Market Overview

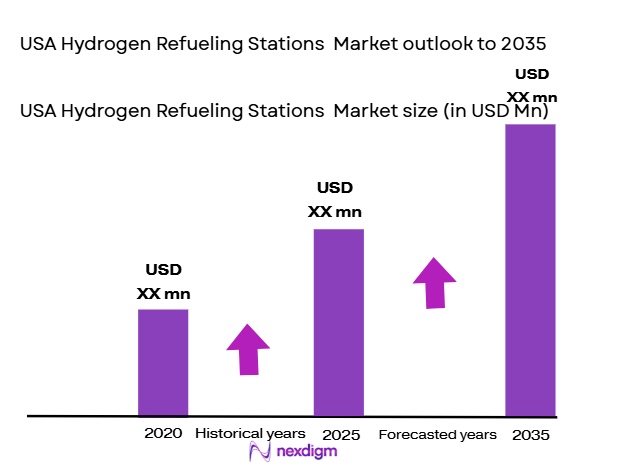

The USA Hydrogen Refueling Stations market is experiencing significant growth, driven by both government policies and technological advancements. In 2024, the market is expected to reach a valuation of approximately , reflecting a growing demand for hydrogen fuel cell vehicles (FCVs) and supportive infrastructure. Key drivers of this growth include governmental incentives, an increasing shift toward renewable energy sources, and rising environmental concerns among consumers. The expansion of the hydrogen refueling network is also being fueled by investments in green hydrogen production and infrastructure, which align with the country’s sustainability goals.

The USA market is heavily dominated by states such as California, Texas, and New York, where policies are conducive to the development of hydrogen refueling stations. California, in particular, leads the market due to its robust support for green energy and the widespread adoption of hydrogen-powered vehicles, especially in urban areas like Los Angeles and San Francisco. These regions benefit from strong governmental policies,

large-scale investments, and collaborations between local authorities and private companies. Additionally, Texas, with its vast energy sector, is increasingly investing in hydrogen technologies to complement its oil and natural gas industry.

Market Segmentation

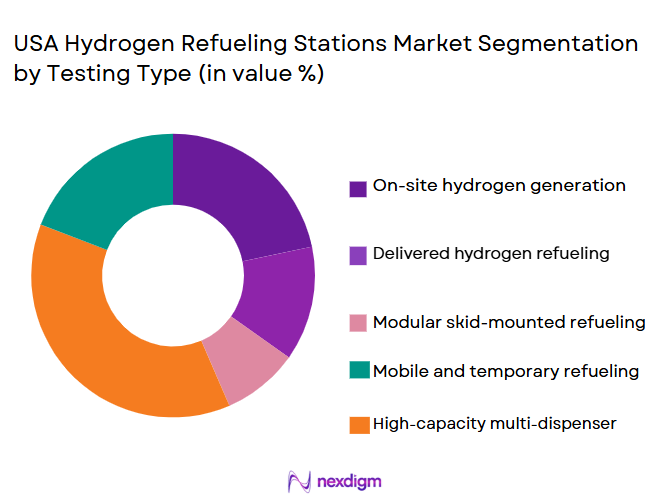

By Testing type

The market for hydrogen refueling stations is segmented by station types into public stations and private stations. Public stations have a dominant market share in the USA, accounting for approximately ~% of the market in 2024. This dominance is driven by government initiatives that encourage the establishment of publicly accessible refueling networks to support the adoption of hydrogen vehicles. Public stations cater to the increasing demand for hydrogen fuel in cities with a high concentration of hydrogen-powered vehicles, and they offer a broader customer base. Additionally, public stations are generally supported by federal and state funding to help establish hydrogen infrastructure.

