Market Overview

The USA Mobile Health Solutions Market was valued at USD ~ million in the prior year and expanded to USD ~ billion in the latest year, reflecting rapid normalization of mobile-first care delivery and self-management at scale. Growth is being pulled by payer coverage expansion for virtual care and monitoring use-cases, provider “digital front door” deployments, and consumer adoption of app-led chronic care and mental health pathways. Additionally, interoperability mandates and API-led data access are improving integration feasibility, supporting enterprise rollouts across health systems and insurers.

Market demand is concentrated in large healthcare and digital-innovation corridors such as California (Bay Area/Los Angeles), New York metro, Boston/Cambridge, Seattle, Chicago, and Texas hubs (Austin/Dallas/Houston). These regions dominate because they combine dense provider networks, leading payer headquarters and employer bases, and deep venture funding ecosystems that accelerate product commercialization and health-system pilots. They also host major EHR and digital health talent pools, enabling faster clinical integration, governance, and scaling of hybrid care workflows across multi-site delivery systems.

Market Segmentation

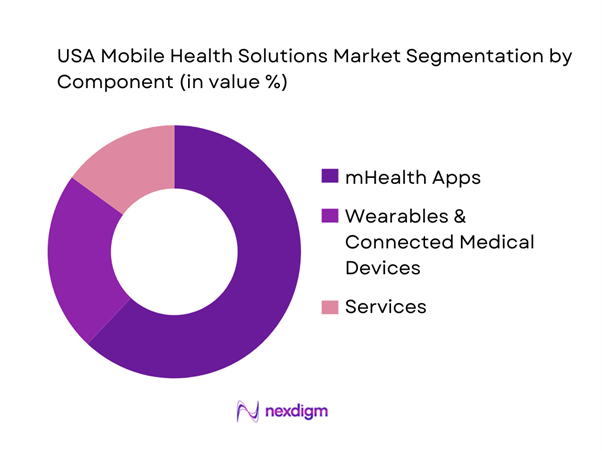

By Component

The USA Mobile Health Solutions Market is segmented by component into mHealth apps, wearables & connected medical devices, and services (care delivery services, implementation, integration, analytics, and program management). Recently, mHealth apps continue to dominate because they scale across both clinical and consumer channels with lower deployment friction than device-heavy programs. Enterprise buyers favor app-led solutions that connect into existing care pathways—virtual visits, triage, care navigation, medication management, chronic disease programs—while consumers adopt app ecosystems that bundle coaching, symptom tracking, and “next-best-action” nudges. App dominance is reinforced by the shift to hybrid care models where engagement, adherence, and outcome reporting happen through mobile interfaces. In the U.S., app ecosystems also benefit from API-driven interoperability readiness and payer/provider digitization that supports member outreach, onboarding, and longitudinal monitoring.

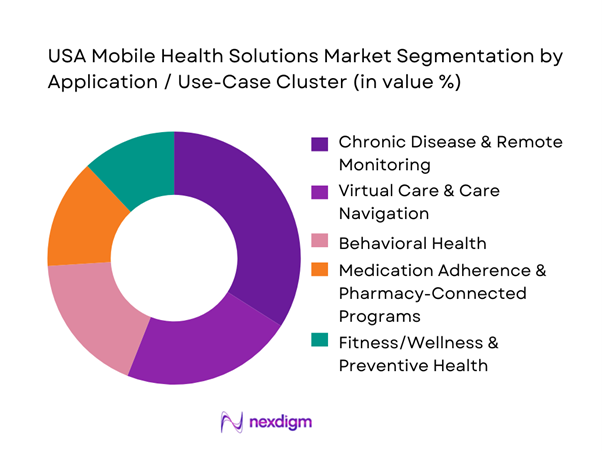

By Application / Use-Case Cluster

The market is segmented by application into chronic disease & remote monitoring, virtual care & care navigation, behavioral health, medication adherence & pharmacy-connected programs, and fitness/wellness & preventive health. Recently, chronic disease & remote monitoring dominates because it ties most directly to measurable clinical outcomes and payer ROI narratives—reduced avoidable utilization, improved adherence, and better risk management in cardiometabolic conditions. U.S. payers and health systems increasingly prioritize programs that can be operationalized in care teams, integrated with claims/EHR workflows, and monitored with clear escalation logic (alerts, thresholds, care manager outreach). This segment also benefits from device/app bundles (CGM, BP cuffs, pulse oximetry, sleep/respiratory monitoring) where engagement loops are mobile-first and outcomes reporting is programmatic. As reimbursement and coverage pathways mature for monitoring-driven care models, chronic programs gain budget priority over “nice-to-have” wellness tools.

