Market Overview

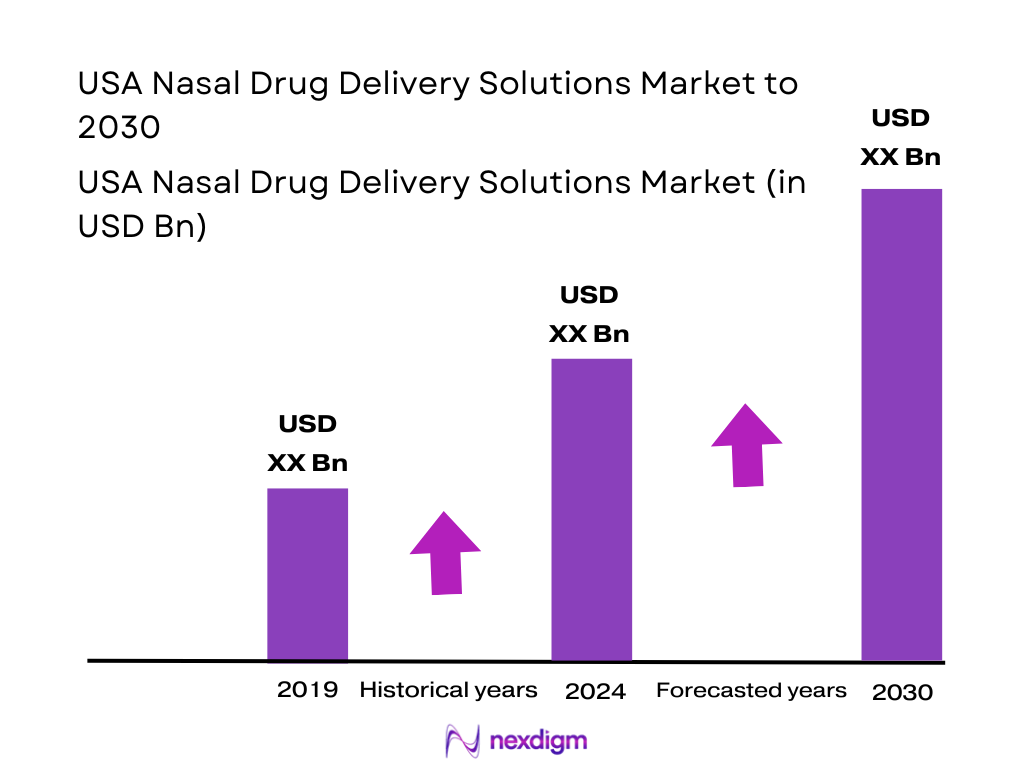

The USA Nasal Drug Delivery Solutions Market is anchored by a large and growing base of intranasal therapies and delivery technologies. Nexdigm reports that the U.S. nasal drug delivery technology market generates revenue of USD ~ million, with nasal sprays as the largest dosage form segment by value. Precedence Research estimates the broader North American nasal drug delivery technology space at USD ~ billion, underscoring the region’s scale. Within this, the U.S. nasal spray industry alone is valued at around USD 10–11 billion, reflecting strong OTC and prescription demand across allergy, congestion and CNS rescue indications.

