Market Overview

The USA Laboratory Data Integration Solutions market is valued at USD ~ billion in 2024. The market is primarily driven by the rapid digital transformation of healthcare systems, increased adoption of cloud-based solutions, and the need for efficient integration of diverse data sources in laboratory settings. The U.S. healthcare industry’s ongoing push towards digitization, coupled with regulatory mandates for streamlined data management, plays a crucial role in this growth. Additionally, advancements in data analytics, artificial intelligence (AI), and machine learning have driven demand for more integrated and efficient laboratory data solutions. As healthcare systems move towards precision medicine and integrated electronic health records (EHR), demand for data integration solutions will continue to rise.

The USA remains the dominant player in the Laboratory Data Integration Solutions market due to its highly advanced healthcare infrastructure, large number of research and clinical laboratories, and stringent regulatory requirements. Key cities like New York, Los Angeles, and Boston lead the market, driven by their dense concentration of healthcare institutions, research hospitals, and diagnostic centers. The adoption of digital health technologies, such as laboratory data integration solutions, is particularly strong in these cities due to the presence of major hospitals, research institutions, and healthcare networks that prioritize data interoperability and real-time analytics for improved patient care and operational efficiency.

Market Segmentation

By Product Type

The USA Laboratory Data Integration Solutions market is divided into standalone data integration solutions and integrated data solutions. Standalone data integration solutions hold a significant portion of the market share due to their ease of implementation and cost-effectiveness, particularly in small and mid-sized laboratories that do not require full-scale system integration. However, integrated data solutions are gaining more traction, particularly in large healthcare systems and multi-site laboratories. These solutions provide seamless data integration across various departments and systems, offering higher scalability and more robust functionalities that improve overall operational efficiency. Integrated data solutions are driven by the increasing need for data interoperability and real-time decision-making across complex healthcare environments.

