Market Overview

The USA Moisturizing Dermatology Creams Market is anchored in the broader U.S. moisturizer category, which recent industry analysis values at about USD ~ billion, with the next measurement cycle implied at roughly USD ~ billion based on an expected compound annual increase of about 5.0. This growth is driven by high skincare engagement, ageing demographics and chronic dryness/eczema prevalence, together with robust spending on skincare within a U.S. skin care products market estimated around USD ~ billion and steadily expanding.

Within the USA Moisturizing Dermatology Creams Market, demand concentrates in high-income, urbanized states such as New York, California, Texas and Florida. New York leads national online interest in skincare, including moisturizers, with more than 440 skincare searches per 100,000 residents, signalling intense category engagement. California, Texas and New York together host well over 500 Sephora and more than 370 Ulta Beauty stores, creating dense access to dermocosmetic cream brands through prestige and mass retail networks that cluster around major metropolitan and dermatologist-rich areas.

Market Segmentation

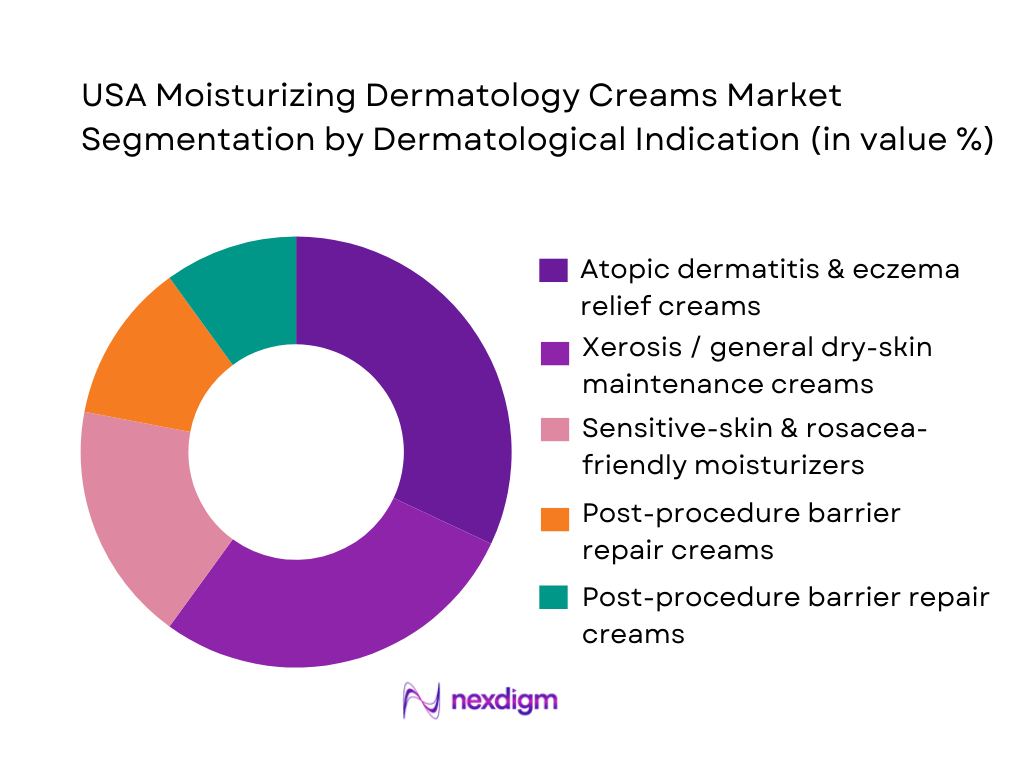

By Dermatological Indication

The USA Moisturizing Dermatology Creams Market is segmented into atopic dermatitis & eczema relief, xerosis/general dryness, sensitive-skin & rosacea-friendly creams, post-procedure barrier repair, and acne-treatment–induced dryness support. Atopic dermatitis & eczema-focused creams currently dominate due to the sizeable clinical burden of eczema and related inflammatory dermatoses, which affect tens of millions of Americans and generate recurring prescription and OTC moisturizing needs. High dermatologist reliance on ceramide-rich, colloidal-oatmeal or petrolatum-based barrier creams, strong endorsements from organizations such as the National Eczema Association, and frequent long-term use across pediatric and adult populations collectively keep this indication at the center of prescription-adjacent moisturizing spend.