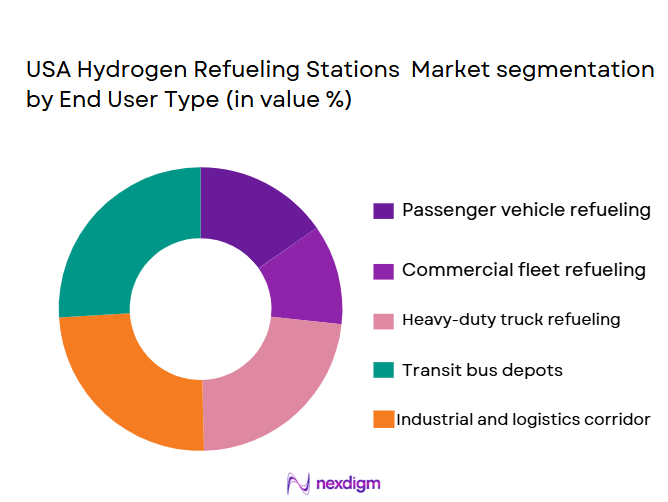

By End User

The segmentation of hydrogen refueling stations by capacity reveals two primary categories: low-capacity stations and high-capacity stations. High-capacity stations are projected to dominate the market, contributing to ~% of the total market share in 2024. The growth of high-capacity stations is primarily driven by the increasing demand for hydrogen refueling in commercial sectors, such as logistics, buses, and fleet operators. These sectors require larger volumes of hydrogen fuel to operate efficiently and meet their energy demands. Furthermore, the development of high-capacity stations is supported by advancements in storage technologies and the growing adoption of hydrogen-powered commercial vehicles.

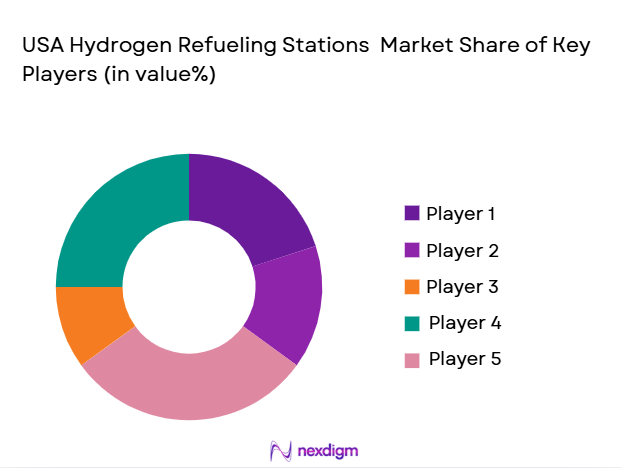

Competitive Landscape

The USA Hydrogen Refueling Stations market is highly competitive, with several global and local players competing for market share. Major companies include Air Liquide, Linde Group, Nel ASA, and Shell, all of which have made substantial investments in hydrogen infrastructure. The market is also witnessing new entrants focusing on innovative and scalable solutions for hydrogen refueling. These players are actively involved in collaborations with government entities and private firms to expand the hydrogen refueling network and meet growing demand in key regions like California and Texas.

| Company | Establishment Year | Headquarters | Revenue (2024) | Market Focus | Technology Focus | Strategic Partnerships | Key Competitor |

| Air Liquide | 1902 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Linde Group | 1902 | Guildford, UK | ~ | ~ | ~ | ~ | ~ |

| Nel ASA | 1927 | Oslo, Norway | ~ | ~ | ~ | ~ | ~ |

| Shell | 1907 | The Hague, Netherlands | ~ | ~ | ~ | ~ | ~ |

| Toyota | 1937 | Aichi, Japan | ~ | ~ | ~ | ~ | ~ |

USA Hydrogen Refueling Stations Market Analysis

Growth Drivers

Urbanization

Urbanization in USA is growing rapidly, with more than ~% of the population residing in urban areas as of . As urban areas expand, the air quality monitoring systems are becoming crucial due to the increasing levels of air pollution associated with traffic, construction, and industrial activities. Jakarta, the capital, is ranked as one of the most polluted cities globally, with particulate matter (PM2.5) levels often exceeding safe limits. The high rate of urban migration and the rising demand for better air quality control are further driving the adoption of air quality monitoring systems across the country.

