Market Overview

The USA mufflers and silencers market is anchored in the wider exhaust value chain. The global automotive exhaust muffler market is valued at about USD ~ billion, reflecting strong replacement and performance-upgrade demand worldwide. In parallel, the United States automotive exhaust systems market generates around USD ~ billion in revenue, underscoring the scale of OEM fitment and aftermarket replacement that feeds dedicated muffler and silencer suppliers.

The USA mufflers and silencers market is dominated by states with dense vehicle fleets and assembly footprints. Recent data show roughly ~ million light vehicles sold annually and more than ~ million motor vehicles produced, placing the country second only to China in automotive output. Vehicle registrations exceed ~ million nationwide, with California, Texas and Florida alone accounting for over 68 million units, creating structurally high replacement and upgrade cycles for mufflers and silencers in these clusters.

Market Segmentation

By Vehicle Type

The USA mufflers and silencers market is segmented into passenger cars, SUVs and pickups, light commercial vehicles (LCVs), medium & heavy commercial vehicles (M&HCVs), off-highway (agricultural and construction) equipment, and performance/racing and specialty vehicles. Recently, SUVs and pickups have emerged as the dominant sub-segment. Their high share of US new light-vehicle sales and park—driven by consumer preference for larger vehicles and the popularity of light trucks for both personal and work use—means each platform carries larger, heavier exhaust hardware, higher sound attenuation needs, and higher replacement value per vehicle than compact passenger cars.

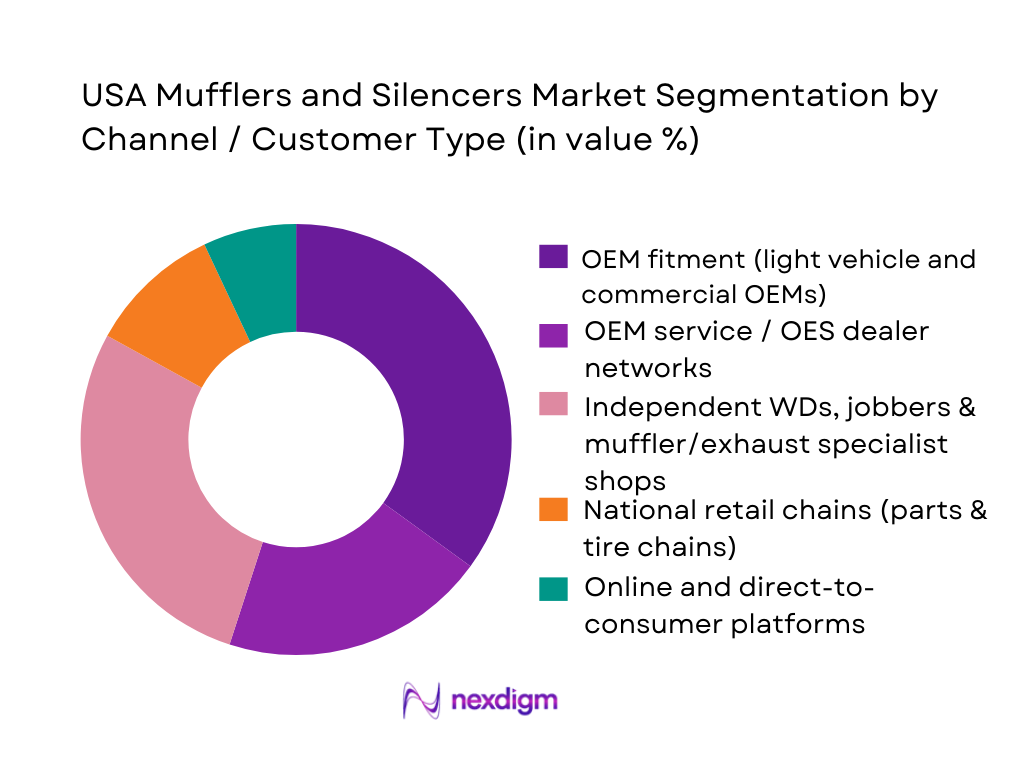

By Channel / Customer Type

The USA mufflers and silencers market is segmented into OEM fitment with light-vehicle and commercial OEMs, OEM service/OES dealer networks, independent aftermarket warehouse distributors and muffler shops, national retail chains, and online/direct-to-consumer channels. OEM fitment retains a dominant share because every internal-combustion vehicle produced requires at least one muffler or silencer assembly tied to emissions certification. High US production volumes for light trucks and medium-duty platforms ensure sustained OEM call-offs, while dealer networks and independent installers capture subsequent replacement cycles as vehicles age and corrosion, damage or acoustic upgrades trigger new demand.

