Market Overview

As of 2024, the USA K-Beauty skincare market is valued at USD 22.6 billion, with a growing CAGR of 7.4% from 2024 to 2030. This market size is driven by consumers’ increasing preference for innovative, effective skincare products enriched with natural ingredients. The market is driven by the growing popularity of skincare routines and the impact of social media in promoting K-Beauty products.

Dominant markets within the USA exhibit strong activity in major cities, especially New York, Los Angeles, and San Francisco. These urban centres boast a high concentration of consumers interested in skincare trends and products, largely due to their diverse demographics and lifestyles that prioritize effective skincare solutions. The popularity of K-Beauty brands in these regions is further augmented by proactive marketing strategies and collaborations with influencers, creating a buzz that drives consumer interest and market growth.

Market Segmentation

By Product Type

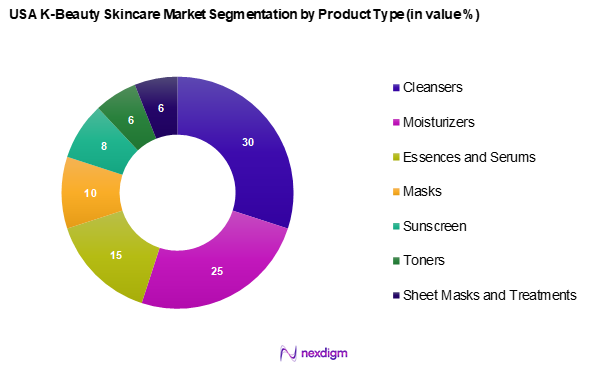

The USA K-Beauty skincare market is segmented into cleansers, moisturizers, essences and serums, masks, sunscreen, toners, and sheet masks and treatments. Among these, the cleansers segment holds a dominant market share due to the foundational role cleansers play in skincare regimens. The rising awareness about skin health has led to increased demand for effective cleansing options that cater to different skin types. Brands are focusing on formulating diverse cleansers, from oil-based to foaming variants, enhancing their appeal among consumers.

By Distribution Channel

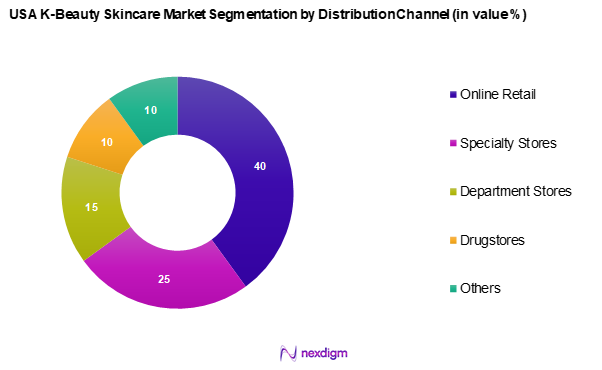

The USA K-Beauty skincare market is segmented into online retail, specialty stores, department stores, drugstores, and others. The online retail segment is leading the market, primarily due to the convenience it offers and the growing influence of e-commerce on consumer purchasing behaviour. With the COVID-19 pandemic accelerating the shift to online shopping, brands are investing heavily in digital marketing and direct-to-consumer sales, resulting in higher visibility and accessibility for K-Beauty products.

Competitive Landscape

The USA K-Beauty skincare market is dominated by key players that include both established brands and emerging names. The competitive landscape is characterized by heavy investment in marketing and product innovation. Major players include Amorepacific Corporation, LG Household & Health Care, and The Face Shop, each possessing strong brand equity and extensive distribution networks, marking a significant influence on the market dynamics.

| Company Name | Establishment Year | Headquarters | Market Segment Focus | Revenue