By End-User

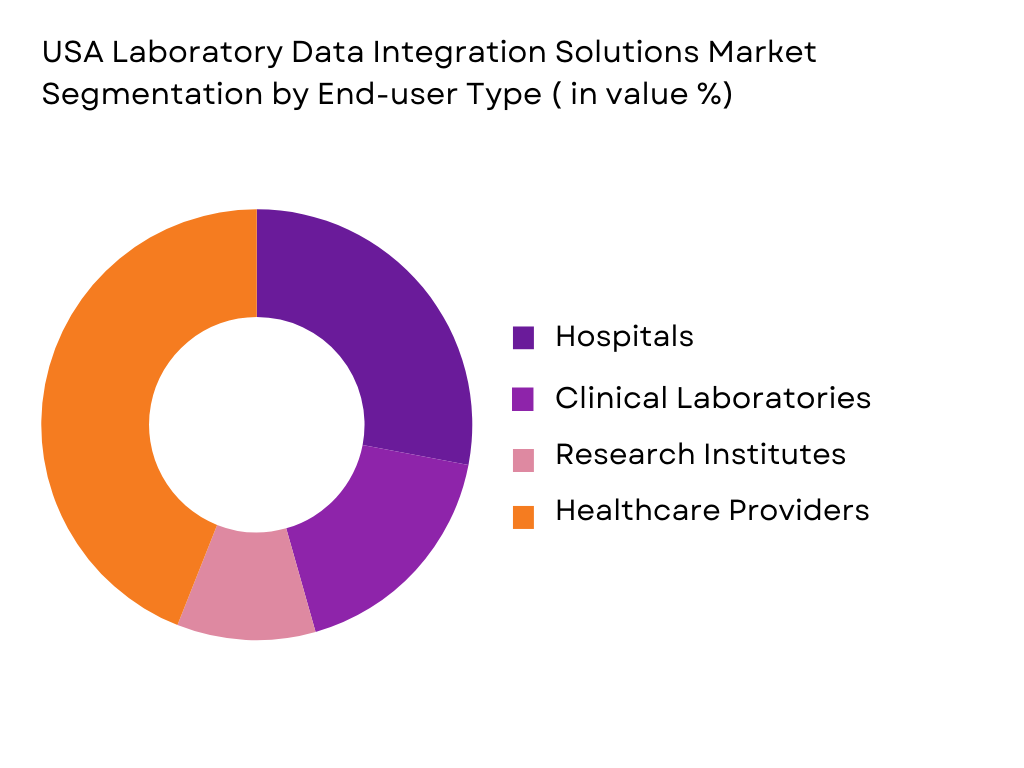

The market is also segmented by end-users, which include hospitals, clinical laboratories, research institutes, and healthcare providers. Hospitals dominate the market due to their large-scale operations, high volume of diagnostic testing, and significant investment in advanced technologies. Clinical laboratories follow closely, driven by the demand for more efficient lab data management and the need for regulatory compliance in laboratory operations. Research institutes are adopting LIS solutions for efficient handling and analysis of vast data sets, particularly in fields like genomics, where data integration and analysis are critical. Healthcare providers are increasingly adopting integrated solutions to streamline their operations and ensure patient care continuity.

Competitive Landscape

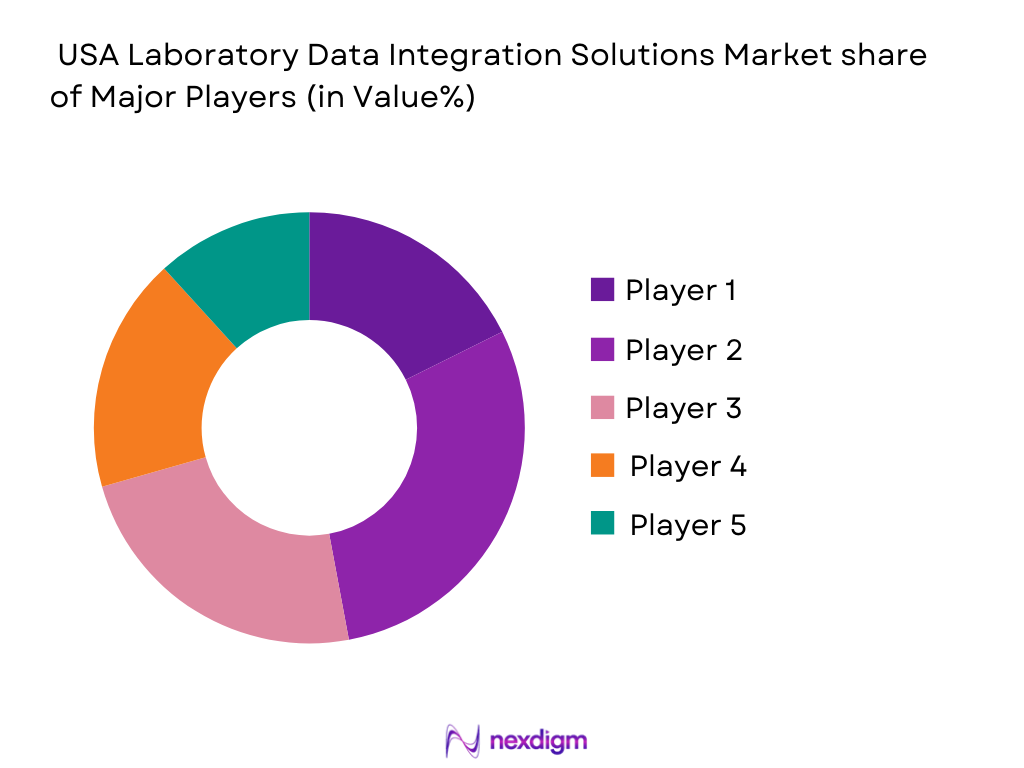

The USA Laboratory Data Integration Solutions market is highly competitive, with numerous players offering solutions ranging from basic data integration systems to comprehensive, AI-driven platforms. The competition is dominated by large players like Cerner Corporation, McKesson Corporation, Oracle Health Sciences, and Siemens Healthineers. These companies lead the market by providing highly scalable and customizable solutions designed to cater to a wide range of healthcare and laboratory requirements. The competitive landscape also includes emerging companies that specialize in niche solutions like cloud-based platforms and AI-driven analytics tools. The market is further influenced by partnerships and acquisitions between tech companies and healthcare providers, enhancing the scope and capabilities of laboratory data integration solutions

