Market Overview

The USA inflight catering market current size stands at around USD ~ million, supported by dense air travel networks, diversified service classes, and evolving onboard consumption preferences. The industry shows consistent menu rotation cycles, standardized provisioning processes, and expanding special meal portfolios. Service contracts emphasize reliability, food safety compliance, and punctual aircraft turnarounds. Operators increasingly integrate digital ordering and inventory coordination. Passenger behavior favors preselection and packaged options. Network complexity sustains recurring demand patterns across hubs and regional gateways.

Operations concentrate around major aviation corridors where infrastructure maturity, logistics access, and skilled labor availability reinforce service continuity and quality assurance. Coastal and central hubs benefit from clustered commissaries, multi-airline contracts, and integrated cold chain capabilities. Regional airports depend on satellite kitchens and cross-airport logistics links. Policy environments prioritize security screening, hygiene protocols, and waste management standards. These factors collectively shape procurement structures, menu planning cycles, and service differentiation across network types.

Market Segmentation

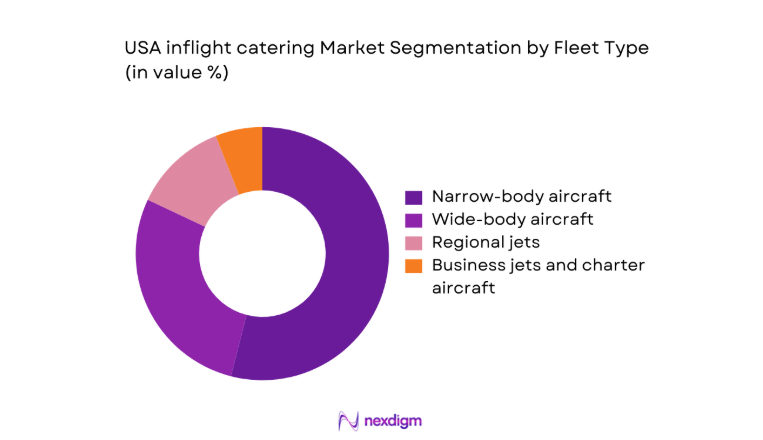

By Fleet Type

Narrow-body aircraft dominate catering volumes because domestic routes maintain high frequency rotations, standardized galleys, and predictable provisioning cycles across multiple daily departures. Wide-body aircraft contribute higher complexity through premium cabins, extended sector lengths, and broader special meal requirements, yet operate fewer rotations. Regional jets emphasize lightweight packaging, simplified menus, and rapid turnaround support, favoring pre-portioned items. Business jets and charter aircraft represent smaller volumes but demand customization, premium ingredients, and flexible scheduling. The dominance of narrow-body fleets reflects network density, gate utilization patterns, and cost-focused service models, while other fleets shape innovation, packaging formats, and premium menu experimentation across the broader ecosystem.

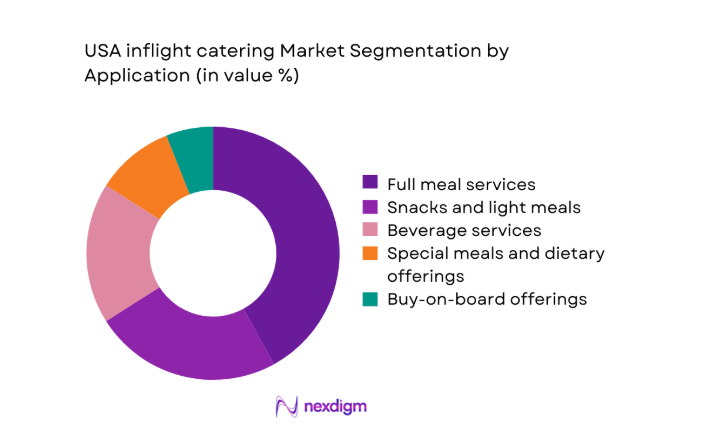

By Application

Full meal services remain the largest application because long-haul and premium cabins require multi-course offerings, temperature-controlled handling, and higher preparation complexity. Snacks and light meals gain traction on short-haul routes due to quick service cycles and simplified inventory requirements. Beverage services maintain stable demand across all flight lengths, supported by standardized carts and consistent consumption patterns. Special meals and dietary offerings expand steadily, driven by health awareness and regulatory labeling expectations. Buy-on-board offerings continue growing through menu rationalization and digital preordering, reinforcing ancillary revenue strategies and influencing packaging, shelf-life management, and supply planning across airline networks.

