Market Overview

The USA Fuel Injection Systems Market is underpinned by a very large internal-combustion vehicle base and steady new-vehicle sales. Recent industry data show U.S. light-duty vehicle sales in the mid-teens of millions of units annually, with electric cars accounting for just over one in ten new sales and hybrids under one in ten, meaning well over ten million new internal-combustion vehicles requiring fuel injection hardware are still sold each year. This volume, coupled with a sizeable in-use parc, drives recurring demand for injectors, pumps, rails and electronic control.

Geographically, the market is concentrated in the traditional automotive manufacturing clusters and regulatory hubs. The Great Lakes belt (centered on Michigan and Ohio) hosts many OEM powertrain engineering centers and Tier-1 fuel-system plants, while the southern auto corridor (including Texas, Alabama and Tennessee) has rapidly expanded assembly and components manufacturing. On the demand side, large truck, SUV and pickup markets in states such as Texas and California, combined with strict emissions regimes led by regulators like the California Air Resources Board, make these states focal points for advanced injection technology adoption.

Market Segmentation

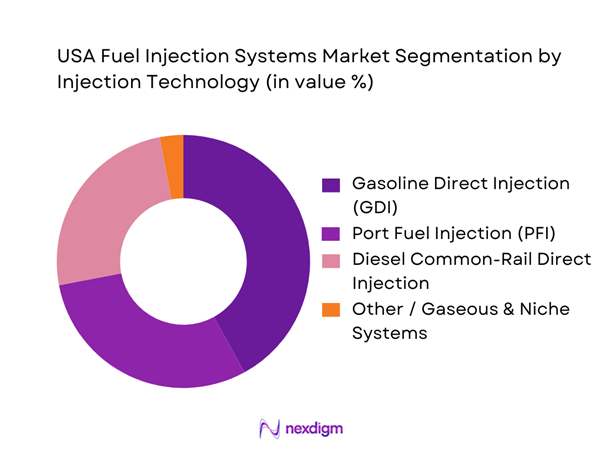

By Injection Technology

The USA Fuel Injection Systems Market is segmented by injection technology into gasoline direct injection, port fuel injection, diesel common-rail and other gaseous or niche systems. Gasoline direct injection holds a dominant technology share because it is now the default choice on many new gasoline passenger cars, crossovers and light trucks, driven by aggressive fuel-economy and emissions requirements. Global research shows the GDI system market at about USD ~ billion with the U.S. alone contributing roughly USD ~ billion, highlighting how strongly U.S. OEMs have shifted to high-pressure, spray-guided combustion architectures versus legacy low-pressure port systems.

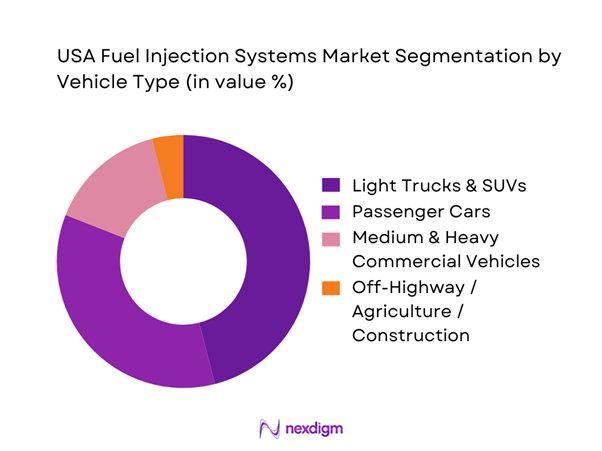

By Vehicle Type

The USA Fuel Injection Systems Market is segmented into passenger cars, light trucks and SUVs, medium and heavy commercial vehicles, and off-highway platforms. Light trucks and SUVs dominate fuel-injection demand because they make up the majority of new light-duty sales in the United States and typically use larger displacement engines with higher injector counts and higher-flow hardware than compact passenger cars. U.S. data over the last several years show light trucks consistently out-selling cars by a wide margin, with overall light-duty sales in the mid-teens of millions of units and truck share above half of that total, reinforcing the leadership of this segment in value terms for injectors, pumps and associated controls.

