Market Overview

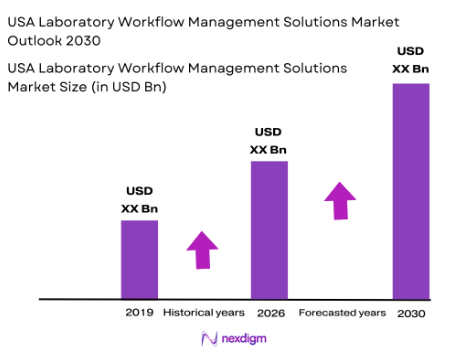

The USA Laboratory Workflow Management Solutions market is valued at USD 5.2 billion in 2024, driven by the increasing need for efficiency, compliance, and automation in laboratory operations. The market has expanded significantly due to the adoption of Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELNs), and other digital solutions aimed at streamlining workflows. The rise in biotechnology research, pharmaceutical advancements, and regulatory requirements are key factors contributing to the market’s growth. In 2023, the U.S. spent over USD 3 billion on laboratory management technologies, including data integration and quality control systems, with an annual growth rate of 7%

The United States is the leading country in the Laboratory Workflow Management Solutions market due to its robust healthcare and pharmaceutical industries, a high number of research and academic laboratories, and stringent regulatory compliance requirements. Cities such as Boston, San Francisco, and New York dominate the market, driven by the presence of major biotech firms, pharmaceutical companies, and renowned academic institutions. The regulatory environment in these regions, such as FDA and HIPAA compliance, accelerates the need for advanced laboratory workflow management systems to streamline operations and ensure data security.

Market Segmentation

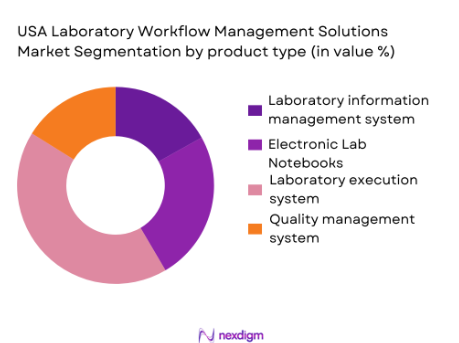

By Product Type

The USA Laboratory Workflow Management Solutions market is segmented by product type into Laboratory Information Management System (LIMS), Electronic Lab Notebooks (ELN), Laboratory Execution Systems (LES), and Quality Management Systems (QMS). Among these, LIMS leads the market. The dominance of LIMS is driven by its ability to automate sample tracking, data management, and integration across laboratory processes. As laboratories increasingly move towards automation to improve efficiency and regulatory compliance, LIMS has become essential, particularly in pharmaceuticals and clinical testing. LIMS solutions help manage vast amounts of data generated in laboratories, making them indispensable for labs aiming to enhance productivity and maintain high standards of accuracy.

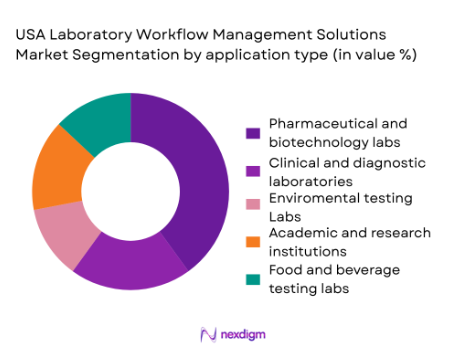

By Application

The market is segmented by application into pharmaceutical and biotechnology labs, clinical and diagnostic laboratories, environmental testing labs, academic and research institutions, and food and beverage testing labs. The pharmaceutical and biotechnology lab segment has the largest share. The growing demand for drug development, clinical trials, and personalized medicine has led to the widespread adoption of laboratory workflow solutions in these sectors. Automation through LIMS and ELNs helps these labs meet strict regulatory requirements and manage complex workflows efficiently, while also reducing human error in research and testing.

Competitive Landscape

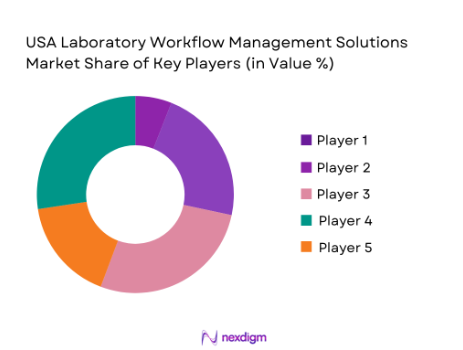

The USA Laboratory Workflow Management Solutions market is dominated by a few key players, including Thermo Fisher Scientific, LabWare, and Agilent Technologies. These companies have a significant presence due to their extensive product portfolios and strong relationships with laboratory facilities across various sectors, including pharmaceuticals, healthcare, and research. The consolidation of market power by these firms highlights their importance in shaping the future of laboratory operations, driving innovation, and ensuring compliance with increasing regulations.

