Market Overview

The U.S. glucometers market is valued at USD ~ billion, driven primarily by the rising prevalence of diabetes and growing health consciousness among the population. In 2025, the market experienced strong demand due to the expanding healthcare infrastructure, increased adoption of continuous glucose monitoring (CGM) systems, and advancements in digital health solutions. The surge in health awareness, combined with ongoing government initiatives for healthcare reform and diabetes management, further contributes to the market’s growth. The sector is supported by robust regulatory frameworks and the proliferation of diabetic patients, with nearly ~ million people diagnosed with diabetes in the U.S., driving substantial demand for glucose monitoring devices.

The U.S. market for glucometers is dominated by major urban centers such as New York, Los Angeles, and Chicago, where high population density and robust healthcare infrastructure create fertile ground for the widespread adoption of glucometers. These cities benefit from a significant number of healthcare providers, including hospitals, diabetes care centers, and retail pharmacies that facilitate the distribution of these devices. Additionally, innovation hubs in Silicon Valley and Boston, which focus on medical technology and digital health, play a crucial role in advancing glucose monitoring solutions, including the integration of AI and wearable technologies.

Market Segmentation

By Product Type

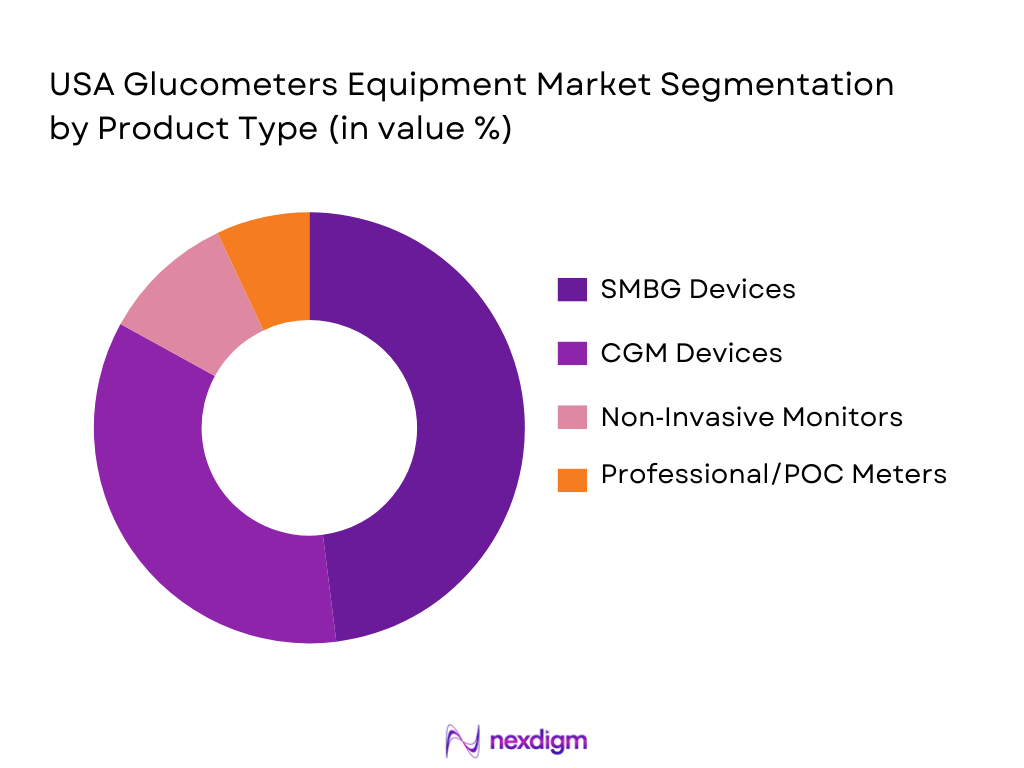

The U.S. glucometers market is segmented into Self‑Monitoring Blood Glucose (SMBG) Devices, Continuous Glucose Monitoring (CGM) Devices, Non‑Invasive Glucose Monitors, and Professional/Point‑of‑Care Glucose Meters. Among these, SMBG devices maintain a significant market share due to their long-standing presence and accessibility, particularly among consumers with type 1 and type 2 diabetes. However, CGM devices are rapidly gaining traction due to their convenience, real-time monitoring, and improved patient compliance. These devices are increasingly preferred by consumers who seek a more integrated and continuous approach to diabetes management.