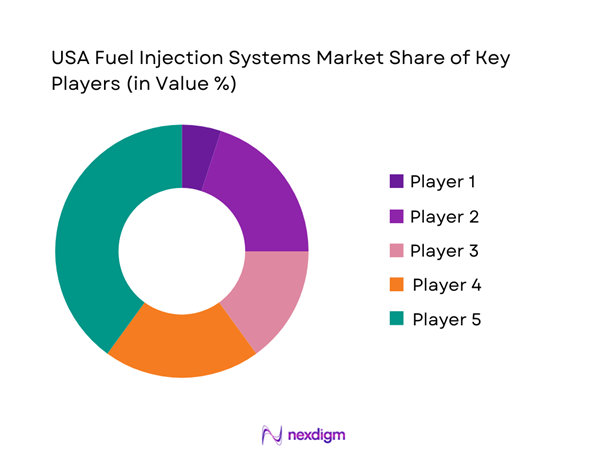

Competitive Landscape

The USA Fuel Injection Systems Market is relatively concentrated among global Tier-1 suppliers and a handful of specialized domestic players. Large multinational groups such as Robert Bosch, Denso, Continental and BorgWarner supply integrated injector-pump-rail-ECU systems to major light-duty and heavy-duty OEMs, while companies like Cummins and Stanadyne focus more heavily on diesel and commercial-vehicle solutions. These players compete on pressure capability, emissions performance, durability in U.S. duty cycles, localization of manufacturing, and the depth of their diagnostics and software integration. Their strong OEM relationships and remanufacturing footprints create substantial barriers to entry for new suppliers.

| Company | Establishment Year | Headquarters (Global) | Core Technology Focus (USA) | Key Vehicle Segments Served | USA Manufacturing / Localization | OEM Program Presence (Illustrative) | Aftermarket & Reman Presence | R&D / Calibration Strength (USA) |

| Robert Bosch | 1886 | Stuttgart, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Denso | 1949 | Kariya, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Continental | 1871 | Hanover, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| BorgWarner (Delphi Technologies) | 1923 (Delphi roots) | Auburn Hills, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Cummins Fuel Systems | 1919 | Columbus, USA | ~ | ~ | ~ | ~ | ~ | ~ |

USA Fuel Injection Systems Market Analysis

Growth Drivers

Emissions and fuel-economy standards

Tightening U.S. emissions policy keeps internal-combustion platforms and their fuel-injection hardware under pressure to improve. In the national greenhouse gas inventory, total U.S. emissions reached ~ million metric tons CO₂-equivalent for the latest reported year, with transportation contributing about 28%. EPA’s light-duty trends report shows new vehicles averaging and in recent model years, forcing OEMs to deploy high-pressure injectors, advanced nozzles and precise electronic control. With the U.S. economy at USD ~ trillion GDP and a vehicle stock of around ~ million road motor vehicles, incremental gains in specific fuel consumption translate into large absolute fuel and emissions reductions that directly depend on injection technology.

Engine downsizing

To meet fuel-economy targets without sacrificing performance, U.S. OEMs have aggressively adopted downsized, boosted gasoline engines that depend on sophisticated fuel-injection hardware. DOE’s Vehicle Technologies Office notes that 22% of new light-duty vehicle models in a recent model year require premium gasoline, a shift strongly associated with smaller, higher-specific-output turbo engines that demand precise mixture control and knock resistance. At the same time, the U.S. vehicle stock is highly motorized at about 779 motor vehicles per 1,000 inhabitants, with a population above ~ million residents. This combination of high motorization, regulatory pressure and premium-fuel-calibrated, high-compression engines drives sustained content per engine for injectors, high-pressure pumps and rail systems.

Market Challenges

EV substitution risk

Electrification is the most direct long-term threat to fuel-injection demand in the USA, especially in light-duty segments. DOE’s Fact of the Week shows that plug-in EVs accounted for 9.1% of all new light-duty vehicle sales in 2023, up from 6.8% in 2022, with cumulative sales of about ~ million plug-in vehicles since 2010. Argonne National Laboratory notes that plug-in electric vehicles reached 9.9% of annual passenger-vehicle sales in 2024. This rapid growth in plug-in share directly displaces new ICE platforms that would otherwise require port-fuel or GDI systems. While the in-use ICE parc remains very large, the trend in new-vehicle mix implies a gradual erosion of long-term fuel-injection volumes in mass-market light-duty segments, forcing suppliers to pivot toward higher-value HD, remanufacturing and alternative-fuel applications.

Diesel share decline

Even as diesel remains indispensable for freight, policy and market signals are nudging some use-cases away from conventional diesel combustion, especially in urban and regional-haul settings. EPA’s greenhouse-gas inventory highlights transportation as about 28% of U.S. emissions, with medium- and heavy-duty trucks a focus of multiple decarbonization plans published by DOE and DOT.² At the same time, EV Fact of the Week data show light-duty plug-in sales surpassing one million units per year, indicating growing comfort with electric powertrains in segments where diesel once had a foothold (such as pickups and urban delivery). State-level climate policies and zero-emission truck regulations, notably in California and several follower states, further signal a tightening window for new diesel platforms in certain GVW classes. For fuel-injection suppliers, this means more investment is needed in advanced aftertreatment-optimized systems for the remaining diesel volume, even as the long-term unit base gradually shifts.

