Market Overview

The USA Laboratory Data Security and Privacy Market is valued at approximately USD ~ billion, with robust growth expected in the coming years. The market is primarily driven by the increasing need for securing sensitive research data, healthcare data, and intellectual property in laboratories, especially in light of heightened cybersecurity threats and regulatory compliance requirements. Rising adoption of laboratory informatics systems, cloud technologies, and stricter enforcement of data privacy regulations, such as HIPAA and CCPA, further fuel this growth. Additionally, laboratories’ growing reliance on electronic records management and the shift towards digital transformation in the healthcare and pharmaceutical industries significantly contribute to the expansion of this market.

The USA, particularly cities such as New York, Boston, and San Francisco, dominates the laboratory data security and privacy market. These cities are hubs for the healthcare and biotechnology industries, which significantly influence the demand for robust data protection solutions. New York, as a financial and healthcare center, and Boston with its strong biotechnology sector, are key drivers. San Francisco is a major player due to its proximity to technology firms focusing on cybersecurity and data privacy. The demand for laboratory data security solutions in these areas is further reinforced by stringent state and federal data privacy regulations and the high value placed on intellectual property protection in research-driven environments.

Market Segmentation

By Solution Type

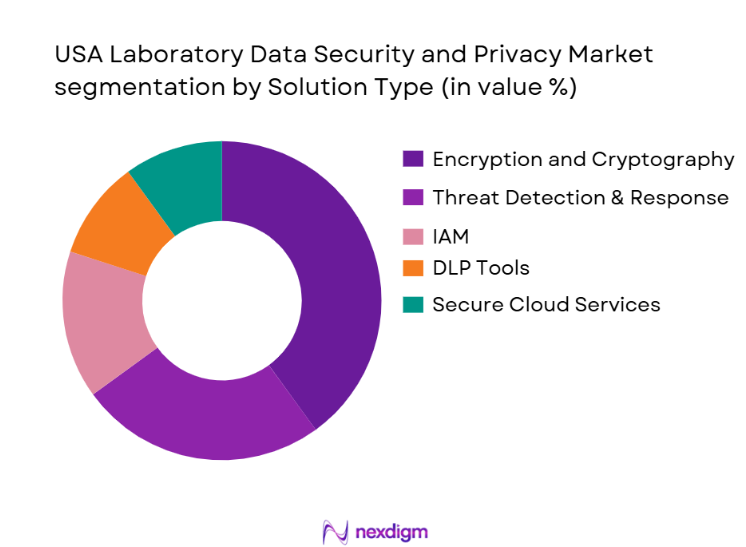

The USA Laboratory Data Security and Privacy Market is segmented by solution type into encryption and cryptography, threat detection and response, identity and access management (IAM), data loss prevention (DLP) tools, and secure cloud services. Encryption and cryptography are dominating the market as the primary method of securing sensitive laboratory data, particularly in research and healthcare sectors, due to their ability to protect data at rest and in transit. Data protection regulations, such as HIPAA, require the encryption of protected health information (PHI), making encryption solutions a key security measure. The increasing integration of cloud-based laboratory information management systems (LIMS) and the need for encrypted communication further contribute to the prominence of encryption technologies in laboratories across the country.

By End-User Industry

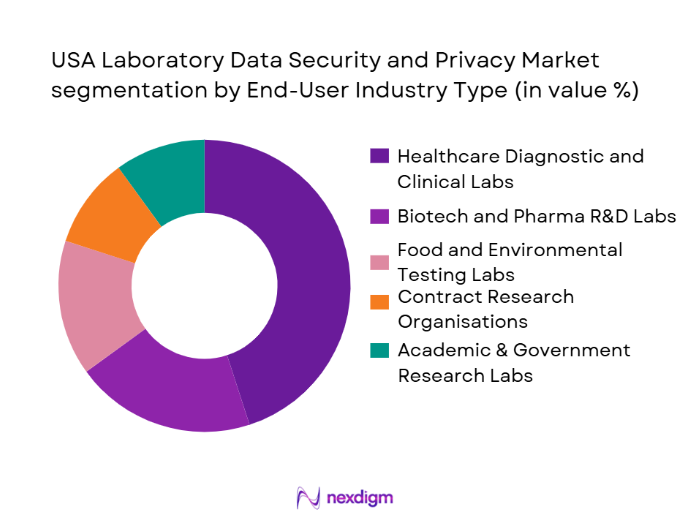

The market is segmented by end-user industry into healthcare diagnostic and clinical labs, biotech and pharma R&D laboratories, food and environmental testing labs, contract research organizations (CROs), and academic and government research labs. Healthcare diagnostic and clinical labs are dominating the market share. This dominance can be attributed to the increasing reliance on digital health records, the need for strict compliance with regulatory standards like HIPAA, and the rise of telemedicine and remote diagnostics. As laboratories handle an increasing volume of sensitive patient data, the demand for secure data management systems has surged, further bolstering the market share of healthcare labs in the laboratory data security and privacy market.

