Market Overview

The USA OEM Manufacturing market current size stands at around USD ~ million, reflecting a mature industrial base shaped by long-standing domestic production ecosystems and localized supplier networks. Demand is sustained by multi-industry OEM programs spanning mobility platforms, aerospace systems, electronics assemblies, and industrial equipment manufacturing. Capital allocation remains disciplined, with investments prioritized toward automation, digital manufacturing integration, and compliance-driven modernization across brownfield facilities. The market structure emphasizes platform standardization, production resilience, and quality assurance across regulated manufacturing environments.

Manufacturing activity is concentrated across the Midwest automotive belt, the Southeast aerospace and defense corridor, the Southwest electronics cluster, and West Coast advanced manufacturing hubs. These regions benefit from dense supplier ecosystems, logistics connectivity to ports and rail corridors, skilled workforce availability, and proximity to major OEM design centers. State-level incentives, industrial parks, and defense-linked manufacturing zones reinforce clustering effects. Policy support for domestic production, infrastructure upgrades, and technology localization further strengthens regional ecosystem maturity and capacity utilization dynamics.

Market Segmentation

By End-Use Industry

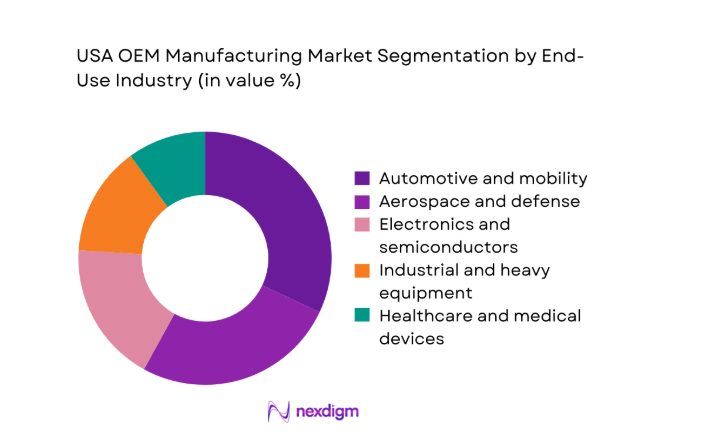

Demand concentration is strongest within automotive and mobility platforms, followed by aerospace and defense manufacturing programs that prioritize domestic sourcing and production security. Electronics and semiconductor equipment manufacturing shows sustained momentum due to localization mandates and supply chain resilience initiatives. Industrial machinery and heavy equipment manufacturing continues to anchor regional OEM footprints across the Midwest and South, supported by infrastructure renewal programs. Healthcare equipment and medical device manufacturing remains a stable niche driven by compliance requirements and domestic production mandates. End-use industry segmentation reflects varying capital intensity, regulatory complexity, production cycle length, and technology integration maturity across OEM programs.

By Technology Architecture

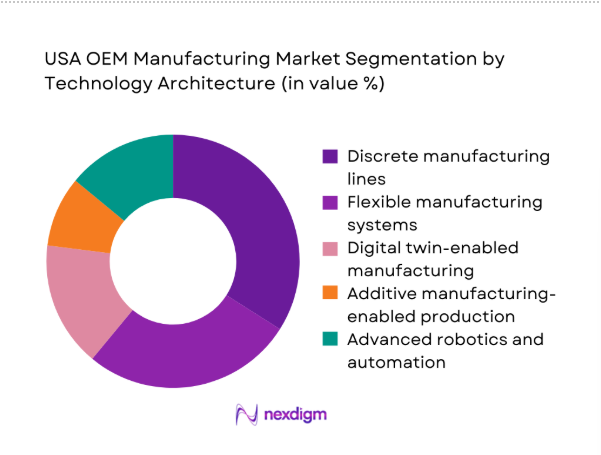

Discrete manufacturing lines dominate legacy OEM facilities due to entrenched production layouts and long equipment depreciation cycles. Flexible manufacturing systems are expanding across new and modernized plants to accommodate product mix variability and shorter model lifecycles. Digital twin-enabled manufacturing is gaining traction within high-complexity production environments, enabling virtual commissioning and process optimization. Additive manufacturing-enabled production remains concentrated in prototyping and low-volume, high-complexity components, particularly within aerospace and medical applications. Advanced robotics and automation architectures continue to scale as labor availability tightens and quality consistency requirements increase across multi-shift operations.

