Market Overview

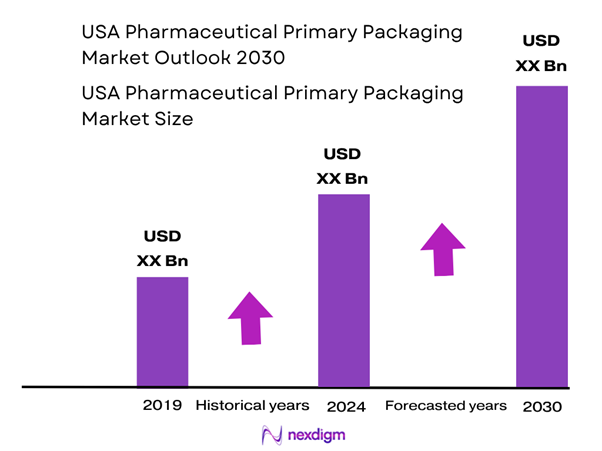

The USA pharmaceutical primary packaging market is valued at USD ~ million, based on the latest country-level estimate for the base year. This market value has been propelled by rising demand for biologics and injectables, growing serialization and tamper-evidence regulatory requirements, and an expansion of domestic pharmaceutical manufacturing and contract packaging operations in the country.

Within the USA, coastal and major biotech clusters such as the Northeast corridor (Massachusetts/New Jersey), the San Francisco Bay Area, and the Greater Philadelphia–Maryland region dominate the primary packaging market. The dominance is due to high concentrations of pharmaceutical and biopharmaceutical OEMs, contract manufacturing/packaging organisations (CMOs/CPOs), and strong supply chain infrastructure for packaging converters serving those hubs.

Market Segmentation

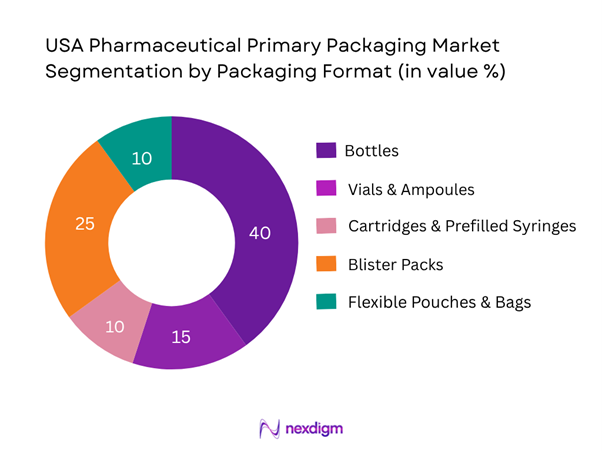

By Packaging Format

Within the USA primary pharmaceutical packaging market, the Bottles sub-segment is the largest contributor. This dominance is because a substantial portion of pharmaceuticals are produced and dispensed as oral solid dose forms (tablets, capsules) which utilize bottles as the primary container. Moreover, bottles offer cost efficiency, established processing lines, and compatibility with automation and high-volume filling, making them a preferred format for generics and mass-market drugs. As large pharmaceutical OEMs and contract packagers continue to scale production of high-volume, low-cost drugs in the USA, bottles continue to hold the majority share.

