Market Overview

The pharmaceutical labelling space in the US sits inside a global pharmaceutical label market valued at about USD ~ billion, up from roughly USD ~ billion one period earlier, reflecting sustained growth in regulated, information-dense labelling. Label demand tracks rising US medicine spending, which IQVIA estimates at USD ~ billion in net manufacturer prices, with total US pharmaceutical sales now in the USD ~billion band, driven by specialty drugs and an aging population.

Within the USA Pharmaceutical labelling Market, demand is concentrated in states that dominate prescription drug spend and biopharma manufacturing. Definitive Healthcare data shows that Texas, California, New York and Florida together account for nearly a third of total US prescription drug spend, reflecting dense populations, specialty care hubs and large hospital systems. US medicine sales of over USD ~ billion, far ahead of the next market, China at about USD ~ billion, reinforcing the USA’s leadership in innovative therapies that require complex, multi-panel and serialized labels. Clustered biopharma corridors (Northeast, California, Midwest) therefore anchor label demand due to high volumes of branded, specialty and clinical-trial products.

Market Segmentation

By Label Type

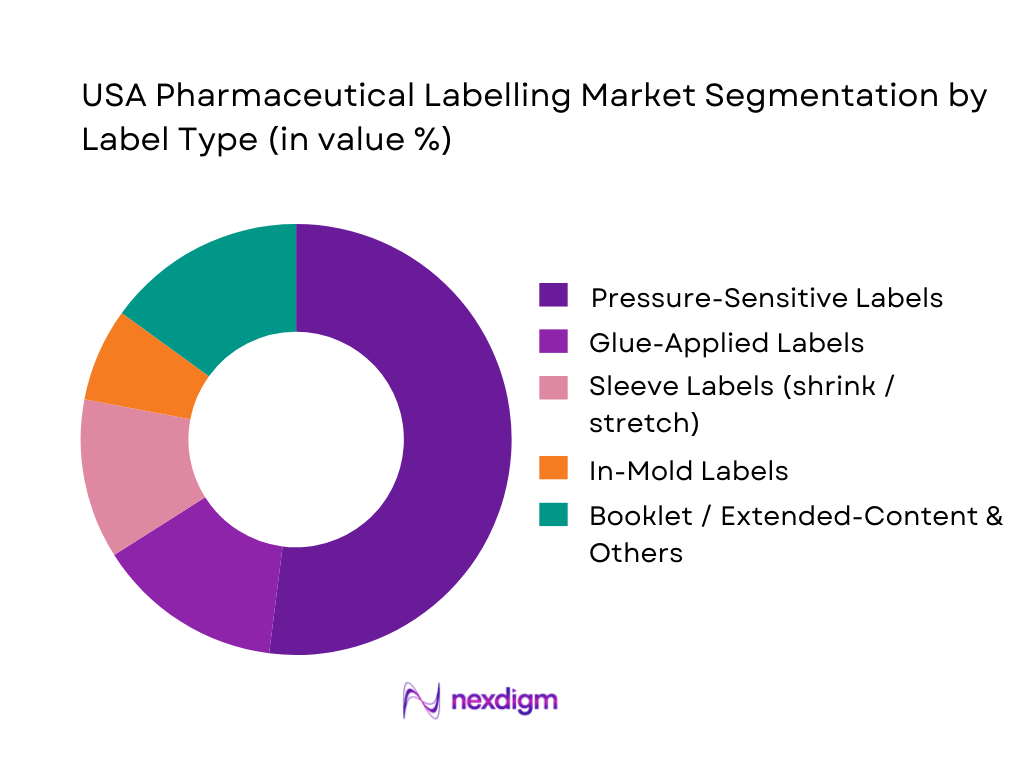

Global studies confirm that pressure-sensitive labels are the dominant label type in pharmaceutical labeling, ahead of glue-applied, sleeve and in-mold formats. In the USA Pharmaceutical Labeling Market, pressure-sensitive labels lead because they support high-speed application on vials, bottles, pre-filled syringes and pens, offer excellent printability for dense regulatory copy, and integrate easily with DSCSA-compliant barcodes and 2D codes. Their flexibility across primary packages (glass, polymer, aluminum) and ability to incorporate tamper-evidence, RFID and variable data make them the default for innovators, generics and CDMOs. Sleeve and booklet labels grow fastest in injectables and specialty biologics, but from a smaller base, while glue-applied and in-mold solutions are niche, focused on large containers and OTC packs.

