Market Overview

The USA gaskets and seals market is valued at approximately USD ~ billion, based on a five-year historical analysis of OEM and aftermarket demand across process industries, transportation and power equipment. This represents an uplift from around USD ~ billion in the prior cycle, reflecting higher sealing content per vehicle, stricter fugitive-emission limits on process plants, and rising reliability requirements in rotating equipment. Growth is underpinned by vehicle production recovery, intensive investment in Gulf Coast petrochemicals and refining, and capital spending in power and water infrastructure that depends on leak-tight piping, valves, compressors and turbines.

Within the USA gaskets and seals market, demand concentrates in automotive, energy and aerospace corridors. The Upper Midwest—centered on Michigan, Indiana and Ohio, which together account for over 40% of US vehicle production—drives high volumes of powertrain, chassis and body sealing content. The Gulf Coast cluster in Texas and Louisiana, producing roughly 80% of the nation’s primary petrochemical supply and over 55% of US refining capacity, anchors heavy use of high-performance flange, heat-exchanger and valve gaskets. Aerospace hubs such as Seattle and Los Angeles add specialized sealing demand for engines, airframes and hydraulic systems.

Market Segmentation

By Type

The USA gaskets and seals market is segmented by type into seals and gaskets. Seals hold a dominant share under this segmentation because they are embedded across dynamic rotating equipment, automotive drivetrains, hydraulic systems and precision motion applications. Global benchmarks indicate seals account for roughly 60% of gaskets and seals revenues, reflecting their extensive use in shaft, rod and rotary interfaces where leakage directly impacts safety, emissions and warranty costs. In the USA, seals also benefit from advanced materials (fluoroelastomers, PTFE composites and engineered thermoplastics) designed for high-speed, high-temperature, chemically aggressive environments typical of Gulf Coast processing plants and high-output powertrains. The combination of stringent fugitive-emission rules, complex under-hood architectures and intensified reliability expectations from OEMs and fleet operators structurally favours higher seal value per asset compared with static gasket joints.

By End-Use Industry

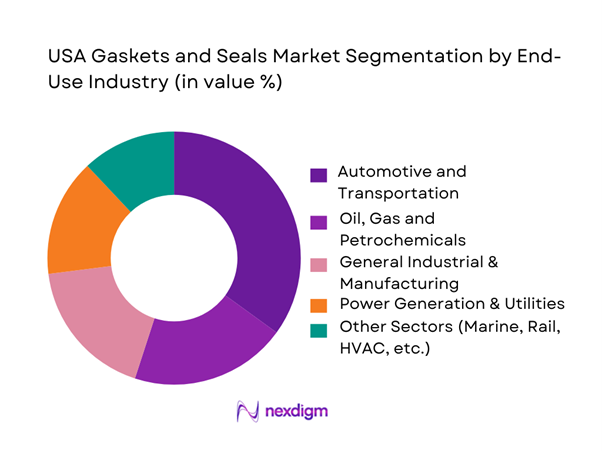

The USA gaskets and seals market is segmented by end-use industry into automotive and transportation, oil, gas and petrochemicals, general industrial and manufacturing, power generation and utilities, and other sectors such as marine, rail, HVAC and food processing. Automotive and transportation hold the leading share because vehicles require hundreds of individual seals and gaskets across engines, transmissions, e-axles, battery packs, HVAC modules and body closures. Global estimates show automotive applications alone contribute about one-third of gaskets and seals demand, supported by annual vehicle output exceeding ~ million units worldwide and rapidly growing EV production that adds battery, thermal and power-electronics sealing. In the USA, the heavy concentration of vehicle assembly and component plants in Michigan, Indiana, Ohio, Kentucky and Alabama—where automotive can account for over 10% of state GDP—further amplifies sealing demand through both OEM fitment and high-intensity aftermarket replacement cycles.

Competitive Landscape

The USA gaskets and seals market is moderately consolidated, with a core group of diversified motion-control, bearing and powertrain suppliers shaping technology direction, value-chain integration and pricing discipline. Global majors such as Parker Hannifin, Freudenberg Sealing Technologies, Trelleborg Sealing Solutions, SKF and Dana combine deep materials science capabilities with extensive OEM platforms in automotive, aerospace, energy and industrial machinery. Their US manufacturing footprints, long-term supply contracts, and ability to engineer application-specific sealing systems—rather than standalone components—create high switching costs for OEMs and industrial operators. At the same time, a long tail of regional converters, cut-gasket specialists and distributors competes on service responsiveness, customization and small-lot runs, especially in MRO and brownfield projects.

