Market Overview

The USA Ketone Testing Devices Market is valued at USD ~ billion, driven by increasing adoption among consumers for home-based monitoring of ketosis levels, especially among individuals with diabetes and those following ketogenic diets. The market’s growth is significantly influenced by the rise in health-conscious consumers and the increasing adoption of personalized health monitoring devices. In particular, blood ketone meters and continuous monitoring devices are expected to see increased demand as technology improves, making them more accessible and accurate for consumer use. This demand is further bolstered by advancements in non-invasive testing technologies and app-based platforms that provide real-time health data.

The USA is a leading market for ketone testing devices, with regions like the Northeast and West showing high adoption rates, largely due to the concentration of healthcare facilities, fitness and wellness centers, and a tech-savvy consumer base. The dominance of cities like New York and Los Angeles is attributed to their significant health-conscious populations and growing awareness of the importance of ketosis for managing diabetes and achieving wellness goals. These cities, along with other healthcare hubs, have influenced supply chains, distribution, and technological advancements in ketone testing devices.

Market Segmentation

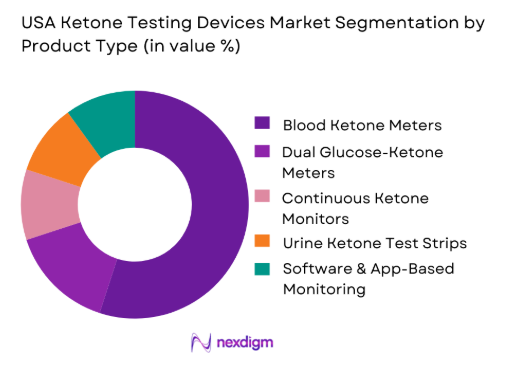

By Product Type

The USA Ketone Testing Devices Market is segmented by product type into blood ketone meters, dual glucose-ketone meters, continuous ketone monitors, urine ketone test strips, and software & app-based monitoring. Blood ketone meters dominate the market due to their accuracy and reliability in measuring blood ketone levels, which is a critical factor for individuals with diabetes or those managing their ketosis levels. Blood ketone meters are trusted by healthcare providers and consumers alike, as they offer precise results and are widely available. This product type has seen the highest penetration in both home-use and clinical settings, contributing to its market dominance.

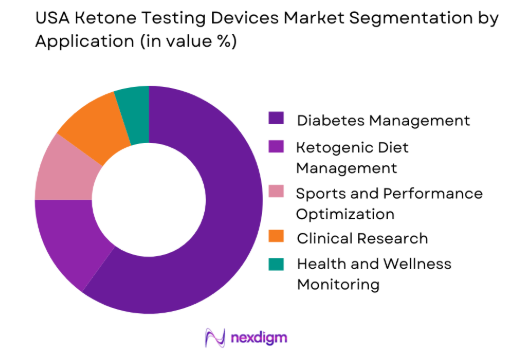

By Application

The market is further segmented by application into diabetes management, ketogenic diet management, sports and performance optimization, clinical research, and health and wellness monitoring. Diabetes management is the largest application segment, as ketone testing is crucial in managing diabetic ketoacidosis (DKA) and preventing other complications in people with diabetes. The increasing prevalence of diabetes in the USA, coupled with the growing adoption of home-based monitoring systems, has led to a rise in demand for ketone testing devices in this segment.

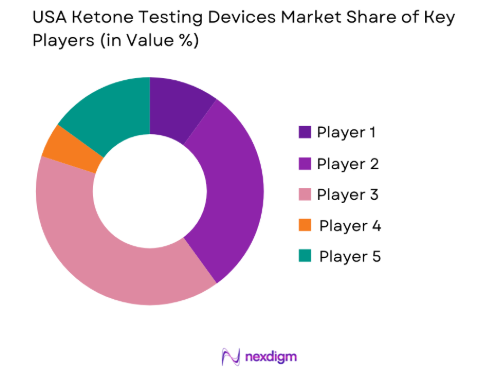

Competitive Landscape

The USA Ketone Testing Devices Market is dominated by a few major players, including Abbott Laboratories and global brands like Keto-Mojo, Nova Biomedical, and ACON Laboratories. This consolidation highlights the significant influence of these key companies, each contributing heavily to product innovation, distribution, and market expansion. These companies are leaders in blood ketone meters, dual glucose-ketone meters, and continuous monitoring devices, and they continue to lead the market through constant innovation and customer-centric offerings.

