roads has reached 12.6 years, with roughly 70% of vehicles older than six years and more than 122 million vehicles older than twelve years, according to data reported by the Associated Press based on national registration files (AP vehicle age report). Higher mileage on older vehicles typically increases failure rates for mufflers, pipes, catalytic converters, diesel after-treatment units, hangers, and sensors, underpinning a structurally high baseline for exhaust aftermarket revenues.

Market Challenges

Raw Material & Precious Metal Volatility

Exhaust systems—especially catalytic converters and diesel after-treatment units—are heavily exposed to platinum-group metal volatility. U.S. Geological Survey data show the average London PM palladium price at about $2,134 per troy ounce in one recent year, dropping to roughly $1,500 per ounce the next; rhodium averaged about $14,800 per ounce before falling to around $6,150 per ounce over the same period (USGS PGM Mineral Commodity Summary). These multi-hundred-dollar swings per ounce complicate costed BOMs for catalysts that can contain grams of platinum, palladium, and rhodium per vehicle. At the same time, U.S. refiners recovered around 42,000 kilograms of palladium and 9,000 kilograms of platinum from autocatalyst scrap, underscoring the material intensity of installed exhaust hardware and driving OEMs and Tier-1s to continuously redesign washcoat loadings, substrate volumes, and recycling strategies to manage cost risk while meeting tightening emission standards.

Stringent EPA/CARB Approvals

Regulatory certification is a structural hurdle for exhaust suppliers, with every vehicle test group requiring EPA Certificates of Conformity and, for many nameplates, separate California Air Resources Board (CARB) approvals. EPA documentation notes that every class of light-duty vehicle sold in the U.S. must hold a certificate valid for a single model year, supported by emissions test data and durability demonstrations. CARB regulations for low-emission and zero-emission vehicles in Title 13 of the California Code of Regulations impose additional requirements on test procedures and engine family limits, often driving more aggressive exhaust layouts than federal baselines. Compliance failures can be costly: in a recent enforcement action, a major U.S. automaker agreed to pay USD 145.8 million in penalties and surrender 50 million metric tons of carbon allowances after federal regulators found excess CO₂ emissions from about 5.9 million vehicles, highlighting how misreported performance against certification limits can trigger large financial exposure.

Opportunities

Lightweighting & Advanced Materials

Lightweighting offers exhaust suppliers a major opportunity to help OEMs meet fuel-economy and CO₂ targets while managing material cost risk. The transportation sector accounts for a substantial share of U.S. greenhouse gas emissions, with EPA estimating its contribution at about 28% of national totals in 2022. Reducing vehicle mass enhances fuel economy and lowers emissions per mile, creating demand for thinner-gauge stainless steels, high-strength alloys, and compact catalyst substrates in exhaust lines. At the same time, USGS data show that U.S. refiners recovered about 42,000 kilograms of palladium and 9,000 kilograms of platinum from autocatalyst scrap in one recent year, highlighting the high material intensity of current converter designs and the potential value unlocked by lower PGM loadings and advanced washcoat formulations (USGS PGM summary). By combining lightweight stainless systems, underbody integration, and more efficient use of precious metals, exhaust suppliers can support OEM CO₂-reduction strategies while improving total cost of ownership for fleets that collectively drive more than 3.2 trillion miles annually on U.S. roads.

Integrated Thermal & Emissions Management

Integrated thermal and emissions management across powertrain and exhaust lines is another promising growth vector. EIA data show that the U.S. consumes around ~ million barrels per day of finished motor gasoline and nearly ~ million barrels per day of distillate fuel in recent reporting periods. Every barrel burned passes through exhaust after-treatment systems that must achieve ultra-low NOx and PM at cold-start and under transient load. EPA’s new Phase 3 greenhouse gas standards for heavy-duty vehicles, along with updated multi-pollutant standards for light-duty vehicles, formalise future compliance trajectories that will require tighter integration between engine controls, exhaust heat management, and after-treatment configuration. Suppliers that can offer complete exhaust-thermal systems—combining close-coupled catalysts, electrically heated catalysts, active thermal management, and optimised under-floor SCR or GPF layouts—are positioned to capture higher content per vehicle. This is especially true in segments such as long-haul trucks and high-output gasoline SUVs that contribute disproportionately to fuel consumption and emissions within the roughly ~ million vehicles operating in the U.S.