| Company | Establishment Year | Headquarters (Global) | Core Gasket/Seal Focus (USA) | Key US End-Use Sectors | US Manufacturing / Service Footprint | Technology & Materials Strengths | OEM vs Aftermarket Orientation | Notable Strategic Focus Areas |

| Parker Hannifin | 1917 | Mayfield Heights, Ohio, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Dana Incorporated (Victor Reinz) | 1904 | Maumee, Ohio, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Freudenberg Sealing Technologies | 1849 | Weinheim, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Trelleborg Sealing Solutions | 1905 (Group) | Trelleborg, Sweden / Stuttgart sealing HQ | ~ | ~ | ~ | ~ | ~ | ~ |

| SKF Group | 1907 | Gothenburg, Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

USA Gaskets and Seals Market Analysis

Growth Drivers

Vehicle build rates

New-vehicle production and sales in the United States form the backbone of demand for automotive gaskets and seals used in engines, e-axles, transmissions and thermal systems. New-car sales reached about ~ million units in 2023, up sharply from ~ million units the year before, as inventories normalized and pent-up demand was released. In 2024, U.S. new-vehicle sales climbed further to ~ million units, the highest level in several years. Plug-in vehicles alone contributed 1,402,371 units of sales in 2023, indicating growing complexity in drivetrains and thermal management, which increases sealing points per vehicle. These volumes directly translate into millions of cylinder-head gaskets, exhaust manifold seals, O-rings and shaft seals annually required for OEM fitment and long-cycle aftermarket replacement.

Process-industry capex

Capital investment in U.S. manufacturing and process industries is a core structural driver for industrial gaskets and seals used in pumps, compressors, heat exchangers, pipelines and reactors. Private fixed investment in manufacturing structures jumped from about USD ~ billion in 2022 to USD ~ billion in 2023 and further to USD ~ billion in 2024. Parallelly, U.S. operable refinery capacity stood around ~ million barrels per day, with Gulf Coast refineries running some of the world’s largest integrated complexes that rely heavily on high-performance flange gaskets, spiral-wound seals and packing sets. Manufacturing remains a major economic pillar, employing about ~ million people in 2022 across thousands of plants where rotating and static equipment need continuous sealing maintenance. These sustained capex flows and asset bases underpin steady replacement and expansion demand for industrial sealing solutions.

Market Challenges and Constraints

Price pressure

Despite strong demand fundamentals, U.S. gasket and seal manufacturers face intense price pressure from OEMs and MRO buyers operating in a highly competitive manufacturing landscape. The Annual Survey of Manufactures framework covers a universe of about 346,000 manufacturing establishments across the country, while the Census Bureau notes that manufacturing directly employed ~ million workers in 2022. By mid-2025, manufacturing’s value added had reached roughly USD ~ trillion, with ~ million people employed and more than 239,000 manufacturers competing for contracts. This dense supplier base, combined with OEMs’ global sourcing strategies and the ability to import competitively priced rubber and plastic products, forces gasket and seal suppliers to continually improve cost structure and productivity while meeting stringent quality and qualification requirements.

Counterfeit risk

Counterfeit and sub-standard industrial and automotive parts, including sealing components, pose safety, warranty and brand-reputation risks in the U.S. gaskets and seals market. U.S. Customs and Border Protection’s FY2023 intellectual property-rights enforcement overview highlights that the total number of goods seized for IP violations more than doubled between FY2019 and FY2023, with small-package environments accounting for nearly 90% of all seizures, reflecting the rise of e-commerce and complex cross-border supply chains (CBP FY2023 IPR Seizure Statistics – via DHS testimony). CBP also processes roughly ~ million small packages per day entering the United States through international mail and express consignment networks, dramatically expanding the monitoring challenge (same CBP source). For gasket and seal OEMs, this environment increases the need for serialized packaging, traceable batch codes, and channel audits to protect safety-critical sealing applications in engines, chemical plants and pipelines from counterfeit intrusion.

Opportunities and White Spaces

Low-emission sealing solutions

Regulatory momentum around decarbonization and fugitive-emission control creates a strong opportunity space for advanced low-emission gaskets and seals. EPA’s 2024 methane regulations for the oil and natural gas sector target reductions in methane from hundreds of thousands of wellheads, gathering lines and processing facilities, with the agency’s overall greenhouse-gas inventory attributing roughly ~ million metric tons CO₂-equivalent to petroleum and natural gas systems in 2022. Heavy-duty vehicle standards alone are projected to avoid ~ billion tons of greenhouse-gas emissions by 2055. These frameworks push refineries, chemical plants, LNG terminals and fleets to replace legacy packing and sheet gaskets with certified low-leak technologies, such as API/TA-Luft-qualified spiral-wound gaskets, fugitive-emission valve packing and elastomers compatible with hydrogen, CO₂ and low-GWP refrigerants. Suppliers that can prove step-change leakage reductions under standardized test protocols, backed by field data, are positioned to capture premium margins and long-term contracts across regulated assets.

