Market Overview

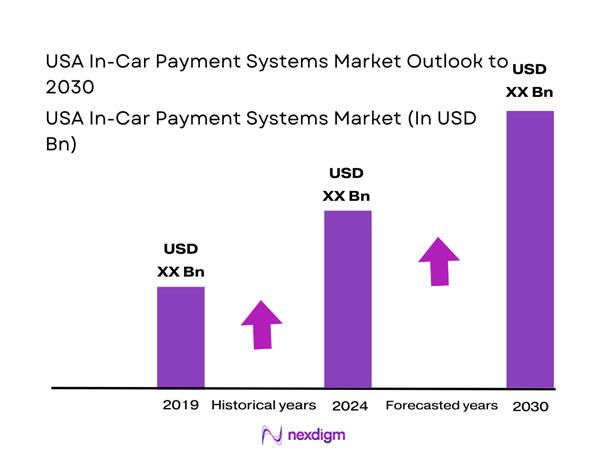

The USA in-car payment systems market is valued at USD ~ billion in ~, driven by increasing consumer demand for seamless, contactless transactions integrated directly into vehicles. This growth is propelled by the rise in connected and infotainment-enabled cars (with embedded digital wallets), consumer preference for convenience in fuel, parking, tolling, EV charging, and drive-thru payments, as well as strong collaboration between automotive OEMs and payment networks. North America holds a leading position due to early adoption of connected vehicle technologies and extensive digital infrastructure that supports in-vehicle commerce platforms.

Within this ecosystem, major metropolitan cities like New York, Los Angeles, Chicago, and Houston dominate usage and investment in in-car payment services, owing to high vehicle density, advanced transportation infrastructure (including smart parking and tolling systems), and greater consumer affinity for digital payments. Additionally, the USA leads because of significant R&D investments by OEMs (like GM, Ford, Tesla) and payment giants (Visa, Mastercard, PayPal), coupled with support from large fuel and charging networks that integrate these payment solutions.

Market Segmentation

By Payment Use Case

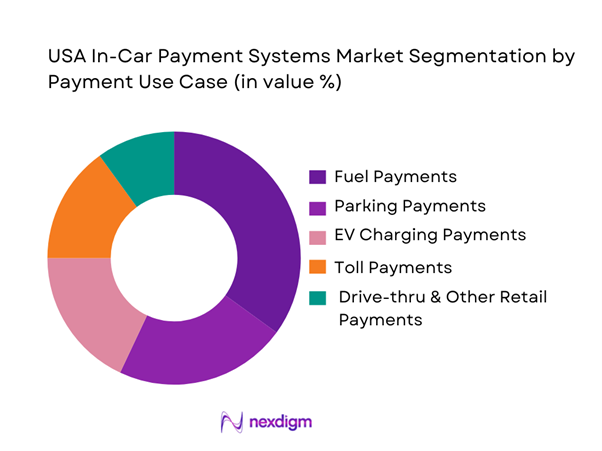

The USA in-car payment systems market is segmented into fuel, parking, EV charging, toll, and drive-thru/other retail payments. Fuel payments currently dominate due to extensive existing fueling infrastructure where drivers regularly transact, making integration of in-car payment solutions a practical extension of daily activities. Long-standing collaborations between fuel station operators, payment networks, and connected car technology providers have accelerated usage and user familiarity. Parking payments follow closely, supported by smart city initiatives in dense urban areas where mobile and in-car payments reduce friction and time spent searching for payment points. EV charging payments are rapidly growing as EV adoption increases, particularly in states like California and New York where charging infrastructure investments are highest. Toll payments benefit from existing electronic tolling (e.g., E-ZPass, FasTrak) that easily integrate with connected vehicle systems, while drive-thru and retail payments segment capture convenience demands from consumers using in-car commerce for food orders and quick commerce. — Data estimated from broader in-vehicle payments trends.