Industrialization

USA’s industrial sector is one of the largest in Southeast Asia, with manufacturing contributing ~% to the country’s GDP in . As industries expand, especially in key sectors like automotive, chemicals, and textiles, air pollution levels have risen significantly, making air quality monitoring systems a critical tool for mitigating environmental impact. The increase in industrial production and its contribution to urban air pollution necessitates a stronger regulatory framework and monitoring solutions, further driving the demand for air quality systems. In , the industrial sector’s CO2 emissions were reported at ~ USD million metric tons. Source: International Monetary Fund (IMF)

Technical Challenges

USA faces technical challenges in implementing and maintaining air quality monitoring systems due to the lack of skilled professionals who can manage and analyze air quality data effectively. As of 2023, less than ~% of air quality monitoring professionals in USA had specialized certifications in environmental data analysis, which hampers the proper utilization of advanced monitoring systems. The lack of robust technical infrastructure in rural and remote areas also limits the expansion of monitoring systems outside of major urban centers, further constraining market growth.

Lack of Skilled Workforce

The shortage of skilled personnel trained in air quality monitoring, data interpretation, and system maintenance poses another significant challenge. The USA government has recognized this gap and has begun to incorporate environmental technology courses in universities. However, as of 2022, only a few universities in USA offered specialized programs in environmental monitoring. The shortage of a skilled workforce limits the growth of air quality monitoring systems, especially in regions outside major cities like Jakarta and Surabaya.

Opportunities

Technological Advancements

Technological advancements in air quality monitoring systems are opening up new opportunities for market expansion in USA. The integration of low-cost, real-time sensors and the advancement of data analytics technologies have made it more feasible to deploy affordable and scalable air quality systems5, new sensor technologies that reduce system costs by up to ~% were introduced, making it easier for municipalities and private companies to invest in air quality monitoring solutions. As of 2023, these innovations are expected to increase system adoption across both urban and rural areas.

International Collaborations

USA is actively collaborating with international organizations and other countries to improve air quality monitoring. A notable example is its partnership with Japan’s Ministry of the Environment, which, in 2023, pledged to support the establishment of more air quality monitoring stations across USA . These international collaborations bring in technological know-how, financial support, and expertise, creating further growth opportunities for air quality monitoring systems. Additionally, the UN’s Sustainable Development Goals (SDGs) provide a framework for international cooperation in improving air quality management in developing countries like USA.

Future Outlook

Over the next few years, the USA Hydrogen Refueling Stations market is expected to experience substantial growth. This expansion will be fueled by ongoing government support, increased adoption of hydrogen fuel cell vehicles, and the growing commitment of the private sector to build a sustainable hydrogen infrastructure. With advancements in hydrogen production technologies and refueling station networks, the market is poised for a steady increase in both the number of stations and refueling capacity. Furthermore, large-scale projects in key regions such as California and Texas will contribute significantly to the market’s evolution, helping to establish hydrogen as a viable alternative fuel source.

Major Players in the Market

- Air Liquide

- Linde Group

- Nel ASA

- Shell

- Toyota

- ITM Power

- Plug Power

- Hydrogenics Corporation

- Ballard Power Systems

- H2 Energy

- FirstElement Fuel

- Honda

- Nikola Corporation

- Daimler AG

- Siemens

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Automotive OEMs

- Hydrogen Fueling Station Operators

- Energy Infrastructure Providers

- Commercial Fleet Operators

- Research and Development Entities

- Hydrogen Production Companies

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research involves mapping out all relevant stakeholders in the USA Hydrogen Refueling Stations market. This step leverages secondary data sources such as industry reports, white papers, and market analyses to identify and define key drivers and barriers affecting the market. By creating an ecosystem map, the objective is to understand the broader market dynamics, focusing on critical variables such as technological advancements, government policies, and infrastructure developments.