By Application

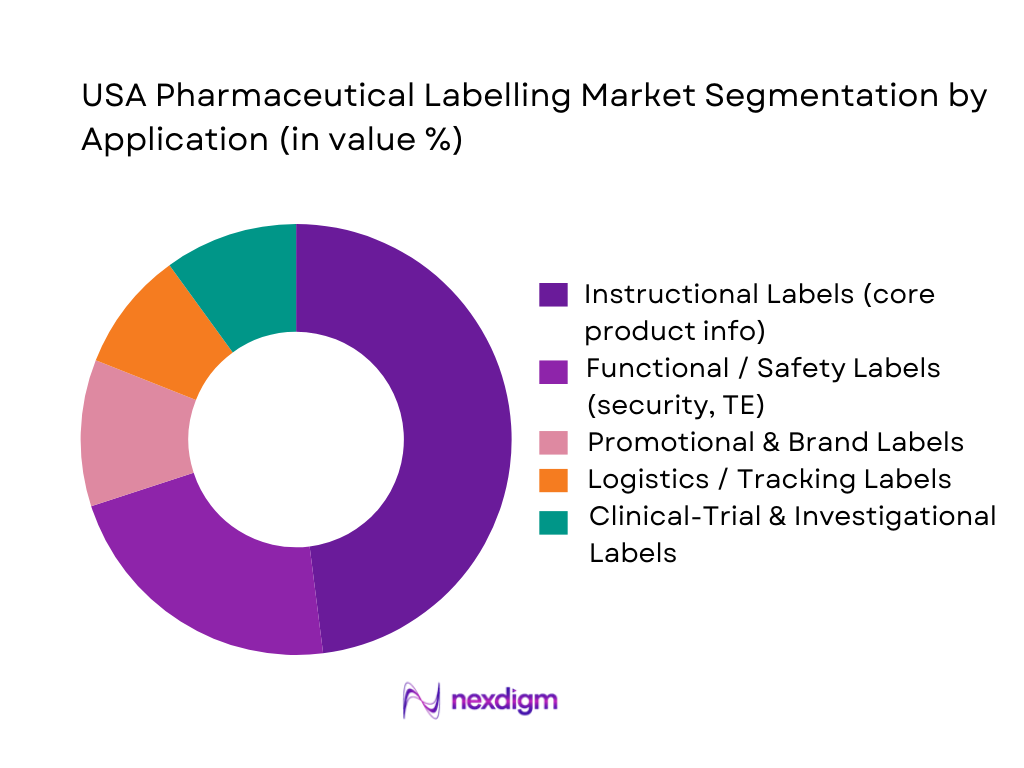

Global pharma labelling studies segment applications into instructional, decorative, functional and promotional labels, with instructional content representing the core of pharma labelling. In the USA Pharmaceutical labelling Market, instructional labels dominate because US FDA rules demand detailed dosing, warnings, black-box statements and risk-management content on virtually every package. DSCSA and FDA guidance also drive the use of functional and safety labels (tamper-evident, anti-counterfeit, temperature-sensitive), but these build on an instructional base rather than displacing it. Promotional and brand labels matter in OTC and DTC-promoted categories, while specialized clinical-trial labels (randomization, blinding, multi-language content) see strong demand from US-led global studies, yet remain a smaller share in value terms compared with commercial instructional labels.

