Market Overview

The manual transmission market, as defined by global revenue in driveline systems that require clutch-pedal and gated-shift operation, is valued at about USD ~ billion. This figure sits within a global automotive transmission space of roughly USD ~ billion, depending on definition and scope. Growth is underpinned by a rebound in global vehicle production, which show rising by about 10.3% over the latest reporting interval, particularly in cost-sensitive passenger car and commercial vehicle segments where manual gearboxes still offer lower upfront cost, robustness, and better perceived control.

In the USA Manual Transmissions Market, dominance is less about specific cities and more about regional use-cases and vehicle categories. Manual boxes remain entrenched in long-haul and vocational heavy-duty trucks, where North American fleets historically preferred manual or non-synchronized gearboxes for high-torque, severe-duty cycles; research on the North American transmission market highlights that heavy-duty manual systems have “traditionally dominated” in HCV applications for robustness and torque-handling.

Market Segmentation

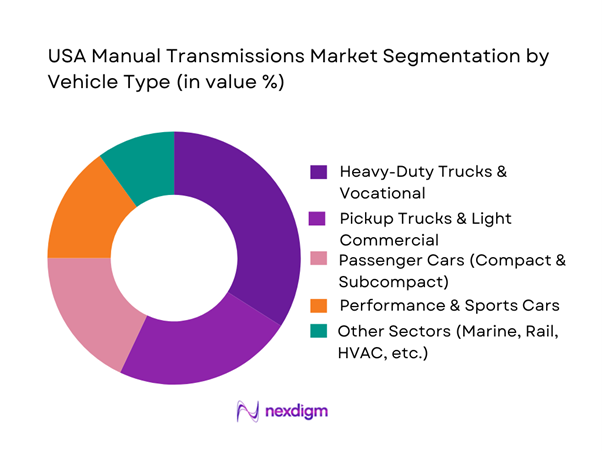

By Vehicle Type

The USA Manual Transmissions Market is segmented into passenger cars, pickup trucks & LCVs, heavy-duty trucks & vocational vehicles, performance & sports cars, and off-highway & specialty vehicles. In recent years, heavy-duty trucks & vocational vehicles have emerged as the dominant revenue contributor, even as manual penetration collapses in mainstream passenger cars. Fleet operators in freight, construction, oil & gas and agriculture continue to value manual gearboxes for their high torque capacity, lower acquisition cost versus advanced automatics, and simpler in-field serviceability. While AMTs are gaining traction in long-haul HCVs, manuals still underpin a sizeable installed base of tractors, dump trucks, mixers and refuse vehicles, creating recurring demand for replacement gearboxes, reman units and clutches. In contrast, passenger car manuals have become niche, and even pickups increasingly migrate to advanced automatics, making heavy-duty and vocational platforms the anchor of manual-transmission profitability in the U.S.