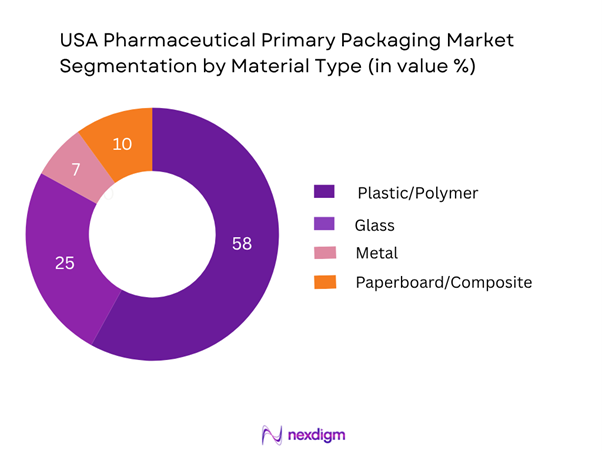

By Material Type

In the material-type segmentation of the USA market, Plastic/Polymer materials lead in value share. Their dominance stems from multiple factors: plastics and polymers offer lightweight characteristics, lower cost compared to glass, compatibility with high-speed filling and conversion, and flexibility to support evolving dosage forms and formats (such as prefilled syringes, cartridges, and flexible pouches). As manufacturers intensify biologic and injectable drug formats which demand single-use and high-barrier polymer containers, the polymer segment remains dominant in the USA primary packaging market.

Competitive Landscape

The competitive landscape in the USA pharmaceutical primary packaging market is characterised by established global and regional packaging suppliers, a trend toward consolidation, innovation in materials and formats, and strategic partnerships with pharmaceutical OEMs and CMOs.

| Company | Establishment Year | Headquarters | Key Product Portfolio (Primary Packaging) | Manufacturing Footprint in USA | R&D/Innovation Focus | Sustainability Initiative | Target Customer Segments |

| Amcor PLC | 1860* | Zurich, Switzerland | – | – | – | – | – |

| Gerresheimer AG | 1864 | Düsseldorf, Germany | – | – | – | – | – |

| West Pharmaceutical Services Inc. | 1923 | Exton, Pennsylvania | – | – | – | – | – |

| AptarGroup Inc. | 1992 | Crystal Lake, IL | – | – | – | – | – |

| Schott AG | 1884 | Mainz, Germany | – | – | – | – | – |

USA Pharmaceutical Primary Packaging Market Analysis

Growth Drivers

Expansion of biologics requiring advanced primary-containers

The U.S. biologics market generated USD 192,408.6 million in revenue in 2024. This large scale of biologic therapies (monoclonal antibodies, RNA therapeutics, etc.) drives demand for more complex primary packaging (prefilled syringes, cartridges, multi-barrier vials) that meet sterility, barrier and dose-accuracy requirements. Because biologics often have higher packaging cost per unit and require customized primary containers, the surge in biologics translates into elevated demand for specialized primary packaging formats in the U.S. Pharmaceutical OEMs and contract packagers must adapt with tailored packaging formats.

Stringent regulatory and traceability mandates pushing packaging upgrades

The U.S. regulatory environment increasingly emphasises serialization, tamper-evidence, child-resistant features and anti-counterfeit controls in pharmaceutical primary packaging. For example, the U.S. generic & biosimilar savings report states that generic/biosimilar medicines generated USD 408 billion in savings for U.S. patients and the healthcare system in 2022. Such large-scale substitution, plus regulatory attention on safety and supply-chain integrity, compels packaging converters and pharma OEMs to upgrade their primary packaging solutions accordingly (for example, adding serialization codes, anti-tamper seals), thereby driving packaging market growth.

Market Challenges

Supply-chain disruptions and drug shortage pressures impacting packaging flows

In the U.S., 49.0% of supply-chain issue reports were associated with actual drug shortages within 12 months (versus 34.0% in Canada) during 2017-2021. Drug shortages, especially of sterile injectables, can ripple upstream into primary packaging requirements. When filling lines are idle or delayed due to shortage of drug substance or packaging components, the packaging supplier is impacted. These disruptions add complexity and cost to packaging supply chains in the U.S. pharma market.

Raw-material volatility and regulatory cost burdens for high-barrier primary containers

The pharmaceutical packaging industry is facing increasing pressure to adopt sustainable and compliant materials: one industry article estimates that the pharmaceutical industry emits ~52 million metric tons of CO₂ annually, which influences packaging material choices. Meanwhile, packaging suppliers must cope with cost escalation of high-barrier glass, COP/COC polymers, and closures suitable for biologics. These cost and compliance burdens (material cost, regulatory qualification) create hurdles for packaging suppliers in the U.S. market.