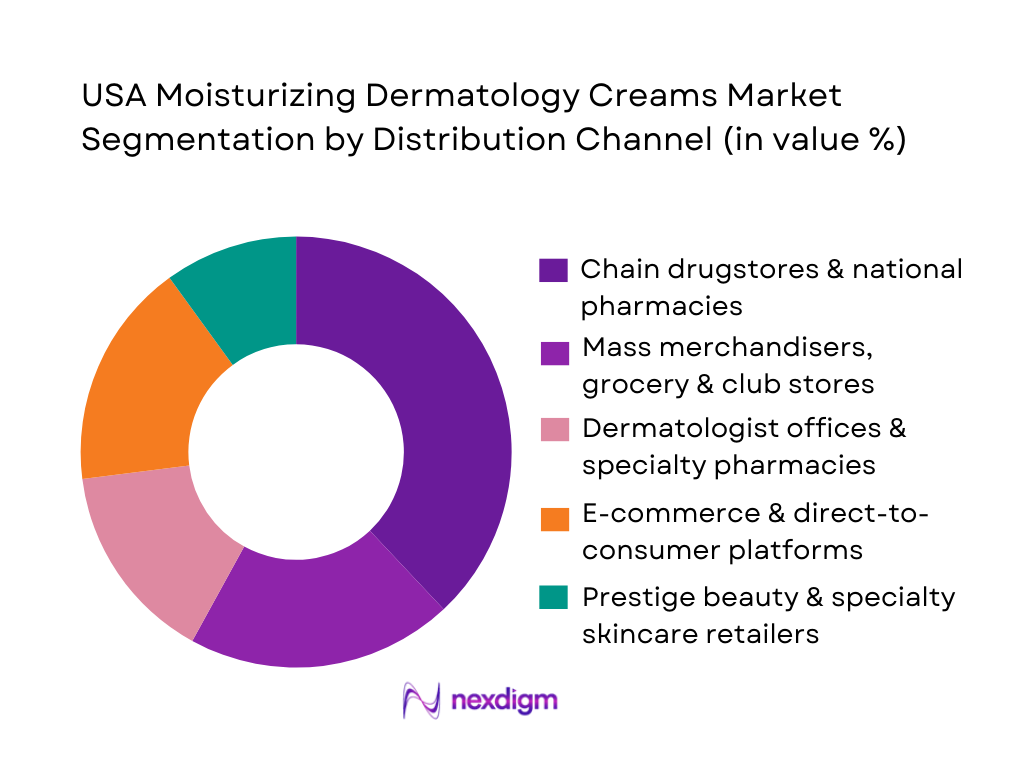

By Distribution Channel

The USA Moisturizing Dermatology Creams Market is segmented into chain drugstores & national pharmacies, mass merchandisers/grocery/club, dermatologist offices & specialty pharmacies, e-commerce & DTC, and prestige beauty & specialty skincare retailers. Chain drugstores and national pharmacy chains dominate because they sit at the intersection of medical credibility and OTC accessibility—housing both prescription-adjacent dermocosmetic brands and reimbursable therapies in the same ecosystem. Large players such as CVS, Walgreens and Rite Aid leverage thousands of locations, integrated pharmacy–front-of-store layouts, and frequent dermatologist recommendations to concentrate footfall for ceramide, colloidal-oat, urea and petrolatum-based creams. Their strong insurance, loyalty-program and clinical-services linkages further reinforce their central role in medicated moisturizing cream purchase journeys versus other retail formats.