Market Segmentation

By Dosage Form

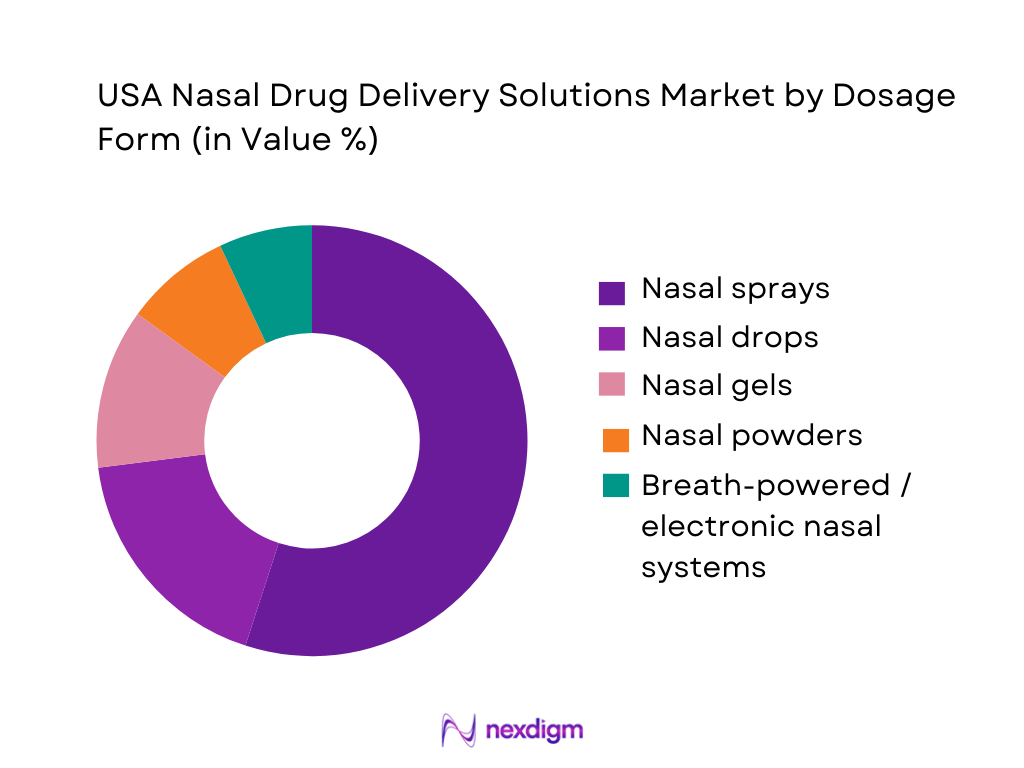

USA Nasal Drug Delivery Solutions Market is segmented by dosage form into nasal sprays, nasal drops, nasal gels, nasal powders and advanced breath-powered or electronic systems. Nasal sprays dominate this segmentation because they are the most established, physician-preferred and payer-accepted format for allergic rhinitis, sinusitis and congestion, and they are widely available both over the counter and by prescription. Nexdigm identifies nasal sprays as the largest revenue-generating dosage form in the U.S. nasal drug delivery technology market, supported by high refill rates and multi-dose usage in chronic conditions.