Modular kits

Growth in complex vehicle parc, industrial installed base and maintenance outsourcing opens white-space for modular gasket and seal kits tailored to specific assets and duty cycles. FHWA data show total U.S. motor-vehicle registrations around ~ million in 2022, including more than ~ million trucks and over ~ million motorcycles, all requiring periodic sealing maintenance in engines, drivetrains and exhaust systems. In parallel, the U.S. Census and BLS report that manufacturing employed about ~ million workers in 2022, with millions more in utilities, construction and transport sectors where pumps, compressors and hydraulic systems rely on standardized sealing spares. BLS occupational statistics list more than ~ million maintenance and repair workers handling multi-brand equipment fleets. Asset operators increasingly favor pre-engineered gasket kits (e.g., full pump sets, exhaust system kits, valve-overhaul kits) that reduce identification errors, cut downtime and enable predictive-maintenance programs. This creates room for gasket and seal suppliers to bundle components with digital catalogs, QR-coded installation guides and torque specifications aligned with OEM and regulatory requirements.

Future Outlook

Over the next several years, the USA gaskets and seals market is expected to post steady, technology-rich growth rather than explosive volume expansion. Moderate top-line gains are projected on the back of 1) vehicle production recovery and powertrain mix diversification, 2) sustained capital programmes in refining, petrochemicals and LNG on the Gulf Coast, and 3) ageing installed bases of turbines, compressors and pumps that demand higher-spec sealing to extend runtime between overhauls.

Electrification will reshape product mix more than total market value: traditional engine gaskets per vehicle will gradually decline, but this is partially offset by new sealing content in battery packs, e-axles, coolant circuits and power electronics, requiring advanced polymer and elastomer solutions with tight tolerance on out-gassing and dielectric performance. Tightening emissions standards on fugitive volatile organic compounds (VOCs) and methane from refineries and chemical plants will further drive adoption of low-leak, fire-safe gaskets, live-loaded packing sets and API-qualified mechanical seals. Meanwhile, digitalization of maintenance will see more seals and gaskets integrated into condition-monitoring and asset-management programs, with OEMs and Tier-1 suppliers offering sealing-as-a-service models bundled with uptime guarantees.

Major Players

- Parker Hannifin Corporation

- Dana Incorporated

- Freudenberg Sealing Technologies

- Trelleborg Sealing Solutions

- SKF Group

- Gates Corporation

- John Crane

- ElringKlinger AG

- Cooper Standard Holdings Inc.

- Hutchinson SA

- Klinger Group

- Flexitallic Group

- Flowserve Corporation

- Garlock Sealing Technologies

Key Target Audience

- Automotive and commercial vehicle OEM powertrain engineering and sourcing teams

- Oil, gas and petrochemical operators and EPC contractors

- Power generation utilities and independent power producers

- Industrial OEMs for pumps, compressors, valves and rotating equipment

- Maintenance, repair and overhaul (MRO) organizations and asset-management service providers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Specialty materials and elastomer suppliers supporting sealing applications

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA gaskets and seals market, spanning OEMs, component suppliers, distributors, EPCs, MRO providers and end-user industries. This step is underpinned by extensive desk research using secondary and proprietary databases, government statistics and company filings to gather industry-level information. The primary objective is to identify critical variables such as installed base of rotating equipment, vehicle production, refinery and petrochemical capacity, and maintenance cycles that shape demand for gaskets and seals.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data for the USA gaskets and seals market, including OEM build rates, aftermarket replacement frequencies and application-specific sealing content. Top-down views (such as national vehicle output, refinery throughput and industrial production indices) are reconciled with bottom-up models built from unit counts of engines, pumps, valves and compressors. Revenue is estimated by mapping average sealing content and price points to each asset class, while validating assumptions against published global and US-specific market sizes and growth rates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses (for example, seals vs gaskets mix, automotive vs process industry weighting, OEM vs aftermarket balance) are validated through structured interviews with product managers, procurement leaders, plant maintenance heads and application engineers active in the USA gaskets and seals market. These consultations—conducted via calls, virtual meetings and targeted surveys—provide operational and financial insights on leak-rate targets, failure modes, materials migration (to PFAS-free or hydrogen-ready solutions) and competitive positioning. Expert input is used to refine segment splits, confirm adoption curves for new materials and technologies, and stress-test the robustness of the forecasting framework.