| Company Name | Establishment Year | Headquarters | Technology Offered | Key Market Focus | Market Reach |

| Thermo Fisher Scientific | 1956 | Waltham, Massachusetts | ~ | ~ | ~ |

| LabWare | 1999 | Wilmington, Delaware | ~ | ~ | ~ |

| Agilent Technologies | 1999 | Santa Clara, California | ~ | ~ | ~ |

| PerkinElmer | 1937 | Waltham, Massachusetts | ~ | ~ | ~ |

| Beckman Coulter | 1935 | Brea, California | ~ | ~ | ~ |

USA Laboratory Workflow Management Solutions Market Analysis

Growth Drivers

Increasing Demand for Data Integration in Laboratories

The growing need for data integration within laboratories is driven by the increasing volume and complexity of data generated in scientific and clinical research. According to the World Bank, the total spending on research and development (R&D) in the United States reached USD 649 billion in 2022, a 3.5% increase from the previous year. This surge in R&D investments calls for more efficient data management and integration. The integration of laboratory data across different platforms helps streamline processes, improve productivity, and ensure data accuracy, which is critical for regulatory compliance and decision-making.

Adoption of Automation in Lab Processes

Automation in laboratories has become a significant growth driver for workflow management systems. The U.S. Bureau of Labor Statistics reported that in 2022, U.S. pharmaceutical companies spent over USD 45 billion on automation technologies. Automation streamlines repetitive tasks such as sample tracking, testing, and reporting, reducing human error, increasing efficiency, and improving productivity. Laboratories are increasingly adopting automated systems like LIMS (Laboratory Information Management Systems) to optimize processes, improve turnaround times, and reduce operational costs, especially in high-throughput labs.

Market Challenges

High Initial Investment Costs for Laboratory Workflow Solutions

The adoption of advanced laboratory workflow solutions often requires a significant initial investment, which can be a barrier for small to medium-sized laboratories. According to a 2023 report by the U.S. Department of Health and Human Services, the cost of implementing a comprehensive Laboratory Information Management System (LIMS) can range from USD 100,000 to USD 500,000, depending on the scale and complexity of the lab. Smaller labs, especially in less lucrative sectors, may find it challenging to justify such high upfront costs, limiting the widespread adoption of these solutions.

Data Privacy and Security Concerns

As laboratories increasingly rely on digital systems for managing sensitive data, data privacy and security concerns have become critical. The U.S. Department of Justice reported that the healthcare sector alone experienced over 700 data breaches in 2022, exposing millions of personal records. These breaches highlight the vulnerabilities of cloud-based solutions in the lab environment, where confidential patient and research data are at risk. Ensuring compliance with regulations such as HIPAA is a major challenge for laboratories using workflow management solutions that handle sensitive data.

Opportunities

Expanding Demand for Real-Time Data Analytics in Laboratories

Real-time data analytics is becoming a critical factor in laboratory management, offering insights that help improve research efficiency and quality control. A report from the U.S. National Institutes of Health (NIH) highlighted that the demand for real-time data processing in laboratories has grown by over 25% in the last two years, driven by the need for faster decision-making, especially in clinical and pharmaceutical research. Real-time analytics help labs optimize workflows, minimize delays, and ensure compliance with regulatory requirements

Rising Adoption of Cloud-Based LIMS Solutions

Cloud-based Laboratory Information Management Systems (LIMS) are becoming increasingly popular due to their scalability, flexibility, and cost-effectiveness. The U.S. government’s General Services Administration (GSA) has been promoting cloud solutions as part of its digital modernization initiative, which has accelerated the adoption of cloud technologies across sectors. In 2023, the number of laboratories using cloud-based LIMS grew by 18%, driven by the ease of integration, lower upfront costs, and the need for remote data access, especially amid the ongoing digital transformation in healthcare.

Future Outlook

The USA Laboratory Workflow Management Solutions market is expected to see substantial growth in the next 5 years, driven by the continued push for laboratory automation and efficiency improvements. The adoption of AI-powered LIMS, cloud-based solutions, and the integration of advanced data analytics will lead to enhanced laboratory performance and productivity. The increasing need for regulatory compliance across industries like pharmaceuticals, food safety, and healthcare will further support the market’s expansion. Additionally, as more laboratories migrate to cloud-based systems, the demand for real-time data analytics and remote monitoring will increase, providing ample growth opportunities for market players.

Major Players in the Market

- Thermo Fisher Scientific

- LabWare

- Agilent Technologies

- PerkinElmer

- Beckman Coulter

- Siemens Healthineers

- Roche Diagnostics

- Bio-Rad Laboratories

- Veeva Systems

- Illumina

- Mettler Toledo

- Abbott Laboratories

- Medrio

- BioMérieux

- LIMS Technologies

Key Target Audience

- Pharmaceutical Companies

- Biotechnology Firms

- Healthcare Institutions

- Clinical Laboratories

- Food and Beverage Testing Labs

- Government Agencies (FDA, CDC, USDA)

- Regulatory Bodies (FDA, EMA, WHO)

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a detailed ecosystem map of key stakeholders in the USA Laboratory Workflow Management Solutions market. This step is supported by secondary research from proprietary databases, industry reports, and expert interviews, identifying crucial market variables like adoption rates, key technology providers, and regulatory impacts.