| Company | Establishment Year | Headquarters | Product Range | Technological Integration | Global Reach | Customer Loyalty | Customer Support |

| Abbott Laboratories | 1888 | Chicago, IL | ~ | ~ | ~ | ~ | ~ |

| Keto-Mojo | 2017 | Tempe, AZ | ~ | ~ | ~ | ~ | ~ |

| Nova Biomedical | 1976 | Waltham, MA | ~ | ~ | ~ | ~ | ~ |

| ACON Laboratories | 1990 | San Diego, CA | ~ | ~ | ~ | ~ | ~ |

| Dexcom | 1999 | San Diego, CA | ~ | ~ | ~ | ~ | ~ |

USA Ketone Testing Devices Market Analysis

Growth Drivers

Increasing Diabetes Prevalence and Insulin-Dependent Patient Base

The growing prevalence of diabetes, particularly among those requiring insulin therapy, is a key driver for the demand for comprehensive diabetes management solutions. As the population of insulin-dependent patients increases, the need for effective monitoring and prevention of diabetes-related complications becomes more pressing. Insulin-dependent patients are at higher risk for diabetic ketoacidosis (DKA), a life-threatening condition that requires regular monitoring of ketone levels. This growing patient base creates a substantial market for diagnostic tools like blood ketone meters and test strips, which are essential for preventing DKA and managing blood glucose levels effectively.

Greater Awareness of DKA Prevention and Sick Day Protocols

There is a growing awareness among both healthcare providers and patients about the importance of DKA prevention and proper management of diabetes during illness. Sick day protocols, which include monitoring blood glucose and ketones regularly, have become more emphasized in diabetes care. Educating patients on the risks of DKA and the importance of proactive monitoring helps reduce hospital admissions and emergency interventions. As more patients and healthcare systems focus on preventing these serious complications, there is increased demand for tools that allow for regular, at-home ketone testing, which drives market growth for blood ketone meters and related products.

Challenges

Low Patient Adherence to Routine Ketone Testing Outside Acute Episodes

A major challenge in the management of diabetes is the low patient adherence to routine ketone testing outside of acute episodes. Many patients do not consistently test for ketones unless they experience symptoms or complications, such as during an episode of high blood sugar or illness. This inconsistency in monitoring puts patients at risk for undiagnosed ketoacidosis, especially in insulin-dependent individuals. Encouraging routine ketone testing outside of acute situations remains a significant barrier to optimal disease management and requires a concerted effort to improve patient education, simplify testing procedures, and emphasize the long-term benefits of regular ketone monitoring.

Higher Per Test Cost for Blood Ketone Strips Versus Urine Strips

The higher per-test cost for blood ketone strips compared to urine strips poses a significant barrier to widespread adoption, especially for patients managing diabetes on a budget. While blood ketone testing provides more accurate and real-time results, the cost of blood ketone strips is significantly higher than that of urine strips, which are more commonly used in routine monitoring. This cost disparity can limit access to accurate monitoring tools, particularly for lower-income patients, and may lead some individuals to rely on urine strips, which offer less precise data and may not detect early signs of ketoacidosis as effectively as blood ketone testing.

Opportunities

Bundled Diabetes Monitoring Kits Combining Glucose, Ketone, and CGM Workflows

One of the key opportunities in the diabetes management market is the development of bundled diabetes monitoring kits that combine glucose monitoring, ketone testing, and continuous glucose monitoring (CGM) workflows. By offering these tools together, patients can benefit from a comprehensive and streamlined approach to managing their diabetes. These kits enable users to monitor both glucose and ketones regularly, providing real-time, actionable data that can help prevent serious complications like DKA. The integration of CGM further enhances the ability to track long-term glucose control, offering a holistic solution for patients to manage their diabetes more effectively and with greater ease.

Retail Channel Expansion Through Pharmacist-Led Diabetes Programs

Expanding retail channels through pharmacist-led diabetes management programs offers a significant opportunity to improve patient care and reach a broader audience. Pharmacists, who are accessible and trusted healthcare professionals, can play a key role in educating patients about the importance of regular ketone and glucose monitoring. By integrating blood ketone and glucose monitoring kits into retail pharmacy offerings, pharmacies can serve as a point of care for patients to access testing supplies, guidance on proper usage, and support for adherence. This approach can increase patient access to necessary monitoring tools, improve routine testing practices, and empower patients to better manage their diabetes.

Future Outlook

The USA Ketone Testing Devices Market is expected to continue growing as the need for at-home health monitoring systems rises. Advances in non-invasive testing and the increasing integration of ketone testing devices with digital health platforms, including telemedicine, will support market growth. As awareness and adoption of health and wellness monitoring tools increase, the market will continue to see expansion and innovation.

Major Players

- Abbott Laboratories

- Keto-Mojo

- Nova Biomedical

- ACON Laboratories

- Dexcom

- LifeScan

- DarioHealth

- Medtronic

- ForaCare Inc.

- EKF Diagnostics

- Nipro Corporation

- i-SENS Inc.