Competitive Landscape

The USA Mobile Health Solutions Market is shaped by a mix of virtual-care platforms, chronic-condition program specialists, device-led ecosystems, and enterprise health IT incumbents. Competition is consolidating around players that can combine clinical credibility, scalable engagement, and enterprise integration—especially with payer/provider buyers seeking fewer vendors with broader capabilities and stronger interoperability readiness.

| Company | Establishment Year | Headquarters | Primary mHealth Focus | Core Buyer Type | Integration Depth (EHR/FHIR/API) | Evidence & Clinical Rigor Posture | Monetization Model | Differentiation Lever |

| Teladoc Health | 2002 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Amwell | 2006 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Omada Health | 2011 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Dexcom | 1999 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Epic Systems | 1979 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

USA Mobile Health Solutions Market Dynamics and Strategic Analysis

Growth Drivers

Virtual care normalization

The U.S. has moved from “telehealth as an exception” to telehealth as an embedded capacity layer, because the underlying economics and access constraints are structural. In an economy producing USD ~ billion in gross domestic product and USD ~ billion in personal consumption expenditures, healthcare systems have incentives to shift eligible encounters to lower-friction digital pathways while preserving clinician time for higher-acuity work. Medicare Fee-for-Service data shows telehealth has stabilized at scale: ~ unique telehealth users were recorded in the full-year summary, and ~ users in one quarter plus ~ users in the next quarter (claims-based), demonstrating that virtual care remains a repeatable delivery channel even after peak-pandemic utilization. This normalization matters for mobile health because the smartphone becomes the default “front door” for triage, scheduling, follow-ups, care navigation, and patient education—especially in metros where population growth is concentrated (and where provider capacity is most strained).

RPM scaling

Remote patient monitoring scales when three conditions align: high chronic burden, reimbursement clarity, and an operational workforce that can manage alerts and escalation. The U.S. demographic base that makes RPM “inevitable” is expanding: the population reached ~ million, and the age ~+ cohort rose to ~ million (a key RPM-eligible pool given cardiometabolic and respiratory disease prevalence). On the funding side, U.S. health spending reached USD ~ trillion and Medicare spending reached USD ~ billion (program-scale dollars that support recurring monitoring workflows across chronic cohorts). CMS has also formalized “telehealth + remote patient monitoring” as a packaged operating model through dedicated Medicare guidance, which reduces implementation ambiguity for providers and digital health operators building mobile-first RPM programs (device onboarding, adherence, escalation protocols, documentation). In a labor market with ~ million employed people and USD ~ trillion in wages, RPM is also a productivity play: it shifts some monitoring load from episodic visits to asynchronous review and protocolized outreach (where clinically appropriate), enabling capacity release without adding clinic rooms.

Challenges

Regulatory complexity

U.S. mobile health operates in a layered regulatory environment: federal reimbursement rules, privacy and security obligations, and state-level practice constraints all interact. A simple structural indicator is governance fragmentation—~ states plus multiple federal programs—creating non-uniform requirements for clinical workflows, clinician coverage models, and telehealth-eligible service definitions. CMS maintains a formal “List of Telehealth Services” payable under Medicare’s Physician Fee Schedule (updated on a recurring cycle), which means mobile health vendors and provider groups must continuously map product capabilities to billable pathways and documentation rules, while also tracking parallel changes through annual Physician Fee Schedule rulemaking. On top of that, CMS telehealth utilization datasets (claims-based) carry explicit disclaimers about claims lag and program differences between Fee-for-Service and Medicare Advantage, which complicates performance benchmarking and compliance reporting across lines of business. In a USD ~ billion economy with healthcare spend at USD ~ trillion, the regulatory cost of “getting it wrong” is high (denials, clawbacks, enforcement risk), pushing vendors toward heavier legal/compliance design, slower rollouts, and more conservative feature sets—especially for clinical decision support or algorithmic triage.