Competitive Landscape

The USA mufflers and silencers market is moderately consolidated at the system level, with global Tier-1 exhaust suppliers such as Tenneco and Forvia (Faurecia) dominating OEM fitment, while a long tail of US-centric brands like AP Emissions, MagnaFlow, Borla and Flowmaster lead in the performance and replacement aftermarket. Heavy-duty and off-highway demand is shaped by specialists such as Donaldson and Cummins Emission Solutions, which integrate mufflers within broader aftertreatment modules, especially for diesel trucks and equipment.

| Company | Establishment Year | Headquarters | Primary Positioning (OEM / Aftermarket Mix) | US Manufacturing Footprint (Muffler Lines) | Key Vehicle Coverage Focus | Technology / Material Focus | Distribution Strengths in USA | Compliance & Performance Positioning |

| Tenneco (Walker, DynoMax) | 1940 | Northville, Michigan, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Forvia (Faurecia) | 1997 | Nanterre, France | ~ | ~ | ~ | ~ | ~ | ~ |

| Eberspächer / Purem | 1865 | Esslingen am Neckar, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| AP Emissions Technologies | 1927 | Goldsboro, North Carolina, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| MagnaFlow (Car Sound Exhaust Systems) | 1981 | Oceanside, California, USA | ~ | ~ | ~ | ~ | ~ | ~ |

USA Mufflers and Silencers Market Analysis

Growth Drivers

VIO expansion and aging vehicle parc

An expanding and aging vehicle parc in the United States structurally supports recurring demand for mufflers and silencers. S&P Global Mobility estimates more than ~ million light vehicles in operation on U.S. roads, with the average age reaching 12.5 years based on recent analysis. CEIC, using FHWA data, puts the broader U.S. motor-vehicle stock at around 284,614,269 registered vehicles, underscoring the scale of the aftermarket pool that will eventually require exhaust replacement as corrosion and fatigue accumulate. With U.S. population around ~ million, this equates to roughly 8 vehicles per 10 residents, keeping the installed base of mufflers and silencers extremely large and replacement-driven.

Average vehicle age and scrappage trends

The U.S. fleet is not only large but structurally old, which tilts maintenance cycles toward exhaust replacement. S&P Global Mobility notes the average age of cars and light trucks has risen to 12.5 years, and its subsequent update shows this creeping further to around 12.6 years, driven by constrained new-vehicle supply and higher interest rates. S&P also highlights that vehicles older than 12 years now account for roughly ~ million units, an all-time high in the fleet. In contrast, U.S. new light-vehicle sales remain in the ~ million range annually, which slows fleet renewal and keeps high-mileage, corrosion-prone vehicles on the road longer—supporting replacement demand for mufflers, resonators and full exhaust assemblies.

Challenges

Downward pressure on aftermarket labor rates

While technician wages are rising, competitive dynamics and consumer price sensitivity keep effective exhaust repair labor rates under pressure. The U.S. Bureau of Labor Statistics reports a median annual wage of USD ~ for automotive service technicians and mechanics, implying meaningful labor cost per bay hour for muffler replacement jobs. At the same time, general median wages across all U.S. occupations are around USD ~, narrowing the gap between technician pay and the broader labor market and fueling ongoing shortages. Shop owners facing higher wages, rent and insurance often hesitate to raise labor rates in lockstep with costs, especially in price-sensitive exhaust work where national chains and online price transparency anchor consumer expectations, compressing margins on muffler and silencer replacement.

Low-cost imported mufflers

Global trade in mufflers and exhaust pipes intensifies price competition for U.S. manufacturers and distributors. World Bank WITS data for HS code 870892 show large-scale imports of mufflers and exhaust pipes into advanced automotive economies, with countries like Mexico, Poland and the European Union shipping tens of millions of kilograms annually; Mexico alone exported over ~ million kg of such parts in a recent year. U.S. buyers can source private-label and OE-style mufflers from these lower-cost manufacturing hubs, placing pressure on domestic producers whose cost base is tied to U.S. wages, energy and environmental compliance. As global merchandise imports into the U.S. exceed USD ~ trillion, the logistics and sourcing infrastructure is well-developed, facilitating high-volume containerized exhaust imports that challenge local price points in retail and wholesale channels.

Opportunities

Upgrade from aluminized to stainless portfolios

Corrosion-prone regions and aging vehicles create a strong case for migrating muffler portfolios from aluminized to stainless steel. World Stainless Association data show global stainless output of about ~ million metric tons, with North America contributing a meaningful share, indicating available capacity for higher-grade exhaust alloys. U.S. stainless melt output of roughly ~ million metric tons underscores domestic supply potential for 409/439 and austenitic grades commonly used in long-life exhausts. With the U.S. vehicle parc exceeding ~ million units and average age around 12.5–12.6 years, millions of vehicles in rust-belt states face repeated exhaust failures, making “lifetime” stainless systems attractive for fleets, ride-hail operators and consumers willing to pay a modest premium to avoid multiple replacements over the remaining service life of the vehicle.

