Market Overview

The USA Hydrogen Fuel Cell Vehicles market is valued at approximately USD ~ billion in 2025, driven by increasing government initiatives, advancements in fuel cell technology, and the growing demand for sustainable transportation solutions. Government subsidies, tax incentives, and stringent emission regulations have played a crucial role in promoting the adoption of hydrogen fuel cell vehicles (FCVs). These factors, combined with a commitment to reducing carbon emissions, continue to drive the market’s growth trajectory. Furthermore, advancements in fuel cell technology, infrastructure development, and an increasing focus on zero-emission vehicles are expected to accelerate market penetration in the coming years.

California remains the dominant region for hydrogen fuel cell vehicles in the USA, due to its progressive stance on clean energy and vehicle emissions. The state has developed a robust hydrogen refueling infrastructure and offers substantial incentives for both consumers and manufacturers. Additionally, cities such as Los Angeles and San Francisco have seen high adoption rates, supported by favorable policies and a growing number of hydrogen fueling stations. The East Coast, particularly areas like New York, is also witnessing increasing adoption, primarily driven by fleet operators and public transportation systems aiming for greener solutions.

Market Segmentation

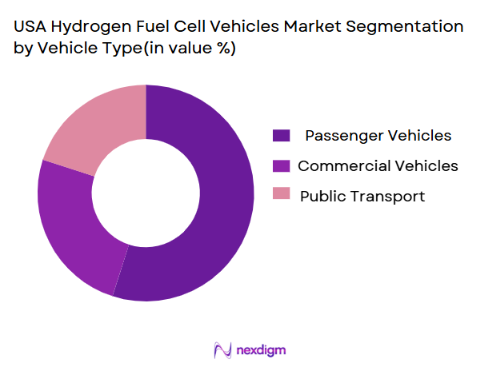

By Vehicle Type

The USA Hydrogen Fuel Cell Vehicles market is primarily segmented by vehicle type into passenger vehicles, commercial vehicles, and public transport. The passenger vehicle segment holds the largest market share, driven by increased consumer interest in zero-emission vehicles and the expansion of hydrogen refueling infrastructure.The passenger vehicle segment is currently dominating the market due to the increasing awareness of eco-friendly transportation solutions and the significant investments made by manufacturers like Toyota and Hyundai in fuel cell technology. The availability of models such as the Toyota Mirai and Hyundai Nexo, along with government incentives and a growing refueling infrastructure, has spurred consumer adoption. In 2024, the passenger vehicle segment is expected to account for over ~% of the total market share.

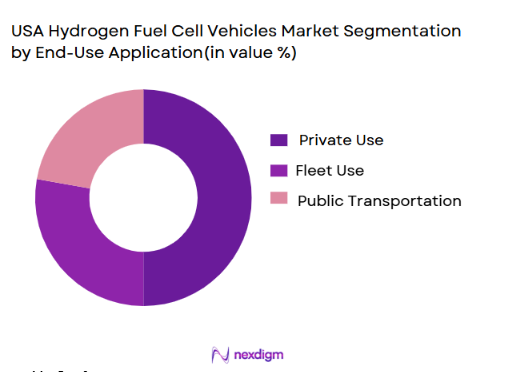

By End-Use Application

The USA Hydrogen Fuel Cell Vehicles market is also segmented by end-use application, with primary sub-segments being private use, fleet use, and public transportation.The private use segment is expected to dominate in 2025 due to the growing number of environmentally-conscious consumers and favorable incentives. The demand for personal hydrogen fuel cell vehicles, such as the Toyota Mirai, is expected to continue to rise as more consumers seek alternative fuels and sustainable transportation options. With the expansion of refueling infrastructure and continued advancements in vehicle affordability and technology, private consumers are increasingly turning to hydrogen fuel cell vehicles as a viable alternative to battery electric vehicles.

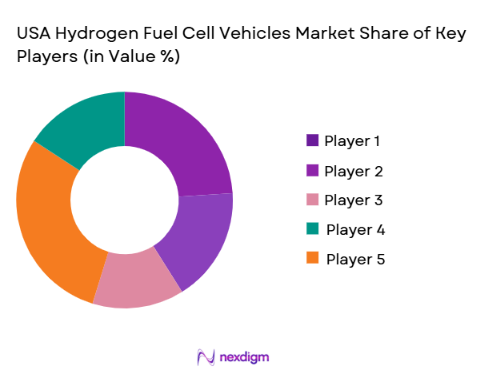

Competitive Landscape

The USA Hydrogen Fuel Cell Vehicles market is competitive, with both established automakers and emerging players making significant strides. Leading companies include Toyota, Hyundai, and Honda, all of which have invested heavily in fuel cell vehicle technology. These players are actively working to expand their market share by improving vehicle performance, increasing hydrogen refueling stations, and reducing production costs. The market is also witnessing the entry of new players focused on hydrogen infrastructure, such as Nikola Corporation, alongside traditional automotive giants investing in clean energy solutions.

