Market Overview

The USA Fitness Tracker Devices Market is valued at approximately USD ~billion, supported by the increasing adoption of wearable technologies and growing consumer interest in health and fitness. This market is propelled by innovations in sensor technology, such as heart rate monitoring, sleep tracking, and bio-metric analysis, alongside the growing prevalence of health-conscious lifestyles. Additionally, consumer awareness about managing chronic health conditions with fitness trackers has been a key driver, reinforcing the growth trajectory of the market. Fitness trackers are increasingly becoming an essential tool for consumers, integrating into daily routines to monitor vital health metrics.

Dominant cities in the USA such as New York, Los Angeles, and Chicago lead the fitness tracker market due to their high concentration of health-conscious consumers and a thriving fitness culture. The technology adoption rate is particularly strong in metropolitan areas where individuals prioritize health management through technology. Furthermore, these regions have a higher percentage of fitness centers and health professionals, making them key hubs for fitness tracker demand. The increase in digital health awareness and the presence of major retail and e-commerce platforms have contributed to these cities dominating the fitness tracker market.

Market Segmentation

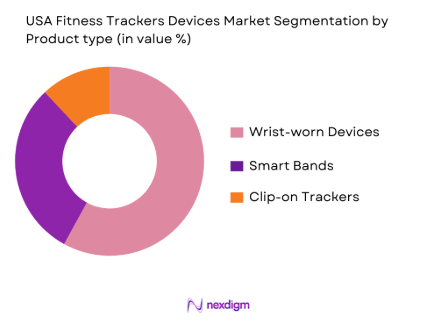

By Product Type

The USA Fitness Tracker Devices market is segmented by product type into wrist-worn devices, smart bands, and clip-on trackers. Among these, wrist-worn devices have captured the largest market share, dominating consumer preferences. This segment includes popular products like smartwatches and advanced fitness trackers such as the Apple Watch, Garmin, and Fitbit. The dominance of wrist-worn devices stems from their multifunctionality, ease of use, and convenience. These devices not only track fitness metrics but also serve as comprehensive smart devices with notifications, music controls, and even payment capabilities. The increasing integration of advanced sensors for accurate health monitoring like ECG and SpO2 levels has also enhanced their appeal among health-conscious consumers.

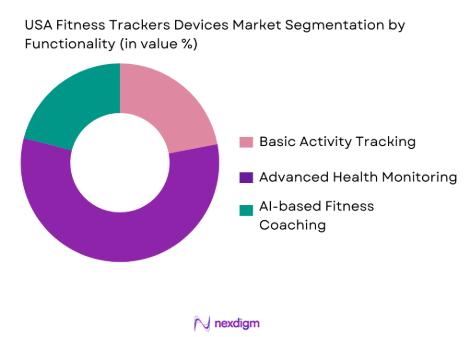

By Functionality

The market is also segmented by functionality, including basic activity tracking, advanced health monitoring (heart rate, blood pressure, oxygen levels), and AI-based fitness coaching. Advanced health monitoring is the dominant sub-segment, with a significant share in the fitness tracker market. This is due to the increasing consumer demand for trackers that provide more than just steps and calorie counting. Features such as heart rate tracking, sleep monitoring, and SpO2 measurements have become crucial selling points. Consumers are looking for more sophisticated devices that can manage their health comprehensively, especially those with chronic conditions or fitness enthusiasts seeking personalized insights. The advent of AI-powered analytics further enhances this segment, allowing for more tailored health and fitness advice.

Competitive Landscape

The USA Fitness Tracker market is competitive, dominated by both established brands and emerging players. Companies like Apple, Fitbit (Alphabet), and Garmin continue to lead, leveraging strong brand loyalty, advanced technology, and significant market presence. Apple’s ecosystem integration and Fitbit’s comprehensive health features give them a strategic edge, while Garmin focuses on the fitness enthusiast niche with rugged, performance-focused devices.