Competitive Landscape

The USA Pharmaceutical labelling Market is supplied by a mix of global packaging majors and specialist healthcare converters. Global leaders in labels such as Avery Dennison, CCL Industries and Multi-Color Corporation (MCC) operate extensive US footprints and dedicate entire business units to pharmaceutical and healthcare labels. Specialist firms such as Nosco and Schreiner MediPharm focus on high-complexity formats—booklet, tamper-evident, needle-safety and smart labels for injectables and devices. Competition revolves around DSCSA-ready serialization, print quality for small fonts, regulatory change agility, and innovation in security, RFID and sustainability rather than just price per thousand labels.

| Company | Establishment Year | Headquarters (Group) | Pharma / Healthcare Label Focus (USA) | Key Pharma Segments Served (USA) | Label Technologies Portfolio | DSCSA / Serialization & Security Capabilities | North America Footprint & Reach | Sustainability / Material Innovation Focus |

| Avery Dennison | 1935 | Mentor, Ohio / Glendale, California, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| CCL Industries (CCL Healthcare) | 1951 | Toronto, Canada / Framingham, MA, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Multi-Color Corporation (MCC) | 1916 | USA (HQ in Cincinnati/Atlanta region) | ~ | ~ | ~ | ~ | ~ | ~ |

| Nosco | 1906 | Pleasant Prairie, Wisconsin, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Schreiner MediPharm (Schreiner Group) | 1951 | Oberschleissheim, Germany; US operations in Blauvelt, NY | ~ | ~ | ~ | ~ | ~ | ~ |

USA Pharmaceutical Labelling Market Analysis

Growth Drivers

DSCSA Track-and-Trace and Unit-Level Serialization

The Drug Supply Chain Security Act is pushing U.S. pharmaceutical labelling toward unit-level serialization and interoperable electronic tracing at the package level, with full traceability requirements coming into force for trading partners after the 2023 interoperability milestone. FDA guidance now expects electronic, package-level transaction data to accompany every saleable unit across a drug supply chain that moves roughly 92% of prescription volumes through wholesalers and three dominant distributors. This wholesale channel structure means serialization and labelling standards must scale to billions of packages within a health system spending about USD ~ trillion annually, with retail prescription drugs the fastest-growing component of national expenditure.

Expansion of Biologics, Injectables and Specialty Drugs

The labelling workload in the USA pharmaceutical labelling market is increasingly driven by biologics, complex injectables and hospital-administered specialty drugs. Health policy analysis shows the expenditure share of traditional small-molecule drugs in the U.S. fell from 69 to 59 over a five-year window ending in 2022, with the balance shifting toward biologic products and other advanced therapies that typically demand more complex carton, vial and device labelling, including multiple panels and language for risk evaluation. In parallel, FDA’s drug evaluation center cleared 55 novel drugs in a single recent year, a portfolio that includes gene-targeted oncology agents, autoimmune biologics, and other specialty classes that must all comply with increasingly detailed container and carton labelling guidance focused on medication-error reduction and device–drug combination clarity.

Market Challenges

Regulatory Interpretation and Change-Management Complexity

The regulatory environment for the USA pharmaceutical labelling market is shaped by overlapping statutes and guidance documents that evolve rapidly. The DSCSA alone has generated multiple guidance texts, pilot programs and public meetings as the FDA moves industry toward interoperable, electronic, package-level tracing across a distribution chain in which about 92 of every 100 prescriptions pass through wholesalers. At the same time, national health spending reached roughly USD ~ trillion in a recent year, with prescription drugs accounting for the fastest growth in expenditure, driving sustained pressure from programs like Medicare’s negotiation initiative and employer-sponsored coverage reporting rules. Each wave of policy activity, from inflation-linked drug reforms to Part D redesign, triggers complex cascades of label updates, PI revisions and packaging-code changes, forcing manufacturers and their labelling vendors to maintain regulatory intelligence and change-control systems robust enough to handle dozens of concurrent projects without error.