Market Opportunities

Sustainable primary packaging as a growth lever within U.S. pharma packaging market

The global sustainable pharmaceutical packaging market was estimated at USD 99,175.5 million in 2024, with North America holding a 35.20% revenue share in 2023. This signals that U.S. pharmaceutical primary packaging suppliers have a major opportunity to grow by offering recyclable materials, lightweight designs or bio-based polymers. As pharma OEMs in the U.S. increasingly embed ESG and circular economy objectives, packaging converters offering sustainability-enhanced primary packaging can capture incremental volume and value.

Smart and connected packaging for patient compliance and drug integrity

As U.S. drug-delivery formats evolve (especially injectables, biologics, self-administration), there is rising demand for “smart packaging” (e.g., sensors, connected caps, dose-tracking) to ensure therapeutic adherence and supply-chain integrity. One source on packaging trends reports that smart and tamper-evident packaging are expected to drive growth in the U.S. pharma packaging market. For primary packaging suppliers, this presents an opportunity to add value-added modules into containers (pre-filled syringes, connected caps) and align with the trend of digital health, thereby enhancing differentiation and growth in the U.S. market.

Future Outlook

Over the next several years, the USA pharmaceutical primary packaging market is expected to exhibit steady growth, underpinned by continued expansion of biologics and injectable therapies, rising demand for smart and sustainable packaging solutions, and regulatory pressures supporting tamper-evidence, serialization and anti-counterfeit measures. Key growth drivers will include shifts to prefilled systems, single-use polymer formats, and increased outsourcing to contract packagers, while cost pressures and supply chain resilience will shape the strategic choices of packaging suppliers.

Major Players

- Amcor PLC

- Gerresheimer AG

- West Pharmaceutical Services Inc.

- AptarGroup Inc.

- Schott AG

- Berry Global Group Inc.

- SGD Pharma SA

- O-I Glass Inc.

- Vetter Pharma-Fertigung GmbH

- MJS Packaging Solutions

- Comar LLC

- Drug Plastics & Glass Company

- Corning Incorporated

- Capsugel (Lonza)

- Owens-Illinois (O-I)

Key Target Audience

- Strategic business units of pharmaceutical OEMs & biologics companies

- Packaging converters and material suppliers

- Contract Manufacturing & Packaging Organisations (CMOs/CPOs)

- Investments & Venture Capitalist Firms (specialising in pharma packaging / supply chain)

- Mergers & Acquisitions advisory teams within healthcare/packaging sectors

- Government & Regulatory Bodies (e.g., US FDA, US Environmental Protection Agency (EPA))

- Procurement, sourcing and supply chain heads in pharmaceutical manufacturing companies

- Sustainability & ESG teams within pharma/packaging companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the ecosystem of the USA pharmaceutical primary packaging market: material suppliers, converters, pharma OEMs, contract packagers, and distributors. Extensive secondary research was undertaken to define major market variables such as packaging format mix, material type, dosage form distribution, and regulatory drivers.

Step 2: Market Analysis and Construction

This stage involved compiling and analysing historical revenue data (2018-2023) for the primary packaging market in the USA, estimating format-wise and material-wise value shares, and constructing unit-price trends. A bottom-up approach (aggregating format and material segments) and top-down triangulation (using country-level market data) were applied to derive the 2024 base value and the 2024-2030 forecast.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary market hypotheses (e.g., bottles continue dominance, polymers over glass growth) were validated via qualitative interviews with industry experts—packaging converters, contract packagers and pharmaceutical OEM sourcing heads. Their inputs provided insights on supply-chain issues, material cost pressures, and format shifts, and refined the assumptions underlying forecast modelling.

