Market Overview

The USA Laboratory Information Systems (LIS) market is valued at approximately USD ~ billion, primarily driven by advancements in healthcare automation, the growing need for enhanced healthcare data management, and increasing healthcare digitization. The adoption of electronic health records (EHR) and the integration of AI and machine learning in laboratory management systems are key drivers of this growth. According to the U.S. Department of Health and Human Services (HHS), the increasing adoption of digital tools in healthcare facilities has been a significant factor in the market’s expansion. The rising demand for accurate, real-time data and improved patient outcomes has spurred the adoption of LIS across hospitals, clinical laboratories, and research institutes. Additionally, regulatory changes and the need for greater efficiency in laboratory operations have contributed to the market’s growth.

The USA dominates the LIS market due to its well-established healthcare infrastructure and regulatory environment. Key regions, including California, New York, and Texas, are at the forefront due to their large healthcare facilities, research institutes, and a high concentration of healthcare professionals. These cities have a high adoption rate of LIS technologies driven by government initiatives to digitize healthcare data and improve operational efficiency. The federal government’s investments in healthcare technology, along with the integration of LIS in hospitals and clinical laboratories, particularly in urban areas, continue to drive the demand for LIS solutions across the country.

Market Segmentation

By Product Type

The USA LIS market is segmented into standalone LIS solutions and integrated LIS solutions. Standalone LIS solutions hold a significant market share due to their specialized nature and ease of implementation in specific laboratory settings. These solutions are favored by smaller clinics and independent laboratories due to their cost-effectiveness and quick deployment. However, integrated LIS solutions, which offer comprehensive functionality by connecting laboratory data with other hospital systems (such as EHR), are gaining traction due to the increasing demand for seamless data management and interoperability across healthcare networks. Integrated solutions are increasingly adopted by large hospitals and multi-site laboratory networks because they provide enhanced functionality, support regulatory compliance, and enable efficient data management.

By End-User

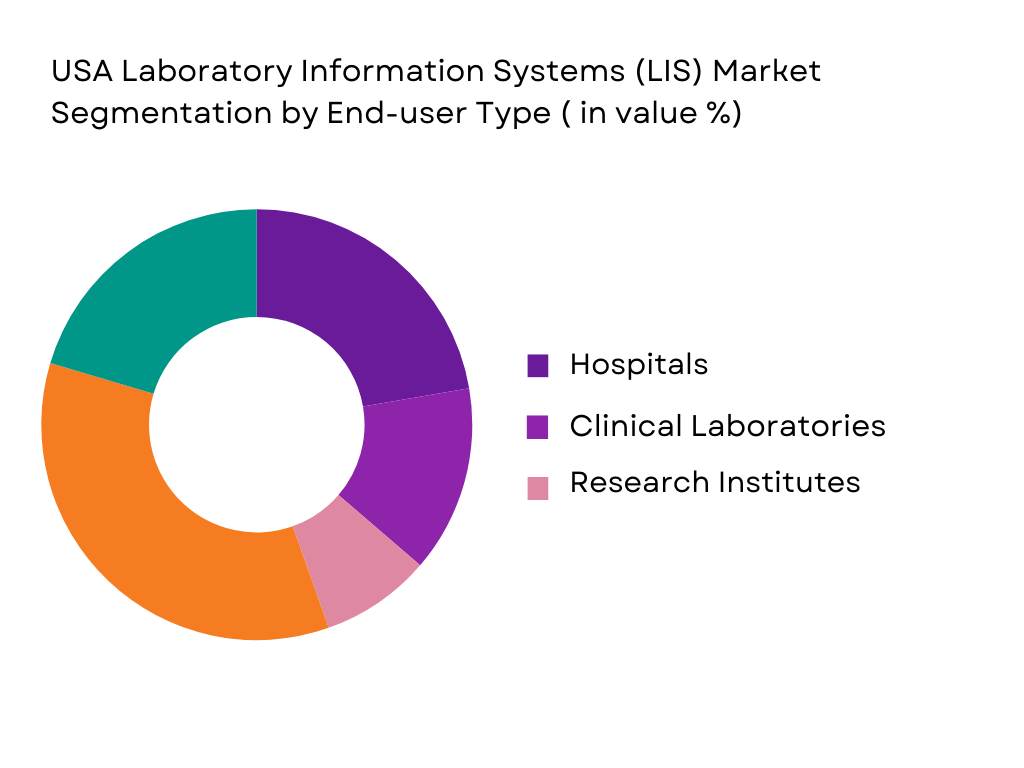

The LIS market is also segmented by end-user, which includes hospitals, clinical laboratories, and research institutes. Hospitals dominate the market share due to the high volume of diagnostic testing, patient care, and the increasing need for real-time data integration across multiple departments. Hospitals are increasingly adopting LIS to streamline laboratory processes, ensure regulatory compliance, and improve patient outcomes through better data management. Clinical laboratories are also significant users of LIS, particularly those focusing on specialized tests, where efficiency and accuracy are critical. Research institutes are adopting LIS solutions for research purposes, such as genomic research, where data management and integration are crucial.