By Therapeutic Application

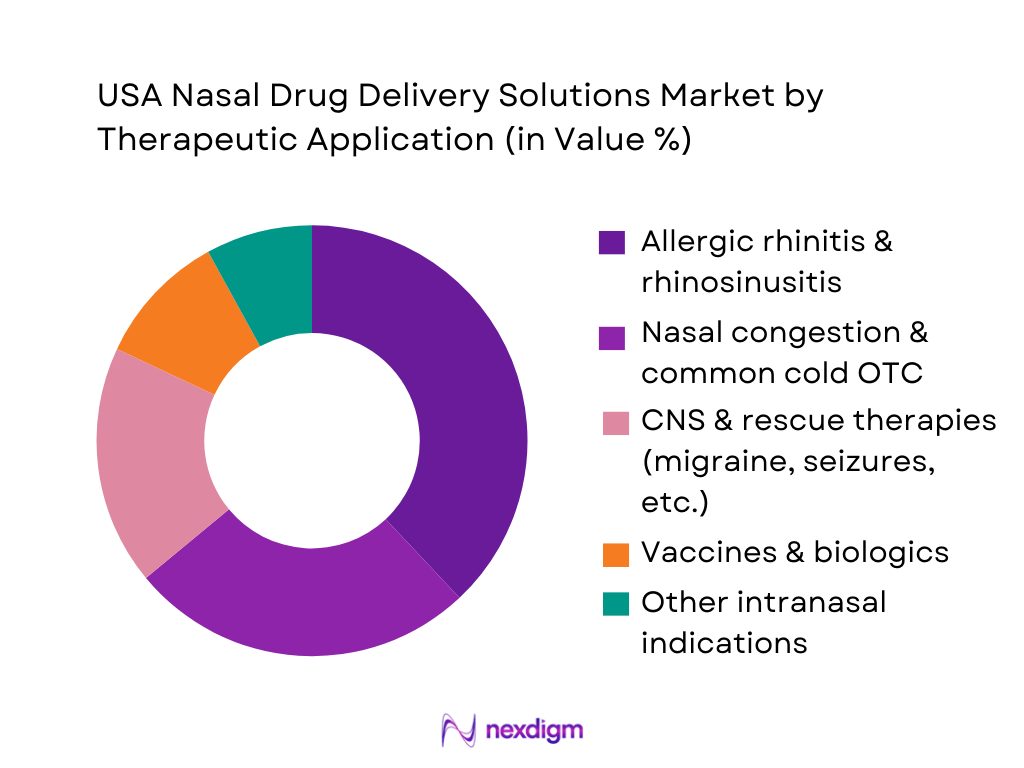

USA Nasal Drug Delivery Solutions Market is segmented by therapeutic application into allergic rhinitis & rhinosinusitis, nasal congestion & common cold OTC, CNS and rescue therapies, vaccines & biologics, and other intranasal indications. Allergic rhinitis and rhinosinusitis form the dominant application due to high disease burden and long-term controller therapy needs. U.S. asthma and allergic diseases affect tens of millions of people, driving sustained demand for intranasal corticosteroids and antihistamine-steroid combinations.

Competitive Landscape

The USA Nasal Drug Delivery Solutions Market is shaped by a mix of large multinational pharmaceutical companies, device specialists and focused intranasal innovators. Grand View Research highlights players such as AstraZeneca, Pfizer, OptiNose, GlaxoSmithKline and Becton Dickinson among the key companies active in nasal drug delivery technology. These firms control major brands in allergic rhinitis, nasal decongestants, intranasal rescue therapies and device platforms, with entrenched relationships across hospital systems, retail chains and payers. Competition increasingly centers on formulation innovation, device engineering (spray pattern, droplet size, unit dose reliability) and lifecycle management of branded products against an expanding pool of generics.

| Company | Establishment Year | Headquarters (Global) | Key Intranasal Brands/Technologies* | Primary Dosage Focus | Core Therapeutic Focus (Nasal) | Intranasal R&D / Pipeline Breadth | U.S. Channel Strength | Device / Platform Capabilities |

| AstraZeneca | 1999 (current form) | Cambridge, United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Pfizer | 1849 | New York, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| GlaxoSmithKline (GSK) | 2000 (current form) | London, United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| OptiNose | 2010 | Yardley, Pennsylvania, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Becton Dickinson (BD) | 1897 | Franklin Lakes, New Jersey, USA | ~ | ~ | ~ | ~ | ~ | ~ |

USA Nasal Drug Delivery Solutions Market Analysis

Growth Drivers

Increasing Allergic Rhinitis Burden & Chronic Sinusitis Population

The USA nasal drug delivery solutions market is underpinned by a very large symptomatic pool. CDC-linked statistics indicate that sinusitis affects about 28.9 million adults in the US each year, driving repeated use of intranasal corticosteroids, decongestant sprays, and saline products. Clinical reviews from major US health institutions estimate that acute or chronic rhinosinusitis and related conditions impact around 30–35 million adults annually, ranking among the most common reasons for antibiotic prescriptions and ENT visits.

