Market Overview

The USA Health Monitoring Devices Market is valued at USD ~ billion in 2024, with continued growth driven by the increasing demand for chronic disease management, preventive healthcare, and the adoption of wearable devices. The market is fundamentally influenced by the ongoing shift toward home-based health monitoring, as consumers and healthcare providers alike look for solutions to reduce in-person visits. Key market drivers include the rising prevalence of lifestyle diseases, an aging population, and the integration of advanced technologies like AI and IoT in healthcare devices.

Regions like California, New York, and Texas dominate the market due to their significant healthcare infrastructure, dense populations, and a higher demand for health monitoring solutions. These regions have seen rapid adoption of wearable devices and remote monitoring technologies. Their dominance is further supported by high consumer awareness about health and fitness, as well as the presence of leading health tech companies like Apple and Fitbit that drive the innovation and distribution of health monitoring devices. The USA’s status as a technology hub also plays a crucial role in global supply chain and technology development for health monitoring.

Market Segmentation

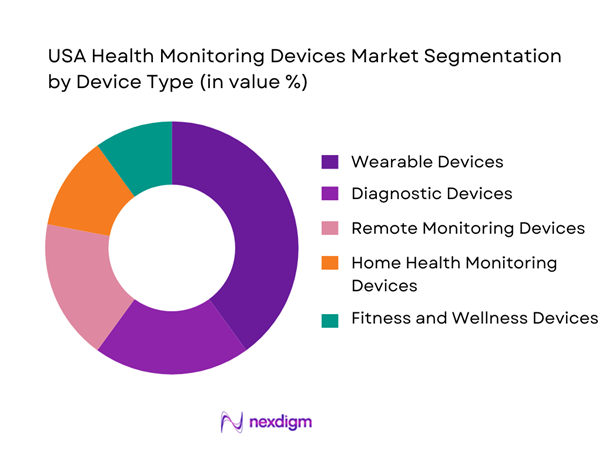

By Device Type

The wearable devices sub-segment dominates the USA Health Monitoring Devices Market due to the growing consumer interest in fitness tracking and health monitoring through devices like smartwatches and fitness bands. Wearables provide real-time, continuous health monitoring, which appeals to both health-conscious consumers and those with chronic conditions. Companies like Apple, Fitbit, and Garmin have revolutionized this space with continuous innovations in sensors and user-friendly designs. Their wide consumer adoption and integration with mobile apps and healthcare systems continue to drive the dominance of this segment.

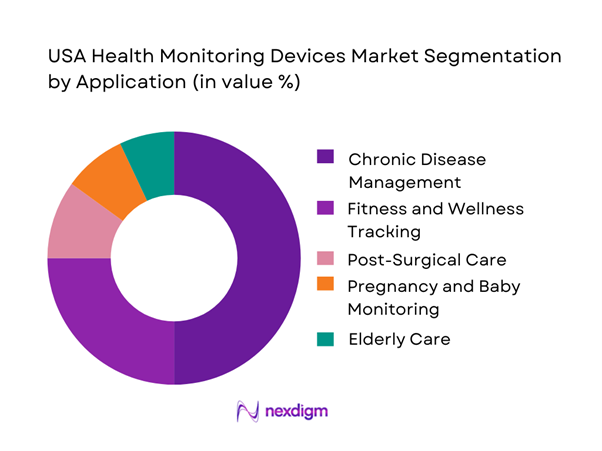

By Application

Chronic disease management leads the application segment, driven by the increasing number of people managing diseases like diabetes, cardiovascular conditions, and respiratory diseases. Devices used for chronic disease management, such as glucose monitors and heart rate monitors, are seeing widespread adoption as they allow for continuous monitoring and better long-term disease management. Key players like Abbott and Medtronic are pivotal in this space, providing devices that empower patients to monitor their conditions from home.

