Market Overview

USA Patient-Provider Communication Platforms Market is valued at USD ~ billion. The market scale is anchored in the structural digitization of front-end healthcare operations, where communication platforms act as the operating layer connecting scheduling, clinical engagement, follow-ups, and administrative coordination. Structural demand is driven by the expansion of outpatient care, shortened inpatient stays, and the rising complexity of care coordination across fragmented delivery settings. Providers increasingly depend on automated reminders, secure messaging, and virtual interaction tools to reduce no-show rates, manage care transitions, and improve staff productivity. Value-based care models further reinforce demand, as patient engagement, continuity, and documentation are now tied to clinical and financial outcomes. These platforms have shifted from optional engagement tools to mission-critical infrastructure embedded within daily provider workflows.

Adoption is concentrated in the Northeast, West Coast, and large Southern healthcare hubs due to dense hospital networks, higher provider consolidation, and stronger health IT spending capacity. States with large integrated delivery networks dominate usage as standardized communication platforms enable system-wide coordination at scale. These regions also benefit from higher digital literacy and patient expectations for app-based interactions. Vendor influence reflects a mix of domestic incumbents deeply embedded in electronic health record ecosystems and global enterprise software firms providing cloud, CRM, and AI capabilities. Domestic vendors dominate clinical workflow integration, while global technology players shape analytics, automation, and omnichannel orchestration capabilities.

Market Segmentation

By Platform Type

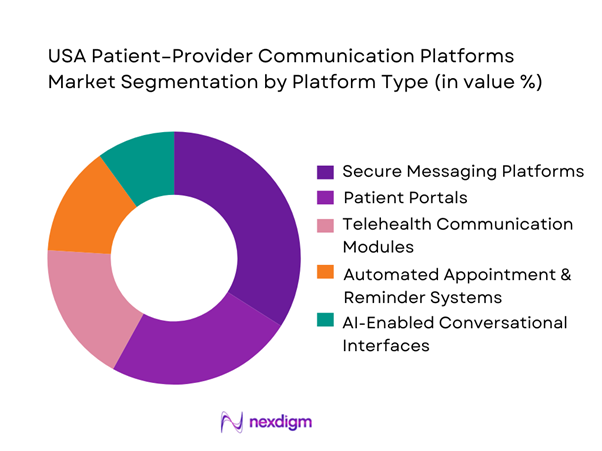

The USA patient–provider communication platforms market is segmented by platform type into secure messaging platforms, patient portals, telehealth communication modules, automated appointment and reminder systems, and AI-enabled conversational interfaces. Secure messaging platforms hold the dominant market share due to their widespread deployment across hospitals and physician practices for clinical queries, follow-ups, and care coordination. Their dominance is supported by integration with EHR systems, ability to replace unsecured communication channels, and strong compliance alignment. Secure messaging reduces administrative overhead, enhances provider responsiveness, and improves patient satisfaction across high-volume outpatient environments, making it the most utilized communication format.

By End User

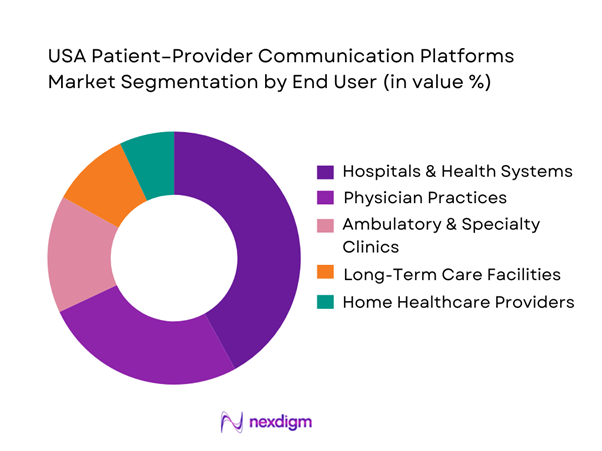

The market is segmented into hospitals & health systems, physician practices, ambulatory & specialty clinics, long-term care facilities, and home healthcare providers. Hospitals and health systems dominate market share due to large patient volumes, complex communication needs, and enterprise-wide deployment of engagement platforms. These organizations require scalable communication tools for appointment coordination, discharge communication, medication adherence, and care navigation. Their purchasing power, bundled IT budgets, and emphasis on patient experience metrics drive higher adoption compared to smaller care settings, reinforcing their leadership within the market.