Artwork Errors, Recalls and Documentation Burden

Labelling and packaging remain critical contributors to medication errors and recalls, intensifying documentation burdens in the USA pharmaceutical labelling market. FDA guidance referencing national patient-safety studies notes that labelling and packaging issues have been implicated in roughly 33 of every 100 reported medication errors and around 30 of every 100 fatalities from medication errors in a large error-reporting dataset. More recent human-factors research similarly finds that about one-third of medication incidents can be traced to confusion over packaging and labelling. FDA’s pharmacovigilance summaries list “look-alike container labels that contribute to wrong-drug errors” among active safety signals under evaluation. High-profile recall announcements, including tablet-strength mix-ups and incorrect strength statements on outer cartons, illustrate how a single artwork error can trigger nationwide retrievals, each requiring complete trace documentation, relabelling plans, and extensive root-cause analysis across prepress, plate-making, print and inspection workflows.

Opportunities

Smart, Connected and RFID/NFC-Enabled Labels

Smart labelling represents one of the clearest future-growth avenues in the USA pharmaceutical labelling market. The U.S. health system’s scale—about USD ~ trillion in spending and more than USD 13,000 of health expenditure per person in a recent year—creates strong incentives to reduce waste, diversion and non-adherence through better tracking and patient engagement at the package level. DSCSA’s drive toward interoperable electronic, unit-level traceability coincides with Medicare’s focus on a small group of high-spend drugs, some of which absorb between USD ~ billion and USD ~ billion of annual program spending each, making even marginal improvements in adherence and supply-chain visibility financially material. Smart labels that embed RFID or NFC can link each pack to electronic health records, support automated verification at wholesaler and pharmacy points that already handle 92 of every 100 prescriptions, and enable real-time inventory and temperature-monitoring data streams. These capabilities tie directly into federal efforts to detect suspicious dispensing patterns and prevent look-alike/ sound-alike mis-fills, positioning connected labels as a compliance and risk-management tool rather than a discretionary add-on.

Sustainable Label Materials and De-Labelling Solutions

Sustainability requirements from regulators, payers and global brand owners are opening space for greener labelling solutions in the USA pharmaceutical labelling market. Per-capita spending on retail pharmaceuticals in the United States has reached about USD ~, more than double the OECD average of USD ~, anchoring a global supply chain that consumes large volumes of coated papers, films and release liners for primary packs, folding cartons and distribution labels. At the same time, PPI data show paperboard container indices around 150 on a 2011 base, signalling long-term upward pressure on fibre-based substrates that encourages down-gauging, recycled content and alternative fibres. U.S. health-system reforms aimed at reducing waste, coupled with extended-producer-responsibility discussions in several jurisdictions, are incentivising materials that can be cleanly removed from vials, syringes and blister cards to simplify recycling, and adhesives that release under standard de-labelling processes. For label converters and material suppliers, this creates an opportunity to differentiate with pharma-grade recyclable facestocks, wash-off adhesives and liner-reduction technologies that meet stringent legibility and durability requirements while supporting hospital sustainability metrics and manufacturer ESG targets across a high-value, heavily scrutinized supply chain.

Future Outlook

Over the next several years, the USA Pharmaceutical labelling Market is expected to expand steadily, underpinned by rising US medicine spend, a shift toward complex biologics and injectables, and full implementation of the Drug Supply Chain Security Act (DSCSA). US medicine spending at around USD ~ billion in net prices and projects it to approach USD ~ trillion in gross terms mid-decade, creating sustained volume and complexity for labels across channels. As packaging & labelling for US pharmaceuticals is forecast to grow at roughly 4.3% annually, the label subsegment should track or slightly outperform this baseline thanks to added value from security, RFID and smart features.

Major Players

- Avery Dennison Corporation

- CCL Industries Inc.

- Multi-Color Corporation

- Nosco, Inc.

- Schreiner MediPharm

- Amcor plc

- Berry Global Group, Inc.