| Company | Establishment Year | Headquarters | Key Market Parameters |

| Toyota Motor Corporation | 1937 | Toyota City, Japan | ~ |

| Hyundai Motor Company | 1967 | Seoul, South Korea | ~ |

| Honda Motor Co., Ltd. | 1948 | Tokyo, Japan | ~ |

| Ford Motor Company | 1903 | Dearborn, Michigan | ~ |

| Nikola Corporation | 2014 | Phoenix, Arizona | ~ |

USA Hydrogen Fuel Cell Vehicles Market Analysis

Growth Drivers

Urbanization

Urbanization in the USA is a key driver for the adoption of hydrogen fuel cell vehicles (FCVs). As cities continue to grow, transportation networks face increased demand, particularly in metropolitan areas. According to the U.S. Census Bureau, in 2023, the population of urban areas accounted for approximately 83% of the total U.S. population, with urbanization rates increasing annually. As urban areas expand, there is greater pressure on cities to adopt sustainable transportation solutions, including hydrogen-powered vehicles. Urban areas like California’s Bay Area have already seen significant investments in hydrogen infrastructure, further supporting FCV adoption.

Industrialization

The industrial sector in the U.S. is undergoing a transformation with a greater emphasis on decarbonization. The U.S. industrial sector is responsible for approximately ~% of the nation’s carbon emissions, as reported by the U.S. Environmental Protection Agency (EPA) in 2022. As part of its commitment to the Paris Agreement, the U.S. aims to significantly reduce industrial emissions. Hydrogen fuel cells offer a promising solution for industries like manufacturing, logistics, and heavy-duty transportation. The growing shift towards cleaner industrial solutions is driving the demand for hydrogen fuel cell vehicles and related infrastructure.

Restraints

High Initial Costs

The high initial cost of hydrogen fuel cell vehicles remains one of the primary restraints to widespread adoption. In 2023, the average price of a hydrogen fuel cell passenger vehicle in the U.S. was around USD 58,000, which is significantly higher than comparable electric vehicles and internal combustion engine vehicles. This price difference is attributed to the cost of fuel cell technology, hydrogen storage systems, and low production volumes. Although government subsidies and incentives are available to offset these costs, they still remain a financial barrier for many consumers. The high upfront costs make hydrogen vehicles less accessible to the general population, especially when compared to more affordable alternatives like battery electric vehicles.

Technical Challenges

There are several technical challenges associated with hydrogen fuel cell vehicles that hinder their growth. One of the most significant challenges is the development of an efficient, cost-effective hydrogen production process. Currently, most hydrogen is produced using natural gas, which negates some of the environmental benefits of hydrogen. Additionally, the efficiency of hydrogen fuel cells and the need for reliable, durable fuel cell components continue to be areas of concern for manufacturers. In 2023, the U.S. Department of Energy reported that while hydrogen fuel cells have made significant strides in terms of efficiency, they still face challenges in terms of lifespan and performance under extreme weather conditions

Opportunities

Technological Advancements

Technological advancements in hydrogen fuel cell technology are a significant opportunity for the market. Innovations in hydrogen production, fuel cell efficiency, and hydrogen storage systems are expected to lower costs and increase the performance of hydrogen vehicles. The U.S. Department of Energy has been investing heavily in hydrogen research, with a focus on improving fuel cell durability, reducing costs, and developing new methods of hydrogen production. As these technological advancements continue, the market for hydrogen vehicles is expected to become more competitive, with lower-priced and higher-performance vehicles available to consumers.

International Collaborations

International collaborations are helping to accelerate the development of hydrogen infrastructure in the U.S. In 2023, the U.S. signed multiple agreements with countries like Japan and Germany to collaborate on hydrogen fuel cell technology and infrastructure development. These partnerships include sharing research and technology, developing global hydrogen refueling networks, and providing joint funding for large-scale hydrogen production projects. These collaborations are crucial to ensuring the success of hydrogen fuel cell vehicles in the U.S. as they foster knowledge exchange and reduce barriers to entry for new players.

Future Outlook

Over the next six years, the USA Hydrogen Fuel Cell Vehicles market is expected to show robust growth. This growth will be driven by ongoing governmental support, advancements in fuel cell technology, and an increasing push toward zero-emission transportation. As the infrastructure for hydrogen refueling expands and the cost of hydrogen fuel cell vehicles decreases, the adoption rate will likely increase significantly. Additionally, hydrogen fuel cell technology is expected to play a crucial role in decarbonizing commercial and heavy-duty transport segments, which are difficult to electrify with battery electric vehicles alone. The combination of these factors will result in sustained growth through 2030.

Major Players in the Market

- Toyota Motor Corporation

- Hyundai Motor Company

- Honda Motor Co., Ltd.

- Ford Motor Company

- BMW Group

- Daimler AG

- Nikola Corporation

- Plug Power Inc.

- Ballard Power Systems

- Air Products and Chemicals, Inc.

