Market Overview

As of 2024, the USA otoscopes market is valued at USD ~ million, with a growing CAGR of 3.5% from 2024 to 2030. This growth is driven by increased awareness and the need for regular ear examinations, alongside technological advancements that enhance diagnostic capabilities. The market has experienced steady growth in recent years, fueled by factors such as telemedicine and home healthcare solutions, which continue to expand access to otoscopic evaluations.

Key states dominating the market include California, Texas, and New York due to their large healthcare infrastructures and the presence of significant medical facilities, particularly ENT clinics and hospitals. These states account for high patient volumes and showcase a commitment to advanced healthcare solutions, creating a robust environment for the adoption of modern otoscopic devices.

Market Segmentation

By Product Type

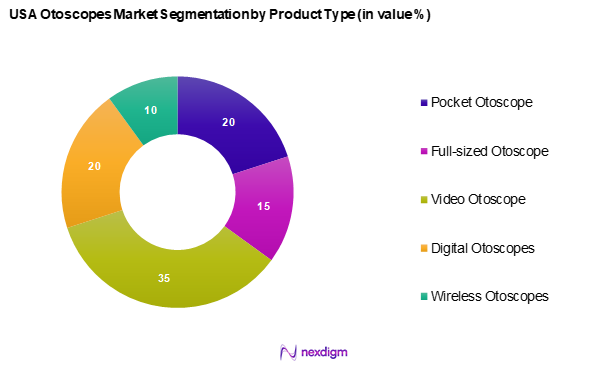

The USA otoscopes market is segmented into pocket otoscopes, full-sized otoscopes, video otoscopes, digital otoscopes, and wireless otoscopes. Currently, the video otoscope segment dominates the market due to its superior imaging capabilities and enhanced patient diagnosis experiences. These devices provide high-definition visuals, allowing healthcare professionals to assess ear conditions more accurately and communicate effectively with patients. As telehealth and educational needs rise, video otoscopes are increasingly favored for their ability to facilitate remote consultations and better patient understanding.

By End User

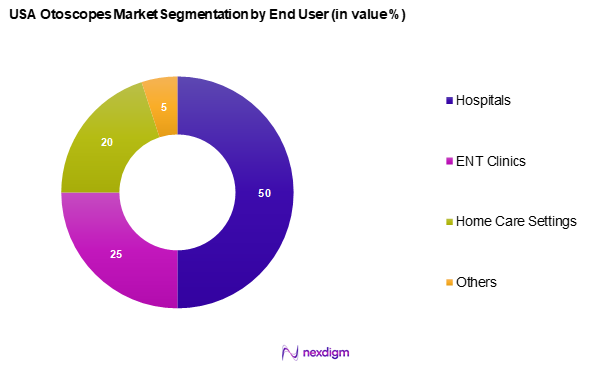

The USA otoscopes market is segmented into hospitals, ENT clinics, home care settings, and others. Hospitals hold a dominant share, driven by their extensive patient base and the integration of advanced medical technologies into their diagnostic procedures. The reliance on accurate and efficient ear examination tools to maintain patient care quality and improve outcomes makes hospitals the largest consumers of otoscopes. Moreover, the growing number of diagnostic procedures taking place in hospital settings further supports this market segment’s growth.

Competitive Landscape

The USA otoscopes market is dominated by several major players, including orlvision GmbH, INVENTIS s.r.l., Prestige Medical, American Diagnostic Corporation, and GF Health Products, Inc. This consolidation highlights the significant influence of these key companies, who set trends in technology and pricing strategies.

| Company Name | Establishment Year | Headquarters | Market Focus | Strengths | Weaknesses | Unique Value Proposition |

| orlvision GmbH | 2008 | Lahnau, Germany | – | – | – | – |

| INVENTIS s.r.l. | 2005 | Padova, Italy | – | – | – | – |

| Prestige Medical | 1936 | New York, USA | – | – | – | – |

| American Diagnostic Corporation | 1984 | New York, USA | – | – | – | – |

| GF Health Products, Inc. | 1946 | Georgia, USA | – | – | – | – |

USA Otoscopes Market Analysis

Growth Drivers

Increase in Prevalence of Ear Disorders

The rising occurrence of ear disorders across the U.S. is a key factor driving the demand for otoscopic devices. A significant portion of the population experiences hearing loss or other ear-related issues, leading to a growing need for regular ear examinations. The aging demographic, particularly older adults, is especially vulnerable to such conditions, further reinforcing the market’s expansion. With a continuous focus on early diagnosis and treatment, otoscopic devices have become essential tools in routine healthcare.

