Market Overview

The USA Laboratory Reporting Systems market is valued at approximately USD ~ billion in 2024, driven by the rapid adoption of digital solutions for laboratory data management and reporting. The market’s growth is primarily fueled by the increasing need for accurate and efficient data reporting in clinical, pharmaceutical, and research laboratories. Regulatory requirements and the push for greater automation in laboratory operations also contribute to the market’s expansion. The healthcare sector, with its vast number of laboratories, is the key driver of this growth

The USA is the dominant country in the laboratory reporting systems market due to its advanced healthcare infrastructure and stringent regulatory standards. Major cities such as New York, Boston, and San Francisco lead the market due to their high concentration of research institutions, pharmaceutical companies, and clinical laboratories. These cities are home to numerous healthcare and biotech hubs, which demand advanced reporting systems to handle complex data, ensure compliance, and enhance operational efficiency. Additionally, the regulatory environment in these regions, such as FDA guidelines, further accelerates the adoption of these solutions.

Market Segmentation

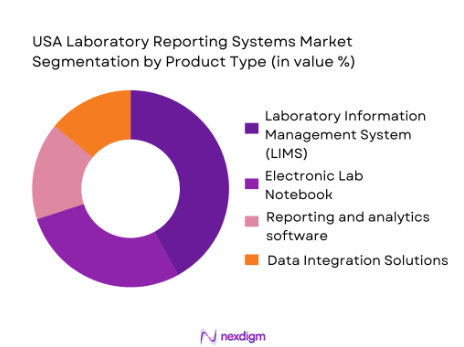

By Product Type

The USA Laboratory Reporting Systems market is segmented into Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELN), Reporting and Analytics Software, and Data Integration Solutions. Among these, LIMS holds the largest share due to its ability to manage and track laboratory samples, data, and workflows. The pharmaceutical and clinical sectors, where accurate sample tracking and data management are critical, are the largest adopters of LIMS. The need to maintain regulatory compliance, ensure data integrity, and improve efficiency in research drives the dominance of LIMS in the market.

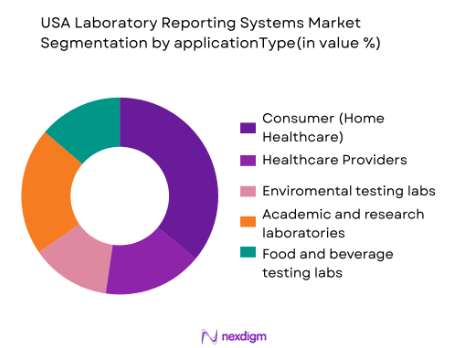

By Application

The market is segmented by application into pharmaceutical and biotechnology labs, clinical and diagnostic laboratories, environmental testing labs, academic and research laboratories, and food and beverage testing labs. The pharmaceutical and biotechnology lab segment holds the largest share. Pharmaceutical and biotechnology labs generate large volumes of data, especially in clinical trials and drug development. LIMS and other reporting systems are essential for managing this data, ensuring compliance with stringent regulatory standards, and streamlining workflows in these complex environments.

Competitve Landscape

In the USA Laboratory Reporting Systems market often considered part of the broader laboratory information management/reporting and informatics landscape—competition is highly fragmented and dynamic. Large established players dominate with comprehensive platforms that integrate reporting with broader lab data management, while numerous niche vendors compete on specialization and cloud-native capabilities. Key incumbents include LabWare, LabVantage Solutions, and Thermo Fisher Scientific, which lead with robust, scalable solutions tailored for pharmaceuticals, biotech, and clinical diagnostics. Other significant competitors include STARLIMS Corporation, Agilent Technologies, LabLynx, and Sapio Sciences, each differentiating through features like workflow automation, cloud deployment, and advanced analytics. Smaller and emerging players such as CloudLIMS, Benchling, and Confidence LIMS also contribute to competitive intensity by offering flexible.

| Company Name | Establishment Year | Headquarters | Technology Offered | Target Market | Market Reach |

| Thermo Fisher Scientific | 1956 | Waltham, Massachusetts | ~ | ~ | ~ |

| LabWare | 1999 | Wilmington, Delaware | ~ | ~ | ~ |

| Agilent Technologies | 1999 | Santa Clara, California | ~ | ~ | ~ |

| PerkinElmer | 1937 | Waltham, Massachusetts | ~ | ~ | ~ |

| Beckman Coulter | 1935 | Brea, California | ~ | ~ | ~ |

USA Laboratory Reporting Systems Market Analysis

Growth Drivers

Data integration and accuracy are crucial in laboratory reporting systems

Due to the increasing volume of data generated by modern laboratories. In the U.S., the healthcare sector alone is expected to generate over 2.3 billion health records in 2024. To manage this volume efficiently, laboratories are adopting systems that integrate data from multiple sources, such as clinical tests, patient histories, and research findings. As a result, the demand for laboratory reporting solutions that ensure seamless data integration and reporting accuracy has surged, aiding in better decision-making and compliance with regulatory standards.