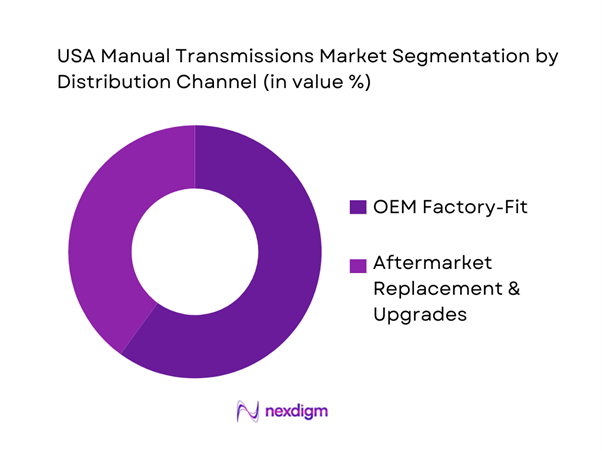

By Distribution Channel

The USA Manual Transmissions Market is divided into OEM factory-fit and aftermarket replacement & upgrades. OEM factory-fit accounts for the larger share, driven by manual gearboxes embedded in new heavy-duty truck platforms, specialized vocational chassis and select performance models. These transmissions are engineered into the vehicle from the outset, often in partnership with Tier-1 suppliers such as Eaton, ZF, Aisin, Magna and Tremec, optimizing torque curves, shift durability and NVH characteristics for specific duty cycles. However, the aftermarket is structurally important, sustained by a sizeable parc of legacy manual vehicles; clutch kits, synchro sets, bearings and remanufactured gearboxes are high-rotation SKUs in independent workshops and OEM dealer networks. In addition, enthusiast-oriented upgrades (e.g., Tremec performance boxes) enable conversion from automatic to manual or from lower-rated to high-torque units. Despite this, OEM installations still dominate total value because high-capacity HCV and vocational gearboxes command premium pricing and are tied to new-vehicle ASPs.

Competitive Landscape

The USA Manual Transmissions Market is shaped by a concentrated group of global Tier-1 suppliers and specialized drivetrain manufacturers, alongside regional players focused on remanufacturing and aftermarket performance. Global names such as Aisin, ZF, Magna Powertrain, Eaton and Tremec anchor OEM fitment in heavy-duty trucks, pickups and performance vehicles, while also supplying clutches, synchronizers and components into the replacement chain. Market-research on the global manual transmission segment indicates that a handful of major players collectively hold roughly one-third of global share, underpinned by deep OEM relationships, multi-continent plant networks and ongoing investments in lightweight materials, shift-feel optimization and integration with hybrid/AMT platforms.

| Company | Establishment Year | Headquarters (Global) | Key U.S. OEM Customers (Manual-Relevant) | Core Manual / HD Focus Areas | U.S. Manufacturing / Engineering Footprint (Manual-Relevant) | Primary Vehicle Segments Served in USA | Technology / Product Differentiators |

| Aisin | 1949 | Kariya, Aichi, Japan | ~ | ~ | ~ | ~ | ~ |

| Tremec | 1964 | Querétaro, Mexico (U.S. operations in Novi, MI) | ~ | ~ | ~ | ~ | ~ |

| ZF Friedrichshafen | 1915 | Friedrichshafen, Germany | ~ | ~ | ~ | ~ | ~ |

| Magna International (Magna Powertrain) | 1957 | Aurora, Ontario, Canada | ~ | ~ | ~ | ~ | ~ |

| Eaton Corporation | 1911 | Dublin, Ireland (U.S. administrative center in Ohio) | ~ | ~ | ~ | ~ | ~ |

USA Manual Transmissions Market Analysis

Growth Drivers

MT Enthusiast Demand Base

The USA manual transmissions market is anchored in a very large combustion-vehicle and driving base. U.S. roads carried ~ registered motor vehicles in the latest available year, up from ~ a year earlier, indicating a net addition of more than ~ million vehicles that can host ICE and manual powertrains. In the same period, road travel reached a record ~ billion vehicle-miles, rising ~ billion miles year-on-year as commuting, leisure and performance driving rebounded. Gasoline use reinforces this activity intensity: Americans consumed ~ billion gallons of gasoline in one year and ~ billion gallons the next, with daily averages climbing from about ~ million to ~ million gallons. Against this backdrop, meaning roughly ~ million vehicles on U.S. roads remain combustion-powered and thus compatible with manual and performance-oriented drivetrains. This very large enthusiast-addressable base underpins sustained aftermarket, retrofit and niche OEM demand for manual transmissions, performance gearsets and high-engagement driving experiences.

Cost-Effective Powertrain Architecture, Weight Efficiency, Direct Drive Efficiency