Bolt-on performance kits and cat-back systems

The dominance of pickups, SUVs and crossovers—representing around 79% of U.S. light-vehicle sales—creates a large base of owners inclined toward personalization, including performance exhaust upgrades. DOE and EIA data show accelerating adoption of electrified powertrains, yet internal-combustion light trucks still account for the majority of new sales, with total new light-duty volumes of about ~ million units recently. This combination of long-bed pickups, off-road-oriented SUVs and mid-size crossovers supports strong interest in cat-back and axle-back systems that enhance sound quality while remaining emissions-compliant. With vehicle miles traveled at ~ trillion annually, a sizeable enthusiast and work-truck population cycles through tires, brakes and exhaust on accelerated schedules, providing recurring opportunities for bolt-on kits, tunable mufflers and premium stainless systems sold through accessory stores, online channels and dealer-installed performance packages.

Future Outlook

Over the next six years, the USA mufflers and silencers market will evolve under competing forces: tightening emissions and noise regulations, gradual electrification of the light-vehicle parc, and a still-growing national fleet driven by robust light-truck and SUV sales. Heavy-duty diesel trucks, vocational vehicles and off-highway machinery will sustain baseline demand for high-capacity silencers, while performance and sound-tuning segments continue to grow around enthusiast communities. Suppliers that can combine corrosion-resistant materials, compact acoustics and regulatory compliance at a competitive cost will capture share.

In parallel, the aftermarket will remain critical as the average vehicle age in the US fleet continues to hover around the low- to mid-teens, keeping replacement cycles healthy for exhaust components. Digital catalogs, VIN-based fitment tools and direct-to-consumer e-commerce will reshape how mufflers are specified and purchased, but installation will still rely heavily on muffler shops, tire chains and independent garages. Integration of mufflers with broader aftertreatment cans in medium- and heavy-duty applications will favor system suppliers with deep engineering and testing capabilities.

Major Players

- Tenneco Inc

- Forvia SE

- Eberspächer Group / Purem by Eberspächer

- AP Emissions Technologies

- MagnaFlow

- Borla Performance Industries

- Flowmaster

- Donaldson Company, Inc.

- Cummins Emission Solutions

- Marelli

- Sejong Industrial Co., Ltd.

- Sango Co., Ltd.

- Yutaka Giken Co., Ltd.

- Friedrich Boysen GmbH & Co. KG

- Akrapovič d.d.

Key Target Audience

- Light-vehicle OEM powertrain & NVH engineering teams

- Commercial vehicle and off-highway OEM procurement and engineering teams

- Tier-1 and Tier-2 exhaust system integrators and metal fabricators

- Independent warehouse distributors, national retail parts chains and installer networks

- Performance and motorsport brands and tuning houses

- Investments and venture capitalist firms

- Government and regulatory bodies

- Steel, stainless-steel and insulation material suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the full ecosystem of the USA mufflers and silencers market, including OEMs, Tier-1 exhaust suppliers, aftermarket brands, steel and acoustic-material producers, distribution networks, and regulatory bodies. This map is built through extensive desk research using secondary and subscription databases covering US exhaust systems, global muffler markets, vehicle production and vehicle-park statistics. The objective is to identify the critical demand- and supply-side variables that drive muffler volumes, pricing and replacement cycles.

Step 2: Market Analysis and Construction

In this phase, we compile and normalize historical data for the US automotive exhaust systems market and the muffler component segment, drawing on sources for system-level and component-level revenues. We cross-reference these with vehicle production, fleet age and registration data from industry associations and statistical bodies to estimate fitted-per-vehicle counts, replacement rates and value per fitment by vehicle class. This supports a combined top-down (exhaust system revenue) and bottom-up (vehicle parc and replacement) sizing approach.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on segment shares, channel structure, CAGR and pricing tiers are then validated through structured interviews with industry experts. These include representatives from exhaust Tier-1s, aftermarket muffler brands, distributors, muffler shops, and powertrain engineers at OEMs. Interviews are conducted via computer-assisted telephone or web-based discussions, focusing on product mix shifts (e.g., stainless vs aluminized), impacts of EV adoption, regulatory compliance costs, and the performance aftermarket. Insights are used to refine preliminary estimates and align them with on-the-ground dynamics.