Automation in laboratories

The rise in automation within laboratories has significantly impacted reporting systems. According to the World Bank, the global investment in automated systems for laboratories exceeded USD 50 billion in 2023. This shift has driven the need for reporting systems that can handle large volumes of data and provide insights for decision-making in real-time. Automation in laboratories enhances efficiency, reduces errors, and accelerates workflows, necessitating more advanced, automated reporting systems to ensure accurate data reporting, improve productivity, and meet compliance requirements.

Market Challenges

High Initial Investment and Maintenance Costs

Laboratory reporting systems require a significant upfront investment, especially for high-performance solutions that cater to large laboratories or research institutions. According to the U.S. National Institutes of Health (NIH), the cost of implementing a robust laboratory information management system (LIMS) can range from USD ~ to USD ~ million, depending on the scale and customization required. Additionally, ongoing maintenance, system updates, and training costs add to the overall financial burden, making it challenging for smaller laboratories to adopt these solutions

Security and Data Privacy Risks with Cloud-Based Reporting

As laboratories increasingly adopt cloud-based solutions for reporting, data privacy and security concerns are growing. According to the U.S. Department of Justice, healthcare data breaches in the U.S. reached 715 cases in 2022, impacting over 40 million individuals. Laboratories that handle sensitive patient data are particularly vulnerable to these risks. The rising number of cybersecurity threats and the need to comply with regulations such as HIPAA and GDPR are key challenges that laboratories face when adopting cloud-based reporting systems, limiting their widespread adoption.

Opportunities

Demand for Real-Time Reporting and Data Analytics

Real-time data reporting is becoming an essential feature in laboratory reporting systems, especially in clinical trials, diagnostics, and healthcare research. With the increasing complexity of medical data, there is a growing demand for systems that can process and report results in real time. The healthcare industry in the U.S. is expected to process over 2.5 quintillion bytes of data in 2024. Real-time analytics ensures faster decision-making, quicker results, and improved patient care. Laboratories adopting systems with real-time reporting features can gain a competitive edge by enhancing efficiency and accuracy.

Adoption of Cloud-Based LIMS Solutions

The shift toward cloud-based Laboratory Information Management Systems (LIMS) is accelerating, driven by the increasing demand for flexible, scalable, and cost-effective solutions. Cloud-based LIMS offers significant advantages over on-premise systems, including remote accessibility, ease of data sharing, and lower initial costs. The cloud computing market in the U.S. is expected to grow by 10% annually, with more laboratories adopting cloud solutions for data storage and reporting. This trend presents an opportunity for companies offering cloud-based LIMS solutions to capture a larger market share in the laboratory sector.

Future Outlook

The USA Laboratory Reporting Systems market is set to grow significantly over the next five years, driven by advancements in automation, cloud-based solutions, and increasing data complexity in laboratory environments. Laboratories are focusing more on real-time data analytics and automation to improve operational efficiency. As personalized medicine, biotech innovation, and the expansion of research sectors continue to rise, the need for advanced, compliant, and scalable reporting systems will further accelerate the growth of this market.

Major Players in the Market

- Thermo Fisher Scientific

- LabWare

- Agilent Technologies

- PerkinElmer

- Beckman Coulter

- Veeva Systems

- Roche Diagnostics

- Illumina

- Siemens Healthineers

- Bio-Rad Laboratories

- Medrio

- Abbott Laboratories

- BioMérieux

- Labcorp

- Mettler Toledo

Key Target Audience

- Pharmaceutical Companies

- Biotechnology Firms

- Healthcare Institutions

- Clinical Laboratories

- Food and Beverage Testing Labs

- Government Agencies (FDA, CDC, USDA)

- Regulatory Bodies (FDA, EMA, WHO)

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying and mapping all major stakeholders in the USA Laboratory Reporting Systems market. Secondary research, including proprietary industry reports, surveys, and government publications, is used to collect data on key variables such as product adoption rates, regulatory changes, and technology trends.

