Market Overview

The USA Fenders market current size stands at around USD ~ million, reflecting steady expansion supported by strong replacement demand and sustained OEM sourcing. In the most recent two years, market value advanced from USD ~ million to USD ~ million, while total shipments increased from ~ units to ~ units across OEM and aftermarket channels. Installed base demand linked to collision repair and vehicle parc aging rose from ~ systems to ~ systems, indicating resilient aftermarket momentum and consistent production of exterior body panels across major vehicle segments.

Dominance in the USA Fenders market is concentrated in automotive manufacturing and repair hubs such as Michigan, Ohio, Texas, and California. These regions benefit from dense OEM assembly footprints, large collision repair networks, and established supplier ecosystems that support stamping, coating, and module integration. High vehicle ownership density, strong insurance-driven repair volumes, and proximity to tier one suppliers enhance supply reliability. Supportive state-level manufacturing policies and logistics infrastructure further strengthen regional leadership in fender production and distribution.

Market Segmentation

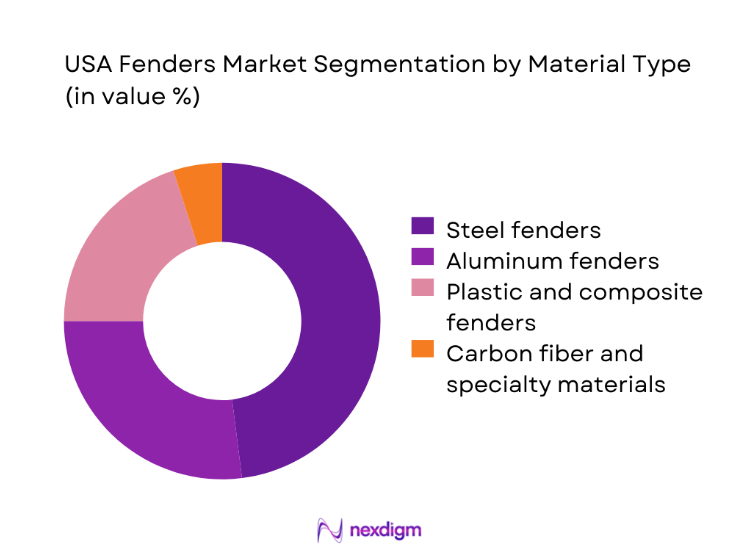

By Material Type

Steel fenders continue to dominate the USA Fenders market due to their cost efficiency, high formability, and deep integration into mass-market vehicle platforms. Aluminum and composite fenders are gaining traction, particularly in electric vehicles and premium SUVs, driven by lightweighting priorities and corrosion resistance requirements. OEMs increasingly balance material selection between performance and total lifecycle economics, while aftermarket suppliers expand offerings in painted and pre-finished variants. The material mix reflects a gradual transition toward advanced substrates without displacing steel in high-volume models, ensuring a diversified and resilient supply landscape.

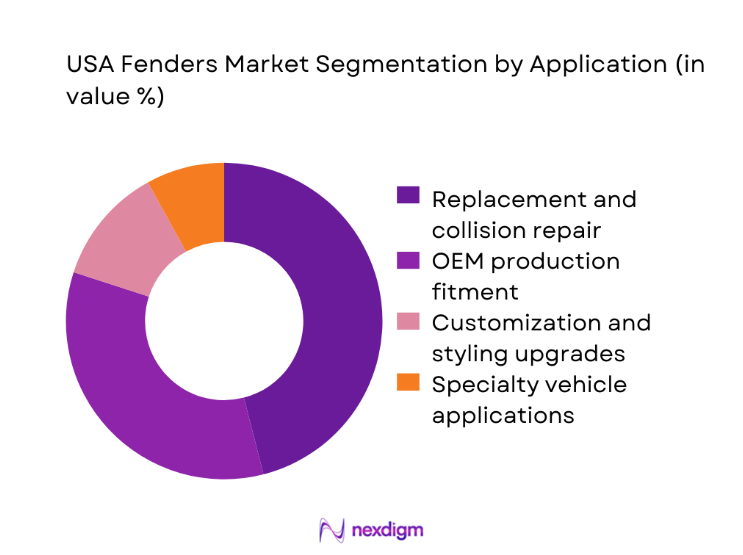

By Application

Replacement and collision repair applications represent the largest demand pool in the USA Fenders market, supported by high accident rates and insurance-led part replacement cycles. OEM fitment remains critical for new vehicle programs, while customization and styling upgrades drive niche demand in pickup trucks and performance vehicles. The application mix is shaped by growing vehicle parc age, increasing complexity of body structures, and rising consumer preference for factory-finish components. This structure ensures that aftermarket volumes remain structurally strong alongside steady OEM sourcing for new model launches.