Competitive Landscape

The competitive landscape is characterized by vertically integrated OEMs alongside diversified manufacturing conglomerates with multi-industry production capabilities. Competitive positioning is shaped by plant footprint scale, automation maturity, supply chain localization depth, and regulatory compliance readiness. Players compete on production reliability, platform standardization, and the ability to support rapid model transitions across regulated end-use industries.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| General Electric | 1892 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Ford Motor Company | 1903 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Caterpillar | 1925 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

USA OEM Manufacturing Market Analysis

Growth Drivers

Reshoring and nearshoring incentives under federal and state programs

Federal manufacturing incentives accelerated domestic capacity expansion across 42 states during 2023 and 2024, supported by 19 federal manufacturing grant programs and 7 major tax credit mechanisms. State-level reshoring packages approved 214 industrial projects, enabling 86 new production lines and 31 plant expansions. Port congestion metrics improved by 28 container dwell time reductions at key gateways, encouraging localization. Rail freight intermodal volumes increased 17 million units in 2024, supporting inland manufacturing clusters. Defense procurement localization mandates covered 124 product categories. Industrial permitting cycle times fell by 61 days, accelerating brownfield modernization. Electricity grid reliability indices improved across 14 manufacturing-intensive states.

Expansion of EV and battery manufacturing capacity in the U.S.

EV platform manufacturing lines expanded across 23 states in 2023 and 2024, adding 48 assembly lines and 21 battery module facilities. Lithium processing permits increased by 9 approvals, while domestic cathode and anode material plants rose by 12 sites. Highway charging corridors expanded across 38 interstate routes, supporting downstream manufacturing utilization. Grid interconnection approvals for industrial loads exceeded 11 gigawatts, enabling high-energy manufacturing operations. Rail car deliveries for battery logistics increased by 6400 units. Environmental permitting timelines shortened by 54 days in designated industrial zones, improving project execution certainty for OEM production facilities.

Challenges

High capital expenditure and long ROI cycles for plant modernization

Plant modernization programs required equipment retrofits across 318 facilities in 2023 and 2024, with average commissioning timelines extending 14 months due to supply lead times. Industrial robotics delivery backlogs reached 26 weeks, delaying automation ramps. Skilled integrator availability constrained 41 percent of modernization schedules across major manufacturing corridors. Grid upgrades for high-load machinery required 9 to 14 months in 27 utility districts. Zoning approvals averaged 118 days across urban manufacturing zones. Environmental compliance audits increased by 22 additional requirements per project. Financing approvals for equipment leasing experienced 37 day processing extensions across regional lenders.

Skilled labor shortages in advanced manufacturing roles

Advanced manufacturing vacancies exceeded 412000 roles across automation technicians, controls engineers, and quality systems specialists during 2023 and 2024. Apprenticeship enrollments rose by 28000 participants, yet program completion timelines averaged 18 months. Vocational training seats expanded by 14000, insufficient to meet projected retirements of 92000 workers across machining and maintenance roles. Overtime utilization increased by 6.2 hours per worker weekly in high-throughput plants. Safety incident rates rose by 0.7 per 100 workers in understaffed shifts. Certification processing for industrial electricians extended by 64 days across multiple states.

Opportunities

Federal incentives for domestic manufacturing and CHIPS-linked programs

Federal industrial incentives supported 67 fabrication-adjacent projects across equipment manufacturing, cleanroom construction, and precision tooling in 2023 and 2024. Cleanroom-certified facilities expanded by 29 sites, improving domestic equipment localization. Wafer tool installation permits increased by 412 approvals, driving OEM demand for high-precision manufacturing systems. Power reliability standards upgraded across 11 industrial corridors, enabling continuous production uptime. Industrial water reuse permits rose by 84 approvals, supporting semiconductor-adjacent manufacturing processes. Logistics node capacity expanded by 9 inland port facilities. Workforce upskilling programs certified 16300 technicians for precision equipment maintenance roles.

Growth in contract manufacturing for electronics and medical devices

Contract manufacturing authorizations increased across 312 production programs in 2023 and 2024, driven by compliance-driven outsourcing within regulated device manufacturing. FDA facility registrations expanded by 417 manufacturing sites, supporting domestic device production scale. Cleanroom square footage approvals increased by 3.1 million across medical device clusters. Electronics assembly line certifications rose by 146 new lines, enabling rapid product iteration cycles. Quality system audit throughput improved by 23 percent, reducing onboarding delays for OEM partners. Cold chain logistics nodes expanded by 41 regional hubs, strengthening device manufacturing distribution readiness and post-production validation workflows.

Future Outlook

The market outlook through 2030 reflects sustained momentum from reshoring policies, EV platform scaling, and defense-linked manufacturing programs. Digital factory adoption and flexible manufacturing architectures will accelerate modernization across brownfield sites. Regional manufacturing clusters are expected to deepen, supported by infrastructure upgrades and workforce development initiatives. Policy continuity and grid reliability improvements will remain critical enablers of production stability and long-term capacity utilization across OEM ecosystems.