Competitive Landscape

The USA Laboratory Data Security and Privacy Market is highly competitive, with both established cybersecurity companies and niche players providing specialized solutions. Major players in this space include global cybersecurity leaders and emerging technology firms. The market is characterized by high barriers to entry due to regulatory compliance requirements and the critical nature of securing laboratory data. Industry leaders such as IBM, Symantec (Broadcom), and Microsoft dominate due to their broad range of security solutions and long-standing presence in the data protection industry. Newer players focus on innovative technologies, such as AI-driven threat detection and privacy management platforms.

| Company Name | Year of Establishment | Headquarters | Market Focus | R&D Investment | Key Product Lines | Compliance Certifications |

| IBM | 1911 | Armonk, NY | ~ | ~ | ~ | ~ |

| Microsoft | 1975 | Redmond, WA | ~ | ~ | ~ | ~ |

| Symantec (Broadcom) | 1982 | Mountain View, CA | ~ | ~ | ~ | ~ |

| Cisco | 1984 | San Jose, CA | ~ | ~ | ~ | ~ |

| Palo Alto Networks | 2005 | Santa Clara, CA | ~ | ~ | ~ | ~ |

USA Laboratory Data Security & Privacy Market Analysis

Growth Drivers

Rising Cybersecurity Threats

The increasing frequency and sophistication of cyberattacks, such as ransomware and data breaches, are driving the demand for advanced laboratory data security solutions. Laboratories are prime targets due to the sensitive nature of the data they handle, prompting greater investment in data protection technologies.

Stricter Regulatory Compliance Requirements

Regulations like HIPAA, CCPA, and other industry-specific guidelines have mandated laboratories to adopt robust security measures to protect sensitive data. These regulations require continuous monitoring and reporting, which is increasing the need for comprehensive security solutions in laboratory environments.

Market Challenges

High Implementation Costs

The costs associated with implementing advanced cybersecurity solutions, including software, hardware, and training, can be prohibitive for smaller laboratories or organizations with limited budgets, leading to slower adoption rates in certain sectors.

Integration Complexities

Laboratories often rely on legacy systems that are difficult to integrate with modern security solutions. The complexity of aligning new data security technologies with existing laboratory information management systems (LIMS) or laboratory information systems (LIS) presents a significant challenge.

Opportunities

Cloud-Based Security Solutions

The growing adoption of cloud technologies in laboratories presents a significant opportunity for vendors to offer scalable and flexible data security solutions. Cloud-based platforms can provide real-time updates, reduce infrastructure costs, and improve data accessibility while maintaining strong security measures.

AI and Machine Learning in Threat Detection

The use of AI and machine learning to predict, detect, and mitigate potential threats is an emerging opportunity in the laboratory data security market. These technologies can enhance the speed and accuracy of threat detection, reducing the risk of data breaches and improving overall security posture in real-time.

Future Outlook

Over the next 5 years, the USA Laboratory Data Security and Privacy Market is expected to show significant growth. The increasing volume of sensitive data being handled by laboratories, combined with the rising number of cyber threats targeting research data and patient information, will continue to drive the demand for robust security solutions. Government regulations surrounding data protection, such as the enforcement of HIPAA and CCPA, will further encourage laboratories to invest in secure data management systems. The ongoing digital transformation in healthcare and research sectors will propel market expansion, with laboratories increasingly relying on cloud-based platforms and cybersecurity tools for data protection.

Major Players

- IBM

- Microsoft

- Symantec (Broadcom)

- Cisco

- Palo Alto Networks

- McAfee

- Fortinet

- Check Point Software Technologies

- Trend Micro

- Forcepoint

- SonicWall

- Okta

- CrowdStrike

- Splunk

- Proofpoint

Key Target Audience

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

- Laboratory Managers and Data Security Heads

- Pharmaceutical & Biotech Companies

- Healthcare Providers and Medical Laboratories

- Cloud Service Providers

- Cybersecurity Solution Providers

- Healthcare IT Systems Integrators

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, an ecosystem map of stakeholders in the USA Laboratory Data Security and Privacy Market is developed. Secondary research and proprietary databases are leveraged to gather critical industry-level data. The goal is to identify and define the key variables that impact the market’s performance and growth potential.