Manual transmissions position themselves as a low-complexity, mechanically efficient option within a high-mileage, fuel-sensitive macro environment. DOE’s New Light-Duty Vehicle Sales fact series shows ~ million new light-duty vehicles sold in a recent year, forming a very large annual replacement pool where even a small manual share translates to meaningful unit volumes. At the same time, DOE notes that motor gasoline consumption in the United States averaged ~ million barrels per day, equal to about ~ million gallons per day, underscoring the scale of fuel spend that fleet operators and private owners try to optimize through efficient gearing and reduced parasitic losses. EPA and DOE efficiency tracking indicate that model-year light-duty vehicles have improved test-cycle fuel economy into the mid-20s miles-per-gallon range on average, while CAFE standard values for passenger cars have been ratcheted up from ~ to ~ miles per gallon over two recent model years. In this tightening regulatory context, manual and lightweight semi-manual designs are used in specific segments (performance coupes, compact crossovers, fleet work trucks) where their comparatively low mass, direct mechanical connection and simpler control logic help OEMs and fleets meet internal fuel-use, durability and serviceability targets without resorting to more complex multi-clutch or high-ratio automatic systems.

Market Challenges

Declining OEM MT Options

The most acute structural challenge for the USA manual transmissions market is the sharp reduction in factory-fitted manual options on new vehicles. U.S. Department of Energy Fact reports that only 65 out of 100 light-duty vehicles produced in 1980 used automatic transmissions, but “more than 99 out of 100” did so in the latest available production year, effectively relegating manuals to a sub-1-in-100 niche of U.S. light-duty production. EPA’s Automotive Trends data, which underpin this DOE analysis, confirm that manual gearboxes have “all but disappeared” from the mainstream U.S. new-vehicle fleet as manufacturers moved to lock-up automatics, dual-clutch units and continuously variable transmissions for efficiency and regulatory compliance. This structural OEM pivot is occurring even as total new light-duty sales remain high at ~ million units annually and total registered vehicles surpass ~ million, meaning replacement cycles are increasingly dominated by automatic, CVT and single-speed electric drive units. For manual-focused suppliers, this compresses high-volume factory installation opportunities into a narrow set of performance nameplates and special-order configurations, forcing a strategic re-weighting toward aftermarket, remanufacturing, motorsport and export-oriented channels.

Automated Transmissions Adoption

The rapid adoption of electrified and advanced automatic powertrains is another major headwind for the USA manual transmissions market. DOE and associated EV programs report that cumulative U.S. plug-in EV sales reached ~ million vehicles, with calendar-year sales hitting 1,402,371 units, more than quadruple their 2020 level. These vehicles, by design, use single-speed reduction gears or multi-mode automatic systems rather than manual transmissions. At the same time, light-duty fleet data show that trucks and SUVs dominate higher-price brackets, and DOE notes that nearly two-thirds of vehicles with manufacturer’s suggested retail prices above a defined threshold are light trucks equipped primarily with automatic, torque-converter or dual-clutch gearboxes. In parallel, EPA-backed trends reveal that a growing share of light-duty vehicles ship with continuously variable transmissions and multi-speed automatics optimized for fuel economy, while CVTs alone account for roughly one quarter of new production. These structural shifts, combined with federal rules targeting more than half of new light-duty sales to be electric or plug-in hybrid within a decade, sharply crowd out manual fitment opportunities and accelerate component standardization around electronically controlled automatic and e-drive platforms.

Opportunities

Performance Car Revival

Despite mainstream electrification, a structurally important opportunity for the USA manual transmissions market lies in the enduring performance and enthusiast segment. Data show that the United States produced ~ motor vehicles in a recent year, including a large base of passenger cars and light trucks that underpin global exports of “vehicles other than railway” worth ~ U.S. dollars. Within this production base, high-output V-8 coupes, turbocharged sports sedans and track-focused variants continue to specify manual transmissions or closely related high-torque gearsets supplied by specialist manufacturers. The broader macro backdrop is supportive: Americans are driving record distances— ~ billion miles annually—and consuming ~ billion gallons of gasoline per year, indicating sustained demand for engaging combustion-powered vehicles alongside EVs. DOE’s EV sales analysis notes that plug-in volumes have more than quadrupled since 2020 but also confirms that plug-ins still represent a small minority of the national vehicle parc, leaving tens of millions of enthusiast-oriented ICE vehicles in circulation and entering second and third ownership cycles where manual swaps, performance clutch kits and close-ratio gearsets are popular upgrades. Collectively, this creates a durable niche for high-margin performance manuals, short-throw shifters and motorsport-grade synchronizer technologies tailored to American pony cars, track specials and homologation models.