By Payment Technology

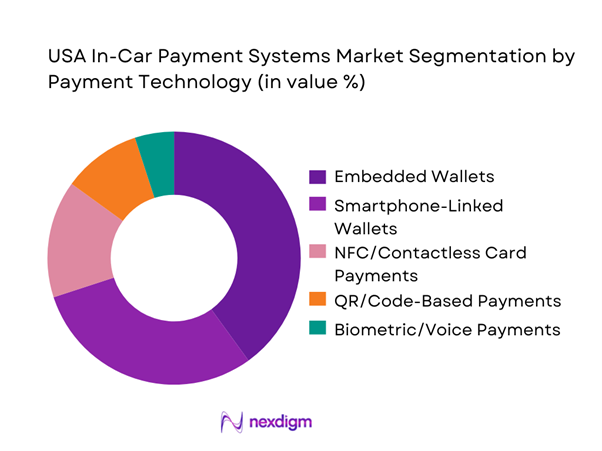

The in-car payment systems market in the USA is segmented into embedded wallets, smartphone-linked wallets, NFC/contactless card payments, QR/code-based, and biometric/voice technologies. Embedded wallets lead due to deep integration into the vehicle’s infotainment system, which allows seamless, hands-free payments for fuel, parking, charging, and other services. Vehicle manufacturers such as Tesla and GM have incorporated these platforms to improve customer experience and promote loyalty. Smartphone-linked wallets (like Apple Pay and Google Pay) follow, as many users prefer familiar mobile payment interfaces that work across contexts beyond the vehicle as well. NFC/contactless card payments remain prevalent due to near-universal adoption and ease of integration. QR/code-based solutions are used mainly at parking and toll points where scanning is required, while biometric/voice payments are emerging as premium, secure alternatives — bolstered by privacy and security enhancements in modern vehicles. — Structured using synthesized market data.

Competitive Landscape

The USA in-car payment systems market is moderately consolidated, with a mix of automotive OEMs, payment processors, digital wallet providers, and technology platforms competing for share. Major players include legacy card networks (Visa, Mastercard), digital wallets (Apple, Google), and OEM-embedded solutions (Ford, GM, Tesla), highlighting the multi-stakeholder nature of the ecosystem. These companies leverage partnerships, extensive vehicle fleets, and broad merchant networks to gain advantage, while innovation in user experience and security remains a key competitive lever.

| Company | Establishment Year | Headquarters | Platform Type | Supported Use Cases | Tech Integrations | Partnership Network | Revenue Model |

| Visa | 1958 | USA | ~ | ~ | ~ | ~ | ~ |

| Mastercard | 1966 | USA | ~ | ~ | ~ | ~ | ~ |

| Apple (Apple Pay) | 1976 | USA | ~ | ~ | ~ | ~ | ~ |

| Google (Google Pay) | 1998 | USA | ~ | ~ | ~ | ~ | ~ |

| Ford Motor Company | 1903 | USA | ~ | ~ | ~ | ~ | ~ |

USA In-Car Payment Systems Market Analysis

Growth Drivers

Connected vehicle parc

The addressable base for in-car payments grows with the on-road vehicle parc that can host telematics, infotainment, and embedded credential vaults. The U.S. had ~ registered motor vehicles (all motor vehicles) in the latest “MV-~” compilation, up from ~ in the subsequent release—both figures indicate a very large installed base for OEMs, Tier-~s, and wallet/processor partners to enable in-dash checkout experiences (fuel, parking, tolling, food, drive-thru, maintenance). In parallel, U.S. macro scale supports continuous digitization: reports GDP of USD ~ and GDP per capita of USD ~, which correlates with high vehicle ownership and strong consumer spend capacity that sustains card-on-file and tokenized commerce use cases inside vehicles. These vehicle counts matter because every incremental model year refresh expands the number of “software-defined” dashboards capable of OTA updates, credential provisioning, and identity verification—prerequisites for OEM commerce monetization without forcing drivers to pick up a phone.