Market Opportunities

Remanufacturing expansion

The large and aging U.S. vehicle parc, combined with sustainability and cost-reduction priorities, creates a strong base for remanufactured fuel-injection components. Vehicle miles traveled reached roughly ~ trillion miles in a recent year, and the country operates about ~ million motor vehicles, implying a vast installed base of injectors, rails and pumps cycling through wear-out. The Automotive Components Remanufacturers Association (APRA) lists more than 15,000 U.S. companies remanufacturing motor-vehicle parts, while estimates from Rochester Institute of Technology cited in the same source identify around 3,800 firms manufacturing motor-vehicle parts. This dense ecosystem, combined with OEM circular-economy commitments and landfill-reduction goals referenced in DOE and EPA sustainability guidance, positions remanufactured injectors, pumps and rails as a growing profit pool. Fuel-injection suppliers that design components for multiple life cycles, standardized cores and traceable digital IDs can capture share across both OEM-authorized and independent remanufacturing networks.

Hydrogen & alternative fuels

Hydrogen internal-combustion engines (ICE) and other alternative fuels offer a future pathway where injection hardware remains central even as carbon intensity declines. The DOE Alternative Fuels Data Center reports 54 open retail hydrogen stations in the United States as of 2024, alongside a broader alternative-fuel network of over 57,000 fueling locations for non-electric alternative fuels as of early 2022. EIA data indicate around 384 megawatts of fuel-cell electric generation capacity across 210 operating fuel-cell units at 151 facilities, underscoring growing technical expertise with hydrogen handling and high-pressure gaseous fuels. Parallel to this, DOE and international consortia highlight heavy-duty hydrogen fuel-cell and hydrogen ICE truck pilots as key decarbonization pathways for long-haul freight. For fuel-injection suppliers, this opens opportunities in high-pressure gaseous-fuel rails and injectors (for hydrogen and natural gas), dual-fuel diesel-hydrogen systems, and alternative-fuel calibrations that reuse existing HD engine platforms while materially cutting tailpipe CO₂ and local pollutants.

Future Outlook

Over the next decade, the USA Fuel Injection Systems Market is expected to grow moderately in value despite an eventual plateau in internal-combustion vehicle sales. Global research places the overall automotive fuel injection system market at roughly USD ~ billion with a mid-single-digit growth trajectory, and specific U.S. studies suggest national revenue in the mid-single-digit billions, rising steadily on the back of higher value-per-engine and remanufacturing. Translating these global and U.S. projections, a working assumption for this report is that the USA Fuel Injection Systems Market grows at an indicative CAGR of about 3–4 for the 2024–2030 period, with value growth increasingly driven by high-pressure systems, hybrid powertrains and premium segments rather than simple vehicle-count expansion.

Major Players

- Robert Bosch

- Denso

- Continental

- BorgWarner (Delphi Technologies)

- Cummins Fuel Systems

- Hitachi Astemo

- Marelli

- Aisin

- Stanadyne

- TI Fluid Systems

- Woodward

- Parker Hannifin (engine & fuel components)

- Eaton (fuel & engine management components)

- Holley Performance Products

Key Target Audience

- Passenger vehicle OEM powertrain and procurement teams

- Commercial vehicle and off-highway OEM engineering and sourcing divisions

- Tier-2 precision components and semiconductor suppliers to fuel-system Tier-1s

- Authorized dealer groups and nationwide independent service chains

- Large fleet operators and leasing companies

- Investments and venture capitalist firms

- Government and regulatory bodies

- Engine and powertrain remanufacturing groups and distribution networks

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the full USA Fuel Injection Systems Market ecosystem, covering OEMs, Tier-1 suppliers, semiconductor and precision-machining vendors, distributors, fleets and aftermarket networks. Extensive desk research drawing on regulatory filings, OEM technical papers, OICA and U.S. vehicle sales statistics underpins this map. The objective is to isolate critical variables such as vehicle parc by fuel type, injection technology penetration, replacement cycles and regulatory milestones that drive market demand.

Step 2: Market Analysis and Construction

In this phase, historical data on global and U.S. automotive fuel-injection revenues and technology splits are compiled from multiple syndicated studies and industry databases. These are combined with statistics on light-duty and heavy-duty vehicle production, imports and sales, and the share of internal-combustion, hybrid and electric powertrains. The result is a bottom-up model of injector and pump volumes, ASPs and system value by vehicle type and technology, cross-validated against top-down global and regional revenue benchmarks.

Step 3: Hypothesis Validation and Expert Consultation

The preliminary market model is then stress-tested through structured interviews with powertrain engineers, product managers and aftermarket leaders from OEMs, Tier-1 suppliers and remanufacturing specialists. Computer-assisted interviews focus on platform-level injection choices, technology roadmaps, warranty and failure-rate patterns, and channel pricing norms. Feedback from these experts is used to refine assumptions on technology mix, replacement rates, discount structures and the practical impact of emissions and fuel-economy rules on system specifications.