Competitive Landscape

The USA Moisturizing Dermatology Creams Market is shaped by a concentrated cluster of dermocosmetic and consumer-health brands with strong dermatologist endorsement and multi-channel distribution. Power brands such as CeraVe (L’Oréal), Cetaphil (Galderma), Eucerin & Aquaphor (Beiersdorf), Vanicream (Pharmaceutical Specialties Inc.), La Roche-Posay (L’Oréal) and Neutrogena (Kenvue/J&J heritage) command significant shelf space in drugstores, mass retail and e-commerce. Many emphasize fragrance-free, non-comedogenic, barrier-repair science with ceramides, glycerin and colloidal oatmeal, supported by clinical studies and seals from eczema and psoriasis foundations. Intensifying competition comes from prestige and indie clinical brands, but dermatologist-recommended, accessibly priced “white-cream” lines continue to anchor repeat volumes.

| Company / Brand | Establishment Year | Headquarters (Global) | Core Moisturizing Focus in USA | Hero Moisturizing Range (USA) | Primary Dermatological Focus | Key Channel Strength in USA | Ownership / Group | Distinctive Claims / Edge |

| CeraVe | 2005 | New York / Clichy | ~ | ~ | ~ | ~ | ~ | ~ |

| Cetaphil | 1947 | Fort Worth / Lausanne | ~ | ~ | ~ | ~ | ~ | ~ |

| Eucerin (incl. Aquaphor/Urea ranges) | ~1900 origins | Hamburg, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Vanicream | 1974–1975 | Rochester, Minnesota, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| La Roche-Posay | 1975 | La Roche-Posay / Levallois-Perret, France | ~ | ~ | ~ | ~ | ~ | ~ |

USA Moisturizing Dermatology Creams Market Analysis

Growth Drivers

Dermatology Visit Volumes

Dermatology-oriented moisturizer demand is anchored in very high U.S. healthcare utilization. The United States has a population of about 340,110,988 people and a GDP of USD ~ trillion, supporting dense specialist networks. Recent national survey data show 95.1 out of every 100 children had contact with a doctor or health professional in the past year, while community health centers recorded 89.5 million adult visits in a single recent year, many for chronic skin and dryness complaints. Combined with health spending of USD 13,432 per person, this high visit volume keeps moisturizers central to everyday dermatologic prescribing and recommendation patterns.

OTC Skin-Health Adoption

OTC moisturizing creams are pulled by strong consumer spending power and self-care habits. U.S. GDP per capita stands near USD ~, and current health expenditure per capita is about USD ~, giving households capacity to buy premium dermocosmetics outside prescription channels. World Bank data show out-of-pocket health spending still forms a significant share of total health expenditure, reinforcing direct retail purchase behavior. At the channel level, Bureau of Labor Statistics output indices for “cosmetics, beauty supplies and perfume stores” show real sectoral output still expanding, with positive growth rates in 2022, 2023 and 2024, indicating resilient demand for skincare aisles where moisturizing dermatology creams are primary basket drivers.

Market Challenges

Regulatory Labeling Tightening

The U.S. Moisturizing Dermatology Creams market faces tighter oversight under the Modernization of Cosmetics Regulation Act (MoCRA), the most significant federal reform of cosmetics law in about 80–85 years. MoCRA expands FDA authority to mandate facility registration, product listing, adverse-event reporting and safety substantiation for cosmetics, including leave-on moisturizers used on compromised skin. At the same time, updated FDA Cosmetics Labeling Guides require clearer disclosure of allergens, color additives and warning statements, raising compliance complexity for products sold across a population above 340 million. Brands marketing dermatology-positioned moisturizers must now maintain robust toxicology files and labeling controls, stretching regulatory and quality budgets.

Increased Scrutiny on Claims

Claims such as “clinically proven barrier repair,” “eczema-friendly,” or “microbiome safe” are under sharper examination as the FDA polices the boundary between cosmetics and unapproved drugs. Congressional and FDA briefings note that drug safety communications are issued for more than one-quarter of new drug and biologic approvals, underscoring how closely benefit–risk messaging is monitored in health-related products. Within this environment, moisturizers that imply treatment of disease (e.g., atopic dermatitis, psoriasis) risk reclassification as drugs. Recent FDA communications emphasize that many products make structure–function or disease claims without NDAs, forcing dermatology-oriented skincare brands to invest heavily in claim substantiation, legal review and post-marketing surveillance, especially in a USD 85,809.9 GDP-per-capita economy where litigation and class actions can be costly.