Step 2: Market Analysis and Construction

In this phase, historical data related to the USA Laboratory Reporting Systems market is analyzed, including adoption trends, market penetration, and revenue generation. Various applications, deployment models, and product types are evaluated to provide an accurate representation of the market size and growth potential.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed in the analysis phase are validated through direct consultations with industry experts. These experts include laboratory managers, IT professionals, and solution providers who offer insights on current trends, challenges, and future developments.

Step 4: Research Synthesis and Final Output

The final step integrates data from primary and secondary sources to create a comprehensive report on the USA Laboratory Reporting Systems market. This includes identifying key opportunities, challenges, and growth strategies for stakeholders involved in the laboratory data management and reporting systems industry.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions (Laboratory Reporting Systems, LIMS, ELN, Abbreviations and Key Terms Data Integration, Workflow Automation, Regulatory Compliance, Market Sizing Approach Top-Down and Bottom-Up Methodologies, Consolidated Research Approach (Primary and Secondary Data Sources, Understanding Market Potential Through In-Depth Industry Interviews (Laboratory Managers, IT Teams, Solution Providers)

- Definition and Scope (Laboratory Reporting Systems and Their Functions)

- Overview Genesis (History and Evolution of Reporting Systems in Laboratories)

- Timeline of Major Players (Key Milestones in Product Development and Market Growth)

- Business Cycle (Adoption Phases, Market Penetration, and Growth Trajectory)

- Supply Chain and Value Chain Analysis (Technology Providers, System Integrators, End Users)

- Growth Drivers

Growing Need for Data Integration and Accuracy in Reporting

Increasing Automation and Data-Driven Decision Making in Laboratories

Rising Regulatory Pressures and Compliance Requirements

Expansion of Healthcare and Pharmaceutical Research Sectors - Market Challenges

High Initial Investment and Maintenance Costs

Security and Data Privacy Risks with Cloud-Based Reporting

Integration Challenges with Existing Laboratory Infrastructure - Opportunities

Demand for Real-Time Reporting and Data Analytics

Adoption of Cloud-Based LIMS Solutions

Growth of Personalized Medicine and Biotech Innovation - Trends

Integration of AI and Machine Learning in Reporting Systems

Emergence of Remote and Decentralized Laboratories

Increasing Focus on Data Privacy and Compliance in Reporting Systems - Government Regulation

Compliance with FDA, HIPAA, and Other Regulatory Standards

Adherence to Data Security Regulations (GDPR, CCPA) - SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

- Stakeholder Ecosystem (Technology Providers, Laboratories, Regulatory Bodies)

- Porter’s Five Forces (Supplier Power, Buyer Power, Barriers to Entry)

- By Value (USD), 2019-2024

- By Volume (Units Installed/Deployed), 2019-2024

- By Average Price (Per Unit/License Fee), 2019-2024

- By Product Type (In Value %)

Laboratory Information Management Systems (LIMS)

Electronic Lab Notebooks (ELN)

Reporting and Analytics Software

Cloud-Based Laboratory Reporting Systems

Data Integration Solutions - By Application (In Value %)

Pharmaceutical and Biotechnology Labs

Clinical and Diagnostic Laboratories

Research and Academic Laboratories

Environmental Testing Laboratories

Food and Beverage Testing Laboratories - By End-User (In Value %)

Hospitals and Medical Institutions

Contract Research Organizations (CROs)

Government Laboratories and Regulatory Bodies

Private Laboratories

Research Institutes and Universities - By Deployment Mode (In Value %)

Cloud-Based Solutions

On-Premise Solutions

Hybrid Solutions - By Region (In Value %)

Northeast

Midwest

South

West

- Market Share of Major Players by Value, 2024

- Cross Comparison Parameters (Company Overview, Product Portfolio, Technology, Pricing Strategies, (Customer Base, Market Reach, Revenue, Distribution Channels)

- SWOT Analysis of Major Players

- Pricing Analysis by Type of Solution

- Detailed Profiles of Major Companies

Thermo Fisher Scientific

LabWare

PerkinElmer

Agilent Technologies

Veeva Systems

Roche Diagnostics

Illumina

Siemens Healthineers

Bio-Rad Laboratories

Beckman Coulter

Medrio

Abbott Laboratories

BioMérieux

Labcorp

Mettler Toled

- Market Demand and Utilization Trends

- End-User Budget Allocations and Purchasing Criteria

- Regulatory and Compliance Requirements in End-User Segments

- Needs, Desires, and Pain Point Analysis for End Users

- Decision-Making Process in Adopting Reporting Systems

- By Value (USD), 2025-2030

- By Volume (Units Deployed), 2025-2030

- By Average Price (Per Unit/License Fee), 2025-2030