Competitive Landscape

The USA Patient-Provider Communication Platforms market is dominated by a few major players, including Epic Systems and global or regional brands like Oracle Health, Salesforce Health Cloud, and athenahealth. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | Deployment Model | Core Focus | Integration Capability | Compliance Coverage | Target End Users |

| Epic Systems | 1979 | Wisconsin | ~ | ~ | ~ | ~ | ~ |

| Oracle Health (Cerner) | 1979 | Missouri | ~ | ~ | ~ | ~ | ~ |

| Salesforce Health Cloud | 1999 | California | ~ | ~ | ~ | ~ | ~ |

| Athenahealth | 1997 | Massachusetts | ~ | ~ | ~ | ~ | ~ |

| TigerConnect | 2010 | California | ~ | ~ | ~ | ~ | ~ |

USA Patient-Provider Communication Platforms Market Analysis

Growth Drivers

Expansion of outpatient and ambulatory care delivery

The shift of care delivery from inpatient hospitals to outpatient clinics and ambulatory centers is a foundational growth driver for patient-provider communication platforms. As encounter volumes increase outside hospital walls, providers must sustain continuous communication before, during, and after visits to maintain care quality and operational efficiency. Appointment coordination, pre-visit instructions, post-visit follow-ups, and medication adherence all rely on scalable communication infrastructure. Manual phone-based workflows are increasingly unsustainable due to staffing constraints and rising patient volumes. Communication platforms automate large portions of these interactions, reducing administrative burden while improving patient responsiveness. As outpatient models continue to expand across specialties, demand for robust, integrated communication platforms strengthens proportionally.

Digital front door and patient experience transformation

Healthcare organizations are investing heavily in digital front door strategies to streamline access and enhance patient experience across the care journey. Patient-provider communication platforms serve as the connective tissue that enables online scheduling, digital intake, reminders, and two-way engagement. Consumer expectations shaped by retail and financial services have transferred into healthcare, making timely digital communication a baseline requirement rather than a differentiator. Providers deploy these platforms to improve access, reduce friction, and maintain brand loyalty in competitive local markets. The emphasis on experience metrics and service accessibility directly accelerates adoption and platform expansion across enterprise provider systems.

Challenge

Clinical workflow disruption and integration complexity

Despite strong demand, integration into existing clinical workflows remains a critical challenge. Many providers operate fragmented IT environments with legacy scheduling, billing, and clinical systems that do not natively align with modern communication platforms. Poorly integrated tools can increase clinician workload, duplicate documentation, and create parallel workflows that undermine efficiency gains. Clinician resistance emerges when communication tools are perceived as additional tasks rather than embedded productivity enablers. Achieving seamless interoperability with electronic health records and care management systems requires time, technical resources, and organizational change management, slowing adoption in resource-constrained provider settings.

Data privacy, consent, and compliance burden

Patient-provider communication platforms operate under strict regulatory requirements governing data security, patient consent, and information access. Ensuring compliant messaging, secure storage, auditability, and identity verification adds operational and technical complexity for both vendors and providers. Missteps in communication compliance expose organizations to legal, financial, and reputational risk, increasing procurement scrutiny and elongating sales cycles. Smaller providers often lack internal expertise to confidently manage these requirements, creating hesitation in platform adoption. Compliance obligations therefore act as both a barrier to entry and a cost driver, particularly for multi-channel and mobile-first communication solutions.

Opportunity

AI-driven automation and intelligent engagement

Artificial intelligence presents a major opportunity to transform patient-provider communication from reactive messaging into proactive engagement. AI-driven routing, automated triage, predictive reminders, and conversational assistants can significantly reduce staff workload while improving response times and patient satisfaction. Intelligent automation enables providers to scale engagement without proportional increases in administrative staffing. As workforce shortages intensify, AI capabilities become a decisive procurement criterion. Platforms that embed intelligence directly into communication workflows are positioned to capture incremental value and expand enterprise adoption across care settings.