Major Players

- General Electric

- Boeing

- Lockheed Martin

- Ford Motor Company

- General Motors

- Tesla

- Caterpillar

- John Deere

- 3M

- Honeywell International

- RTX Corporation

- Northrop Grumman

- Emerson Electric

- Intel Corporation

- Flex

Key Target Audience

- Automotive and EV OEM manufacturing leadership

- Aerospace and defense program offices within federal agencies

- Electronics and medical device OEM sourcing heads

- Industrial equipment manufacturers and plant operators

- State economic development agencies and permitting authorities

- Federal manufacturing and procurement agencies

- Investments and venture capital firms

- Environmental and industrial safety regulatory bodies such as OSHA and EPA

Research Methodology

Step 1: Identification of Key Variables

Production architectures, end-use demand patterns, localization mandates, automation penetration, regulatory constraints, and supply chain resilience indicators were defined to frame the analytical scope. Variable selection prioritized factors directly influencing OEM production capacity, compliance complexity, and modernization feasibility across domestic manufacturing ecosystems.

Step 2: Market Analysis and Construction

Industrial facility mapping, capacity utilization proxies, and program-level production indicators were synthesized to construct market structure. Segmentation logic aligned technology architectures with end-use industries and regional manufacturing clusters to reflect operational realities and investment priorities.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through structured consultations with plant operations leaders, compliance officers, and manufacturing systems integrators. Feedback cycles refined assumptions on modernization timelines, workforce constraints, and regulatory bottlenecks impacting production scalability.

Step 4: Research Synthesis and Final Output

Findings were consolidated through cross-validation of institutional indicators, permitting datasets, and infrastructure readiness benchmarks. The synthesis emphasized consistency across regional dynamics, technology adoption pathways, and policy-driven manufacturing localization effects.

- Executive Summary

- Research Methodology (Market Definitions and OEM manufacturing scope across automotive, aerospace, electronics, and industrial equipment, Segmentation taxonomy by contract manufacturing, in-house production, and platform-based manufacturing models, Bottom-up plant capacity mapping and revenue estimation by NAICS codes and OEM program volumes, Revenue attribution by OEM program lifecycle, bill-of-material value capture, and localization rates)

- Definition and Scope

- Market evolution

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Reshoring and nearshoring incentives under federal and state programs

Expansion of EV and battery manufacturing capacity in the U.S.

Rising defense and aerospace procurement programs

Automation adoption to offset skilled labor shortages

Localization of semiconductor and electronics fabrication

Infrastructure modernization and industrial equipment demand - Challenges

High capital expenditure and long ROI cycles for plant modernization

Skilled labor shortages in advanced manufacturing roles

Supply chain volatility for critical components and raw materials

Energy cost volatility and grid reliability concerns

Regulatory compliance complexity across states and federal mandates

Technology integration challenges across legacy manufacturing systems - Opportunities

Federal incentives for domestic manufacturing and CHIPS-linked programs

Growth in contract manufacturing for electronics and medical devices

Digital factory transformation and Industry 4.0 adoption

Public-private partnerships for defense and infrastructure programs

Expansion of advanced materials and additive manufacturing use

Growth of brownfield modernization projects - Trends

Acceleration of smart factory and digital twin deployments

Shift toward modular and flexible manufacturing lines

Increased localization of critical component production

Adoption of predictive maintenance and AI-driven quality control

Growth of sustainability-driven manufacturing practices

Rising use of collaborative robots on assembly lines - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Fleet Type (in Value %)

In-house OEM manufacturing

Contract manufacturing and EMS

Hybrid captive–outsourced manufacturing

Joint venture manufacturing platforms - By Application (in Value %)

Automotive and EV platforms

Aerospace and defense systems

Industrial machinery and equipment

Consumer electronics and appliances

Medical devices and life sciences equipment - By Technology Architecture (in Value %)

Discrete manufacturing lines

Flexible manufacturing systems

Digital twin-enabled manufacturing

Additive manufacturing-enabled production

Advanced robotics and automation - By End-Use Industry (in Value %)

Automotive and mobility

Aerospace and defense

Electronics and semiconductors

Industrial and heavy equipment

Healthcare and medical devices

Energy and utilities equipment - By Connectivity Type (in Value %)

Isolated on-premises manufacturing systems

MES-integrated factory networks

Industrial IoT-enabled connected factories

Cloud-integrated manufacturing platforms

5G-enabled smart factory connectivity - By Region (in Value %)

Northeast

Midwest

South

West

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (manufacturing footprint scale, automation intensity, vertical integration depth, supply chain localization rate, digital factory maturity, sectoral revenue mix, cost competitiveness, ESG compliance maturity)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

General Electric

Boeing

Lockheed Martin

Ford Motor Company

General Motors

Tesla

Caterpillar

John Deere

3M

Honeywell International

RTX Corporation

Northrop Grumman

Emerson Electric

Intel Corporation

Flex

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Volume, 2025–2030