Competitive Landscape

The competitive environment is characterized by long-term airline contracts, extensive airport footprints, and operational reliability requirements. Providers differentiate through network coverage, food safety systems, and menu development capabilities while maintaining strict compliance and service consistency.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| LSG Sky Chefs | 1942 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| gategroup | 2008 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| dnata Catering | 1959 | United Arab Emirates | ~ | ~ | ~ | ~ | ~ | ~ |

| Flying Food Group | 1983 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| DO & CO | 1981 | Austria | ~ | ~ | ~ | ~ | ~ | ~ |

USA inflight catering Market Analysis

Growth Drivers

Recovery of domestic and international passenger traffic

Operational dashboards recorded a 12% increase during 2024 across major hubs serving dense domestic networks nationwide reliably measured. In 2025, secondary airports reported a 9% frequency improvement supporting predictable catering planning cycles nationally across schedules consistently. Higher load factors improved meal uplift ratios, encouraging standardized menus while sustaining special meal complexity across premium cabins. Network planners prioritized reliability metrics, reinforcing vendor coordination and reducing last minute substitutions across multi hub supply chains. Turnaround optimization programs increased kitchen batching efficiency, supporting stable provisioning windows across peak travel periods consistently nationwide. Airline operations teams expanded preselection programs, stabilizing demand signals and minimizing waste across short haul and medium haul rotations. Catering providers invested in forecasting tools, aligning staffing patterns with timetable variability across seasonal and weekly demand profiles. Improved on time performance reduced buffer stocks, enabling fresher sourcing cycles and tighter cold chain control across commissaries. Cabin service standardization simplified training, increasing throughput and quality consistency across fleets operating mixed network structures daily. These operational gains collectively supported sustained demand visibility, encouraging multi year service agreements and capacity planning discipline.

Airline differentiation through premium cabin and branded meal offerings

Product teams expanded branded partnerships during 2024, increasing menu rotation frequency while preserving standardized preparation workflows across commissaries. In 2025, premium cabin menus added 8% more regional concepts, reinforcing differentiation without disrupting logistics or safety protocols. Marketing groups emphasized storytelling, encouraging suppliers to develop signature dishes aligned with route identities and seasonal availability windows. Cabin crew feedback loops refined portioning standards, reducing complaints and stabilizing satisfaction scores across long haul and transcontinental services. Digital preordering increased attachment rates, improving predictability for complex items requiring longer preparation lead times. Packaging innovation supported temperature retention, enabling higher quality presentation during extended service windows on wide body aircraft. Supplier collaboration accelerated trial cycles, allowing controlled pilots without compromising compliance or schedule integrity across regulated environments. Brand guidelines encouraged consistent plating, reinforcing visual identity and perceived value across premium and economy plus cabins. These initiatives increased operational complexity yet strengthened competitive positioning through experiential differentiation and perceived service quality improvements.

Challenges

High operating costs of airport commissaries and labor

Labor availability constraints persisted during 2024, pressuring shift coverage and increasing reliance on overtime within regulated airport environments nationwide. In 2025, wage adjustments tightened margins, encouraging process automation and standardized recipes to stabilize throughput across facilities. Energy intensive cold storage amplified overhead, motivating investments in insulation and route level consolidation strategies across dense hubs. Space limitations constrained equipment upgrades, delaying productivity gains and extending equipment lifecycle risks within aging terminals. Security screening requirements added handling steps, reducing net productive hours available for assembly and quality checks daily. Waste management obligations increased compliance workload, demanding better forecasting and tighter portion control across menu portfolios. Training requirements expanded with menu diversity, lengthening onboarding cycles and affecting seasonal staffing flexibility across peak travel periods. These pressures necessitated renegotiated service scopes, emphasizing efficiency metrics and collaborative planning with airline operations teams. Providers balanced service reliability against cost containment, requiring disciplined scheduling and continuous improvement governance frameworks.