By Technology

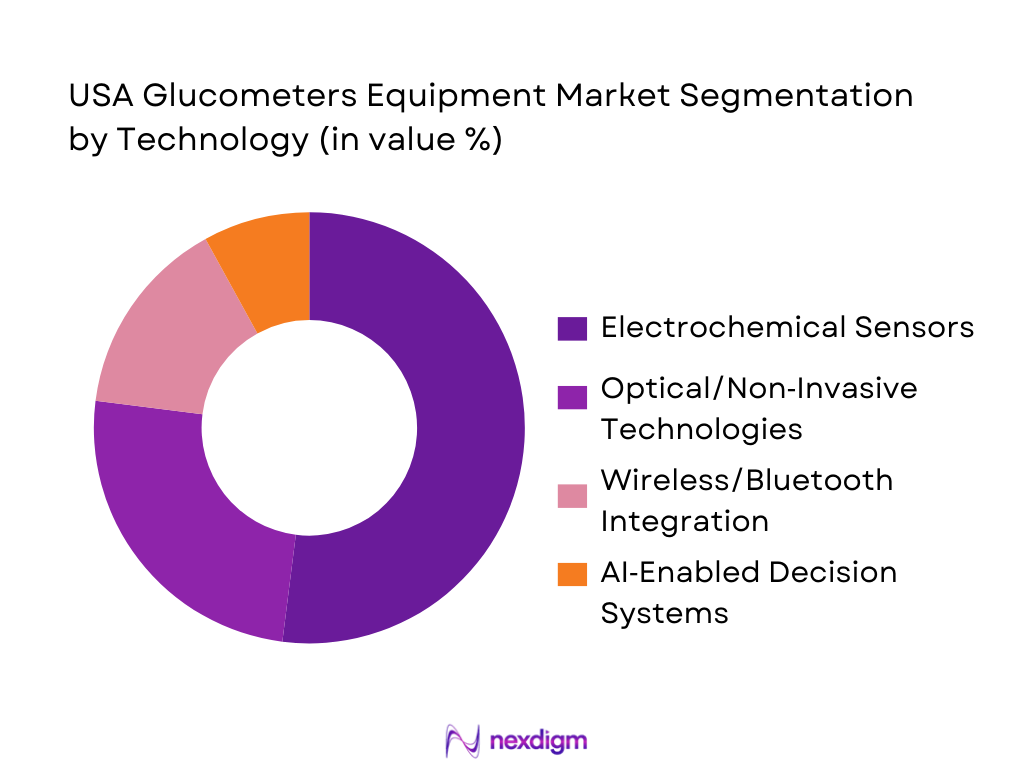

The technology segment is categorized into Electrochemical Sensors, Optical/Non‑Invasive Technologies, Wireless/Bluetooth Integration, and AI‑Enabled Decision Systems. Electrochemical sensors are the most dominant technology in the market, especially in SMBG devices, as they have been around the longest and offer reliable, accurate results. However, with the advent of innovation, non‑invasive technologies and wireless integration are gaining popularity. The growth of AI-enabled systems is expected to drive future market trends, as these devices provide better data analysis and predictive capabilities, making diabetes management more personalized.