Opportunities

Barrier Science Innovations

Advances in skin-barrier biology create a strong innovation runway for U.S. moisturizing dermatology creams. With around 31.6 million Americans living with eczema and atopic dermatitis affecting 9.6 million children and 16.5 million adults, demand for clinically validated barrier-repair formulations is systemic rather than niche. At the macro level, health spending per person above USD ~ and GDP per capita near USD ~ support physician-driven adoption of higher-priced, ceramide-rich creams that can reduce flare frequency and steroid use. Barrier-focused research pipelines—from filaggrin biology to tight-junction modulation—allow brands to pair moisturizers with companion diagnostics or digital monitoring, positioning them as quasi-therapeutic tools in chronic-care pathways rather than simple cosmetics.

Microbiome-Friendly Moisturizers

Growing understanding of the skin microbiome opens a differentiated premium tier for “microbiome-supporting” moisturizers. Scientific reports highlight that atopic dermatitis and other dermatoses involve dysbiosis rather than just barrier damage, and global dermatology trials increasingly incorporate microbiome endpoints and sequencing. In a market where U.S. GDP accounts for over a quarter of global nominal output and health expenditure surpasses USD ~ trillion, there is headroom to invest in probiotic, postbiotic and microbiome-friendly emulsifier systems that avoid microbiota-disruptive preservatives. These products can be targeted to the millions of patients with eczema and allergic skin disease, as well as wellness-oriented consumers seeking science-backed sensitive-skin routines, giving manufacturers a compelling innovation lane within a crowded moisturizer category.

Future Outlook

Over the next six years, the USA Moisturizing Dermatology Creams Market is expected to expand steadily, underpinned by rising health-care expenditure, which reached about USD ~ trillion and USD 14,570 per capita in the U.S., sustaining demand for chronic skin-condition care. Continued growth in dermatologist density in urban centers, expansion of med-spas and derm clinics, and high consumer willingness to trade up to “clinical” moisturizers support robust value growth within derm-grade creams. At the same time, regulatory tightening under modernized U.S. cosmetics law and heightened recall scrutiny will reward brands with strong quality systems and transparent ingredient science.

Major Players

- Aquaphor

- Aveeno

- Avène

- CeraVe

- Cetaphil

- Eucerin

- First Aid Beauty

- La Roche-Posay

- Neutrogena

- Olay

- Paula’s Choice

- SkinCeuticals

- Vanicream

- Vichy

- Differin / Galderma moisturizer lines

Key Target Audience

- Global and domestic skincare & dermocosmetic manufacturers

- Pharmaceutical and OTC dermatology companies

- Dermatology clinic chains, hospital systems and medical spa operators

- Pharmacy, drugstore and grocery retail chains

- E-commerce marketplaces and DTC beauty platforms

- Raw material and active-ingredient suppliers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the full ecosystem of the USA Moisturizing Dermatology Creams Market, including dermocosmetic brands, OTC drug manufacturers, dermatologists, pharmacies, e-commerce platforms and ingredient suppliers. Using extensive desk research and syndicated databases on the U.S. moisturizer and skincare markets, we identify critical variables such as indication mix (eczema, xerosis, sensitive skin), channel weights, pricing tiers, regulatory status and dermatologist endorsement intensity.

Step 2: Market Analysis and Construction

In this phase, we consolidate historical and forecast data on the U.S. moisturizer and facial moisturizer categories, including revenue, product mix and channel splits, to construct a specialized view of the USA Moisturizing Dermatology Creams Market. We benchmark dermatologist-recommended brands, estimate indication-level demand using eczema and dry-skin prevalence and assess revenue concentration across drugstores, mass retail, e-commerce and clinic channels. This yields a robust top-down and bottom-up triangulation of market size, growth and segment weights.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on indication dominance, channel momentum, brand tiers and pricing power are validated through structured interviews with dermatologists, retail category buyers, brand managers and medical-spa operators. These consultations provide operational and financial insights on prescription-adjacent moisturizer uptake, patient adherence to barrier-repair regimens and the shift toward clinical-beauty brands. Primary findings are cross-checked against external benchmarks such as prestige and mass beauty sales data and derm distribution studies to reduce bias.