Step 4: Research Synthesis and Final Output

The final phase integrates quantitative models and expert feedback into a coherent market view. We iterate between top-down revenue projections anchored in published exhaust and muffler statistics, and bottom-up models based on vehicle parc, scrappage and replacement behavior. Scenario analysis is applied to reflect different pathways for internal-combustion phase-down, regulatory tightening and heavy-duty diesel demand. The result is a fully triangulated, validated estimate of the USA mufflers and silencers market size, growth trajectory, segment splits, competitive landscape and five- to six-year outlook.

- Executive Summary

- Research Methodology (Market definitions for OEM and aftermarket mufflers/silencers, acoustic performance benchmarks in dB(A), backpressure and flow metrics, VIO and VMT-based sizing models, replacement-rate and failure-mode modeling, SKU-level mix and mix-shift analysis, multi-source triangulation across VIO databases, exhaust system teardown benchmarking, primary interviews with installers/fleet managers/WDs, secondary validation using registration and scrappage statistics, limitations and data normalization assumptions)

- Definition and Scope

- Market Structure: OEM vs OES vs Independent Aftermarket

- Evolution of Exhaust Architectures in Light Vehicle and Heavy-Duty Platforms

- Role of Mufflers and Silencers within Complete Exhaust Line-Up

- Value Chain and Supply Chain Mapping from Coil Steel to Service Bay

- Growth Drivers

VIO expansion and aging vehicle parc

Average vehicle age and scrappage trends

VMT recovery and commuting patterns

Tightening EPA and state-level noise limits

CARB and non-CARB exhaust compliance) - Challenges

Downward pressure on aftermarket labor rates

Low-cost imported mufflers

Raw-material price volatility in flat steel and stainless

Complexity of fitment on modern platforms

Packaging constraints in downsized/turbo vehicles - Opportunities

Upgrade from aluminized to stainless portfolios

Bolt-on performance kits and cat-back systems

CARB-compliant high-flow solutions

Industrial generator and compressor silencers

Muffler solutions tailored for hybrids and range-extender units - Trends

Migration to modular exhaust assemblies

3D-scanned fitment and virtual validation

Additive manufacturing and hydroforming in muffler internals

Active valves and multi-mode sound profiles

Lightweighting using thin-gauge stainless and composites - Regulatory and Standards Landscape

- Technology and Design Benchmarking

- Ecosystem and Stakeholder Mapping

- Porter’s Five Forces Analysis

- Market Attractiveness and Margin Pool Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- Installed Base, 2019-2024

- Average Realization per Unit and Mix by Material Grade, 2019-2024

- By Vehicle Type (in Value %)

Passenger cars

Crossovers/SUVs

Pickups

LCVs

M/HCVs

Off-highway/agri/construction) - By Powertrain and Fuel Type (in Value %)

Gasoline

Diesel

CNG/LPG

Hybrid

Range-extender

Performance applications - By Product Type (in Value %)

OE-style replacement mufflers

Performance/aftermarket mufflers

Resonators and glasspacks

Industrial/engine-generator silencers

Specialty and custom-fabricated systems - By Material and Coating (in Value %)

Aluminized steel

409 stainless steel

304 stainless steel

High-temperature alloys

Coated/painted constructions

- By Sales Channel (in Value %)

OEM fitment

OES dealer network

Warehouse distributors/jobbers

Retail chains

Online marketplaces - By End User and Fleet Profile (in Value %)

Individual retail customers

National/regional fleets

Leasing and rental operators

Municipal fleets

Performance and motorsport customers - By Region within USA (in Value %)

Northeast

Midwest

South

West

- Market Share of Major Players by Value and Volume

- Cross Comparison Parameters for Leading Players (USA muffler and silencer SKU coverage by VIO, OE vs aftermarket revenue mix in exhaust systems, US manufacturing and assembly footprint and capacity, CARB/EPA-compliant coverage breadth, stainless-steel and performance portfolio depth, distribution footprint across WDs/jobbers/retail chains, average warranty mileage and claims ratio, catalog and digital enablement including VIN lookup and installer tools)

- Competitive Strategies and Go-to-Market Models

- Pricing and Discount-Structure Analysis

- Strategic Developments and Investment Landscape

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

Tenneco / Walker Emissions Control

Faurecia

Eberspächer

Bosal

MagnaFlow

Flowmaster

Borla Performance Industries

AP Emissions Technologies

MBRP Performance Exhaust

Dinex

Friedrich Boysen GmbH & Co. KG

BENTELER Automotive

Yutaka Giken

Donaldson Company

- Replacement Behavior and Trigger Events

- Purchasing Criteria and Brand Perception

- Installer and Workshop Perspective

- Fleet and Industrial Buyer Perspective

- End-Use Case Profiles

- By Value, 2025-2030

- By Volume, 2025-2030

- Installed Base, 2025-2030

- Average Realization per Unit and Mix by Material Grade, 2025-2030