Competitive Landscape

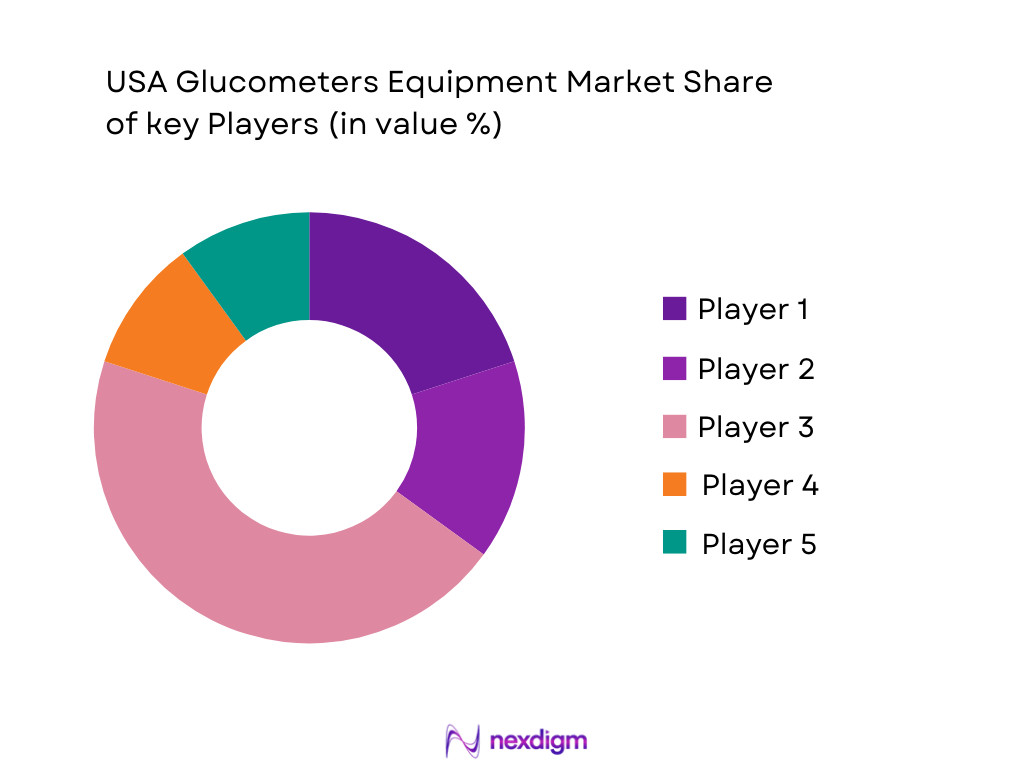

The U.S. glucometers market is highly competitive, dominated by major players such as Abbott Laboratories, Dexcom, Medtronic, Roche, and Ascensia. These companies offer a wide range of glucometers, from traditional SMBG devices to advanced CGM systems, and have made significant investments in research and development. The market is characterized by strong brand loyalty and strategic partnerships with healthcare providers, positioning these players as key industry influencers. The dominance of these companies is attributed to their extensive distribution networks, technological innovation, and strong regulatory compliance.

| Company | Establishment Year | Headquarters | Product Portfolio | Market Reach | Revenue | R&D Investment |

| Abbott Laboratories | 1888 | Chicago, Illinois | ~ | ~ | ~ | ~ |

| Dexcom, Inc. | 1999 | San Diego, California | ~ | ~ | ~ | ~ |

| Medtronic Plc | 1949 | Dublin, Ireland | ~ | ~ | ~ | ~ |

| Roche Diabetes Care | 1896 | Basel, Switzerland | ~ | ~ | ~ | ~ |

| Ascensia Diabetes Care | 2016 | Basel, Switzerland | ~ | ~ | ~ | ~ |

USA Glucometers Equipment Market Analysis

Growth Drivers

Urbanization

Urbanization has significantly contributed to the growth of the U.S. glucometers market. The U.S. urban population reached ~ % in 2025, up from ~% indicating a steady increase in urban migration. As urban areas tend to have better healthcare infrastructure and access to advanced medical devices, the demand for glucometers has increased. The growth of urban centers like New York, Los Angeles, and Chicago has led to greater awareness and adoption of diabetes management solutions, including glucometers. Additionally, the availability of healthcare facilities and diabetes clinics in urban areas promotes the use of advanced glucose monitoring systems.

Industrialization

Industrialization, particularly the expansion of the healthcare sector, has propelled the demand for glucometers. In 2025, healthcare spending in the U.S. surpassed USD ~ trillion, accounting for approximately ~ % of the country’s GDP, according to the U.S. Centers for Medicare & Medicaid Services. With the industrialization of healthcare, there has been an increase in healthcare facilities, research institutions, and medical equipment manufacturing. The U.S. is witnessing a significant surge in investment in healthcare infrastructure, which is directly impacting the availability and accessibility of glucometers for consumers, ultimately fostering market growth.