Step 4: Research Synthesis and Final Output

The final phase saw synthesis of validated data and analysis into this report format, inclusion of competitive landscape tables, segmentation tables, and forecast modelling. Rigour was ensured via cross-checking multiple sources and aligning definitions (e.g., primary packaging scope) to industry standards.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations and Terminology, Market Sizing Approach, Data Sources & Consolidated Research Approach (primary interviews with pharma packaging executives, secondary data, proprietary databases), In-Depth Industry Interviews & Validation, Limitations, Assumptions, and Future Considerations)

- Definition and Scope of the Market

- Genesis and Evolution

- Timeline of Major Milestones

- Supply Chain & Value Chain Analysis

- Stakeholder Ecosystem

- Regulatory & Compliance Landscape

- Growth Drivers

Rise in injectables/biologics

Serialization/regulation

Sustainability push - Market Challenges

Raw-material price volatility

Regulatory cost burdens

Counterfeit risk - Market Opportunities

Smart packaging

Circular economy

Single-use primary containers - Market Trends

Lightweighting

Premiumization of primary packaging for biologics

Shift to COP/COC - Regulatory & Sustainability Impact

FDA guidance

Child-resistant packaging

Recycled content mandates - SWOT Analysis

- Porter’s Five Forces

- Market Size by Value (USD Mn), 2019-2024

- Market Size by Volume (units, tonnes or number of containers), 2019-2024

- Average Price Trend (USD per unit or per container), 2019-2024

- Historical Growth (past 5-year CAGR), 2019-2024

- By Packaging Format (value % or units)

Bottles (rigid plastic/glass)

Vials & Ampoules (glass)

Cartridges & Prefilled Syringes (injectables)

Blister Packs (solid-dose)

Flexible Pouches & Bags (liquid or granules)

Caps, Closures and Seals (secondary but still primary-container related) - By Material Type (value % or units)

Glass

Plastic/Polymer (e.g., COP/COC)

Paperboard/Composite (for certain pouches)

Metal (aluminum foils, lids) - By Drug Delivery / Dosage Form (value % or volume)

Oral Solid Dose (tablets, capsules)

Injectable (vials, syringes, cartridges)

Topical / Transdermal (tubes, sachets)

Inhalation / Nasal Devices (prefilled inhalers) - By End-User / Customer Type (value % or units)

Pharmaceutical OEMs (branded generics)

Biopharmaceutical OEMs (biologics)

Contract Manufacturing & Packaging Organizations (CMOs/CPOs) - By Geography / Region within USA (value % or units)

East Coast Corridor

Midwest & Central Plains

West Coast & Pacific Region

Southern Belt

- Market Share of Major Players (by value and units in the container/format market)

- Cross Comparison Parameters (Company Overview, Business Strategy, Recent Developments, Strengths, Weaknesses, Product Portfolio in Primary Packaging, Material Innovation, Manufacturing Footprint, Plant Capacity, Conversion Costs, R&D Focus, Sustainability Credentials, Customer Relationships, Supply Chain Integration, Price Positioning)

- Detailed Profiles of Major Companies

Amcor PLC

Gerresheimer AG

West Pharmaceutical Services Inc.

Berry Global Group Inc.

AptarGroup Inc.

SCHOTT AG

SGD Pharma SA

Corning Incorporated

O‑I Glass Inc.

Vetter Pharma‑Fertigung GmbH

MJS Packaging Solutions

Comar LLC

Stevanato Group

Gerhard Schubert GmbH

Thermo Fisher Scientific, Inc.

- Demand & Utilization Patterns by Drug Class

- Purchasing Behaviour and Budget Allocations

- Regulatory/Compliance Requirements for End-Users

- Pain-Points, Needs and Buyer Priorities

- Decision-Making Process & Value Chains

- By Value (USD Mn), 2025-2030

- By Volume (units/tonnes), 2025-2030

- By Average Price (USD per unit or system), 2025-2030

- Forecast Scenarios (Base, Optimistic, Conservative), 2025-2030