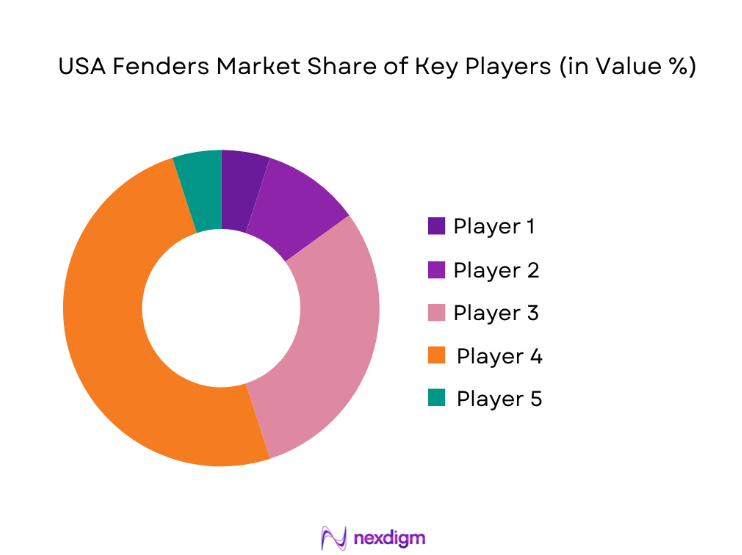

Competitive Landscape

The USA Fenders market exhibits moderate concentration, with a group of large integrated automotive suppliers controlling a significant share of OEM programs, while a fragmented aftermarket supports replacement demand. Tier one suppliers dominate advanced material fenders and module integration, whereas aftermarket distributors and regional manufacturers compete on availability, fitment breadth, and service responsiveness.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Flex-N-Gate | 1956 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Gestamp | 1997 | Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| OPmobility | 1946 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| LKQ Corporation | 1998 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

USA Fenders Market Analysis

Growth Drivers

Rising vehicle production and model refresh cycles

Vehicle production volumes in the USA expanded from ~ vehicles to ~ vehicles between recent operating cycles, driving incremental demand for exterior body panels. New model introductions across SUVs and electric vehicles increased sourcing requirements from ~ units to ~ units for fender assemblies, particularly in aluminum and composite formats. OEM tooling programs supported installation of ~ systems in stamping and forming lines, enabling faster ramp-ups for refreshed platforms. This production momentum reinforced baseline procurement from tier suppliers, ensuring stable offtake for both traditional steel fenders and lightweight alternatives across mass-market and premium vehicle segments.

Growth in collision repair and insurance-driven replacements

Collision repair volumes generated replacement demand for ~ units of fenders annually, supported by insurance claim processing across major metropolitan areas. Replacement activity expanded from ~ systems to ~ systems in certified repair networks, reflecting higher vehicle parc density and longer vehicle lifecycles. Aftermarket distribution handled shipments rising from ~ units to ~ units, driven by preference for OEM-equivalent panels and pre-painted components. This structural reliance on replacement cycles provides consistent revenue streams for manufacturers and distributors, insulating the market from short-term fluctuations in new vehicle sales.

Challenges

Volatility in steel and aluminum prices

Material cost volatility affected procurement planning as steel and aluminum inputs fluctuated from USD ~ million to USD ~ million in aggregate sourcing value for major suppliers. OEM contracts adjusted volumes from ~ units to ~ units to manage exposure, while tier suppliers increased inventory buffers from ~ systems to ~ systems. These shifts placed pressure on working capital requirements and complicated long-term pricing stability. For aftermarket players, inconsistent material costs constrained margin predictability, requiring frequent recalibration of supplier agreements and distribution pricing frameworks.

High tooling and stamping capital costs

Capital allocation for new stamping tools and dies increased from USD ~ million to USD ~ million across recent platform programs, limiting entry for smaller manufacturers. Installation of advanced forming lines rose from ~ systems to ~ systems, reflecting the need to support multi-material body panels. These high upfront investments extend payback periods and elevate risk exposure when model lifecycles shorten. As a result, suppliers face tighter capacity planning constraints, reinforcing consolidation trends and reducing competitive intensity in high-volume OEM programs.

Opportunities

Growth in electric vehicle body panel redesigns

Electric vehicle platforms introduced new body architectures that expanded demand for redesigned fenders from ~ units to ~ units across recent launch cycles. Lightweight structures supported installation of ~ systems in aluminum forming and composite molding, enabling improved range performance. OEM sourcing budgets for exterior panels increased from USD ~ million to USD ~ million, creating fresh revenue pools for suppliers with advanced material expertise. This transition positions innovative manufacturers to secure long-term platform contracts tied to next-generation electric vehicle programs.

Rising demand for corrosion-resistant and lightweight materials

Demand for corrosion-resistant coatings and lightweight substrates drove shipments of advanced fenders from ~ units to ~ units in recent procurement cycles. OEMs expanded qualification programs from ~ systems to ~ systems to validate composite and aluminum solutions, particularly for coastal and high-humidity regions. Investment in surface treatment and finishing lines increased from USD ~ million to USD ~ million, enabling suppliers to meet durability standards while reducing total vehicle mass. These material shifts create differentiated value propositions for manufacturers capable of balancing performance with cost efficiency.