Step 2: Market Analysis and Construction

The second step focuses on compiling and analyzing historical market data, particularly related to hydrogen refueling stations’ establishment, growth, and utilization rates across the USA. This involves an in-depth assessment of regional adoption rates, particularly in states like California, Texas, and New York. Additionally, the research will also evaluate infrastructure gaps and how they impact the expansion of refueling stations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses based on initial research will be validated through consultations with industry experts from refueling station operators, fuel cell vehicle manufacturers, and energy producers. These experts will provide insights into the challenges and opportunities in the market. Interviews will be conducted with professionals in both the public and private sectors to understand the operational nuances of hydrogen fueling infrastructure.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all gathered data and validating market assumptions through expert feedback and operational data from hydrogen refueling station operators. This ensures that the final report offers a comprehensive and well-rounded understanding of the USA Hydrogen Refueling Stations market, providing actionable insights to stakeholders across various sectors.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations Market Sizing Approach Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Key Market Drivers (Regulatory & Policy Influence, Technological Advancements)

- Major Stakeholders & Ecosystem Overview

- Supply Chain and Value Chain Analysis

- Key Components: Hydrogen Production, Storage, and Distribution

- Growth Drivers

Federal and state decarbonization mandates supporting hydrogen mobility

Rising deployment of fuel cell electric vehicles in commercial fleets

Government funding for alternative fuel infrastructure expansion - Market Challenges

High upfront capital costs for station deployment

Limited hydrogen supply chain and distribution infrastructure

Standardization and interoperability issues across station designs - Market Opportunities

Expansion of hydrogen corridors for heavy-duty transportation

Integration of renewable hydrogen production at refueling sites

Private investment growth through infrastructure-as-a-service models - Trends

Shift toward modular and scalable station architectures

Increased adoption of high-pressure 700 bar refueling systems

Growing collaboration between OEMs, utilities, and energy majors

- Government Regulations and Standards

SASO Compliance

Local Content Requirements

Industrial Localization Policies

Automotive Safety Standards

- SWOT Analysis of the Hydrogen Refueling Market

SWOT Analysis of Major Players (Strengths, Weaknesses, Opportunities, Threats)

Pricing Analysis and Cost Structure Comparison (By Station Type, Region, and Technology)

Stakeholder Ecosystem

Porter’s Five Forces Analysis

Competitive Intensity and Entry Barrier Assessment

- By Value 2019- 2025

- By Volume 2019- 2025

- By Average Price of Hydrogen 2019- 2025

- Regional Breakdown of Station Deployments 2019- 2025

- Growth Rate Analysis of Existing Stations 2019- 2025

- By System Type (In Value%)

On-site hydrogen generation systems

Delivered hydrogen refueling systems

Modular skid-mounted refueling stations

Mobile and temporary refueling stations

High-capacity multi-dispenser stations - By Platform Type (In Value%)

Passenger vehicle refueling stations

Commercial fleet refueling hubs

Heavy-duty truck refueling stations

Transit bus depots

Industrial and logistics corridor stations - By Fitment Type (In Value%)

New greenfield station installations

Retrofit of existing fuel stations

Standalone hydrogen-only stations

Co-located multi-fuel stations

Port and industrial zone installations - By EndUser Segment (In Value%)

Automotive OEM-backed networks

Public transit authorities

Logistics and freight operators

Energy and oil & gas companies

Municipal and government agencies - By Procurement Channel (In Value%)

Direct EPC contracts

Public-private partnership projects

Government-funded tenders

Long-term supply and service agreements

Leasing and build-own-operate models

- Market Share Analysis

- Cross Comparison Parameters

(Installed capacity, Geographic footprint, Technology offering, Partnerships, Pricing strategy) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Air Liquide

Air Products and Chemicals

Linde

Plug Power

Nel Hydrogen

Chart Industries

FirstElement Fuel

Shell

BP

Cummins

McPhy Energy

Hexagon Purus

Nikola

Toyota Tsusho America

Hyzon Motors

- Fleet operators prioritize uptime, fast refueling, and fuel supply reliability

- Public agencies focus on compliance with emissions reduction targets

- Energy companies leverage hydrogen stations to diversify fuel portfolios

- OEM-backed networks emphasize geographic coverage and brand alignment

- Forecast Market Value 2025–2030

- Forecast Installed Units 2025–2030

- Price Forecast by System Tier 2025–2030

- Future Demand by Platform 2025–2030