Step 2: Market Analysis and Construction

This phase involves collecting and analyzing historical data related to laboratory data security solutions, focusing on product adoption rates, deployment models, and revenue generation. A thorough evaluation of key service providers, market penetration, and associated trends will help construct a robust market model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested and validated through expert consultations, such as structured interviews and surveys with laboratory managers, cybersecurity experts, and industry stakeholders. This helps refine the data and ensures that insights are directly based on real-world practices and conditions in the laboratory data security market.

Step 4: Research Synthesis and Final Output

The final research phase involves engaging directly with leading cybersecurity firms and laboratory organizations to validate insights obtained during previous stages. Feedback is incorporated into the final report to ensure the accuracy and reliability of the market data, ensuring it reflects current and future industry trends.

- Executive Summary

- Research Methodology (Laboratory Data Security, Data Privacy in Labs, Market Valuation Assumptions, Bottomup Data Synthesis, Data Triangulation Approach, Limitations & Market Confidence Levels)

- Market Landscape and Structure

- Market Genesis & Digital Laboratory Evolution

- Data Governance & Compliance Frameworks

- Information Security Taxonomy in Lab Settings

- Value Chain – From Sample Acquisition to Data Retention

- Data Flow & Threat Vectors in Labs

- Growth Drivers

Exponential Growth in Lab Data Volume & Complexity

Regulatory Pressure on Data Privacy

Cloud Migration & Remote Collaboration Needs

Rising Cyber Threat Exposure in Lab IT/OT Convergence - Market Challenges

Legacy Systems Vulnerabilities

Skills Gap & Security Resource Constraints

Integration Complexity Across Platforms - Opportunities

AIEnabled Security Analytics & Predictive Controls

ZeroTrust Architectures in Laboratory Ecosystems

Privacy Automation & Consent Workflow Platforms - Market Trends

Move to CloudFirst Secure Architectures

Integrated LIMS/LIS with Builtin Security & Audit Trail

Regulatory Intelligence Tool Adoption - Regulatory Environment & Compliance Analysis

Federal & State Data Security Mandates

Audit Standards & EPHI Protection Requirements

- Market Value 2019-2025

- Installed Base 2019-2025

- Security Incidents & Breach Data 2019-2025

- Compliance Expenditure Trends 2019-2025

- Cost of Data Loss & Productivity Impact 2019-2025

- By Solution Type (In Value%)

Encryption & Cryptography

Threat Detection & Response

Identity & Access Management (IAM)

Data Loss Prevention (DLP) Tools

Cloud & Virtualization Security Solutions - By Deployment Mode (In Value%)

OnPremise Security Stack

CloudNative Security Services

Hybrid & Distributed Security Models - By Data Privacy Approach (In Value%)

Privacy Management Platforms

Compliance & Policy Automation Tools

Data Masking & Tokenization Solutions - By EndUser Industry (In Value%)

Healthcare Diagnostic & Clinical Labs

Biotech & Pharma R&D Laboratories

Food & Environmental Testing Labs

Contract Research Organizations (CROs)

Academic & Government Research Labs - By Region (In Value%)

Northeast

West

Midwest

South

- Market Share – Top Security & Privacy Offerings

- Market Presence by EndUser Segment

- CrossComparison Parameters

Solution Portfolio Strength

Security Certification & Compliance Alignment

Threat Intelligence & Incident Response Capability

Market Reach & Deployment Footprint

R&D & Innovation Index

Integration with Laboratory Systems

Pricing Models & Licensing Flexibility

Customer Support & SLAs - Major Players

IBM Security

Microsoft

Cisco Systems Security

Splunk

Palo Alto Networks

Symantec

OneTrust

TrustArc

BigID

Securiti.ai

McAfee Enterprise Security

Fortinet Security Fabric

Trend Micro

Okta

Forcepoint Data Security

- Security Spend Patterns by Lab Type

- Purchase Drivers (Risk vs. Compliance)

- Pain Point Analysis (Data Exposure, Unauthorized Access)

- Procurement Processes & Budgeting

- Vendor Selection Criteria

- Security Solutions Revenue 2026-2030

- Deployment Footprint 2026-2030

- Privacy Software Adoption 2026- 2030

- Growth by Lab Type & Industry 2026-2030