Future Outlook

Over the next several years, the USA Exhaust Systems Market is expected to expand steadily as internal-combustion and hybrid vehicles continue to dominate the on-road fleet, even while pure battery-electric penetration increases. The US automotive exhaust systems market to grow from about USD ~ billion in recent revenues to around USD ~ billion by 2030, reflecting a CAGR of roughly 6.1% from 2024 to 2030.

Growth will be underpinned by cumulative light-vehicle sales staying near or above mid-teen million units, hybrid volumes rising, and regulatory pressure from EPA Tier 3 and CARB LEV III demanding more complex and durable after-treatment architectures. At the same time, increasing plug-in and battery-electric vehicle penetration, volatility in platinum-group metal prices, and possible reforms to federal fuel-economy and GHG rules will shape medium-term exhaust demand. Suppliers that pivot toward lightweight materials, low-NOx heavy-duty systems, hybrid-optimized exhaust and smart, sensor-rich architectures are likely to capture disproportionate value in the evolving USA Exhaust Systems Market.

Major Players

- FORVIA / Faurecia

- Purem by Eberspächer

- BOSAL Group

- Futaba Industrial Co., Ltd.

- Yutaka Giken Co., Ltd.

- Sejong Industrial Co., Ltd.

- Magna International

- Katcon Global

- AP Exhaust Technologies

- Auto-jet Muffler Corporation

- Benteler Automotive

- Continental AG

- Marelli

- Sango Co., Ltd.

Key Target Audience

- Global and regional light-vehicle OEMs

- Commercial vehicle and off-highway OEMs

- Tier-1 exhaust and after-treatment system suppliers

- Performance and replacement aftermarket brands & distributors

- Investments and venture capitalist firms

- Government and regulatory bodies

- Steel, specialty alloy and catalyst material suppliers

- Fleet operators and mobility service providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the full ecosystem of the USA Exhaust Systems Market, covering OEMs, Tier-1 suppliers, aftermarket distributors, material suppliers, regulators and fleets. This is supported by extensive desk research using premium databases, regulatory sources and trade statistics to identify critical variables such as vehicle production, parc age, emission standards, after-treatment penetration, material pricing and aftermarket replacement cycles.

Step 2: Market Analysis and Construction

Next, historical revenue streams for the USA Exhaust Systems Market are compiled, segmented by vehicle type, technology (DOC, DPF, GPF, SCR, three-way catalysts), fuel type and sales channel (OEM vs aftermarket). This phase integrates light-vehicle sales, hybrid penetration, heavy-duty registrations and replacement rates to construct a bottom-up market model, cross-checked with top-down benchmarks from leading research houses and company disclosures to ensure internal consistency.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on growth drivers, technology mix, pricing and regional demand are validated through structured interviews with exhaust system engineers, product managers, procurement heads at OEMs, aftermarket category leads and regulatory experts. These discussions, conducted via CATI and online consultations, provide granular insights on platform-level exhaust content, material choices, emission-compliance strategies and expected shifts toward hybrid and BEV architectures in the USA Exhaust Systems Market.

Step 4: Research Synthesis and Final Output

Finally, quantitative and qualitative insights are synthesized into a cohesive narrative, detailing segment-level forecasts, technology roadmaps, competitive positioning and risk scenarios. Direct triangulation with multiple Tier-1 suppliers and OEM sourcing teams is used to refine revenue estimates and validate penetration assumptions. The result is a rigorous, decision-ready view of the USA Exhaust Systems Market, with clear implications for capacity planning, product development, M&A and strategic partnerships.