Omnichannel orchestration across the care continuum

Providers increasingly seek unified platforms capable of orchestrating messaging, voice, video, and notifications within a single operational framework. Omnichannel communication allows organizations to meet patients on preferred channels while maintaining centralized governance, analytics, and documentation. This capability is especially valuable for managing diverse patient populations and chronic care pathways requiring frequent touchpoints. Vendors that deliver seamless channel integration with consistent user experience gain competitive advantage. As care delivery becomes more distributed, omnichannel orchestration represents a key growth vector for platform expansion and differentiation.

Future Outlook

The USA Patient-Provider Communication Platforms market is expected to evolve toward deeply integrated, intelligence-driven engagement layers embedded across healthcare delivery. Platforms that combine secure communication, automation, analytics, and interoperability will be best positioned to support care coordination, operational efficiency, and patient experience objectives as healthcare delivery continues to decentralize and digitize.

Major Players

- Epic Systems

- Oracle Health

- Salesforce Health Cloud

- Athenahealth

- Veradigm

- Luma Health

- Relatient

- OhMD

- TigerConnect

- PerfectServe

- Artera

- Updox

- PatientPop

Key Target Audience

- Hospitals and integrated delivery networks

- Physician groups and specialty clinics

- Ambulatory and outpatient care providers

- Payers and managed care organizations

- Digital health solution providers

- Healthcare IT system integrators

- Investments and venture capitalist firms

- Government and regulatory bodies (United States)

Research Methodology

Step 1: Identification of Key Variables

Market scope, care settings, communication modalities, deployment models, and buyer segments were defined to establish analytical boundaries.

Step 2: Market Analysis and Construction

Demand drivers, usage patterns, and value attribution logic were assessed across healthcare delivery environments within the United States.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through structured expert inputs across provider, vendor, and industry stakeholder perspectives.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a coherent market model with integrated qualitative and quantitative insights.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Patient Communication Usage and Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- USA Healthcare Delivery Architecture

- Growth Drivers

Rising outpatient care volumes

Shift toward value-based care coordination

Digital front door expansion across providers

Patient experience and access mandates

Care team productivity optimization - Challenges

Clinical workflow integration complexity

Data privacy and security compliance burden

Fragmented IT landscapes across providers

Staff adoption resistance and training gaps

Reimbursement alignment uncertainty - Opportunities

AI-driven patient engagement automation

Omnichannel communication orchestration

Integration with population health programs

Personalized outreach for chronic care

Scalable solutions for mid-sized providers - Trends

Increased use of asynchronous communication

Mobile-first patient engagement strategies

Automation of appointment and follow-up flows

Integration with remote monitoring ecosystems

Analytics-driven patient communication optimization - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Revenue, 2019–2024

- By Active Provider Licenses, 2019–2024

- By Patient Touchpoints Enabled, 2019–2024

- By Care Setting (in Value %)

Hospitals

Physician Groups and Clinics

Ambulatory and Outpatient Centers

Long-Term and Post-Acute Care

Home Health Agencies - By Communication Modality (in Value %)

Secure Messaging

Voice and IVR

Video Consult and Virtual Visits

Email and Asynchronous Messaging

Automated Reminders and Notifications - By Technology / Platform Type (in Value %)

Standalone Communication Platforms

EHR-Integrated Communication Modules

Mobile-First Patient Engagement Apps

Contact Center and Call Management Systems

AI-Enabled Conversational Platforms - By Deployment / Delivery Model (in Value %)

Cloud-Based

On-Premise

Hybrid - By End-Use Customer Type (in Value %)

Integrated Delivery Networks

Independent Hospitals

Multi-Specialty Physician Groups

Payers and Managed Care Organizations

Digital Health Providers - By Region (in Value %)

Northeast

Midwest

South

West

- Competition ecosystem overview

- Cross Comparison Parameters (interoperability with EHR systems, HIPAA compliance depth, omnichannel coverage, scalability across care settings, analytics and reporting capability, AI automation maturity, implementation timeline, total cost of ownership, customer support model)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Epic Systems

Oracle Health

Salesforce Health Cloud

athenahealth

Veradigm

Luma Health

Relatient

OhMD

TigerConnect

PerfectServe

Artera

Twilio Segment

Updox

PatientPop

Spruce Health

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Revenue, 2025–2030

- By Active Provider Licenses, 2025–2030

- By Patient Touchpoints Enabled, 2025–2030