Digital wallets penetration

In-car payment UX improves when consumers already trust mobile wallets, device-based authentication, and stored credentials—reducing friction when the car becomes “another screen” for the same payment identity. Payments research shows U.S. consumers made an average of ~ payments per month using a mobile phone in the measured period (reflecting routine wallet-style behavior that can be extended into the vehicle context through companion apps, OEM apps, and in-dash wallet rails). That behavioral base is reinforced by the U.S. economy’s absolute scale—USD ~ GDP and USD ~ GDP per capita—supporting dense merchant acceptance, high card/wallet issuance, and large transaction volumes that payment networks prioritize with tokenization and fraud tooling. For in-car payments, this matters because wallet familiarity makes it easier to push “one-tap” and “biometric + token” flows into head units while keeping the phone as a secure authenticator (or fallback) rather than the primary checkout device. It also supports multi-merchant credential reuse: when a driver already uses a phone wallet for everyday purchases, they are more likely to accept OEM prompts like “save this card to your vehicle profile,” “use passkey/biometric,” and “auto-pay at participating merchants,” which reduces abandonment at the dashboard and increases conversion for EV charging, parking, tolls, and drive-thru.

Challenges

Driver distraction constraints

In-car payment UX faces a hard constraint: regulators, safety advocates, and OEM HMI policies must minimize cognitive load, especially at speed. Official CrashStats research notes report ~ fatalities in distraction-affected crashes and ~ fatal crashes that involved distraction in the cited year—numbers that keep “eyes-off-road” time under scrutiny and push payment flows toward parked-only checkout, voice-first confirmations, and background authentication rather than active typing. Even beyond distraction-specific reporting, estimates of ~ total traffic fatalities in the referenced year reinforce why OEMs design infotainment lockouts and why payment prompts must be timed to safe contexts (arrival, charging stall, parking, drive-thru queue). The macro environment matters too: with U.S. GDP at USD ~ and GDP per capita at USD ~, consumers place high value on convenience, but safety tradeoffs are unacceptable at national scale because liability and reputational downside is enormous. For in-car payments, the practical implication is that the market’s growth is gated by human-factors engineering: successful deployments default to low-interaction patterns (auto-pay, subscription, tokenized “confirm only”) and shift complex steps (card entry, KYC, dispute setup) to companion apps while using the vehicle as a confirmation and status surface. The vendor stack must therefore include HMI compliance testing, voice assistant integration, and a clear policy layer (what can be purchased while moving, how receipts and disputes are handled, and how merchants present offers without turning the dashboard into an ad wall).

Fraud / ATO risks

Account takeover (ATO), credential stuffing, and scam payment requests are a direct threat to in-car commerce because vehicles are “sticky identities” tied to location, routes, and stored payment tokens—high-value targets for criminals. Annual reporting shows the scale of cyber-enabled harm: ~ complaints and USD ~ in losses in the latest annual report, which signals how aggressively criminals exploit new payment channels. Consumer reporting also recorded ~ consumer reports, reflecting the massive reporting volume linked to fraud and identity issues at U.S. digital scale—conditions under which any new channel (like in-car checkout) will be tested by attackers immediately. In a market where GDP is USD ~ and GDP per capita is USD ~, the sheer volume of transactions and stored credentials makes “fraud externalities” unavoidable, so OEMs and payment partners must architect for zero-trust: device binding, tokenization, step-up authentication, abnormal behavior detection, and rapid de-provisioning when a vehicle is sold or a driver profile changes. This is especially acute for tolling and parking scams: multiple U.S. transportation agencies and consumer protection bodies have issued warnings about fake toll payment texts, showing how criminals mimic transportation payment brands because they expect people to pay quickly to avoid penalties. For in-car payments, the winning architectures will treat the head unit as a controlled UI but keep cryptographic keys in secure elements and rely on passkeys/biometrics through trusted devices, while building strong customer support flows to freeze accounts and reverse unauthorized purchases before disputes cascade into brand damage.