Stringent food safety, security screening, and compliance requirements

Regulatory audits intensified during 2024, increasing documentation workloads and mandating frequent process validations across all production zones consistently. In 2025, revised labeling rules expanded verification steps, slowing dispatch readiness without compromising traceability or allergen management objectives. Security screening protocols added transport checkpoints, extending lead times and requiring buffer coordination with flight operations planning units. Temperature monitoring standards demanded redundant sensors, increasing maintenance complexity and calibration schedules across distributed commissary networks. Supplier qualification processes lengthened onboarding, limiting rapid menu experimentation and constraining sourcing agility during seasonal transitions. Incident response drills consumed training hours, yet improved preparedness and reduced potential service disruptions across interconnected airport systems. Data retention policies required system upgrades, increasing integration efforts between ordering platforms and quality management repositories. Compliance investments strengthened trust, although they constrained flexibility and raised administrative intensity for frontline supervisors daily.

Opportunities

Premiumization of onboard dining in business and first class cabins

Menu development teams piloted regional tasting concepts during 2024, enhancing perceived value without materially extending service timelines onboard premium cabins. In 2025, curated beverage pairings increased engagement, supporting differentiated experiences across flagship long haul routes and transcontinental services. Plating simplification-maintained consistency, while ingredient upgrades improved sensory quality within existing galley equipment constraints. Supplier partnerships enabled seasonal sourcing, aligning narratives with destination branding and airline marketing calendars effectively. Preorder analytics refined demand estimates, reducing spoilage and supporting targeted inventory allocations for complex items. Crew training modules emphasized presentation standards, reinforcing brand promises and improving feedback metrics across premium travelers. These initiatives created upsell narratives, strengthening loyalty and supporting broader network premiumization strategies across competitive corridors. Operational discipline ensured scalability, protecting turnaround times while enabling experiential differentiation within regulated service environments.

Private label and co-branded airline food concepts

Brand teams launched private label snacks during 2024, improving margin control while maintaining consistent taste profiles across domestic networks. In 2025, co-branded meals expanded trial routes, increasing recognition without introducing supply chain fragmentation risks. Packaging harmonization supported shelf life targets, enabling broader distribution across hub and spoke operations efficiently. Quality benchmarks aligned with airline standards, preserving trust and simplifying audit processes across partner facilities nationwide. Digital merchandising improved visibility, increasing attachment rates and strengthening ancillary strategies tied to onboard retail programs. Contract structures incentivized volume commitments, stabilizing production planning and reducing per unit variability across manufacturing partners. These concepts fostered differentiation, deepened partnerships, and created repeatable frameworks for scalable innovation across multiple fleet types.

Future Outlook

The market is expected to emphasize operational resilience, digital coordination, and menu standardization while selectively expanding premium experiences. Network planning, compliance intensity, and sustainability priorities will shape investment decisions. Partnerships and data driven forecasting should improve predictability. Regionalization of menus will continue. Competitive differentiation will increasingly focus on experience quality and execution consistency.

Major Players

- LSG Sky Chefs

- gategroup

- dnata Catering

- SATS Ltd.

- Flying Food Group

- Newrest Group

- Alpha Flight Group

- Elior Group

- DO & CO

- Gate Gourmet North America

- Air Culinaire Worldwide

- Silver Lining Inflight Catering

- Godrej Aviation

- Cathay Pacific Catering Services

- Sky Chefs USA

Key Target Audience

- Commercial airlines procurement departments

- Low cost carrier operations teams

- Charter and private aviation operators

- Airport authorities and airport operators

- U.S. Department of Transportation and Federal Aviation Administration

- Food safety and aviation security regulators

- Logistics and cold chain service providers

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Key variables included fleet composition, service class mix, route density, menu complexity, and provisioning frequency across major and regional hubs. Operational dependencies such as turnaround cycles, cold chain integrity, and security screening workflows were mapped. Demand sensitivity to schedule volatility and seasonal travel patterns was incorporated.