Step 2: Market Analysis and Construction

This phase focuses on analyzing historical market data, assessing trends in workflow management technology adoption across sectors like pharmaceuticals and healthcare. It involves evaluating the market’s penetration and understanding the resultant revenue streams driven by various types of laboratory workflow management solutions.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses developed during market analysis will be validated by consulting with industry experts through structured interviews. This validation process will provide key insights into operational challenges, the future adoption of workflow solutions, and the implications of emerging technologies like AI and cloud computing.

Step 4: Research Synthesis and Final Output

In this final phase, direct engagement with industry leaders and laboratory personnel will help refine the report’s findings. This will ensure that the data is up-to-date and actionable, offering a comprehensive analysis of the current and future states of the USA Laboratory Workflow Management Solutions market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions Workflow Management, LIMS, and Integration Solutions, Abbreviations and Key Terminologies LIMS, ERP, RFID, IoT, AI, Market Sizing Approach Top-Down and Bottom-Up Methodology, Consolidated Research Approach, Secondary Data Review and Primary Insights, Understanding Market Potential Through In-Depth Industry Interviews Lab Managers, IT Officers, and Service Providers)

- Definition and Scope (Laboratory Workflow Management Software, Types, and Scope of Usage)

- Overview Genesis (Evolution of Laboratory Management Solutions, Shift from Manual to Automated Systems)

- Timeline of Major Players (Key Innovators and Their Milestones)

- Business Cycle (Product Lifecycle, Adoption by Industry, Commercialization Phases)

- Supply Chain and Value Chain Analysis (Technology Providers, System Integrators, and End Users)

- Growth Drivers

Increasing Demand for Data Integration in Laboratories

Adoption of Automation in Lab Processes

Rising Focus on Compliance and Regulatory Needs

Technological Advancements in AI and IoT Integration - Market Challenges

High Initial Investment Costs for Laboratory Workflow Solutions

Data Privacy and Security Concerns

Lack of Skilled Workforce to Manage Complex Systems - Opportunities

Expanding Demand for Real-Time Data Analytics in Laboratories

Rising Adoption of Cloud-Based LIMS Solutions

Growth of the Biotechnology and Pharmaceutical Sectors - Trends

Integration of Artificial Intelligence and Machine Learning

Expansion of IoT-Enabled Laboratory Equipment

Increasing Trend of Cloud-Based Solutions and SaaS Models - Government Regulation

Regulatory Framework for Laboratory Standards (FDA, HIPAA)

Compliance with Data Security Regulations (GDPR, CCPA) - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- Competitive Ecosystem

- By Value (USD), 2019-2024

- By Volume (Units Deployed), 2019-2024

- By Average Price (Per Unit/System), 2019-2024

- By Product Type (In Value %)

Laboratory Information Management System (LIMS)

Electronic Lab Notebooks (ELN)

Laboratory Execution Systems (LES)

Quality Management Systems (QMS)

Laboratory Automation and Instrument Management Solutions - By Application (In Value %)

Pharmaceutical and Biotechnology Labs

Clinical and Diagnostic Laboratories

Environmental Testing Labs

Academic and Research Institutions

Food and Beverage Testing Labs - By End-User (In Value %)

Hospitals and Medical Institutions

Contract Research Organizations (CROs)

Government Laboratories and Regulatory Bodies

Private Laboratories

Research Institutes and Universities - By Deployment Mode (In Value %)

Cloud-Based Solutions

On-Premise Solutions

Hybrid Solutions - By Region (In Value %)

Northeast

Midwest

South

West

- Market Share of Major Players by Value, 2024

- Cross Comparison Parameters (Product Portfolio, LIMS, ELN, LES, Technology Innovation, Regulatory Compliance: Support for compliance with industry standards (e.g., HIPAA, 21 CFR, Customer Base: Diversity of industries and end-users served pharma, diagnostics, etc, Deployment Flexibility: Availability of cloud, on-premise, and hybrid deployment options.

- SWOT Analysis of Major Players

- Pricing Analysis by Type of Solution

- Detailed Profiles of Major Companies

Thermo Fisher Scientific

LabWare

Abbott Laboratories

PerkinElmer

Agilent Technologies

Veeva Systems

Siemens Healthineers

Illumina

Labcorp

Beckman Coulter

Roche Diagnostics

Medrio

Bio-Rad Laboratories

BioMérieux

Mettler Toledo

- Market Demand and Utilization Trends

- End-User Budget Allocations

- Regulatory and Compliance Requirements for Laboratories

- Needs, Desires, and Pain Point Analysis for End Users

- Decision-Making Process in Adopting Workflow Management Solutions

- By Value (USD), 2025-2030

- By Volume (Units Deployed), 2025-2030

- By Average Price (Per Unit/System), 2025-2030