Step 4: Research Synthesis and Final Output

The final phase integrates quantitative models and qualitative insights into a coherent view of the USA gaskets and seals market, including market size, segment splits, growth drivers, challenges and opportunities. Direct engagement with OEMs and Tier-1 sealing specialists helps validate assumptions on new programme launches, platform lifecycles and material substitution trends, while plant-level feedback from refineries, chemical complexes and power stations calibrates aftermarket replacement and upgrade cycles. The result is a triangulated, bottom-up and top-down synchronized dataset that underpins the narrative sections, competitive benchmarking and strategic recommendations of this report.

- Executive Summary

- Research Methodology (Market Definitions, Taxonomy and Assumptions, Research Design and Data Sources, Market Sizing and Forecasting Approach, Primary Research and Expert Validation, Limitations, Sensitivity Checks and Scenario Building)

- Definition and Scope

- Sealing System Architecture Across Key Applications

- Market Genesis and Evolution of Sealing Technologies

- Business Cycle: From Compound and Sheet to Installed Gasket/Seal

- Supply Chain and Value Chain Structure

- Growth Drivers

Vehicle build rates

Process-industry capex

Reliability

Emissions compliance - Market Challenges and Constraints

Price pressure

Counterfeit risk

Qualification cycles

Supply security - Opportunities and White Spaces

Low-emission sealing solutions

Modular kits

Condition-based maintenance - Trends

Standardization vs customization

Engineered composites

Digital design

Selection tools - Technology and Materials Roadmap

- Government and Regulatory Framework

- SWOT Analysis

- Stake Ecosystem Mapping

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- Average Realization per Unit and per Equipment Bill of Materials, 2019-2024

- By Product Category (in Value %)

Flat and Spiral Wound Gaskets

Ring-Type Joint and Metallic Gaskets

Compression Packing and Mechanical Packing Sets

Radial Shaft Seals and Rotary Seals

Hydraulic and Pneumatic Seals (O-rings, U-cups, wipers, guide rings) - By Material Class (in Value %)

Elastomeric Seals

PTFE and Expanded PTFE Gaskets and Seals

Graphite, Mica and High-Temperature Sheet and Gaskets

Metallic and Semi-Metallic Gaskets and Seals

Compressed Fiber and Non-Asbestos Sheets - By Application / Sealing Function (in Value %)

Flange and Piping Connections

Pumps, Valves and Mechanical Equipment Stuffing Boxes

Engines, Transmissions and Driveline Components

Compressors, Turbines and Rotating Machinery

Exhaust and Emissions Systems - By End-Use Industry (in Value %)

Automotive and Commercial Vehicles

Aerospace and Defense

Oil, Gas, Petrochemicals and Refineries

Chemicals, Specialty Chemicals and Industrial Gases

Power Generation - By Sales Channel (in Value %)

Direct OEM Supply

Industrial MRO and Reliability Contracts

Distributor and Fabricator Networks

Online, Catalog and E-Commerce Channels

EPC, Turnaround and Shutdown Contractors - By Performance Rating and Duty Severity

Low-Pressure Utility and HVAC Duty

Medium-Pressure Process and Mechanical Duty

High-Pressure, High-Temperature Process Duty

Cryogenic and Ultra-Low-Temperature Duty

Fugitive-Emission-Certified and Environmental-Duty Sealing

- Market Share of Major Players by Value and Volume

- Cross Comparison Parameters (Product portfolio breadth across static/dynamic sealing; End-use and application coverage; Material and technology capability for severe duty; Compliance with US and international sealing standards and emissions norms; OEM vs MRO revenue mix; USA manufacturing and service footprint; Engineering, testing and field-services capability; Digital tools, configuration and lifecycle-support offerings)

- Comparative SWOT Analysis of Leading Players

- Pricing and Value Positioning Analysis

- Detailed Profiles of Major Companies

Parker Hannifin Corporation

Freudenberg Sealing Technologies

Trelleborg Sealing Solutions

SKF Group

Dana Incorporated

ElringKlinger AG

John Crane

EagleBurgmann

Flexitallic Group

Garlock Sealing Technologies

Flowserve Corporation

James Walker Group

KLINGER Group

Lamons

- End-User Demand and Installed-Base Utilization

- Procurement Models and Budgeting Patterns

- Reliability, Uptime and Environmental Performance Requirements

- End-User Needs, Pain Points and Unmet Requirements

- Decision-Making Units and Buying Center Analysis

- By Value, 2025-2030

- By Volume, 2025-2030

- Average Realization per Unit and per Equipment Bill of Materials, 2025-2030