Rising Demand for Non-Invasive Systemic Delivery

Growing chronic disease burden and high healthcare utilization are pushing clinicians and patients toward non-invasive, rapid-onset nasal delivery for selected systemic therapies (e.g., migraine, seizure, opioid overdose). US national health expenditure reached 4.9 trillion US dollars in 2023, equivalent to 14,570 dollars per person, indicating strong capacity and willingness to pay for differentiated drug–device solutions that reduce hospital use and emergency room load.

Challenges

Complex FDA Requirements for Nasal Bioequivalence

Regulatory expectations for nasal sprays and powders in the USA are technically demanding, raising development timelines and costs. FDA’s product-specific guidances for locally acting nasal suspensions and solutions require extensive in vitro characterization—including spray pattern, plume geometry, droplet size distribution, and comparative deposition studies—for each reference listed drug, with more than nine separate nasal products already covered by bespoke guidance. In addition, complex generics must demonstrate Q1/Q2 formulation sameness and device similarity, plus, in many cases, in vivo pharmacokinetic or pharmacodynamic bridging, even when systemic exposure is low. This is unfolding within a broader environment of 4.9 trillion dollars in national health spending and rapidly growing generic competition, pushing sponsors to absorb high upfront regulatory science investments before accessing the US intranasal market.

High R&D & Device-Engineering Costs

Nasal drug delivery products sit at the intersection of high-value pharmaceuticals and precision-engineered medical devices, both of which are R&D intensive in the USA. National statistics show gross domestic expenditure on research and development reaching 923.2 billion dollars in 2022, with US companies accounting for about 30% of global R&D and pharmaceuticals among the most R&D-intensive industries. Trade and investment analyses place pharmaceutical and medicine manufacturing’s direct economic output at over 800 billion dollars in 2022, supporting more than 3.2 million direct and indirect jobs and reflecting substantial ongoing commitments to laboratory infrastructure, clinical trials, and device engineering.

Opportunities

Intranasal Biologics & RNA-Based Vaccines

The USA is at the forefront of biologics and RNA platform innovation, creating a strong springboard for future intranasal applications. NIH and international trackers count more than 800 active or planned clinical trials globally for next-generation COVID-19 vaccines, including mucosal and intranasal constructs, with a significant cluster led or co-led by US institutions. The US population exceeded 340.1 million people in 2024, with WHO data confirming a dense physician and nurse workforce and high urbanization—conditions that support rapid roll-out of innovative vaccination modalities once approved. Seasonal influenza alone is estimated by CDC to cause 9–41 million illnesses annually in the US, with 140,000–710,000 hospitalizations and 12,000–52,000 deaths in typical seasons, demonstrating the scale of respiratory vaccine demand that intranasal or mucosal biologics could increasingly tap when they offer needle-free, potentially transmission-blocking protection.

Expansion in Intranasal CNS Rescue Therapies

The opioid and broader drug-overdose crisis has sharply increased demand for fast-acting CNS rescue therapies, with nasal delivery emerging as the preferred community route. CDC reports approximately 105,000 drug-overdose deaths in 2023, nearly 80,000 involving opioids, while more detailed analyses show 79,358 opioid-involved deaths in 2023 alone, underscoring the need for widely deployable reversal agents. In response, FDA has approved multiple intranasal opioid antagonists, including the first nalmefene hydrochloride nasal spray in 2023 and subsequent auto-injector formulations, with agency communications citing more than 107,000 overdose deaths in 2023 as a justification for expanding community access.

Future Outlook

Over the next several years, the USA Nasal Drug Delivery Solutions Market is expected to expand steadily as manufacturers leverage the nasal route for both local and systemic delivery. Nexdigm projects that the U.S. nasal drug delivery technology market will grow from USD 24,072.3 million to USD 41,204.3 million, supported by an expected compound annual growth rate of 8 from 2024 to 2030. Growth will be led by continued dominance of nasal sprays, accelerated uptake of intranasal rescue therapies and the emergence of nasal vaccines and biologics for respiratory and CNS conditions.