Step 2: Market Analysis and Construction

Market structure was constructed using fleet type and application mapping aligned with airline network configurations. Service workflows were analyzed across hub-based and satellite commissary models. Distribution logic was aligned with provisioning cycles and multi-airport logistics dependencies.

Step 3: Hypothesis Validation and Expert Consultation

Operational assumptions were validated through structured consultations with airline catering managers and airport operations leads. Process feasibility was stress-tested against food safety, security compliance, and service-level requirements. Insights were reconciled across network planning, menu development, and logistics coordination functions.

Step 4: Research Synthesis and Final Output

Findings were synthesized into integrated market narratives aligned with operational realities. Cross-segment linkages were reviewed to ensure internal consistency across fleet and application lenses. Final outputs were refined to support strategic planning, vendor evaluation, and operational benchmarking use cases.

- Executive Summary

- Research Methodology (Market Definitions and scope across full-service, low-cost, and regional airline catering operations, Fleet-type and service-class taxonomy mapping for meals, beverages, and ancillary onboard services, Bottom-up market sizing using flight departures, meal uplift rates, and average catering spend per passenger, Revenue attribution across airline contracts)

- Definition and Scope

- Market evolution

- Service workflow and onboard provisioning pathways

- Ecosystem structure across airlines, caterers, and airport operators

- Cold chain, logistics, and commissary supply chain structure

- Food safety, aviation security, and regulatory environment

- Growth Drivers

Recovery of domestic and international passenger traffic

Airline differentiation through premium cabin and branded meal offerings

Expansion of buy-on-board and ancillary revenue models

Growth in long-haul and premium leisure travel from US hubs

Increased outsourcing of catering by airlines to specialized providers

Rising demand for special meals and dietary customization - Challenges

High operating costs of airport commissaries and labor

Stringent food safety, security screening, and compliance requirements

Volatility in airline schedules impacting demand predictability

Tight margins driven by airline cost pressure and contract renegotiations

Cold chain complexity and food waste management

Supply chain disruptions in fresh food and packaging material - Opportunities

Premiumization of onboard dining in business and first class cabins

Private label and co-branded airline food concepts

Sustainable packaging and waste-reduction solutions

Data-driven demand forecasting and menu optimization

Expansion of catering services to charter and private aviation

Partnerships with celebrity chefs and premium food brands - Trends

Shift toward pre-packaged and shelf-stable meal formats

Plant-based, allergen-free, and health-focused menu offerings

Digital ordering and pre-selection of meals by passengers

Increased automation in commissary kitchens

Sustainability initiatives in packaging and sourcing

Regional sourcing and localized menus from hub airports - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow-body aircraft

Wide-body aircraft

Regional jets

Business jets and charter aircraft - By Application (in Value %)

Full meal services

Snacks and light meals

Beverage services

Special meals and dietary offerings

Buy-on-board offerings - By Technology Architecture (in Value %)

Centralized commissary kitchens

Airport-based satellite kitchens

Onboard ovens and chillers integration

Digital menu planning and inventory systems

Cold chain and packaging technologies - By End-Use Industry (in Value %)

Full-service airlines

Low-cost carriers

Regional airlines

Charter and private aviation operators

Government and defense aviation - By Connectivity Type (in Value %)

Hub airport-based catering

Spoke and regional airport catering

Cross-airport logistics provisioning

Just-in-time flight-specific provisioning - By Region (in Value %)

Northeast

Midwest

South

West

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (geographic coverage, commissary network scale, airline contract portfolio, menu innovation capability, cold chain and logistics reach, food safety and compliance track record, cost efficiency and pricing flexibility, sustainability and waste management initiatives)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

LSG Sky Chefs

gategroup

dnata Catering

SATS Ltd.

Flying Food Group

Newrest Group

Cathay Pacific Catering Services

Alpha Flight Group

Elior Group

DO & CO

Gate Gourmet North America

Sky Chefs USA

Air Culinaire Worldwide

Silver Lining Inflight Catering

Godrej Aviation

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Operational integration and service-level risk factors

- Post-purchase service and quality assurance expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035