| Company | Establishment Year | Headquarters | Product Type | Key Technology | Partnerships | Market Focus |

| Cerner Corporation | 1979 | North Kansas City, Missouri, USA | ~ | ~ | ~ | ~ |

| McKesson Corporation | 1833 | Irving, Texas, USA | ~ | ~ | ~ | ~ |

| Oracle Health Sciences | 1977 | Redwood City, California, USA | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Erlangen, Germany | ~ | ~ | ~ | ~ |

| Labcorp | 1978 | North Carolina, USA | ~ | ~ | ~ | ~ |

USA Air Quality Monitoring System Market Analysis

Growth Drivers

Urbanization

Urbanization is one of the primary drivers of the air quality monitoring system market in Indonesia. The urban population in Indonesia reached ~% of the total population in 2023, as reported by the World Bank. This urban growth has led to increased air pollution due to higher traffic density, construction activities, and industrialization in major cities like Jakarta and Surabaya. As urban areas continue to expand, the need for effective air quality monitoring systems to track pollutants like PM2.5 and CO2 becomes essential for both public health and regulatory compliance

Industrialization

Industrialization in USA is accelerating the demand for air quality monitoring systems. As Indonesia’s manufacturing sector grew at a rate of 5.02% in 2023, the environmental impact of industrial emissions has raised concerns about air pollution. Industries, especially in areas like Jakarta, Surabaya, and Batam, are contributing to the rise in air pollutants. In response, there is increasing pressure from the government and environmental organizations to install monitoring systems that can provide real-time data to manage air quality more effectively.

Restraints

High Initial Costs

The high initial costs associated with the installation of air quality monitoring systems represent a major restraint for the market. These systems, especially those designed for real-time monitoring, require advanced sensors, software, and infrastructure, which can be expensive for both public and private sectors. The setup costs for installing a comprehensive monitoring system that includes multiple sensors for pollutants like nitrogen dioxide (NO2), sulfur dioxide (SO2), and carbon monoxide (CO) can exceed millions of rupiahs. For local governments and small enterprises, these high costs may limit the adoption of such technologies.

Technical Challenges

The complexity of implementing and maintaining air quality monitoring systems is another significant restraint. These systems require regular calibration, maintenance, and servicing to ensure accuracy and reliability. In USA, the lack of local technical expertise and service infrastructure for high-end monitoring systems presents a challenge. Moreover, the integration of monitoring data from various sources into a centralized system can be complex due to the fragmented nature of Indonesia’s urban and industrial landscape. This creates barriers to widespread adoption.

Opportunities

Technological Advancements

Technological advancements in air quality monitoring systems provide significant opportunities for market growth. The development of more affordable, accurate, and easier-to-use monitoring systems, including IoT-enabled devices, offers solutions that can be more widely adopted across Indonesia. Additionally, advancements in data analytics, artificial intelligence (AI), and machine learning are enabling smarter air quality monitoring systems that provide real-time insights and predictions. These innovations are expected to reduce the cost of deployment and improve the accuracy and efficiency of monitoring, making it more accessible to a wider range of users

International Collaborations

USA’s growing international collaborations with environmental organizations and technology providers present opportunities for the air quality monitoring system market. The country is increasingly engaging with global institutions to share knowledge and technology regarding air quality management. These collaborations often result in the adoption of advanced technologies and international best practices for monitoring systems. International aid programs and investment from the World Bank and other global organizations have facilitated the implementation of high-tech monitoring networks in major cities. Such collaborations are expected to accelerate the adoption of monitoring systems across the country.