(USD Mn) |

Market Share | Global Reach |

| Amorepacific Corporation | 1945 | Seoul, South Korea | – | – | – | – |

| LG Household & Health Care | 1947 | Seoul, South Korea | – | – | – | – |

| The Face Shop | 2003 | Seoul, South Korea | – | – | – | – |

| COSRX | 2014 | Seoul, South Korea | – | – | – | – |

| Dr. Jart+ | 2005 | Seoul, South Korea | – | – | – | – |

USA K-Beauty Skincare Market Analysis

Growth Drivers

Rising Demand for Natural Ingredients

The USA K-Beauty market is witnessing considerable growth due to a heightened demand for natural ingredients in skincare products. Consumers are increasingly gravitating towards clean beauty, favouring products that are free from harmful chemicals. This trend aligns with a broader consumer movement toward sustainability and eco-friendly practices. The growing consciousness regarding health and well-being among American consumers reflects a desire for skincare solutions that prioritize organic and natural sources, showcasing a robust demand for products that are both safe and effective.

Growing Awareness of Skincare Regimens

An increased awareness and adoption of skincare regimens among consumers significantly propels the K-Beauty market forward. Many individuals are becoming more invested in their skincare routines, recognizing the importance of daily care for maintaining skin health. This growing emphasis on self-care and holistic health is encouraging a culture in which consumers actively seek out effective skincare solutions. As people prioritize their skincare, they also desire products that complement and enhance their routines, driving market growth and innovation.

Market Challenges

Regulatory Compliance

Navigating the complexities of regulatory compliance poses challenges for K-Beauty skincare brands in the USA. With strict guidelines laid out by the FDA regarding ingredient safety, labelling, and manufacturing practices, and brands must navigate a rigorous landscape. Frequent recalls of cosmetic products highlight the need for brands to adhere to stringent safety standards. The associated costs of compliance can deter smaller and emerging brands from entering the market, which in turn can impact their ability to innovate and meet evolving consumer demands for efficiency and safety.

High Competition in the Market

The USA K-Beauty skincare market is characterized by intense competition, with a plethora of local and international brands vying for consumer attention. The saturated market landscape presents challenges for brand differentiation and retention, making it difficult for newcomers to establish a foothold. Established brands, benefiting from strong customer loyalty and visibility, invest significantly in marketing and influencer partnerships, creating barriers for lesser-known brands. This competitive pressure can limit market access and impact profit margins, challenging the overall growth potential for many companies.

Opportunities

Increasing Male Skincare Products

The rising interest in skincare among male consumers represents a significant growth opportunity within the USA K-Beauty market. As social norms evolve and more men embrace personal care, the demand for skincare products tailored to this demographic is on the rise. The expanding male grooming market encourages brands to diversify their product offerings to cater to an increasingly diverse consumer base. By tapping into this emerging trend, brands can position themselves to capitalize on the growing acceptance of skincare routines among men.

Sustainable and Eco-friendly Products

There is a burgeoning opportunity for brands that prioritize sustainable and eco-friendly product offerings within the K-Beauty segment. Many consumers are showing a willingness to invest in products that are environmentally friendly, reflecting a notable shift towards sustainability. This increasing preference is driving brands to innovate, focusing on cruelty-free formulas and ethically sourced ingredients, while also exploring sustainable packaging solutions. As consumer values shift toward sustainability, brands that embrace these trends are more likely to gain traction in the market.

Future Outlook

Over the next five years, the USA K-Beauty skincare market is expected to show substantial growth driven by the ongoing consumer trend towards natural and sustainable products, coupled with advancements in product formulation and technology. The market’s shift toward e-commerce and personalized skincare solutions is anticipated to further fuel this expansion, as brands increasingly leverage digital platforms to enhance consumer engagement and drive sales.

Major Players

- Amorepacific Corporation

- LG Household & Health Care

- The Face Shop

- COSRX

- Jart+

- Laneige

- Etude House

- Missha

- Banila Co.

