Market Overview

The U.S. oral drug solutions market is valued at approximately USD ~ billion (for non-sterile liquids & suspensions sub-category in 2024). The value for 2023 is lower but the market is showing a rising trend as pharmaceutical formulators shift toward more patient-friendly formats, especially for paediatric and geriatric populations who struggle with swallowing solid dosage forms. The growth is also driven by rising chronic disease prevalence, dose-flexibility demands, and outsourcing of formulation of liquid oral products.

Within the U.S., major cities and regions such as New York metropolitan area (pharma/biotech hub), Boston–Cambridge region (large contract manufacturing and R&D clusters), and the San Francisco Bay Area / Silicon Valley (innovative pharma-formulation start-ups) dominate the market owing to high concentration of pharmaceutical corporations, strong FDA-regulatory infrastructure, cluster of CDMOs (contract development & manufacturing organisations), and patient populations with higher healthcare access. Furthermore, states like California and Massachusetts have a dense base of pharma manufacturing facilities and favourable incentives, which supports dominance in development and commercialization of advanced oral liquid drug solutions.

Market Segmentation

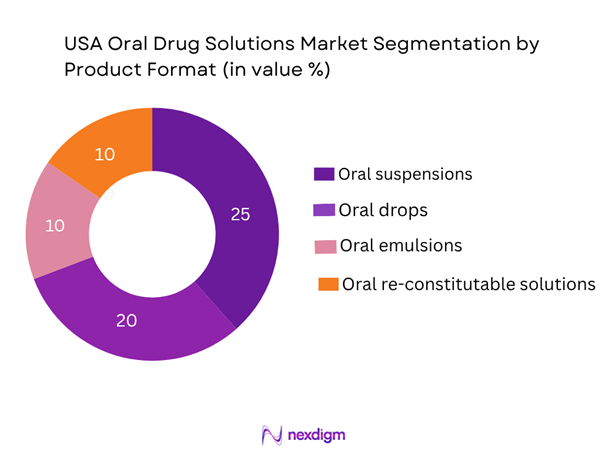

By Product Format

The U.S. oral drug solutions market is segmented by product format into ready-to-use liquid solutions, suspensions, drops, emulsions/micro-emulsions and re-constitutable solutions. Of these, ready-to-use liquid solutions currently dominate the share with about 35% of the market due to their convenience, minimal preparation by healthcare providers or patients, and increased adoption in paediatric and geriatrics where ease-of-administration is critical. Also, pharmaceutical companies favour ready-to-use formats to reduce preparation errors, improve patient compliance, and differentiate from generic solid dosage forms. The suspension segment is next, as many APIs require this format for stability or taste-masking in children. Emulsions and re-constitutable forms are smaller but rising due to niche APIs and personalised dosing.

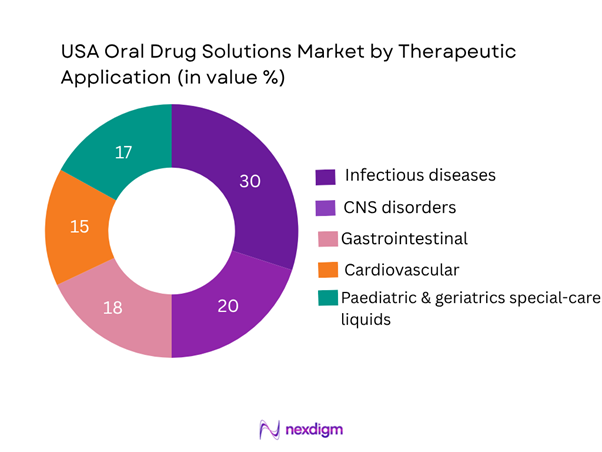

By Therapeutic Application

U.S. oral drug solutions market is segmented by therapeutic application into infectious diseases (oral liquid antibacterials, antivirals), CNS disorders (liquids aimed at children/elderly), gastrointestinal & hepatic disorders, cardiovascular/metabolic conditions, and paediatric & geriatrics special-care solutions. The infectious diseases segment leads with approximately 30% share in 2024 owing to the tradition of antibiotic syrups, high incidence of paediatric infections, and generics manufacturers offering liquid formats. The paediatric & geriatrics special-care liquids are also significant (~17%) as these patient cohorts often cannot swallow tablets and require tailored dosing. The cardiovascular/metabolic liquids segment is smaller but growing as companies reformulate existing solid dosage forms into liquid formats to address dose flexibility and patient adherence issues among older adults.

Competitive Landscape

The U.S. oral drug solutions market is moderately fragmented but features several large pharmaceutical and formulation-contract-manufacturing players offering oral liquid dosage forms, outsourcing and specialised injection of liquid solutions (except injectable) for oral administration. Key players include branded pharmaceutical firms, generic specialists and CDMOs focusing on oral liquid platforms.