Step 4: Research Synthesis and Final Output

Finally, the validated data set is synthesized into forecasts for the USA Fuel Injection Systems Market by value, volume, technology and vehicle type. Scenario analysis incorporates different EV and hybrid adoption paths, regulatory tightening speeds and macroeconomic cycles. Detailed competitive profiling and segmentation outputs are then developed for business-planning use, including TAM/SAM/SOM views, white-space opportunity maps and strategic recommendations tailored to OEM, Tier-1, aftermarket and investment audiences. The end result is a coherent, validated and decision-ready view of the market.

- Executive Summary

- Research Methodology (Market Definitions, System Boundaries and Assumptions, Abbreviations and Technical Glossary, Market Sizing Approach, Top-Down and Bottom-Up Forecasting Framework, Primary Research Approach, Secondary Research Approach, Data Triangulation and Validation, Study Limitations and Sensitivity Checks)

- Definition and Scope

- Role of Fuel Injection Systems in USA Powertrain Portfolio

- Evolution of Injection Technologies in USA

- Business Cycle: From Raw Materials, Precision Components and ICs to Calibrated Systems

- Supply Chain and Value Chain Mapping: Semiconductor, Mechatronics, Assembly and Calibration

- Growth Drivers

Emissions and fuel-economy standards

Engine downsizing

Turbocharging

Diesel

HD demand - Market Challenges

EV substitution risk

Diesel share decline

Cost and complexity

Semiconductor supply - Opportunities

Remanufacturing expansion

Hydrogen & alternative fuels

Premium & HD duty cycles

Diagnostics & smart fuel systems - Trends

GDI penetration

Higher rail pressures

Cylinder deactivation

48V hybrids

Hydrogen ICE - Regulatory and Compliance Landscape

- Technology and Innovation Roadmap

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- Market SWOT Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average System and Component Price, 2019-2024

- Installed Base and Replacement Opportunity, 2019-2024

- By Vehicle Category (in Value %)

Passenger Cars

Light Trucks and SUVs

Medium-Duty Trucks and Buses

Heavy-Duty Trucks and Tractors

Off-Highway, Construction, Agriculture and Industrial Engines - By Engine and Fuel Type (in Value %)

Gasoline Spark-Ignition Engines

Diesel Compression-Ignition Engines

Flex-Fuel / High-Ethanol Engines

CNG / LPG Engines

Alternative and Hydrogen-Ready ICE Platforms - By Injection Technology (in Value %)

Throttle-Body / Single-Point Injection

Multi-Port / Port Fuel Injection

Gasoline Direct Injection Systems

Diesel Common-Rail Systems

Unit Injector and Pump-Line-Nozzle Systems - By Component (in Value %)

Injectors

High-Pressure Pumps and Low-Pressure Feed Pumps

Rails, Lines and Pressure Regulators

Engine Control Units and Injection Controllers

Sensors, Valves and Filtration Assemblies - By Sales Channel (in Value %)

OEM / Factory Fitment

OEM Service / OES Channels

Independent Aftermarket – New Parts

Remanufactured and Refurbished Injection Components - By System Pressure Band (in Value %)

Low-Pressure Systems for Port Injection

Medium-Pressure Gasoline Direct Injection Systems

High-Pressure On-Road Diesel Common-Rail Systems

Ultra-High-Pressure Heavy-Duty and Off-Highway Systems

- Market Share of Major Players by Value and Volume

Market Share of Major Players by Injection Technology Cluster - Cross Comparison Parameters (company overview & ownership; fuel-injection portfolio breadth across gasoline/diesel/gaseous; injection technology and pressure capability; USA OEM and HD/off-highway program penetration; regulatory and emissions compliance capabilities for EPA/CARB/OBD; USA manufacturing, localization and remanufacturing footprint; electronics, software and diagnostics integration depth; aftermarket channel strength and performance/alternative-fuel innovation focus)

- Detailed Profiles of Major Companies

Robert Bosch LLC

Denso Corporation

Continental Automotive Systems

Delphi Technologies

Hitachi Astemo Ltd.

Stanadyne LLC

Cummins Inc.

Marelli Holdings Co. Ltd.

TI Fluid Systems plc

Woodward Inc.

Aisin Corporation

Keihin Corporation

Edelbrock LLC

Holley Performance Products Inc.

- Light-Duty OEM Customer Analysis

- Heavy-Duty Truck and Off-Highway OEM Analysis

- Fleet Operator and Commercial User Segmentation

- Installer and Service Network Mapping

- End-User Needs, Pain Points and Decision Drivers

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average System and Component Price, 2025-2030

- Installed Base and Replacement Opportunity, 2025-2030