Major Players

- AstraZeneca

- Pfizer

- GlaxoSmithKline (GSK)

- Bayer Healthcare

- Novartis

- Bausch Health / Bausch + Lomb

- Teva Pharmaceuticals

- Amneal Pharmaceuticals

- Dr Reddy’s Laboratories

- OptiNose

- Becton Dickinson (BD)

- Catalent

- Aptar Pharma

- Kurve Therapeutics

- Emergent BioSolutions

Key Target Audience

- Intranasal and respiratory pharmaceutical manufacturers (Rx and OTC)

- Drug–device combination and nasal delivery device manufacturers (including platform and component suppliers)

- Contract development and manufacturing organizations (CDMOs) focused on sterile fill-finish and nasal system assembly

- Hospital and integrated health system pharmacy teams (formulary committees, procurement and therapeutics committees)

- Retail and e-pharmacy chains (national drugstore and mass-merchandiser pharmacy operators)

- Investments and venture capitalist firms (focusing on biopharma, MedTech and drug-delivery innovation)

- Government and regulatory bodies (U.S. Food and Drug Administration, Centers for Medicare & Medicaid Services, U.S. Department of Veterans Affairs)

- Health insurance companies and pharmacy benefit managers (PBMs) responsible for coverage and reimbursement of intranasal therapies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the full ecosystem of the USA Nasal Drug Delivery Solutions Market, including pharmaceutical companies, device manufacturers, CDMOs, regulators, providers and payers. Extensive desk research using regulatory databases (FDA), company filings and syndicated market studies is used to define critical variables such as dosage form mix, therapeutic application areas, device types and distribution channels. This stage establishes the taxonomy, definitions and boundaries of the market.

Step 2: Market Analysis and Construction

In this phase, historical revenue and volume data for nasal drug delivery technologies are compiled from sources such as Grand View Research, Precedence Research and other credible industry datasets. Adoption patterns across OTC and prescription segments, inpatient vs outpatient use and the evolution of intranasal rescue therapies are analyzed. Quantitative models integrate epidemiology of respiratory and CNS conditions, treatment rates, dosing frequencies and channel mix to construct a robust bottom-up and top-down view of market size and structure.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on dosage-form leadership, application-level growth, pricing dynamics and device innovation are validated through in-depth interviews and surveys with ENT specialists, allergists, neurologists, hospital pharmacists, procurement heads and device engineers. Computer-assisted interviews with commercial leaders from key manufacturers and CDMOs provide operational and financial insights, particularly around capacity planning, regulatory timelines and payer negotiations. Feedback from these experts is used to refine assumptions and reconcile any discrepancies in secondary data.

Step 4: Research Synthesis and Final Output

The final phase synthesizes market sizing, segmentation and qualitative insights into an integrated analytical framework. Scenario analysis is conducted on factors such as uptake of intranasal vaccines, regulatory changes for OTC decongestants and competitive launches in rescue therapies. The resulting outputs include size and forecast models, granular segment breakdowns, competitive benchmarking and strategic recommendations tailored for manufacturers, investors and healthcare decision-makers active in the USA Nasal Drug Delivery Solutions Market.

- Executive Summary

- Research Methodology (Market Definitions, Pharmacological Classifications, Device Typologies, Primary Research Frameworks, Market Sizing Metrics, Assumptions, Scope Inclusions/Exclusions)