In the current landscape, a handful of large players exert strong influence through scale, integrated formulation-manufacturing capabilities, and branded plus generic portfolios. However, niche specialists and CDMOs focused on paediatric/geriatrics oral solutions are gaining traction. Outsourcing to CDMOs is increasing as pharmaceutical companies look to accelerate time-to-market, leverage specialised flavour-masking and stability technologies, and outsource fill-finish of liquids due to high regulatory burden.

| Company | Establishment Year | Headquarters | Oral Liquid Solutions Revenue Estimate | Generic vs Branded Mix | Manufacturing Footprint (U.S.) | Flavour/Taste-Masking Capability | Partnerships/Alliances |

| Pfizer Inc. | 1849 | New York, NY | – | – | – | – | – |

| Johnson & Johnson | 1886 | New Brunswick, NJ | – | – | – | – | – |

| Abbott Laboratories | 1888 | Abbott Park, IL | – | – | – | – | – |

| Teva Pharmaceutical Industries | 1901 | North Wales, PA | – | – | – | – | – |

| Catalent, Inc. | 2007 | Tampa, FL | – | – | – | – |

USA Oral Drug Solutions Market Analysis

Key Growth Drivers

Rising prevalence of chronic diseases

In the U.S., 76.4 % of adults (representing about 194 million individuals) reported at least one chronic condition in 2023, and 51.4 % (approximately 130 million) reported having multiple chronic conditions. Chronic diseases such as cardiovascular disease, diabetes and chronic kidney disease impose extensive ongoing medication regimens, increasing demand for patient-friendly oral dosage formats such as liquid solutions rather than only tablets. Moreover, chronic disease management accounts for roughly 90 % of the U.S. total annual health-care expenditure (~US $4.1 trillion) according to one source. This high burden of chronic disease drives growth in oral drug-liquid formats, especially when patients require long-term therapy, dose flexibility or difficulty swallowing solids.

Increased paediatric / geriatric oral liquid use & shift from solid dosage for dysphagia patients

In the elderly population, swallowing disorders or dysphagia are common and complicate solid-dose medication adherence. Studies indicate that among hospitalized older adults with dementia and suspected dysphagia (mean age ~85.7 years), use of thick/modified liquids is common. In addition, in the U.S. population, children and older adults often require taste-masked liquid formulations for antibiotics, antiseizure drugs or chronic therapy. The combination of an ageing population and paediatric care demand increases the appeal of oral drug solutions. With higher prevalence of multiple chronic conditions in older adults (78.8 % of older adults had two or more chronic conditions in 2023), the need for easier-to-administer liquid oral medications becomes more pronounced, thereby driving growth in the oral drug solutions market.

Key Market Challenges

Formulation stability

Oral liquid drug solutions present formulation-engineering challenges including hydrolytic degradation, microbial contamination, sensitivity to excipients, and the need for preservatives or special packaging. While solid dosage forms are typically more stable, liquids necessitate more robust stability studies. This elevated requirement increases development and manufacturing costs and can slow time-to-market. For example, the U.S. regulatory guidelines for non-sterile liquids require stringent microbial and preservative efficacy testing.

Taste-masking and cost burdens

Liquid medications, particularly for paediatric and geriatric populations, often require taste-masking technologies (e.g., ion-exchange resins, coating microparticles, flavour systems) which add formulation complexity and cost. These additional steps increase the unit cost of production compared with conventional solid oral forms. The increased cost burden may make generics or low-cost producers less able to compete and can act as a barrier for some entrants.

Opportunities

Innovation in oral spray/solution forms

There is an opportunity for formulation innovation beyond classic oral syrups or suspensions, including oral sprays, self-microemulsifying solutions, and novel fixed-dose combination liquids. As patients increasingly seek convenience and dose-flexibility, liquid oral solutions with improved bioavailability and ease-of-administration can capture incremental value. The rise in digital health and patient-centric formulations further supports this trend.

Paediatric and geriatrics formulation expansion

The paediatric and geriatric sub-populations are growth hot-spots for oral drug solutions. Children often require liquid dosage forms due to swallowing limitations, and older adults frequently face dysphagia or polypharmacy requiring dose flexibility. Developing tailored formulations (e.g., taste-masked paediatric syrups, geriatrics friendly drops) can unlock growth. Coupled with favourable regulatory incentives for paediatric formulations from the U.S. FDA, this represents a significant opportunity.

Future Outlook

Over the next six years, the U.S. Oral Drug Solutions Market is expected to experience steady expansion driven by ageing demographics, growth of paediatric formulations, and the surge in chronic-disease management therapies that require patient-friendly liquid dosage forms. Increased investments by CDMOs in taste-masking and stabilisation technologies will enhance outsourcing adoption among branded and generic drug developers. Additionally, FDA’s emphasis on paediatric labelling and reformulation incentives under the Best Pharmaceuticals for Children Act (BPCA) will continue to stimulate R&D investments. Integration of digital quality control and automated fill-finish will further optimise productivity across large-scale facilities.

Major Players

- Pfizer Inc.