Future Outlook

The USA Fenders market is expected to sustain steady expansion through the end of the decade as electric vehicle adoption reshapes exterior body design and materials sourcing strategies. Lightweighting, modularization, and sensor integration will remain central themes influencing product development. Regional manufacturing and aftermarket consolidation will strengthen supply resilience and service reach. As regulatory focus on efficiency and recyclability grows, innovation in sustainable materials is set to define competitive advantage.

Major Players

- Magna International

- Gestamp

- Martinrea International

- Flex-N-Gate

- Autokiniton

- Benteler Automotive

- OPmobility

- Novelis Automotive

- ArcelorMittal Automotive

- Aisin Automotive

- Tower International

- LKQ Corporation

- TYC Genera

- Sherman Parts

- Keystone Automotive

Key Target Audience

- Automotive OEM procurement and platform strategy teams

- Tier one and tier two body panel manufacturers

- Collision repair networks and certified body shops

- Aftermarket distributors and parts retailers

- Fleet maintenance and fleet management companies

- Electric vehicle manufacturers and integrators

- Investments and venture capital firms focused on mobility technologies

- Government and regulatory bodies including the National Highway Traffic Safety Administration and the Environmental Protection Agency

Research Methodology

Step 1: Identification of Key Variables

Core demand drivers, supply constraints, and material trends were mapped to define the operating scope of the USA Fenders market. Key variables included OEM sourcing volumes, aftermarket replacement intensity, and technology adoption rates. Regulatory and compliance factors were aligned with product development cycles to ensure analytical consistency.

Step 2: Market Analysis and Construction

Data frameworks were built around production flows, distribution channels, and application use cases. Segmentation structures were validated through cross-functional industry inputs. Market sizing models integrated shipment patterns, installed base indicators, and revenue streams to create a cohesive analytical baseline.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were tested through structured consultations with industry executives, procurement managers, and technical specialists. Assumptions on material transitions and capacity expansion were refined. Feedback loops ensured that competitive dynamics and buyer behavior were accurately represented.

Step 4: Research Synthesis and Final Output

Insights from quantitative modeling and qualitative validation were consolidated into a unified market narrative. Strategic implications were aligned with operational realities across OEM and aftermarket channels. Final outputs were structured to support decision-making for investors, manufacturers, and policy stakeholders.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, automotive fender system taxonomy across steel aluminum and composite designs, market sizing logic by vehicle production and fender content value, revenue attribution across panels materials and assembly, primary interview program with OEMs Tier 1 suppliers and body structure manufacturers, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Vehicle design and repair usage pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising vehicle production and model refresh cycles

Growth in collision repair and insurance-driven replacements

Lightweighting trends to improve fuel efficiency and EV range

Increased adoption of aluminum and composite body panels

Customization demand in pickup trucks and SUVs

Expansion of advanced driver assistance systems requiring sensor-compatible panels - Challenges

Volatility in steel and aluminum prices

High tooling and stamping capital costs

Complexity in repairing multi-material body structures

Supply chain disruptions and logistics costs

Intense price competition in the aftermarket segment

Quality and fitment issues in low-cost imported panels - Opportunities

Growth in electric vehicle body panel redesigns

Rising demand for corrosion-resistant and lightweight materials

Expansion of certified aftermarket replacement programs

Integration of sensor housings into exterior body components

Localized manufacturing to support OEM nearshoring strategies

Development of recyclable and sustainable body panel materials - Trends

Shift from steel to aluminum and composites in premium vehicles

Increased modularization of front-end body structures

Growing role of tier-one suppliers in exterior module integration

Digital tooling and simulation for faster panel development

Rising penetration of painted and pre-finished fenders

Aftermarket consolidation among distributors and repair networks - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Passenger vehicles

Light commercial vehicles

Heavy commercial vehicles

Off-road and specialty vehicles - By Application (in Value %)

Front fenders

Rear fenders and quarter panels

Replacement and collision repair

Customization and styling upgrades - By Technology Architecture (in Value %)

Stamped steel fenders

Aluminum body panels

Plastic and composite fenders

Carbon fiber and advanced materials - By End-Use Industry (in Value %)

Automotive OEM production

Aftermarket and collision repair

Fleet maintenance operators

Specialty vehicle manufacturers - By Connectivity Type (in Value %)

Conventional non-integrated fenders

Sensor-integrated fenders for ADAS

Aero-optimized smart body panels - By Region (in Value %)

Northeast

Midwest

South

West

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (manufacturing footprint, material capability, OEM relationships, aftermarket reach, cost competitiveness, tooling expertise, quality certifications, sustainability initiatives)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Magna International

Gestamp

Martinrea International

Flex-N-Gate

Autokiniton

Benteler Automotive

Thyssenkrupp Automotive Body Solutions

OPmobility (Plastic Omnium)

Novelis Automotive

ArcelorMittal Automotive

Aisin Automotive

Tower International

LKQ Corporation (Keystone Automotive)

TYC Genera

Sherman Parts

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030