Competitive Landscape

The USA Laboratory Information Systems (LIS) market is highly competitive, with several key players driving the technological advancements and adoption of LIS solutions. Leading players such as Cerner Corporation, Meditech, and McKesson Corporation dominate the market through their broad product portfolios, innovation in system integration, and strategic partnerships with hospitals and healthcare providers. These companies offer both standalone and integrated LIS solutions, and their products are designed to meet the increasing demands for data accuracy, patient safety, and regulatory compliance. The market is also characterized by increasing competition from newer players focusing on cloud-based solutions and AI-enabled platforms for more efficient data analysis and decision-making.

| Company | Establishment Year | Headquarters | Product Type | Key Technology | Partnerships | Market Focus |

| Cerner Corporation | 1979 | North Kansas City, Missouri, USA | ~ | ~ | ~ | ~ |

| Meditech | 1969 | Massachusetts, USA | ~ | ~ | ~ | ~ |

| McKesson Corporation | 1833 | Irving, Texas, USA | ~ | ~ | ~ | ~ |

| Labcorp | 1978 | North Carolina, USA | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Erlangen, Germany | ~ | ~ | ~ | ~ |

USA Laboratory Information Systems (LIS) Market Analysis

Growth Drivers

Urbanization

Urbanization is a significant driver in the adoption of Laboratory Information Systems (LIS) in the USA, as increasing population densities and urban expansion place greater demands on healthcare facilities and laboratory systems. The U.S. urban population reached ~% in 2024, according to the U.S. Census Bureau, with large metropolitan areas like New York, Los Angeles, and Chicago housing significant numbers of healthcare facilities. This demographic shift is increasing the demand for more efficient laboratory management systems to handle growing patient populations. The rise in healthcare facility establishments in urban regions supports the need for advanced LIS solutions to streamline operations, ensure data accuracy, and improve patient outcomes.

Industrialization

Industrialization in the USA has resulted in increased diagnostic requirements, particularly for healthcare industries focused on research, diagnostics, and pharmaceuticals. The industrial output of the USA was valued at USD ~ trillion in 2024, contributing to the expansion of clinical research and diagnostics labs. The demand for LIS solutions is fueled by the increasing complexity of laboratory processes that require more advanced data handling, automation, and regulatory compliance. The rise of industrial operations, particularly in biopharma and diagnostics, further drives the adoption of LIS to support efficient workflow and quality assurance within these sectors.

Restraints

High Initial Costs

The adoption of Laboratory Information Systems (LIS) in the USA is hindered by the high initial costs of implementation. The integration of advanced software and hardware, including data storage solutions, sensors, and training, can be prohibitively expensive, especially for smaller laboratories. According to the U.S. Bureau of Labor Statistics, the average initial investment in IT infrastructure for healthcare facilities in the U.S. can exceed USD ~. This significant financial barrier slows down the widespread adoption of LIS, particularly in smaller healthcare settings where budget constraints are more pressing. Despite long-term operational savings, the upfront cost remains a critical challenge for many institutions.

Technical Challenges

LIS solutions rely heavily on complex software and hardware components, which present significant technical challenges for implementation and ongoing management. In particular, the integration of LIS with existing hospital management systems and electronic health records (EHR) can be difficult due to varying standards and system incompatibilities. Many healthcare providers also face challenges in maintaining data security, ensuring data integrity, and adhering to evolving regulatory standards. These technical hurdles require continuous investment in IT expertise and system upgrades, presenting an obstacle for some institutions in adopting LIS effectively.

Opportunities

Technological Advancements

The rapid pace of technological advancements in data analytics, artificial intelligence (AI), and cloud computing presents significant opportunities for the LIS market. By leveraging AI, machine learning, and big data analytics, LIS solutions can automate various aspects of laboratory management, such as diagnostic test interpretation, predictive analysis, and patient data management. Additionally, the shift toward cloud-based LIS solutions enables healthcare providers to reduce infrastructure costs and improve accessibility to data across multiple locations. These technological innovations will likely drive future growth, making LIS solutions more efficient and affordable for a wide range of healthcare providers.