Fleet Demand for Low-Complexity Transmissions

Another opportunity resides in vocational and regional-haul fleets that continue to value robustness and mechanical simplicity over maximal automation. DOE’s petroleum product consumption data show that total U.S. “product supplied” for petroleum fuels reached about ~ million barrels per day, with distillate fuels for heavy-duty trucks alone accounting for ~ million barrels per day at a recent monthly peak—evidence of intense freight and construction activity placing heavy loads on drivetrains. FHWA travel trends, meanwhile, attribute a substantial share of the ~ billion vehicle-miles of annual travel to commercial and combination trucks, which DOE notes can average more than ~ miles of operation per year for combination units. In these duty cycles, vocational fleets in construction, agriculture, oilfield service and municipal operations still specify non-synchronized or semi-automatic manual transmissions because of their proven durability, lower electronic content and easier field repair compared with fully integrated automatic or electric drive units. As U.S. manufacturing value added remains above ~ trillion U.S. dollars and freight-intensive sectors expand, niche demand for rugged, rebuildable manual and AMT gearboxes with manual heritage—especially in Classes 6–8 and off-highway support fleets—offers a defensible and growing aftermarket for specialist transmission builders, component suppliers and remanufacturers.

Future Outlook

Over the next planning period, the USA Manual Transmissions Market is expected to shrink in mainstream light vehicles but remain resilient in heavy-duty, fleets and enthusiast niches, tracking a global manual-transmission growth rate of around 4–5% in value terms but with a slower U.S. trajectory because of rapid adoption of automatics and EVs. Manual take-rates in new passenger cars are likely to edge closer to statistical noise as OEMs drop low-volume trims; recent coverage of Nissan’s Versa highlights how low (<5%) manual demand can no longer justify tooling in entry-level sedans. At the same time, OEMs and Tier-1 suppliers are investing in hybridized and electronically-assisted manual concepts, including faux manual interfaces for EVs, as seen in recent patents and technology showcases from Ford and Honda that simulate clutch and shift feel via software.

Major Players

- Aisin Corporation

- ZF Friedrichshafen AG

- Magna International

- Eaton Corporation

- Tremec Corporation

- Allison Transmission

- Hyundai Transys

- BorgWarner Inc.

- Schaeffler Group

- Divgi TorqTransfer Systems

- Ricardo plc

- Getrag

- Meritor

- Dana Incorporated

Key Target Audience

- OEM Powertrain Strategy & Product Planning Teams

- Tier-1 Transmission and Driveline Suppliers

- Heavy-Duty Fleet Operators and Leasing Companies

- Aftermarket Distributors and Dealer Service Networks

- Performance & Motorsport Vehicle Builders and Tuners

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Industrial & Off-Highway Equipment OEMs

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the USA Manual Transmissions Market ecosystem, spanning OEMs, Tier-1 suppliers, HD fleets, performance segments and aftermarket channels. Extensive desk research draws on transmission-focused market reports identify pivotal variables such as vehicle parc by transmission type, manual penetration by segment, duty-cycle patterns, torque bands, and regulatory constraints.

Step 2: Market Analysis and Construction

We next compile and analyze historical and current data for both the global manual transmission market and the U.S. automotive transmission market, MRFR and transmission-system studies. This includes assessing manual vs automatic share across vehicle types, OEM vs aftermarket revenue splits, and HCV vs LCV usage. A bottom-up model aggregates revenues from OEM fitment volumes and aftermarket replacement cycles, cross-checked against top-down benchmarks from global and U.S. transmission market sizes.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on manual-transmission decline in passenger cars, resilience in heavy-duty and performance niches, and the pace of AMT substitution are validated through interviews with OEM powertrain managers, Tier-1 transmission engineers, fleet maintenance heads and aftermarket distributors. Computer-assisted interviews gather insights on real-world shift patterns, driver preference, TCO comparisons between manual and AMT, and the impact of evolving emissions and safety regulations. These perspectives help refine assumptions on penetration rates, product mix and life-cycle replacement intervals.