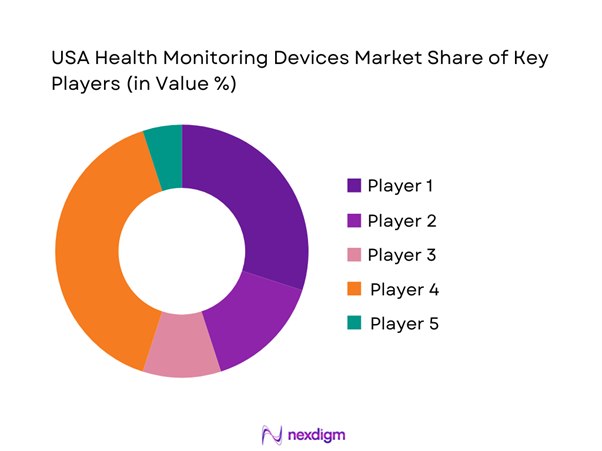

Competitive Landscape

The USA Health Monitoring Devices market is dominated by a few major players, including Medtronic, and global brands like Apple, Garmin, and Abbott Laboratories. This consolidation highlights the significant influence of these key companies, who continue to innovate and expand their market share with cutting-edge health monitoring technologies.

| Company | Establishment Year | Headquarters | Market Share (%) | Revenue (USD) | Device Types Offered | Distribution Channels | Regulatory Certifications | Technological Integration |

| Medtronic | 1949 | Minneapolis, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Apple | 1976 | Cupertino, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin | 1989 | Olathe, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott Laboratories | 1888 | Abbott Park, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Fitbit | 2007 | San Francisco, USA | ~ | ~ | ~ | ~ | ~ | ~ |

USA Health Monitoring Devices Market Analysis

Growth Drivers

Increasing Prevalence of Chronic Diseases

The rising number of individuals with chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders is significantly driving the demand for health monitoring devices. These conditions require ongoing management and monitoring, leading to increased adoption of devices that enable real-time data tracking. As healthcare systems shift towards preventative care, the need for continuous monitoring to manage chronic conditions has become more pronounced. This trend is prompting both healthcare providers and consumers to seek more accessible, reliable, and efficient solutions to monitor health metrics, thereby expanding the market for health monitoring devices.

Technological Advancements in Wearable Devices

Wearable devices have evolved significantly in recent years, thanks to advancements in sensor technology, battery life, and connectivity. These innovations enable devices to provide more accurate and real-time health data, such as heart rate, blood pressure, glucose levels, and even sleep patterns. The integration of AI and machine learning algorithms has enhanced the functionality of these devices, allowing for personalized health recommendations and early detection of potential health issues. As technology continues to improve, the popularity and demand for wearable health monitoring devices are expected to rise, fueling further growth in the market.

Market Challenges

High Cost of Advanced Health Monitoring Devices

Despite the growing demand for health monitoring devices, the high cost of advanced technologies remains a significant barrier to widespread adoption. Many of the most effective devices, particularly those used for chronic disease management or specialized health tracking, are priced at a premium, which limits access for certain consumer groups. This is especially challenging for individuals without insurance coverage or those living in lower-income areas. While technological advancements have made devices more affordable over time, the initial investment required for some of the top-tier models continues to deter broader adoption and market penetration.

Data Privacy and Security Concerns

As health monitoring devices collect sensitive personal health data, concerns about data privacy and security have become increasingly important. The storage and transmission of health data raise significant privacy risks, especially with the potential for hacking and unauthorized access. Consumers and healthcare providers are becoming more cautious about the safety of health-related data, leading to increased scrutiny over device manufacturers’ data protection measures. Regulatory frameworks like HIPAA have imposed strict requirements on data handling, but concerns persist over compliance and the potential for breaches, which can undermine consumer trust and limit adoption rates.

Opportunities

Growing Demand for Elderly Care Devices

As the global population ages, there is an increasing demand for health monitoring devices tailored to the elderly. Devices that assist with the management of chronic diseases, track mobility, and monitor vital signs are becoming essential in elderly care, helping to reduce hospital visits and enabling independent living. The demand for wearable health devices, such as fall detection sensors, heart rate monitors, and glucose meters, is especially strong. The ability of these devices to provide peace of mind to caregivers and family members, while improving the quality of life for elderly individuals, presents a significant growth opportunity in the health monitoring market.