- Gerresheimer AG

- WestRock Company

- Essentra plc

- 3M Company

- SATO Holdings Corporation

- Consolidated Label Co.

- Resource Label Group

Key Target Audience

- Innovator and Specialty Biopharmaceutical Manufacturers

- Generic Drug Manufacturers and ANDA-Focused Companies

- Contract Development and Manufacturing Organizations (CDMOs) and Contract Packaging Organizations (CPOs)

- Packaging & Label Converters and Pre-Press Solution Providers

- Pharmaceutical Supply-Chain and Serialization Technology Providers

- Hospitals, Integrated Delivery Networks (IDNs) and Specialty Pharmacies

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first phase involved mapping the USA Pharmaceutical labelling Market ecosystem across drug manufacturers, CDMOs, label converters, material suppliers, wholesalers, pharmacies and technology vendors. Extensive secondary research was conducted using paid and public databases, regulatory filings (FDA, DSCSA), IQVIA and EFPIA medicine-spending reports to identify the critical variables driving label demand—such as prescription volumes, biologics mix, serialization mandates, packaging formats and state-level prescription spend.

Step 2: Market Analysis and Construction

In this stage, we synthesized global pharmaceutical labelling and US pharmaceutical packaging & labelling market data from syndicated research providers and triangulated it with medicine-spending statistics for the US. We constructed a top-down view anchored on reported global and US packaging & labelling revenues, then derived the labelling subsegment using typical label-to-packaging cost ratios, DSCSA implementation intensity, and biologics share. This was cross-checked with bottom-up indicators such as label press installations, plant footprints and converter revenue disclosures.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on segment shares (by label type and application), growth hot spots (injectables, biologics, e-pharmacy) and competitive positioning were validated through structured interviews and virtual consultations with operations, regulatory and commercial leaders at converters, CDMOs and pharma manufacturers. These discussions focused on label SKU proliferation, print technology migration, serialization readiness, and the impact of DSCSA go-live on artwork, data carriers and inspection systems. Qualitative insights were used to calibrate segment-level growth assumptions and refine comparative positioning of key players.

Step 4: Research Synthesis and Final Output

Finally, we integrated quantitative and qualitative findings into a coherent narrative for the USA Pharmaceutical labelling Market. Segmental estimates were stress-tested against multiple scenarios (base, accelerated biologics uptake, delayed regulatory enforcement) to ensure internal consistency. The resulting market views prioritize directional accuracy and structural insight, while clearly distinguishing between reported figures and analytical estimates used to approximate label-only revenues within the broader US pharmaceutical packaging & labelling value chain.

- Executive Summary

- Research Methodology (Market Definitions and Scope, Abbreviations and Regulatory References, Market Sizing and Forecasting Approach, Consolidated Research Approach, Primary Research Approach, Secondary Research Approach, Assumptions and Scenario Framework, Study Limitations and Future Refinements)

- Definition and Scope

- Role of labelling within the Pharmaceutical Packaging Value Chain

- Evolution of Pharmaceutical labelling and Serialization in the US

- Regulatory and Compliance Landscape (FDA, DSCSA, USP, State Boards)

- Integration with Artwork Management, ERP, MES and LIMS Systems

- Growth Drivers

DSCSA Track-and-Trace and Unit-Level Serialization

Expansion of Biologics, Injectables and Specialty Drugs

Outsourcing to CDMOs, CMOs and Label/Artwork Specialists

E-Pharmacy, Mail-Order and Central-Fill Growth

Global Supply, Export-Oriented labelling Needs - Market Challenges

Regulatory Interpretation and Change-Management Complexity

Artwork Errors, Recalls and Documentation Burden

Capacity Bottlenecks for Specialty and Smart Labels

Raw-Material Volatility and Supply Risk

Talent and Skill Gaps in QA, Prepress and Serialization IT - Opportunities

Smart, Connected and RFID/NFC-Enabled Labels

Sustainable Label Materials and De-labelling Solutions

Late-Stage Customization and On-Demand Digital Printing

Clinical and Small-Batch Specialty labelling Niches

Value-Added Services - Trends

Migration from Paper to Filmic and Functional Constructions

Growth of Extended-Content and Multi-Panel Labels

Increasing Use of Vision Inspection, Camera Systems and 100% Verification

Integration of labelling with MES, Serialization and Warehouse Systems

Co-development Models between Pharma and Label Converters - Regulatory and Standards