| Company | Establishment Year | Headquarters | Product Portfolio | Revenue | Market Focus | Distribution Channels |

| Apple | 1976 | Cupertino, CA | ~ | ~ | ~ | ~ |

| Fitbit (Alphabet) | 2007 | San Francisco, CA | ~ | ~ | ~ | ~ |

| Garmin | 1989 | Olathe, KS | ~ | ~ | ~ | ~ |

| Samsung Electronics | 1969 | Seoul, South Korea | ~ | ~ | ~ | ~ |

| Polar Electro | 1977 | Kempele, Finland | ~ | ~ | ~ | ~ |

USA Fitness Tracker Devices market Analysis

Growth Drivers

Rising Fitness & Health-Conscious Consumer Base

The growing fitness and health-conscious consumer base in the U.S. is one of the major driving forces behind the fitness tracker market. According to a 2024 report from the U.S. Bureau of Labor Statistics, 48.3% of Americans participated in some form of physical activity or exercise in 2024. Additionally, health-related spending in the U.S. is on the rise, with a 5% year-over-year increase in personal health expenditures reported by the U.S. Department of Health and Human Services. This increasing focus on fitness and well-being, combined with a greater shift towards digital health monitoring, drives the demand for fitness trackers as part of consumers’ everyday fitness routines. The growing integration of fitness tracking into lifestyle choices is solidifying this trend.

Integration of AI & Personalized Insights

AI and personalized health insights have become a key feature for fitness tracker companies aiming to cater to the growing demand for more sophisticated wearables. The implementation of AI-driven features, such as real-time health analytics and personalized fitness coaching, has gained widespread adoption. For instance, the U.S. market has seen a 20% rise in AI-powered health apps since 2022, as reported by the National Health Statistics Reports. Furthermore, AI integration enhances device functionality, driving user engagement. AI’s ability to analyse large data sets and offer actionable insights aligns with the increasing demand for more tailored health solutions, contributing to an upward growth trajectory for fitness trackers.

Market Challenges

Data Privacy & Regulatory Concerns

As fitness trackers collect sensitive health data, concerns about data privacy and security have surfaced. In 2024, the Federal Trade Commission (FTC) warned that consumers’ health data from wearable devices, including fitness trackers, is vulnerable to breaches if not properly protected. A report by the U.S. Government Accountability Office (GAO) found that 42% of fitness trackers and related apps had insufficient privacy policies in place to protect user data. This regulatory gap raises significant concerns among consumers, especially with increasing reports of data misuse. Such concerns could limit widespread adoption unless stricter regulations are implemented to safeguard personal health data.

Battery Life & Sensor Accuracy Limitations

Battery life and sensor accuracy are key challenges for the fitness tracker market. Despite advancements in wearable technology, many fitness trackers still face limitations in battery life, with many devices only lasting up to 24 hours on a single charge. The U.S. National Institute of Standards and Technology (NIST) reported in 2024 that the short lifespan of battery power remains a barrier to consumer satisfaction in the fitness tracker segment. Additionally, concerns around sensor accuracy, particularly with devices that track heart rate, blood oxygen levels, and sleep patterns, have been voiced. With inconsistent readings, consumers may be deterred from relying on wearable devices for precise health data.

Opportunities

Healthcare Provider Integrations

Healthcare providers are increasingly integrating fitness trackers into their treatment and wellness plans, providing a significant opportunity for growth in the fitness tracker market. In 2024, the U.S. Department of Veterans Affairs announced that it would offer free fitness trackers to veterans as part of its initiative to promote preventive health. By integrating these devices into patient care, healthcare providers can monitor patients’ vital health metrics remotely, improving overall care efficiency. As telemedicine continues to grow, fitness trackers will play an integral role in bridging the gap between patients and healthcare professionals, making this a promising growth area for the market.

Subscription & Data Monetization Services

Subscription-based models for fitness tracking services, including premium memberships for advanced analytics and personalized coaching, are emerging as a major opportunity for growth. The U.S. fitness tracker market has seen a rise in subscription offerings from companies like Fitbit Premium, which provides users with detailed health insights, sleep tracking, and workout guidance. The subscription service market in the U.S. has been growing steadily, with over ~ million paid users on Fitbit Premium as of 2023. Fitness tracker companies are increasingly focusing on monetizing user data for advanced health recommendations, further expanding revenue streams.

Future Outlook

The USA Fitness Tracker Devices Market is poised to continue its growth trajectory over the next few years, driven by technological advancements and an increasing focus on health and wellness. With innovations like advanced health sensors, real-time data tracking, and personalized fitness recommendations, the market is expected to witness sustained demand. Government health initiatives promoting preventive care and the increasing adoption of telemedicine further boost the relevance of fitness trackers. As the integration of AI in health monitoring increases, consumers are expected to demand more advanced features, expanding the scope of the market. By 2030, fitness trackers will become an even more integral part of daily life for health-conscious individuals.