Restraints

High Initial Costs

The high initial costs of advanced glucometers, especially Continuous Glucose Monitoring (CGM) devices, remain a major barrier for widespread adoption. In 2025, the average cost of a CGM system was around USD ~, with ongoing sensor replacements costing approximately USD ~ every month. The relatively high prices of these devices pose financial challenges for individuals, especially those without adequate insurance coverage. This cost barrier limits the adoption of CGMs in lower-income households and smaller healthcare facilities. The rising healthcare expenditure also intensifies concerns about affordability in the diabetes care segment.

Technical Challenges

The technical challenges related to glucose monitoring systems are another restraint for market growth. Glucometers, particularly non-invasive technologies, are often hindered by accuracy issues. According to the FDA, there have been multiple instances where non-invasive glucometers failed to meet the required standards for blood glucose measurement. Additionally, maintenance and calibration issues in existing SMBG devices continue to affect their effectiveness. These technical hurdles can result in reduced consumer trust in the devices, limiting their adoption despite the growing demand for advanced monitoring solutions in the market.

Opportunities

Technological Advancements

Technological advancements present a major opportunity for the U.S. glucometers market. The rapid integration of Artificial Intelligence (AI) and Machine Learning (ML) in glucose monitoring devices is expected to revolutionize the sector. AI-powered glucose monitoring systems can provide real-time, actionable insights, enhancing the overall diabetes management experience. In 2025, the FDA approved several AI-based devices for glucose monitoring, marking a significant step forward in transforming the diabetes care landscape. This shift towards technologically enhanced devices is expected to meet the demand for personalized, accurate, and efficient diabetes management solutions in the market.

International Collaborations

International collaborations and partnerships in the healthcare and medical device sectors offer substantial opportunities for market growth. In 2025, collaborations between U.S. companies and global organizations led to improved access to glucometers in emerging markets. For example, a partnership between Abbott Laboratories and the World Health Organization (WHO) aimed at improving the availability of diabetes care products in low-income regions, creating potential revenue streams for U.S. manufacturers. Such collaborations are expected to increase market reach, foster technological exchange, and create new channels for expanding glucometer use, ultimately contributing to market growth.

Future Outlook

Over the next 5 years, the U.S. glucometers market is expected to show steady growth driven by increased adoption of continuous glucose monitoring (CGM) devices, advancements in non‑invasive glucose monitoring technologies, and greater integration of AI-based decision systems. Consumer demand for more personalized and convenient diabetes management solutions will further fuel market growth. Additionally, regulatory advancements and the increased prevalence of diabetes in the U.S. will contribute to the widespread adoption of next-generation glucose monitoring systems. The market is anticipated to continue evolving with innovative product launches and enhanced functionalities in digital health.

Major Players in the U.S. Glucometers Market

- Abbott Laboratories

- Dexcom, Inc.

- Medtronic Plc

- Roche Diabetes Care

- Ascensia Diabetes Care

- LifeScan

- Arkray, Inc.

- B. Braun Melsungen AG

- AgaMatrix

- Bionime Corporation

- Nova Biomedical

- Senseonics

- Prodigy Diabetes Care

- Johnson & Johnson

- DarioHealth

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (FDA, CDC)

- Healthcare Providers (Hospitals, Diabetes Care Centers)

- Healthcare Insurance Companies

- Medical Device Manufacturers

- Technology Providers (AI & Wireless Integration Companies)

- Retailers and Distributors of Medical Devices

- Diabetes Advocacy Organizations

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying and defining the key variables that influence the U.S. glucometers market. This process includes an in-depth review of secondary data from proprietary databases and market reports, focusing on industry trends, consumer preferences, and technological advancements. We map out the full ecosystem of stakeholders including manufacturers, suppliers, healthcare providers, and end-users to ensure a comprehensive understanding of market dynamics.

Step 2: Market Analysis and Construction

This phase includes compiling and analyzing historical data related to the U.S. glucometers market, examining factors such as market penetration, the growth rate of various product segments, and regulatory compliance. We also analyze service quality statistics, particularly for CGM devices, to assess their role in shaping the market.