- Linde Group

- Siemens Energy

- Panasonic Corporation

- Toyota Tsusho Corporation

- General Motors

Key Target Audience

- Automobile Manufacturers (OEMs)

- Energy Providers & Hydrogen Fuel Suppliers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., U.S. Department of Energy, Environmental Protection Agency)

- Fleet Operators (Transportation Companies)

- Automotive Component Suppliers

- Hydrogen Infrastructure Developers

- Logistics and Public Transport Authorities

Research Methodology

Step 1: Identification of Key Variables

The first phase involves mapping the entire ecosystem of the USA Hydrogen Fuel Cell Vehicles Market. This includes identifying key market variables such as government regulations, infrastructure development, consumer adoption patterns, and technological advancements in fuel cell vehicles.

Step 2: Market Analysis and Construction

This phase will involve gathering historical data on market trends, production volumes, and adoption rates. We will analyze various factors affecting market growth, including fuel infrastructure, government policies, and technological innovations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated based on secondary research and validated through expert consultations. We will conduct interviews with industry practitioners, OEMs, fuel providers, and infrastructure developers to refine the market data.

Step 4: Research Synthesis and Final Output

The final output will be synthesized using data collected from the previous steps, including in-depth insights into market dynamics, consumer behavior, key players, and regulatory factors. This final report will be cross-verified with stakeholders in the industry to ensure the accuracy and completeness of the analysis.

- Executive Summary

- Research Methodology(Market Definitions and Assumptions,USA-Specific Terminologies,Abbreviations,Market Sizing Logic,Bottom-Up & Top-Down Validation,Triangulation Framework,Primary Interviews Across OEMs, Fuel Providers, Infrastructure Developers, and Government Agencies,Demand-Side & Supply-Side Weightage,Data Reliability Index,Limitations & Forward-Looking Assumptions)

- Definition and Scope

- Market Genesis and Evolution Pathway

- USA Hydrogen Fuel Cell Vehicles Industry Timeline

- Hydrogen Fuel Cell Vehicles Business Cycle

- Fuel Cell Vehicles Supply Chain & Value Chain Analysis

- Key Growth Drivers

Government Incentives and Regulations

Demand for Zero-Emission Vehicles

Technological Advancements in Fuel Cells - Market Opportunities

Expansion of Hydrogen Infrastructure

Commercial and Fleet Adoption

Potential in Heavy-Duty and Freight Transportation - Key Trends

Rise of Sustainable and Clean Transportation

Fuel Cell Technology Advancements

Increasing Investment in Hydrogen Fuel Infrastructure - Regulatory & Policy Landscape

US Federal Policies and Hydrogen Adoption

State-Specific Regulations & Incentives

Hydrogen Fuel Standards and Certification - SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats - USA Hydrogen Fuel Cell Vehicles End-User Analysis

Demand Pattern & Utilization Metrics

Procurement Models & Purchasing Cycles

Compliance & Certification Expectations

Needs, Desires & Pain-Point Mapping

Decision-Making Framework (Private Consumers vs Fleets)

Cost vs. Sustainability Prioritization

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Selling Price, 2019-2025

- By Vehicle Type (In Value %)

Passenger Vehicles

Commercial Vehicles

Public Transport (Buses)

Heavy Duty Trucks

- By End-Use Application (In Value %)

Private Use

Fleet Use

Public Transportation

- By Fuel Infrastructure (In Value %)

Hydrogen Fueling Stations

Refueling Infrastructure Development

- By Technology (In Value %)

Fuel Cell Electric Vehicles (FCEVs)

Hybrid Fuel Cell Electric Vehicles

- By Region (In Value %)

West Coast

East Coast

Midwest

Southern USA

- By Consumer Segment (In Value %)

Early Adopters

Mass Market (Private & Fleet Users)

- Market Share Analysis

- Cross Comparison Parameters(Product Portfolio Breadth, Fuel Cell Efficiency and Durability, Regulatory Approvals in the USA, Pricing & Reimbursement Alignment, Local Distribution Footprint, Manufacturing & Localization Capabilities, R&D Investment and Technological Advancements, Strategic Partnerships & Collaborations)

- SWOT Analysis of Key Players

Strengths

Weaknesses

Opportunities

Threats - Pricing Analysis

Comparison of Prices Across Vehicle Types

Pricing Strategies for Different Consumer Segments - Detailed Company Profiles

Toyota Motor Corporation

Hyundai Motor Company

Honda Motor Co., Ltd.

General Motors

Ford Motor Company

BMW Group

Daimler AG

Nikola Corporation

Plug Power Inc.

Ballard Power Systems

Air Products and Chemicals, Inc.

Linde Group

Siemens Energy

Panasonic Corporation

Toyota Tsusho Corporation

- Demand Pattern & Utilization Metrics

- Procurement Models & Purchasing Cycles

- Compliance & Certification Expectations

- Needs, Desires & Pain-Point Mapping

- Decision-Making Framework (Private Consumers vs Fleets)

- Cost vs. Sustainability Prioritization

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Selling Price, 2026-2030