- Johnson & Johnson

- Abbott Laboratories

- Teva Pharmaceutical Industries Ltd.

- Catalent Inc.

- GlaxoSmithKline plc (GSK)

- Novartis AG

- Sanofi S.A.

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Reddy’s Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Amneal Pharmaceuticals Inc.

- Mylan N.V. (Viatris)

- Aenova Group

Key Target Audience

- Pharmaceutical manufacturing companies

- CDMOs (Contract Development & Manufacturing Organizations)

- Investments and Venture Capitalist Firms

- Hospital Pharmacy Procurement Departments

- Retail Pharmacy Chains and Distributors

- Paediatric and Geriatric Healthcare Product Developers

- Government and Regulatory Bodies (e.g., U.S. Food and Drug Administration – CDER)

- Healthcare Insurers and Pharmacy Benefit Managers (PBMs)

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping the complete ecosystem of the U.S. oral drug solutions market, including manufacturers, CDMOs, distributors, and patient segments. Extensive desk research and industry databases were used to determine critical variables like product type, dosage form, and regulatory requirements.

Step 2: Market Analysis and Construction

Historical data on product volume, therapeutic applications, and distribution trends were analysed to establish market structure. Financial reports and FDA drug approval data were integrated to assess active formulation pipelines and revenue streams.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on growth drivers, format preferences, and outsourcing patterns were validated through telephonic interviews with pharma R&D leaders and formulation scientists. Their feedback provided ground-level insights into production capacity and cost barriers.

Step 4: Research Synthesis and Final Output

The final phase synthesised secondary research and expert insights into a validated bottom-up model for market estimation and forecast. Each finding was benchmarked against industry and regulatory data to ensure comprehensive and accurate analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach [by value $/unit volume/average price], Consolidated Research Approach, Primary Research Interviews & Expert Validation, Limitations & Future Research Directions)

- Definition and Scope of “oral drug solutions”

- Historical Genesis and Evolution of the segment

- Business Cycle and Market Life-Cycle Stage

- Supply Chain & Value Chain Analysis

- Regulatory Framework & Reimbursement Landscape

- Key Technological Enablers & Formulation Innovations

- Growth Drivers

Rising prevalence of chronic diseases

Increased paediatric/geriatric oral liquid use

Shift from solid dosage for dysphagia patients - Market Challenges

Formulation stability

Taste-masking cost

Regulatory burdens for liquid oral dosage, competition from solid forms - Opportunities

Innovation in oral spray/solution forms

Paediatric and geriatrics formulations

Outsourcing/CDMO growth - Emerging Trends

Flavour-masking technologies

Dose-flexibility

Patient-centric formulations

E-commerce growth for oral solutions - Regulatory & Reimbursement Considerations

FDA guidances for paediatric liquids

Bioequivalence of generics

Medicaid/Medicare coverage - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value (US $/year), 2019-2024

- By Volume (litres/millilitres or dose units), 2019-2024

- By Average Selling Price (US $/mL or per dose), 2019-2024

- Historic Trend (base-year to current) and Year-on-Year growth, 2019-2024

- By Product Type (in value %):

Ready-to-use oral solutions

Oral suspensions

Oral drops

Oral emulsions/microemulsions

Oral reconstitutable solutions - By Therapeutic Application (in value %):

Infectious diseases (antibiotics/antivirals)

Central nervous system (CNS) disorders

Cardiovascular/metabolic (liquid formulations)

Gastrointestinal & hepatic disorders

Paediatric & geriatrics special care solutions - By Distribution Channel (in value %):

Hospital pharmacies & institutional healthcare

Retail pharmacies

Online pharmacies / e-commerce - By End-User / Administration Setting (in value %):

Home-care/self-medication

Outpatient clinical settings

In-hospital inpatient use - By Region / Geography within USA (in value %):

Northeast

Midwest

South

West

- Market Share of Key Players by Value/Volume (latest available year)

Cross-Comparison Parameters: (Company Overview, Business Strategy, Recent Product Launches, Strengths, Weaknesses, Manufacturing Footprint & Capacity, Pipeline of Oral Solutions, Revenues from Oral Solutions, Generic vs Branded Mix, Contract Manufacturing Partnerships) - SWOT Profile of Major Players

- Company Profiles of Major Players:

Pfizer Inc.

BristolMyers Squibb Company

Johnson & Johnson

Roche Holding AG

Novartis AG

GlaxoSmithKline plc

Sanofi S.A.

AbbVie Inc.

Mylan N.V.

Catalent Inc.

Thermo Fisher Scientific Inc.

Fresenius Kabi AG

Teva Pharmaceutical Industries Ltd.

Dr. Reddy’s Laboratories Ltd.

Hikma Pharmaceuticals PLC

- Demand & Utilisation Patterns

- Budget Allocations & Purchasing Behaviour

- Regulatory/Compliance Impact

- Patient Needs, Pain Points & Unmet Needs

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030