Step 3: Hypothesis Validation and Expert Consultation

We develop and validate market hypotheses through computer-assisted telephone interviews (CATIs) with industry experts, healthcare professionals, and company representatives. This step helps refine the initial assumptions and gather on-the-ground insights into operational trends, emerging technologies, and customer preferences.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all research data to provide an integrated market outlook. Direct engagement with manufacturers and distributors is conducted to verify and enrich the quantitative data, ensuring that the final analysis reflects the current and future state of the U.S. glucometers market. This final output includes actionable insights and strategic recommendations for stakeholders.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, U.S. Healthcare Reimbursement Framework, Abbreviations, Triangulation Approach, Market Sizing Approach, Primary vs Secondary Research, Limitations)

- Definition & Inclusions: SMBG, CGM, Point‑of‑Care & Non‑Invasive Devices

- Adoption & Usage Criteria

- U.S. Disease Burden & Demand Drivers

- Regulatory & Reimbursement Landscape Specific to USA

- Market Genesis & Adoption Timeline

- Key Product Launches & FDA Milestones

- Evolution of SMBG to Continuous Monitoring

- U.S. Value & Volume Chain

- Manufacturing & Test Strip Supply Chain

- Clinical Distribution & Retail Channel Flows

- Growth Drivers

Rising Prevalence of Diabetes & Prediabetes

Consumer Shift to CGM & Wearable Monitoring

Digital Health & Smartphone Ecosystem Integration

Reimbursement Expansion & OTC Device Adoption

- Market Challenges

Supply Chain Constraints on Test Strips

Pricing Pressure & Insurance Coverage Limitations

LifeScan Bankruptcy & Competitive Pressures

- Opportunities

Expansion into Wellness/Health‑Track Segment (OTC CGMs)

AI & Predictive Analytics in Glucose Data

Non‑Invasive Solutions Market Growth

- Trends & Innovation Vectors

Sensor Longevity & UX Improvements

Integration with Mobile Apps & Health Platforms

Subscription Business & DTC Models

- Regulatory & Reimbursement Overview

FDA Approval Pathways & OTC Refined Standards

Medicare/Private Payer Reimbursement Dynamics

- Comprehensive SWOT Analysis

- U.S. Diabetes Care Ecosystem Map

- Porter’s Five Forces

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Product Type (In Value %)

Self‑Monitoring Blood Glucose (SMBG) Devices

Continuous Glucose Monitoring (CGM) Devices

Non‑Invasive Glucose Monitors

Professional/Point‑of‑Care Glucose Meters

- By Technology (In Value %)

Electrochemical Sensors

Optical/Non‑Invasive Technologies

Wireless/Bluetooth Integration

AI‑Enabled Decision Systems

- By End‑User (In Value %)

Home Care

Hospitals & Clinics

Diagnostic Labs

Retail & Direct‑to‑Consumer

- By Distribution Channel (In Value %)

Retail Pharmacies

Online Pharmacies & E‑Commerce

Device OEM Direct

Specialty Medical Distributors

- U.S. Market Share — Value & Volume

- Cross‑Comparison Parameters (Company Overview; Product Portfolio Depth; Innovation Index; FDA Clearances; U.S. Market Revenue; U.S. Distribution Reach; ASPs; Patent Strength; Test Strip Ecosystem; Sensor Durations; Retail Access; Direct Contracts; Integration Capabilities; Partnerships & Alliances)

- Competitive SWOT Profiles

- Pricing Analysis by SKU & Channel (U.S. Specific)

- Detailed Company Profiles

Abbott Laboratories (FreeStyle Libre Series)

Dexcom, Inc. (Dexcom G Series & OTC Stelo)

Medtronic Plc (Guardian & Related Platforms)

Roche Diabetes Care (Accu‑Chek Hybrid)

Ascensia Diabetes Care

LifeScan (OneTouch)

Arkray, Inc.

B. Braun Melsungen AG

AgaMatrix

Bionime Corporation

Nova Biomedical

Sinocare

DarioHealth Corp.

Senseonics (Eversense CGM)

Prodigy Diabetes Care

- Demand Metrics (Utilization & Frequency)

- Purchasing Power & Insurance Influence

- Pain Points & Unmet Needs

- Clinical vs. Consumer Decision Pathways

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030