Step 4: Research Synthesis and Final Output

In the final phase, quantitative models and qualitative insights are synthesized into a coherent view of the USA Manual Transmissions Market. Additional discussions with manual-focused suppliers (e.g., Tremec, Eaton HD) and performance tuners help validate niche-segment demand for high-torque and enthusiast-oriented gearboxes. The resulting estimates for market size, segment shares and forward CAGR are cross-reconciled against global manual-transmission growth (4.3% CAGR) and U.S. automotive transmission benchmarks, ensuring that the final output reflects both top-down industry structure and bottom-up usage realities across vehicle types and channels.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Transmission Architecture Scope, Multi-Source Market Sizing Approach, Primary Interviews with OEM/Tier-1 Powertrain Engineers, Calibration Experts & Aftermarket Rebuilders, Data Triangulation Model, Bottom-Up Vehicle-Model-Level Validation, Top-Down Fitment Ratio Checks, Forecasting Logic Based on Powertrain Mix Shifts, Limitations & Sensitivity Scenarios)

- Definition and Scope

- Evolution and Technology Genesis

- OEM Adoption Timeline and Platform Shifts

- Business Cycle: From Forging–Machining–Heat Treatment–Assembly–Calibration

- Supply Chain & Value Chain Structure

- Growth Drivers

MT Enthusiast Demand Base

Cost-Effective Powertrain Architecture, Weight Efficiency, Direct Drive Efficiency) - Market Challenges

Declining OEM MT Options

Automated Transmissions Adoption

Skilled Technician Shortage - Opportunities

Performance Car Revival

Fleet Demand for Low-Complexity Transmissions

Rebuild-Heavy Aftermarket Base - Trends

Lightweight Gear Materials

Carbon-Fiber Synchronizers

Rev-Matching Integration

Short-Throw Shifter Adoption - Government Regulations

- SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Unit Shipments & Installed Base, 2019-2024

- By Average Powertrain Mix Contribution, 2019-2024

- By Vehicle Type (In Value %)

Passenger Cars

Light Trucks / Pickups

SUVs / Crossovers

HD Trucks

Off-Highway & Performance Enthusiast Platforms

- By Transmission Architecture (In Value %)

5-Speed Manual

6-Speed Manual

7-Speed Manual

Close-Ratio Manual

Heavy-Duty Multi-Speed Manuals - By Engine Compatibility (In Value %)

Naturally Aspirated Gasoline Engines

Turbocharged Gasoline Engines

Small-Block Diesel Engines

High-Performance Engines

Fleet-Use Engines - By End-User Channel (In Value %)

OEM Assembly Line

Authorized Dealerships

Independent Aftermarket Installers

Transmission Rebuilders

Fleet & Government Procurement - By Region (In Value %)

West

Midwest

South

Northeast

Mountain States

- Market Share of Major Players

Share by Transmission Architecture - Cross Comparison Parameters (Torque Handling Capability, Synchronizer Technology, Shift-Feel & NVH Calibration Benchmarks, Gear Ratio Spread and Performance Mapping, Transmission Mass & Lightweighting Technologies, OEM Platform Coverage, Rebuildability Index & Parts Availability, Warranty & Durability Cycles)

- SWOT Analysis for Major Players

- Pricing Analysis

- Profiles of Major Companies

Aisin

Magna Powertrain

Tremec

ZF Friedrichshafen

Getrag

BorgWarner

Eaton

Honda Powertrain Division

Toyota Motor Corporation Transmissions

GM Powertrain

Ford Performance Powertrain

Subaru Heavy Industries

Chrysler/Stellantis Powertrain

Muncie Rebuilding Network

- OEM Powertrain Strategy Alignment

- Consumer Preferences

- Fleet Requirements

- Pain Points

- Decision-Making Criteria

- By Value, 2025-2030

- By Volume, 2025-2030

- By Unit Shipments & Installed Base, 2025-2030

- By Average Powertrain Mix Contribution, 2025-2030