International Collaborations

International collaborations between U.S. healthcare providers, technology developers, and global partners are opening new opportunities for LIS adoption. Collaborations in the development of next-generation LIS solutions, such as cloud-based platforms and interoperable systems, help to improve system functionality and expand the market reach. Furthermore, partnerships between U.S. healthcare systems and international technology providers allow for cross-border knowledge exchange, providing access to more cost-effective solutions and creating a robust ecosystem for the development of advanced LIS technologies. These collaborations will continue to foster innovation and market growth.

Future Outlook

The future outlook for the USA LIS market is promising, with the continued growth of healthcare automation, increasing healthcare digitization, and the rising demand for integrated solutions. Over the next several years, the market is expected to experience significant growth due to the ongoing adoption of AI, machine learning, and cloud-based technologies in laboratory management systems. Government initiatives aimed at improving healthcare efficiency and patient safety are expected to further accelerate the demand for LIS solutions. Additionally, the need for data integration and real-time analytics in laboratory settings will continue to drive innovation and market expansion. The shift toward personalized medicine and genomics research is also expected to open new avenues for LIS growth, particularly in research-focused applications.

Major Players

- Cerner Corporation

- Meditech

- McKesson Corporation

- Labcorp

- Siemens Healthineers

- Abbott Laboratories

- Roche Diagnostics

- Sunquest Information Systems

- Intersystems

- Xifin

- Clarity LIS

- Hewlett-Packard

- Epic Systems

- Athenahealth

- GE Healthcare

Key Target Audience

- Hospitals

- Clinical Laboratories

- Research Institutes

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Diagnostic Testing Laboratories

- Health IT Solution Providers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying critical market variables influencing the USA LIS market, such as technological advancements, regulatory factors, healthcare industry trends, and the adoption of AI and cloud technologies. Secondary research is conducted through trusted sources such as government agencies, healthcare institutions, and industry reports.

Step 2: Market Analysis and Construction

Historical data on LIS adoption across hospitals, clinical laboratories, and research institutes are analyzed to create a model of current market dynamics. Factors such as healthcare facility size, technological investments, and the regulatory environment are evaluated to construct the market size and growth trajectory.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on future growth trends are validated through consultations with industry experts, including healthcare IT professionals, system integrators, and regulatory bodies. These consultations provide insights into the market’s direction, helping refine forecasts and assumptions.

Step 4: Research Synthesis and Final Output

The final step synthesizes all collected data and expert insights to deliver a comprehensive, actionable market analysis. This process includes validating findings with key stakeholders and ensuring that the final output reflects the most accurate and current market conditions.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Market Definitions and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Diagnostic Testing

Advancements in Laboratory Automation

Integration of AI and Machine Learning - Market Challenges

High Initial Investment for Implementation

Lack of Skilled Personnel

Data Privacy and Security Concerns - Opportunities

Emerging Markets in APAC

Expanding Research Applications

Government Initiatives and Funding - Trends

Cloud-based LIS Adoption

Increasing Demand for Real-Time Data and Analytics

Integration with Electronic Health Records (EHR)

Government Regulation

FDA and CLIA Regulations

Data Security and Privacy Laws (HIPAA)

Regulatory Changes for Lab Management Solutions - SWOT Analysis

Porter’s Five Forces

Competition Ecosystem

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Product Type (In Value %)

Standalone LIS Solutions

Integrated LIS Solutions - By Delivery Mode (In Value %)

On-Premise LIS Solutions

Cloud-Based LIS Solutions - By End-User (In Value %)

Hospitals

Clinical Laboratories

Research Institutes - By Region (In Value %)

North America

Europe

Asia-Pacific - By Technology (In Value %)

Data Analytics in LIS

Artificial Intelligence & Machine Learning

Automation Technologies in LIS

- Market Share of Major Players by Type of LIS Segment

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent, Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of LIS, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players in LIS Market

- Detailed Profiles of Major Companies

Cerner Corporation

Meditech

McKesson Corporation

Labcorp

Siemens Healthineers

Abbott Laboratories

Roche Diagnostics

Sunquest Information Systems

Intersystems

Xifin

Clarity LIS

Hewlett-Packard

Epic Systems

Athenahealth

GE Healthcare

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Price, 2026-2030