Technological Advancements in Otoscopic Devices

Innovations in otoscopic technology, such as digital otoscopes with high-definition imaging and wireless connectivity, are enhancing diagnostic capabilities. These advancements enable healthcare professionals to capture and analyze ear conditions more effectively while facilitating seamless consultations with specialists. The integration of artificial intelligence in otoscopic devices is also improving diagnostic accuracy and efficiency. As technology continues to evolve, these innovations are expected to play a crucial role in transforming ear healthcare.

Market Challenges

High Cost of Advanced Otoscopes

The expense associated with advanced otoscopic devices poses a challenge to broader adoption, particularly for smaller medical practices and clinics. With healthcare costs on the rise, many providers opt for more affordable alternatives, limiting the widespread implementation of technologically advanced otoscopes. Budget constraints in hospitals and healthcare facilities also impact purchasing decisions, affecting market penetration of high-end devices.

Limited Awareness among Medical Practitioners

Despite the availability of advanced otoscopic technology, a gap in awareness and training among healthcare providers hinders its full adoption. Many primary care practitioners still rely on traditional methods due to a lack of familiarity with newer digital tools. Regional disparities in access to training and resources further contribute to the underutilization of advanced otoscopes, particularly in rural areas. Addressing this issue through targeted education and training programs could enhance market growth.

Opportunities

Growth of Telemedicine

The expansion of telemedicine presents a major opportunity for the otoscope market. Digital otoscopes are increasingly being integrated into telehealth platforms, enabling remote diagnosis of ear conditions. This is particularly beneficial for patients in underserved areas, where access to specialized care may be limited. The growing acceptance of virtual healthcare solutions underscores the potential for otoscopic devices to become an integral part of remote consultations.

Expanding Geriatric Population

The aging population and its increasing healthcare needs are creating new growth avenues for the otoscope market. Older adults are more susceptible to ear disorders, necessitating frequent screenings and medical check-ups. With healthcare policies emphasizing preventive care for seniors, there is a growing demand for diagnostic tools that cater to this demographic. As healthcare facilities adapt to meet the needs of an aging society, the adoption of otoscopic devices in routine examinations is expected to rise.

Future Outlook

Over the next five years, the USA otoscopes market is expected to show significant growth, driven by advancements in otoscopic technology, increasing awareness of ear health, and the integration of telemedicine. The demand for remote consultation and patient education further propels market dynamics, as providers look to enhance diagnostic capabilities and accessibility. Trends such as the rising geriatric population and a focus on home healthcare are also set to influence the market positively.

Major Players

- orlvision GmbH

- INVENTIS s.r.l.

- Prestige Medical

- American Diagnostic Corporation

- GF Health Products, Inc.

- WA Warehouse

- HEINE Optotechnik GmbH & Co. KG

- Midmark Corporation

- Halma PLC

- Olympus America

- 3M

- Others

Key Target Audience

- Healthcare Providers

- Private Clinics

- Medical Equipment

- Manufacturers

- Government and Regulatory Bodies (e.g., FDA, CDC)

- Healthcare Distributors

- Insurance Companies

- Investments and Venture Capitalist Firms

- Research Organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA otoscopes market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as market trends, competitive landscape, and consumer behaviour.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA otoscopes market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates, which are vital for understanding market growth and potential areas for expansion.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through computer-assisted telephone interviews (CATIs) with industry experts representing diverse companies within the sector. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data and identifying emerging trends.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple otoscope manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA otoscopes market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increase in Prevalence of Ear Disorders

Technological Advancements in Otoscopic Devices - Market Challenges

High Cost of Advanced Otoscopes

Limited Awareness among Medical Practitioners - Opportunities

Growth of Telemedicine

Expanding Geriatric Population - Trends

Rising Demand for Home Healthcare Solutions

Increased Adoption of Mobile Health Applications - Government Regulation

FDA Device Regulations

Safety Standards for Medical Devices - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type, (In Value %)

Pocket Otoscope

Full-sized Otoscope

Video Otoscope

Digital Otoscopes

Wireless Otoscopes - By End User, (In Value %)

Hospitals

ENT Clinics

Home Care Settings

Others - By Application, (In Value %)

ENT Examination

Hearing Assessment

Patient Education - By Distribution Channel, (In Value %)

Offline Sales

Online Sales - By Region, (In Value %)

West Coast

East Coast

Midwest

South

Mountain States

- Market Share of Major Players On The Basis of Value/Volume

Market Share of Major Players by Type of Otoscopes Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Strengths, Weaknesses, Organizational Structure, Revenues, Production Capacity, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Based on SKUs for Major Players

- Detailed Profiles of Major Companies

orlvision GmbH

INVENTIS s.r.l.

Prestige Medical

American Diagnostic Corporation

GF Health Products, Inc.

WA Warehouse

HEINE Optotechnik GmbH & Co. KG

Midmark Corporation

Halma PLC

Olympus America

3M

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030