Data privacy friction

Privacy friction is intensifying because mobile health sits between HIPAA-regulated care delivery and consumer apps that may fall outside HIPAA but still handle sensitive health data. The FTC finalized updates clarifying that health apps, connected devices, and similar products must comply with the Health Breach Notification Rule, expanding expectations for breach notification scope and content. Separately, HHS OCR’s breach portal continuously lists reportable breaches under investigation, reinforcing that enforcement and disclosure are operational realities, not theoretical risks. The market impact is practical: privacy compliance now shapes product architecture (data minimization, encryption at rest and in transit, audit logging), vendor selection (BAAs, subcontractor risk), and go-to-market speed (security reviews by health systems and payers). Macroeconomic scale makes the stakes larger: with USD ~ trillion in wages and ~ million employed, employers and payers are increasingly sensitive to reputational risk and identity fraud tied to health data, and that pushes mobile health contracts toward stricter security controls, shorter breach-notification SLAs, and more restrictive data-sharing clauses—raising integration cost and reducing the “move fast” mentality common in consumer tech.

Opportunities

Outcomes-based contracting

Outcomes-based contracting becomes more feasible as the U.S. system digitizes administrative and clinical data, enabling measurement beyond encounter counts. The near-term opportunity is powered by current-scale payer operations: Medicare Advantage prior authorization volume alone reached ~ million determinations (with ~ million unfavorable determinations), demonstrating both the operational intensity of utilization management and the value of solutions that reduce avoidable utilization while improving appropriateness. Meanwhile, the financing backdrop—USD ~ billion in Medicare spending and USD ~ billion in private health insurance spending—creates budget headroom for contracts tied to measurable outcomes (reduced readmissions, controlled BP readings with documented follow-up, reduced avoidable ED utilization), provided measurement is credible. The opportunity for mobile health vendors is to position programs as “performance infrastructure”: longitudinal engagement + RPM + navigation, coupled with data capture that payers accept for adjudication. In a USD ~ billion economy, stakeholders want productivity and cost-control mechanisms that scale; outcomes-based models align incentives for sustained engagement and integration (because payment depends on impact, not downloads).

Pharmacy–clinical convergence

The convergence of pharmacy and clinical workflows is a high-leverage opportunity for mobile health because medication access, adherence, and chronic condition coaching sit at the intersection of consumer convenience and clinical outcomes. The spending base is already massive: out-of-pocket spending reached USD ~ billion, and Medicare spending reached USD ~ billion, both of which are heavily influenced by medication use and chronic disease management pathways. As mobile health apps increasingly embed refill management, medication reminders, pharmacist consult scheduling, and escalation to clinicians, they can reduce care fragmentation—especially in metros where ~ million people live and where retail access plus provider density makes hybrid models workable. Digitally, the path is supported by broad consumer app familiarity in an economy with USD ~ billion in personal consumption expenditures, enabling “health journeys” that behave like mainstream consumer services while still meeting clinical governance needs. The near-term growth vector is not “more prescriptions” as a future claim; it is the current reality that payers, providers, and pharmacies have the scale and financial incentive to operationalize app-based coordination, particularly for cardiometabolic and behavioral health pathways where adherence and follow-up drive downstream utilization.

Future Outlook

Over the next ~ years, the USA Mobile Health Solutions Market is expected to grow strongly, led by hybrid care standardization across health systems and increasing payer emphasis on measurable outcomes. Mobile-first engagement and continuous monitoring will expand beyond single-condition tools into multi-condition platforms. AI-enabled triage, personalization, and care navigation will reduce operational burden on care teams while improving adherence. Interoperability maturity and API-based data exchange will further accelerate enterprise procurement and integration-led scaling.

Major Players

- Teladoc Health

- Amwell

- Doximity

- Omada Health

- Hims & Hers Health

- Noom

- CVS Health

- UnitedHealth Group / Optum

- Amazon

- Epic Systems

- Oracle Health

- Philips

- Dexcom

- ResMed

Key Target Audience

- Health System Leadership

- Payers and Medicare Advantage Plan Leaders

- Medicaid Managed Care Organizations

- Self-Insured Employers

- Pharmacy & PBM Stakeholders

- Connected Device & Wearables OEMs

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

We begin by mapping the U.S. mHealth ecosystem across providers, payers, employers, pharmacies/PBMs, device OEMs, and platform vendors. Secondary research is complemented with structured extraction of variables influencing demand—coverage pathways, integration requirements, clinical evidence posture, and operating model constraints. This step establishes the segmentation logic and the adoption drivers that are unique to U.S. buyer behavior.