- Executive Summary

- Research Methodology (Market Definitions & System Boundary – Engine-to-Tailpipe, Vehicle Class Taxonomy, Data Triangulation Approach, Content-per-Vehicle & Penetration Modeling, Replacement Cycle Modeling, Primary Expert Interviews, Secondary Data Sources & Benchmarks, Forecasting Framework, Scenario Assumptions, Limitations)

- Definition and Scope of Exhaust Systems

- Exhaust Systems within USA Powertrain & Emissions Ecosystem

- Industry Structure – OEM, Tier-1, Tier-2, Performance Aftermarket

- Business Models – Build-to-Print vs Co-Development vs Aftermarket Brands

- Supply Chain and Value Chain Mapping (Raw Materials to Scrap & Recycling)

- Regulatory Landscape – Federal and State Emissions, OBD, GHG & NVH Norms

- Growth Drivers

Vehicle Parc Expansion

Fleet Aging, Miles Driven

Emission Norm Tightening

Inspection Programs

Diesel & GDI Mix - Market Challenges

Raw Material & Precious Metal Volatility

Stringent EPA/CARB Approvals

Warranty & Liability Exposure

Counterfeit & Low-Cost Imports

OEM Sourcing Consolidation - Opportunities

Lightweighting & Advanced Materials

Integrated Thermal & Emissions Management

Retrofit Programs

Hydrogen & Fuel-Cell Exhaust

Smart/Active Exhaust Valves - Trends

Downsized Turbo Engines

GDI and GPF Uptake

Cold-Start Emissions Focus

Underbody Packaging Constraints with Batteries

Dealer-to-Online Shift in Aftermarket - Regulatory and Standards Mapping

- Market-Level SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- Pricing and Margin Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By OEM vs Aftermarket, 2019-2024

- By Light Vehicle vs Commercial Vehicle, 2019-2024

- By Vehicle Type (in Value %)

Passenger Cars

SUVs & Crossovers

Pickup Trucks & Full-Size Light Trucks

Vans & Minivans

Medium-Duty Trucks - By Fuel & Powertrain Type (in Value %)

Gasoline

Diesel

Flex-Fuel and Biofuel-Compatible

CNG / LPG

Hybrid-Electric (HEV) - By Exhaust Aftertreatment Technology (in Value %)

Three-Way Catalytic Converters

Diesel Oxidation Catalysts (DOC)

Diesel Particulate Filters (DPF)

Selective Catalytic Reduction (SCR) Systems

Gasoline Particulate Filters (GPF) - By Component and Module (in Value %)

Exhaust Manifolds and Integrated Manifold-Converters

Catalytic Converters

DPF / GPF Canisters

Mufflers & Silencers

Resonators & Tailpipes / Tips

Oxygen / Lambda Sensors, NOx Sensors - By Material and Substrate (in Value %)

Stainless Steel Grades

Aluminized Steel and Mild Steel

High-Nickel and Specialty Alloys

Ceramic Substrates

Metallic Substrates and Foils - By Sales Channel (in Value %)

OEM / Factory-Fill

OES / Dealer Networks

Independent Aftermarket

Performance & Tuning Aftermarket Specialists

Online Marketplaces and eRetail - By Region within USA (in Value %)

Northeast

Midwest

South

West

- Market Share of Major Players

- Cross Comparison Parameters for Major Players (Company Overview, Exhaust & Aftertreatment Technology Portfolio by Vehicle Class, Emission Norm Coverage in USA Light and Heavy-Duty Segments, US Manufacturing and Assembly Footprint, Key OEM Platforms and Aftermarket Customer Base, Content-per-Vehicle and Program Wins, R&D Intensity & Patents in Exhaust / Aftertreatment, Distribution & Service Network Strength, Sustainability & Recycling Initiatives)

- Competitive Strategy and Positioning Analysis

- Market-Level Competitive Benchmarking

- Detailed Profiles of Major Companies

Tenneco

Faurecia

Eberspächer Exhaust Technology

BOSAL Group

BENTELER Automotive

Friedrich Boysen GmbH & Co. KG

Sejong Industrial

Yutaka Giken Company Limited

Sango Co., Ltd.

Futaba Industrial Co., Ltd.

MagnaFlow

Borla Performance Industries

Johnson Matthey

Umicore – Automotive Catalysts

- OEM Customer Analysis

- Aftermarket Customer Analysis

- End-User Needs, Desires and Pain Point Analysis

- Purchasing Power and Budget Allocation

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By OEM vs Aftermarket, 2025-2030

- By Light Vehicle vs Commercial Vehicle, 2025-2030