- Value Chain and Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- Competition Ecosystem

- By Value, 2019-2024

- By Volume, 2019-2024

- Average Realization per Thousand Labels, 2019-2024

- labelling Spend per Thousand Prescriptions / Doses, 2019-2024

- Installed Printing and Converting Capacity Snapshot, 2019-2024

- By Label Format (in Value %)

Pressure-Sensitive Prime and Functional Labels

Booklet and Extended-Content Labels

Shrink Sleeves and Wrap-Around Labels

Smart and Connected Labels

Tamper-Evident, Void and Security Labels - By Application / Use Case (in Value %)

Prescription (Rx) Oral Solids and Liquids

Specialty Injectables and Biologics

Over-the-Counter and Consumer Health Products

Clinical Trial and Investigational Products

Medical Devices and Combination Products - By Printing and Coding Technology (in Value %)

Flexographic and Combination Conventional Printing

Digital Toner and Inkjet Label Printing

Thermal Transfer, Thermal Inkjet and Laser Coding

Hybrid Presses with In-line Finishing

Offline Serialization, Inspection and Re-Reeling Platforms - By Material and Adhesive System (in Value %)

Paper Labels

Filmic Labels – PP/PE/PET

Foil, Laminate and High-Barrier Constructions

Adhesive Chemistries

Inks, Varnishes and Functional Coatings - By Packaging Level (in Value %)

Primary Container Labels

Secondary Carton and Kit Labels

Tertiary Case and Pallet Labels

Ancillary and Flag Labels

Clinical and Hospital Pharmacy Labels - By End-User Type (in Value %)

Innovator and Branded Pharmaceutical Companies

Generic Drug Manufacturers

Biotech and Cell/Gene Therapy Sponsors

CDMOs / CMOs and Clinical-Packaging Providers

Hospital, IDN and Specialty Pharmacies

- By Region (in Value %)

Northeast

Midwest

South

West

- Market Share of Major Players on the Basis of Value and Volume

Market Share by Label Format

Market Share by End-User Segment - Cross Comparison Parameters (Company Overview, Pharma Label Portfolio Breadth, DSCSA & 21 CFR Compliance Capabilities, Digital & Variable-Data Printing Capability, Smart/RFID & Anti-Counterfeit Solutions, Clinical-Trial & Multi-Language Expertise, Sustainability & Low-Migration Material Profile, US Manufacturing Footprint & Pharma-Cluster Proximity, Value-Added Services and Technical Support)

- SWOT Analysis of Major Players

- Pricing and Commercial Model Analysis

- Detailed Profiles of Major Companies

CCL Industries / CCL Healthcare

Multi-Color Corporation

Avery Dennison

UPM Raflatac

WS Packaging Group

Nosco

Schreiner MediPharm

Resource Label Group

WestRock

Amcor

Berry Global

Gerresheimer

Cenveo

Zebra Technologies

- Demand and Utilization Patterns by End-User Cluster

- Procurement Practices and Budget Allocation

- Regulatory, QA and Validation Expectations

- Pain Point and Risk Analysis

- Decision-Making Process and Vendor Selection Criteria

- By Value, 2025-2030

- By Volume, 2025-2030

- Average Realization per Thousand Labels, 2025-2030

- labelling Spend per Thousand Prescriptions / Doses, 2025-2030

- Installed Printing and Converting Capacity Snapshot, 2025-2030