Major Players

- Apple

- Fitbit

- Garmin

- Samsung Electronics

- Polar Electro

- Amazfit

- Xiaomi

- Withings

- Fossil Group

- Suunto

- Huawei

- Coros

- Oura Health

- Whoop

- TicWatch

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Healthcare Providers & Insurers

- E-commerce and Retail Distributors

- Fitness and Wellness Brands

- Corporate Wellness Program Managers

- Technology Manufacturers and OEMs

- Health Data Analytics Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key components of the USA Fitness Tracker Devices Market, identifying all stakeholders and factors influencing the market, including health consciousness, technological adoption, and consumer preferences. This will be done through desk research, gathering data from public and proprietary sources.

Step 2: Market Analysis and Construction

In this phase, historical data will be collected on market trends, growth drivers, and technological advancements. We will assess the penetration of fitness trackers in various sectors, like sports, healthcare, and wellness, to gauge their impact on market revenues.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from wearable tech companies, healthcare professionals, and market analysts will validate our hypotheses. These consultations will provide insights into the practical applications of fitness trackers, consumer behavior, and market predictions.

Step 4: Research Synthesis and Final Output

The final research phase will consolidate the findings into a cohesive analysis. Engagement with manufacturers, suppliers, and distributors will help refine market size calculations and forecast future trends, providing an actionable market report.

- Executive Summary

- Research Methodology (Definitions of Fitness Tracker Devices, Wearable Health Metrics, Device Classifications, Market Sizing Approach – Volume vs Value vs Unit Shipments, Data Sources & Triangulation, Primary & Secondary Research Framework, Assumptions & Limitations)

- Market Genesis & Adoption Timeline

- Technological Evolution of Fitness Trackers

- Industry Lifecycle & Business Models

- Value Chain and Distribution Structure

- Growth Drivers

Rising Fitness & Health-Conscious Consumer Base

Integration of AI & Personalized Insights

Expansion of Digital Health Initiatives

Chronic Disease Management Demand - Market Challenges

Data Privacy & Regulatory Concerns

Battery Life & Sensor Accuracy Limitations

Competitive Pressure & Rapid Feature Obsolescence

- Opportunities

Healthcare Provider Integrations

Subscription & Data Monetization Services

Smart Ring & Multi‑Modal Wearables Partnerships with Health Insurers

- Market Trends

Miniaturization & Sensor Accuracy

Personalized Wellness Platforms

Cross‑Platform Ecosystem Integration

- By Market Value, 2019-2025

- By Unit Shipments, 2019-2025

- By Average Selling Price, 2019-2025

- By Installed Base, 2019-2025

- By Health Metrics Penetration, 2019-2025

- By Product Type (In Value%)

Wrist‑Wear Trackers

Smart Bands

Smart Watches

Smart Rings & Other Wearables

Clip‑On / Non‑Wrist Devices

- By Functionality (In Value%)

Basic Activity Tracking

Heart Rate Monitoring

Sleep & Stress Analytics

Advanced Bio‑Metrics (SpO₂, ECG, Glucose Forecasting)

Coaching & AI‑Based Fitness Insights - By Distribution Channel (In Value%)

Online Retail (E‑commerce Share %)

Direct OEM Sales

Specialty Retailers

Big‑Box Electronics Stores

Telecommunication Carrier Bundling - By End User Demographics (In Value%)

Individuals / Consumers

Fitness Enthusiasts & Athletes

Health & Wellness Patients

Corporate Wellness Programs

Senior / Healthcare Monitoring Users - By Price Tier (In Value%)

Premium

Mid‑Tier

Value Segment

- Market Share Analysis (Revenue & Units) – Top Players

- Cross Comparison Parameters (Company Overview, Revenue, Device Portfolio Breadth, U.S. Installed Base, ASP by Device Tier, R&D Intensity, Distribution Reach, Health Analytics Capabilities)

- SWOT Analysis

- Price Matrix

- Porter’s Five Forces

- Major Players

Apple Inc.

Google / Fitbit

Samsung Electronics

Garmin Ltd.

Polar Electro

Xiaomi

Withings

Oura

Amaz fit

Fossil Group

Mobvoi

Suunto

Huawei

Coros

Fitbit Health Solutions

- Usage Patterns & Frequency Metrics

- Purchase Drivers & Channel Preferences

- Feature Prioritization & Willingness to Pay

- Brand Loyalty & Switching Behavior

- Feedback on Accuracy & Data Sharing Preferences

- Revenue Forecast by Segment, 2026-2030

- Unit Shipment & Adoption Curve, 2026-2030

- Segment Growth Drivers & Barriers, 2026-2030

- Emerging Sub‑Segment Prospects, 2026-2030