Step 4: Research Synthesis and Final Output

In the final phase, we integrate quantitative outputs with qualitative insights from leading brands’ financial commentary, product pipelines, recall events and regulatory developments, including recent FDA actions on moisturizers and updated cosmetic regulations. The result is a validated, segment-level forecast of the USA Moisturizing Dermatology Creams Market through 2030, covering indication-wise revenue, channel evolution, competitive dynamics and strategic white-space opportunities for innovators and investors.

- Executive Summary

- Research Methodology (Market Definitions & Scope Parameters, Regulatory Classifications for Dermatology Creams, Ingredient Inclusion Criteria, Clinical Efficacy Standards, Market Sizing Logic for Rx/OTC/DTC, Forecasting Assumptions, Consolidated Research Framework, Primary Dermatologist Interviews, Secondary Validation, Data Triangulation Approach, Limitations & Forward-Looking Adjustments)

- Definition & Scope of Moisturizing Dermatology Creams

- Market Genesis & Evolution of Dermatology Moisturizers

- Clinical & Non-Clinical Use Cases

- Product Lifecycle & Formulation Innovation Cycle

- Supply Chain & Value Chain Architecture (Dermatology-Focused)

- Growth Drivers

Dermatology Visit Volumes

OTC Skin-Health Adoption

Chronic Skin Conditions Prevalence

Sensitivity & Allergic Reaction Trends

Ingredient Validation Growth - Market Challenges

Regulatory Labeling Tightening

Increased Scrutiny on Claims

Ingredient Safety Debates

High R&D Testing Burden

Competitive Saturation) - Opportunities

Barrier Science Innovations

Microbiome-Friendly Moisturizers

Prescription-to-OTC Switches

Skinimalism & Dermocosmetic Growth

AI-Based Dermatology Diagnostics - Trends

Active Barrier Repair

Hypoallergenic Reformulations

Peptide Base Penetration

Non-Steroidal Soothing Systems

Subscription DTC Models - Government & Regulatory Framework

- SWOT Analysis

- Dermatology Stakeholder Ecosystem Mapping

- Porter’s Five Forces

- Competition Ecosystem Mapping

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average SKU Range, 2019-2024

- By Ingredient System (in Value %)

Barrier Repair Ceramides

Hyaluronic Acid Systems

Occlusives

Humectant-Dominant Formulations

Niacinamide-Infused Creams - By Dermatological Indication (in Value %)

Eczema/Atopic Dermatitis

Psoriasis-Linked Dryness

Xerosis/Senile Dry Skin

Post-Procedure Creams

Acne-Treatment Induced Dryness - By Skin Barrier Need-State (in Value %)

Barrier-Repair

Deep Moisturization

Lightweight Hydration

Sensitive-Skin Safe

Non-Comedogenic - By Distribution Channel (in Value %)

Dermatologist Clinics

Drugstores/Pharmacies

Mass Retail

Online Marketplaces

DTC Dermatology Brands - By Consumer Cohort (in Value %)

Pediatric

Adult

Geriatric

Ethnic Skin Needs

Dermatology Patients vs. Mass Consumers

- Market Share of Major Players (By Revenue & Unit Volume)

- Market Share by Ingredient System

- Cross Comparison Parameters (Dermatology Heritage, Ingredient R&D Pipelines, Clinical Trial Backing, Number of Dermatologist Touchpoints, Prescription vs OTC Penetration, Distribution Channel Strength, Skin-Type Portfolio Depth, Allergen-Free/Fragrance-Free Portfolio Strength)

- SWOT Analysis of Major Competitors

- Pricing Architecture Analysis (By Key SKUs Across Channels)

- Detailed Profiles

CeraVe

Cetaphil

Eucerin

Vanicream

Aveeno

La Roche-Posay

Neutrogena

First Aid Beauty

Aquaphor

Skinfix

Paula’s Choice

Curel

Bioderma

Avene

The Ordinary (DECIEM)

- Dermatology Patient Profiling

- Purchasing Power & Affordability Architecture

- Physician Recommendation Influence Levels

- Consumer Need-State Mapping & Pain Points

- Treatment Pathway & Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average SKU Range, 2025-2030