Opportunities

Fleet-grade in-car commerce

Fleet operators (delivery, utilities, field service, car rental, corporate mobility) create a high-value “managed transaction” environment where in-car payments can be controlled with policy, limits, and auditability—exactly what is needed to scale beyond consumer convenience into enterprise spend. The U.S. fleet opportunity sits on top of the country’s enormous vehicle base—~ to ~ registered vehicles—which includes millions of commercial trucks and service vehicles in breakdowns, meaning fleet spend on tolls, fuel, charging, parking, and maintenance is structurally large in transaction count even when individual ticket sizes are small. The macro environment—USD ~ GDP and USD ~ GDP per capita—supports dense logistics networks and high utilization driving patterns that make “embedded payments” valuable: fewer receipts, less fraud leakage, automated reconciliation. Risk data reinforces why fleets will pay for controlled in-car commerce: reported USD ~ in losses highlight that enterprise payments are under constant attack; fleet-grade in-car payments can reduce exposure by limiting merchant categories, geofencing purchases, requiring driver authentication, and tying every transaction to vehicle telematics context (time, location, route). The near-term growth lever is not futuristic numbers; it is today’s infrastructure and compliance momentum: reporting already shows funded ports are operating, enabling managed fleet charging accounts that can be triggered from dispatch systems and settled automatically without individual driver reimbursement. Fleet-grade in-car commerce becomes a platform play: OEMs and payments partners can sell “payments + policy + reconciliation” subscriptions to enterprises, accelerating adoption without needing every consumer to change behavior first.

Unified charging + parking accounts

A unified account that spans EV charging and parking is one of the cleanest “bundle” opportunities for the U.S. in-car payments market because the transactions are location-triggered, time-bounded, and naturally integrated with navigation. Charging infrastructure growth provides current, measurable proof of expanding transaction endpoints: continuously updated charging infrastructure datasets show federal corridor deployment has already begun with funded stations opened in ~ states and ~ ports operating. Parking digitization rides on the same fundamentals: a massive U.S. driving population (totals of ~ to ~ registered vehicles) and consumer familiarity with digital payments (average ~ mobile-phone payments per month), which makes it realistic to consolidate multiple mobility payments into one credential and one receipt stream. Macro scale supports bundle economics: USD ~ GDP and USD ~ GDP per capita underpin high urbanization, dense commercial activity, and frequent “arrive-park-charge” journeys in metro areas where EV adoption and paid parking overlap. The key is to use current-state data (not future guesses) to justify why bundling wins now: fraud and dispute pressures are already large—~ consumer reports and ~ complaints—so consolidating into one authenticated, tokenized account with strong controls can reduce credential sprawl (many apps, many stored cards) and improve security posture. For OEMs, a unified charging+parking wallet increases stickiness because it becomes part of the daily commute loop, not a niche feature used only on road trips.

Future Outlook

Over the next several years, the USA in-car payment systems market is expected to witness accelerated growth driven by expanding adoption of connected and autonomous vehicles, proliferation of EV charging infrastructure, and increasing preference for digital wallets and embedded commerce experiences. Enhanced security technologies such as biometric authentication and tokenization will further build consumer trust, while deep learning and voice-activated payment interfaces will streamline in-car transactional flows. Regulatory alignment with PCI standards and privacy guidelines will also support safer, standardized deployments across OEM platforms.

Major Players

- Visa

- Mastercard

- American Express

- Apple

- PayPal

- Stripe

- Tesla

- General Motors

- Ford Motor Company

- Shell

- BP/Amoco

- ChargePoint

- Mastercard Acquire

Key Target Audience

- Automotive OEMs and Tier-~ Infotainment Suppliers

- Payment Networks & Card Issuers

- Digital Wallet & Fintech Platforms

- Fuel Retailers & Network Operators

- EV Charging Infrastructure Providers

- Tolling and Smart Parking Authorities

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, key stakeholders across automotive OEMs, payment processors, digital wallet providers, and merchant networks were mapped to define drivers, use cases, and technology touchpoints. Extensive secondary research from credible reports and data sources was conducted to assemble foundational market information.