- Klairs

- Sulwhasoo

- Skinfood

- Nature Republic

- Tony Moly

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (FDA, FTC)

- Beauty Retail Chains

- E-commerce Platforms

- Spas and Salons

- Dermatology Clinics

- Health and Wellness Influencers

- Marketing and Branding Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA K-Beauty skincare market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables influencing market dynamics, including consumer preferences and competitive landscape characteristics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA K-Beauty skincare market. This includes assessing market penetration trends, product performance across various categories, and resultant revenue generation. Furthermore, an evaluation of quality statistics for products will be conducted to ensure the reliability and accuracy of revenue estimates, allowing for a robust framework for forecasting future trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies within the skincare segment. These consultations provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data established in earlier research phases.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple K-Beauty manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA K-Beauty skincare market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Demand for Natural Ingredients

Growing Awareness of Skincare Regimens - Market Challenges

Regulatory Compliance

High Competition in the Market - Opportunities

Increasing Male Skincare Products

Sustainable and Eco-friendly Products - Trends

Growth of Subscription Box Services

Customizable Skincare Solutions - Government Regulation

Cosmetic Product Regulations

Import Tariffs

Safety Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Cleansers

– Foam Cleansers

– Gel Cleansers

– Oil-Based Cleansers

– Micellar Waters

Moisturizers

– Creams

– Lotions

– Gels

– Emulsions

Essences and Serums

– Hydrating Essences

– Anti-aging Serums

– Brightening Serums

– Exfoliating Serums

Masks

– Wash-off Masks

– Overnight/Sleeping Masks

– Peel-off Masks

Sunscreen

– Physical (Mineral) Sunscreens

– Chemical Sunscreens

– Hybrid Sunscreens

Toners

– Hydrating Toners

– pH-Balancing Toners

– Exfoliating Toners

Sheet Masks and Treatments

– Sheet Masks

– Spot Treatments

– Eye Patches

– Ampoules - By Distribution Channel (In Value %)

Online Retail

– Brand Websites

– Multi-brand Marketplaces

– Subscription Boxes

Specialty Stores

– Sephora

– Ulta Beauty

– K-Beauty Boutiques

Department Stores

– Macy’s

– Nordstrom

– Bloomingdale’s

Drugstores

– Walgreens

– CVS

– Rite Aid

Others

– Pop-Up Shops

– Airport Duty-Free Stores

– Direct-to-Consumer (D2C) Channels - By Skin Type (In Value %)

Oily

– Oil-Control Products

– Sebum-Reducing Serums

– Mattifying Moisturizers

Dry

– Deep Hydration Creams

– Humectant-Based Essences

– Rich Emollient Masks

Combination

– Dual-Zone Products

– Balancing Toners

– Lightweight Gels

Sensitive

– Hypoallergenic Products

– Fragrance-Free Formulas

– Calming Ampoules

Normal

– Maintenance Routines

– Everyday Hydration Sets

– General Care Masks - By Consumer Demographics (In Value %)

Age Group (18–24)

Age Group (25–34)

Age Group (35–44)

Age Group (45+) - By End-User (In Value %)

Individual Consumers

– DIY Skin Regimen Kits

– Daily Care Products

– Online and In-store Shoppers

Spas and Salons

– Professional Use Essences

– Facial Masks for Treatments

– Exclusive Brand Tie-Ups

Dermatology Clinics

– Medically Approved K-Beauty Brands

– Prescription-Based Serums

– Sensitivity-Friendly Lines

Hotels and Resorts

– K-Beauty Amenity Kits

– Miniature Luxury Product Lines

– Exclusive Guest Gifting

Online Subscription Services

– Monthly Product Curations

– Limited-Edition Korean Brands

– Routine Discovery Boxes - By Region (In Value %)

West Coast

East Coast

Midwest

South

Mountain States

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenue, Revenue by Product Type, Product Portfolio, Distribution Channels, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis by Key Players

- Detailed Profiles of Major Companies

Amorepacific Corporation

LG Household & Health Care

The Face Shop

Dr. Jart+

Innisfree

COSRX

Sulwhasoo

Laneige

Etude House

Missha

Banila Co.

Klairs

Skinfood

Nature Republic

Tony Moly

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030