Step 2: Market Analysis and Construction

We compile historical indicators and triangulate revenues by component and use-case cluster using a hybrid top-down and bottom-up approach. Bottom-up modeling uses vendor portfolios, deployment footprints, and monetization models (PMPM, per-visit, device-led ecosystems). Top-down validation checks are applied against broader digital health and care-delivery digitization signals to ensure coherence.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through expert consultations (CATI-style) with provider digital leaders, payer care management teams, employer benefits heads, and senior executives from mHealth vendors. These interviews refine assumptions on engagement decay, integration timelines, reimbursement enablement, and procurement criteria. Findings are reconciled across stakeholders to remove single-bias viewpoints.

Step 4: Research Synthesis and Final Output

We consolidate insights into a unified model, stress-testing segment mixes and competitive positioning through multiple triangulation loops. Outputs include market sizing, segmentation shares, competitive benchmarking, and future outlook narratives aligned to U.S. regulatory and reimbursement realities. Final deliverables are quality-checked for internal consistency and buyer relevance.

- Executive Summary

- Research Methodology (Market definition & inclusion/exclusion, taxonomy for mHealth vs telehealth vs RPM vs DTx, assumptions & abbreviations, bottom-up revenue build by solution archetype, top-down triangulation via healthcare spend/digital adoption indicators, primary interviews mix—providers/payers/employers/digital health vendors, validation through reimbursement & coding logic, limitations and sensitivity checks)

- Definition and Scope

- Market Genesis and Inflection Points

- Stakeholder Map and Decision Rights

- End-to-End Value Chain

- Business Cycle and Buying Motions

- Growth Drivers

Virtual care normalization

RPM scaling

Payer digitization

Employer health spend optimization

Device ecosystem penetration - Challenges

Regulatory complexity

Data privacy friction

Clinical evidence burden

Engagement decay

Integration debt - Opportunities

Outcomes-based contracting

Pharmacy-clinical convergence

Hospital-at-home enablement

AI-enabled care navigation

Specialty care virtualization - Trends

Hybrid care pathways

Multimodal sensing

Ambient/continuous monitoring

Patient “digital front door”

Clean-room analytics partnerships - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- Installed Base, 2019–2024

- Service Revenue Mix, 2019–2024

- Average Realized Revenue Metrics, 2019–2024

- By Fleet Type (in Value %)

Telehealth/virtual visits

Remote Patient Monitoring

Digital Therapeutics

Chronic care management apps

Medication adherence & pharmacy-connected apps - By Application (in Value %)

Behavioral health

Diabetes/CGM-enabled programs

Hypertension/cardiac

Respiratory/sleep

Women’s health - By End-Use Industry (in Value %)

Health systems & physician groups

Payers/MA & managed Medicaid

Self-insured employers

Pharmacies/PBM ecosystems

Consumers/D2C - By Region (in Value %)

Home-based care

Ambulatory/outpatient

Post-acute

Hospital-at-home enablement

Employer/occupational health - By Connectivity Type (in Value %)

Provider-prescribed

Payer-covered benefit

Employer benefit

App-store/D2C

Pharmacy-led programs - By Technology Architecture (in Value %)

iOS/Android native

Wearables integration

Connected medical devices

AI triage/chat

EHR-embedded modules

- Competitive Positioning Map

- Cross Comparison Parameters (FDA/SaMD & claims posture, HIPAA vs FTC-HBNR compliance stance, EHR integration depth, FHIR/US Core + TEFCA readiness, reimbursement enablement, clinical evidence & outcomes transparency, security assurance stack, engagement performance)

- Recent Developments Tracker

- Pricing & Contracting Models

- SWOT of Major Players

- Detailed Profiles of Major Companies

Teladoc Health

Amwell

Doximity

Omada Health

Hims & Hers Health

Noom

CVS Health

UnitedHealth Group / Optum

Amazon

Epic Systems

Oracle Health

Philips

Dexcom

ResMed

- Provider Segment

- Payer Segment

- Employer Segment

- Consumer Segment

- By Value, 2025–2030

- Installed Base, 2025–2030

- Service Revenue Mix, 2025–2030

- Average Realized Revenue Metrics, 2025–2030