Future Outlook

The future outlook for the USA Laboratory Data Integration Solutions market is promising, with significant growth expected in the coming years. The healthcare industry’s shift toward more connected and integrated ecosystems is driving the demand for data integration solutions that enable interoperability and streamline data exchange. Over the next several years, innovations in artificial intelligence and machine learning are expected to significantly enhance the capabilities of laboratory data integration solutions. The growing need for real-time data analysis, coupled with the rising adoption of cloud-based solutions and regulatory compliance mandates, will continue to support the expansion of the market. Moreover, the increasing focus on precision medicine and personalized healthcare will create further demand for sophisticated data management systems that can handle large volumes of complex data.

Major Players

- Cerner Corporation

- McKesson Corporation

- Oracle Health Sciences

- Siemens Healthineers

- Labcorp

- Intersystems

- IBM Watson Health

- Philips Healthcare

- GE Healthcare

- Sunquest Information Systems

- Xifin

- Cognizant

- Meditech

- Health Catalyst

- Healthstream

Key Target Audience

- Hospitals

- Clinical Laboratories

- Research Institutes

- Healthcare Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Diagnostic Testing Laboratories

- Health IT Solution Providers

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing a detailed market framework by identifying the key drivers, challenges, and factors affecting the adoption of laboratory data integration solutions. It relies on extensive desk research, analyzing secondary sources such as healthcare and technology reports, industry news, and government publications.

Step 2: Market Analysis and Construction

In this step, historical data on the adoption of laboratory data integration solutions is collected and analyzed to understand trends, market penetration, and key influencing factors such as healthcare digitization and regulatory changes.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted with healthcare IT professionals, laboratory managers, and vendors to validate assumptions, gain deeper insights, and refine market forecasts. These consultations involve one-on-one interviews and discussions with key stakeholders across the industry.

Step 4: Research Synthesis and Final Output

The final report synthesizes insights gathered from primary and secondary research to create an actionable market forecast. All findings are verified with industry experts to ensure accuracy and relevance, providing a comprehensive understanding of the laboratory data integration solutions market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Market Definitions and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Healthcare Digitization

Rise in Big Data in Healthcare

Advancements in Data Interoperability

Government Healthcare Initiatives - Market Challenges

High Implementation Costs

Complexity of Data Security and Privacy

Data Integration Challenges Across Platforms - Opportunities

Expansion of Cloud-Based Solutions

Adoption of AI and Machine Learning in Data Integration

Growth in Research and Development Sectors - Trends

Increasing Adoption of Real-time Data Processing

Cloud Integration and Scalability

Demand for Advanced Analytics and AI in Healthcare - Government Regulation

- SWOT Analysis

- Porter’s Five Forces

- Competition Ecosystem

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Product Type (In Value %)

Standalone Data Integration Solutions

Integrated Data Solutions - By Delivery Mode (In Value %)

On-Premise Solutions

Cloud-Based Solutions - By End-User (In Value %)

Hospitals

Clinical Laboratories

Research Institutes

Healthcare Providers - By Region (In Value %)

North America

Europe

Asia-Pacific - By Technology (In Value %)

Data Analytics Integration

Real-time Data Management

Artificial Intelligence and Machine Learning

- Market Share of Major Players( Value/Volume)

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Data Integration Solution, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players in the USA Laboratory Data Integration Solutions Market

- Detailed Profiles of Major Companies

Cerner Corporation

Meditech

McKesson Corporation

Oracle Health Sciences

GE Healthcare

Siemens Healthineers

Labcorp

Intersystems

IBM Watson Health

Philips Healthcare

Sunquest Information Systems

Xifin

Clarity LIS

Cognizant

Health Catalyst

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030