Step 2: Market Analysis and Construction

Historical data sets for market size and segmentation were compiled for the USA market, focusing on transaction value and active deployment metrics. This included reviewing in-vehicle payment adoption in fuel, parking, charging, and other use cases to assess revenue contribution per segment.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions and trends were validated through interviews and published insights from industry experts, OEM representatives, and fintech professionals. These consultations helped refine growth projections and understand technological adoption constraints.

Step 4: Research Synthesis and Final Output

Finally, data was synthesized using both top-down and bottom-up approaches to triangulate market size and forecast figures. Segment analysis and competitive benchmarking were completed by integrating primary insights with vetted secondary data, ensuring reliability of the final market assessment.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Scope Boundary and Inclusion/Exclusion Criteria, Market Engineering and Sizing Approach, Primary Interviews Across OEMs/Payment Networks/Merchants, Validation via Regulatory/Standards Sources, Data Triangulation and Reconciliation, Limitations and Key Considerations)

- Definition and Scope

- Overview Genesis

- Timeline of Major Platform Milestones

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

connected vehicle parc

digital wallets penetration

EV charging session growth

parking digitization

OEM recurring revenue focus - Challenges

driver distraction constraints

fraud/ATO risks

fragmented merchant acceptance

interoperability and standards gaps

chargeback and dispute handling - Opportunities

fleet-grade in-car commerce

unified charging+parking accounts

embedded loyalty and subscriptions

tolling expansion

insurer/fintech co-products - Trends

tokenization-first rails

biometrics and passkeys

contextual commerce via navigation

bundled mobility wallets

in-car app stores - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- By Transaction Volume, 2019–2024

- Installed Base, 2019–2024

- Service Revenue Mix, 2019–2024

- Service Revenue Mix, 2019–2024

- By Payment Use Case (in Value %)

fuel at pump

EV charging

parking meters/garages

tolling

drive-thru/QSR

- By In-Vehicle Experience Type (in Value %)

native IVI checkout

voice commerce

QR/phone handoff

companion-app initiated

- By Payment Instrument (in Value %)

network cards

ACH

prepaid

private-label accounts

fleet cards

BNPL/financing where applicable

- By Identity and Authentication (in Value %)

biometric-in-vehicle

phone biometric

passcode

risk-based step-up

token binding

- By Technology Stack (in Value %)

OEM-first commerce platform

third-party aggregator

wallet-first flow

processor-led orchestration

- By Vehicle Software Environment (in Value %)

Android Automotive-based IVI

proprietary IVI

smartphone projection-dependent flows

- By Customer Type (in Value %)

retail consumers

rideshare drivers

commercial fleets

rental/fleet operators

- By Vehicle Type (in Value %)

passenger cars

SUVs

pickups

light commercial vehicles

- By Region (in Value %)

Northeast

Midwest

South

West

urban vs suburban penetration characteristics

- Market Positioning of Major Players

- Cross Comparison Parameters (OEM Coverage & Active Fleet Enablement, Merchant Network Breadth in Fuel/Parking/Charging/Tolls, IVI/OS Integration Depth & UX Flow, Payment Rail Support & Wallet Compatibility, Security/Tokenization/Biometric Readiness, Fraud/Dispute Operations and Chargeback Handling, Partnership Ecosystem Strength, Monetization Model and Unit Economics Levers)

- SWOT Analysis of Major Players

- Business Model and Pricing Architecture

- Detailed Profiles of Major Companies

Visa

Mastercard

American Express

PayPal

Stripe

Apple

Google

Amazon

General Motors

Ford Motor Company

Stellantis

Tesla

Mercedes-Benz

BMW

- Demand and Utilization

- Purchasing Power and Wallet Preferences

- Compliance and Trust Expectations

- Needs, Desires, and Pain Points

- Decision-Making Process

- By Value, 2025–2030

- By Transaction Volume, 2025–2030

- Installed Base, 2025–2030

- Service Revenue Mix, 2025–2030