- Definition & Scope

- Evolution of Intranasal Delivery Technologies

- Value Chain Mapping

- Nasal Drug–Device Combination Ecosystem

- Regulatory Pathways Summary

- Growth Drivers

Increasing Allergic Rhinitis Burden & Chronic Sinusitis Population

Rising Demand for Non-Invasive Systemic Delivery

FDA Approvals of Novel Intranasal Rescue Therapies

Technology Advancements in Device–Drug Combination Systems

Growing Adoption of Self-Administration & Homecare - Market Challenges

Complex FDA Requirements for Nasal Bioequivalence

High R&D & Device-Engineering Costs

Quality Variability in Generic Nasal Sprays

Device Malfunction, Spray Pattern Variability, and Patient Technique

API Supply Chain Sensitivities (Sterile Fill-Finish Constraints) - Opportunities

Intranasal Biologics & RNA-Based Vaccines

Expansion in Intranasal CNS Rescue Therapies

CDMO Partnerships for Nasal Device Manufacturing

Preservative-Free & Sterile Single-Dose Innovations

Smart and Connected Nasal Drug Delivery Devices - Trends

Shift to Breath-Powered Delivery for Enhanced Absorption

Growth of Digital-Adherence Linked Nasal Devices

Intranasal Psychedelic Therapies for Mental Health

Patient-Centric Nasal Packaging & Design Optimization - Regulatory Landscape

FDA Requirements for Spray Pattern, Droplet Size & In Vitro Testing

Combination Product Regulations (OCP)

cGMP for Nasal Sterile Manufacturing

Drug Shortage & Emergency Use Pathways - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- Competition Ecosystem (Manufacturers, CDMOs, Device Innovators)

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Realized Price, 2019-2024

- By Dosage Form (in Value %)

Aqueous Nasal Sprays

Nasal Powders

Nasal Gels

Nasal Suspensions

Breath-Powered & Electronic Nasal Delivery Systems - By Drug Class / Therapeutic Category (in Value %)

Intranasal Corticosteroids (INCS)

Antihistamines & Decongestants

Analgesic, Sedative & Rescue Therapies (Ketamine, Naloxone, Benzodiazepines)

Nasal Vaccines & Biologics

Central Nervous System Intranasal Products (Migraines, Seizures) - By End User (in Value %)

Hospital Pharmacies

Retail Pharmacies

ENT & Allergy Clinics

Urgent Care Centers

Homecare / Self-administration - By Distribution Channel (in Value %)

Wholesalers / Distributors

Direct Hospital Procurement

Retail Chains (CVS, Walgreens, Walmart)

Online Pharmacy & E-pharmacy Platforms

Government Contracts (DoD, VA) - By Device Type (in Value %)

Standard Metered-Dose Nasal Sprayers

Breath-Powered Delivery Systems

Unit-Dose Nasal Devices

Multi-Dose Preservative-Free Systems

Smart Nasal Drug Delivery Devices (Sensors, Digital Adherence Tools)

- Market Share Analysis (Value & Volume)

Market Shares by Drug Class

Market Shares by Device Type

Market Shares by Distribution Channel - Cross-Comparison Parameters (Intranasal Pipeline Strength, Device Engineering Capabilities, Manufacturing Capacity, Regulatory Approval Speed, Distribution Reach, Formulation Innovation, Digital/Smart Device Integration, API Security & Supply-Chain Robustness)

- SWOT of Major Players

- Pricing Analysis of Key SKUs (Unit Dose, Multi-Dose, Branded vs Generic)

- Detailed Profiles of Major Companies

AstraZeneca

Johnson & Johnson (Janssen)

Pfizer

GlaxoSmithKline (GSK)

Bayer Healthcare

Novartis

Bausch Health / Bausch + Lomb

Amneal Pharmaceuticals

Teva Pharmaceuticals

Hikma Pharmaceuticals

Catalent (Device–Drug Combination CDMO)

Aptar Pharma (Nasal Device Leader)

Kurve Therapeutics (Breath-Powered Systems)

OptiNose

Emergent BioSolutions (Intranasal Rescue Therapies)

- Healthcare Facility Adoption Patterns

- Prescribing Trends Among ENT, Allergists & Neurologists

- Procurement Criteria (Device Reliability, Sterility, Unit Cost, Reimbursement)

- Patient Preferences & Barriers (Ease of Use, Dose Accuracy)

- End-User Pain Point Mapping

- Decision-Making Framework

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Realized Price, 2025-2030