- Roche Diagnostics

- GlucoMe

- Taidoc Technology

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (FDA, NIH)

- Healthcare providers

- Home healthcare consumers

- Pharmaceutical companies

- Medical device manufacturers

- Retail distributors

- Telehealth platforms

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the market’s key variables, including product types, technologies, and end-user segments. This is achieved through secondary research, focusing on market data, reports, and expert insights.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data on sales, market trends, and consumer behavior. The analysis also covers the distribution and market reach of key players, providing a comprehensive view of the market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested and validated through interviews with industry experts, including product manufacturers, healthcare professionals, and key distributors. This validation process helps refine the market model and ensure accuracy.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the data from expert interviews, secondary research, and market analysis to generate a final, comprehensive market report. This ensures that the conclusions drawn are based on robust, validated data.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, ketone testing taxonomy across blood breath and urine, market sizing logic by device base and test strip consumption, revenue attribution across meters strips sensors and analyzers, primary interview program with clinicians payers distributors and manufacturers, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Ketone Testing in the USA

- DKA Risk Landscape and Clinical Use Cases

- Care Pathway Mapping Across Hospital ED ICU Clinic and Home Use

- OTC Availability and Retail Channel Influence

- Reimbursement and Coverage Landscape for Blood Ketone Testing

- Growth Drivers

Increasing diabetes prevalence and insulin dependent patient base

Greater awareness of DKA prevention and sick day protocols

Growth of SGLT2 inhibitor use and euglycemic DKA monitoring needs

Expansion of ketogenic diet adoption and metabolic health tracking

Rise of remote care programs for high risk diabetes populations - Challenges

Low patient adherence to routine ketone testing outside acute episodes

Higher per test cost for blood ketone strips versus urine strips

Coverage variability and limited reimbursement for home ketone supplies

Accuracy concerns for breath ketone devices versus blood reference

Retail substitution and confusion across ketone measurement types - Opportunities

Bundled diabetes monitoring kits combining glucose ketone and CGM workflows

Retail channel expansion through pharmacist led diabetes programs

Employer and payer supported DKA prevention initiatives

Innovation in lower cost blood ketone strips and multi analyte biosensors

Integration of ketone monitoring into digital coaching and RPM platforms - Trends

Shift toward blood ketone testing for clinical decision making

Growth of dual glucose ketone ecosystems in home monitoring

Expansion of app based logging and trend analytics for ketone users

Increased focus on DKA risk stratification in care management programs

Improving breath ketone device usability for wellness monitoring - Regulatory & Policy Landscape

SWOT Analysis

Stakeholder & Ecosystem Analysis

Porter’s Five Forces Analysis

Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Test Strip and Sensor Consumption, 2019–2024

- By Device Installed Base, 2019–2024

- By Blood vs Urine Testing Revenue Split, 2019–2024

- By Fleet Type (in Value %)

Hospitals emergency departments and intensive care

Outpatient clinics and endocrinology practices

Retail pharmacies and drugstore clinics

Home self monitoring users

Long term care facilities - By Application (in Value %)

Diabetic ketoacidosis screening and monitoring

Sick day management for insulin users

Ketogenic diet and metabolic therapy monitoring

Sports and performance nutrition tracking

Hospital inpatient metabolic status monitoring - By Technology Architecture (in Value %)

Blood ketone meters using beta hydroxybutyrate strips

Dual glucose ketone meters and strip ecosystems

Urine ketone dipsticks and semi quantitative readers

Breath ketone analyzers for consumer monitoring

Lab chemistry analyzers supporting ketone measurement - By Connectivity Type (in Value %)

Standalone meters with on device logs

Bluetooth connected meters and mobile apps

Cloud based diabetes management dashboards

EHR integrated inpatient monitoring workflows

Remote patient monitoring enabled ketone programs - By End-Use Industry (in Value %)

Hospital systems and acute care providers

Primary care and specialty clinics

Retail pharmacy operators and DME suppliers

Payers and value based care programs

Consumer wellness and nutrition platforms - By Region (in Value %)

Northeast

Midwest

South

West

- Positioning driven by strip ecosystem economics accuracy and ease of use

- Partnership models with payers pharmacy chains and diabetes digital platforms

- Cross Comparison Parameters (beta hydroxybutyrate measurement accuracy, strip cost per test, meter and strip ecosystem availability, sample type and minimum volume, time to result, connectivity and app analytics quality, reimbursement and formulary access, interoperability with diabetes management platforms)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Porter’s Five Forces

- Detailed Profiles

Abbott

Roche Diabetes Care

Ascensia Diabetes Care

LifeScan

Nova Biomedical

EKF Diagnostics

PTS Diagnostics

ARKRAY

Acon Laboratories

Trividia Health

ForaCare

Keto Mojo

Biosense Technologies

House of Keto Monitor Brands

TaiDoc Technology

- Clinician preferences for blood ketone testing accuracy and thresholds

- Patient willingness to pay and frequency of testing behavior

- Payer coverage criteria for ketone strips and monitoring programs

- Retail pharmacist influence on OTC ketone product selection

- Total cost of ownership drivers across meter ecosystem and consumables

By Value, 2025–2030

By Test Strip and Sensor Consumption, 2025–2030

By Device Installed Base, 2025–2030

By Blood vs Urine Testing Revenue Split, 2025–2030