Increasing Integration of AI and Big Data Analytics

The integration of artificial intelligence (AI) and big data analytics into health monitoring devices offers a wealth of opportunities. AI-powered algorithms can analyze large sets of health data in real-time, providing personalized insights and early detection of potential health issues before they become critical. The use of big data analytics enables healthcare providers to better understand patient trends, optimize treatment plans, and improve outcomes. As these technologies advance, they are expected to revolutionize health monitoring, offering greater accuracy and precision in detecting and managing health conditions, which will drive significant growth in the market.

Future Outlook

The USA Health Monitoring Devices Market is expected to continue growing as technological innovations, like AI and IoT integration, make health devices more efficient and accessible. Additionally, the increasing shift toward home healthcare solutions, coupled with government incentives and consumer demand for personalized healthcare, will further drive adoption. The market is poised for continued expansion, with wearable devices remaining the dominant product category due to their ease of use and continuous monitoring capabilities.

Major Players

- Medtronic

- Apple Inc.

- Garmin Ltd.

- Abbott Laboratories

- Fitbit

- Withings

- Omron Healthcare

- Samsung Electronics

- Boston Scientific

- ResMed

- Biotelemetry

- Dexcom

- Honeywell

- Philips Healthcare

- Xiaomi

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (FDA, CDC)

- Healthcare providers (Hospitals and clinics)

- Medical device distributors

- Insurance providers

- Elderly care centers

- Fitness and wellness enthusiasts

- Medical technology developers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key drivers of market growth, such as technological innovations and healthcare trends. This is done through secondary research and expert interviews to establish the foundational variables influencing market dynamics.

Step 2: Market Analysis and Construction

Data regarding current market trends, device adoption, and consumer behavior are collected and analyzed to understand past growth patterns and project future trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with key industry experts, including device manufacturers, healthcare providers, and technology specialists, to ensure that the data is accurate and reliable.

Step 4: Research Synthesis and Final Output

The final analysis synthesizes findings from both primary and secondary research, integrating expert opinions and market data to provide actionable insights for stakeholders.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Prevalence of Chronic Diseases

Technological Advancements in Wearable Devices

Rising Health Consciousness Among Consumers - Market Challenges

High Cost of Advanced Health Monitoring Devices

Data Privacy and Security Concerns

Regulatory and Compliance Requirements - Opportunities

Growing Demand for Elderly Care Devices

Increasing Integration of AI and Big Data Analytics

Advancements in Mobile Health Apps - Trends

Shift Towards Preventive Healthcare

Focus on User-Friendly and Affordable Devices

Integration of Smart Healthcare Ecosystems - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- Installed Base / Active Usage Metric, 2019–2024

- Service / Revenue Mix, 2019–2024

- By Device Type (In Value %)

Wearable Devices

Diagnostic Devices

Remote Monitoring Devices

Home Health Monitoring Devices

Fitness and Wellness Devices - By Application (In Value %)

Chronic Disease Management

Fitness and Wellness Tracking

Post-Surgical Care

Pregnancy and Baby Monitoring

Elderly Care - By Distribution Channel (In Value %)

Online Retail

Retail Pharmacies

Hospitals and Healthcare Institutions

Medical Equipment Distributors

Direct-to-Consumer Sales - By Region (In Value %)

Northeast

Midwest

South

West - By Technology (In Value %)

Bluetooth Enabled Devices

IoT-based Devices

AI-driven Health Monitoring

Non-invasive Monitoring Technologies

- Competition ecosystem overview

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Touchpoints, Distribution Channels, Margins, Unique Value Offering)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Medtronic

Philips Healthcare

Abbott Laboratories

Garmin Ltd.

Omron Healthcare

Fitbit

Withings

Apple Inc.

Samsung Electronics

Xiaomi

Boston Scientific

ResMed

Honeywell

Biotelemetry

Dexcom

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- Installed Base / Active Usage Metric, 2025–2030

- Service / Revenue Mix, 2025–2030