Market Overview

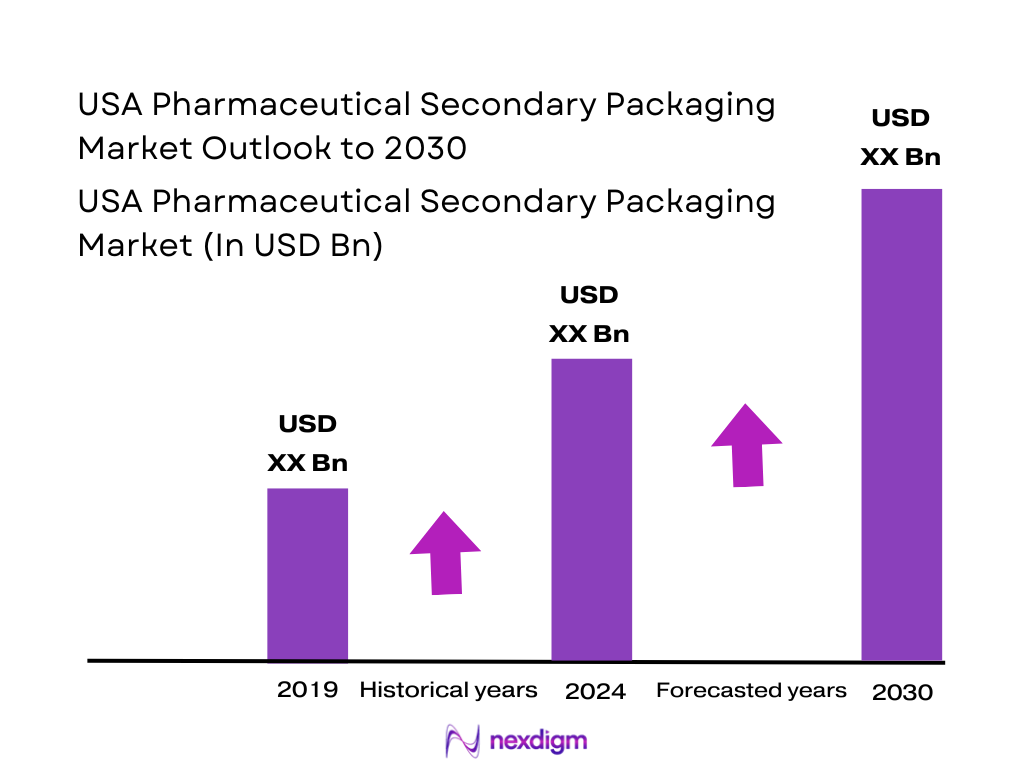

The U.S. pharmaceutical packaging market — which includes secondary packaging and related services — is estimated at USD ~ billion in 2024, according to a market-data source targeting the U.S. market. This valuation reflects growing demand across the pharmaceutical value chain, driven by rising biologics production, increasing regulatory compliance costs (e.g., serialization, tamper-evident packaging), growth in self-administered injectables and prefilled syringes, expansion of OTC and specialty drugs, and the shift toward mail-order and e-pharmacy distribution channels that require robust secondary packaging for safe transportation and patient delivery. The cost and complexity per unit pack are rising, supporting higher overall packaging-services revenues.

The market is heavily dominated by companies based in or operating across major U.S. pharmaceutical hubs such as the Northeast corridor (New Jersey, Pennsylvania, Massachusetts), the Midwest (e.g., Ohio), and key manufacturing hubs in the South and Southeast (e.g., North Carolina, Kentucky). These regions dominate because of high concentration of pharmaceutical manufacturing, CDMO facilities, biologics fill/finish sites, and integrated packaging-services providers — leading to high demand for secondary packaging services in proximity to drug production. Moreover, close proximity reduces supply-chain risk and helps meet stringent regulatory and cold-chain requirements, which reinforces U.S. dominance in the global pharmaceutical-packaging services ecosystem.

Market Segmentation

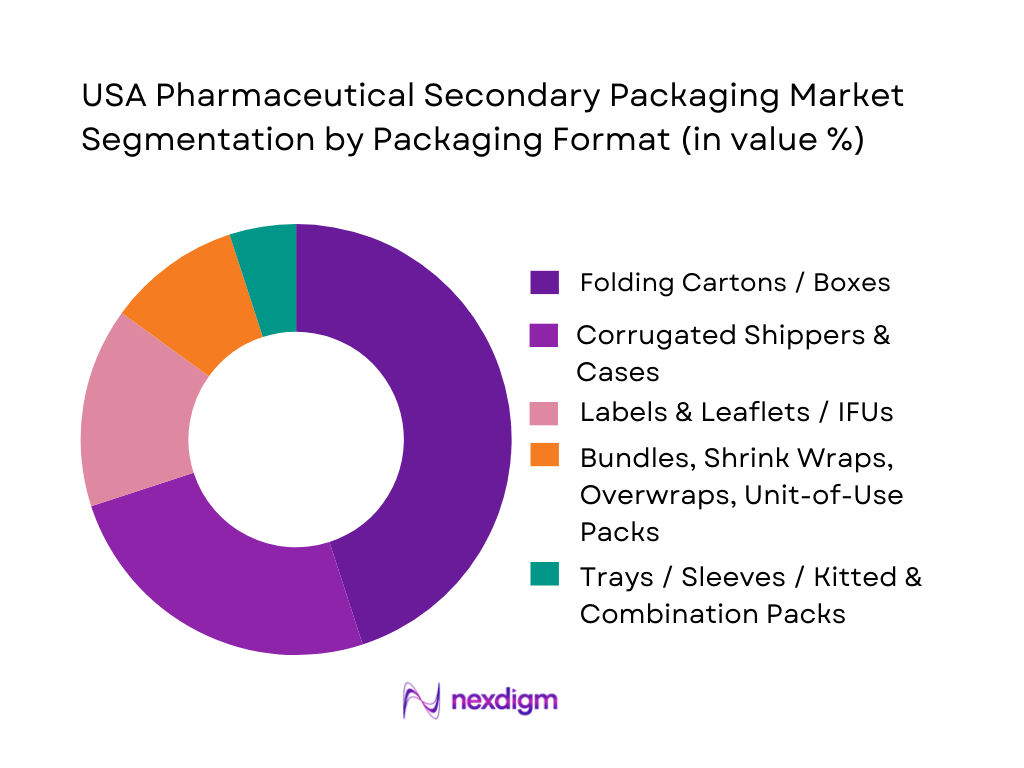

By Packaging Format

The U.S. pharmaceutical secondary packaging market is segmented into folding cartons/boxes, corrugated shippers & cases, labels & leaflets (IFUs), bundling/shrink-wrap/overwrap formats, and trays/sleeves or kitted combination packs. In 2024, folding cartons and boxes hold the dominant share — primarily because most pharmaceuticals (tablets, capsules, blister packs, bottles) are shipped in carton-in-carton retail packs for pharmacies and hospitals, making cartons essential at large scale. Cartons offer cost-effective protection, regulatory compliance for labeling, artwork flexibility, and are well-suited for high-volume packaging lines.

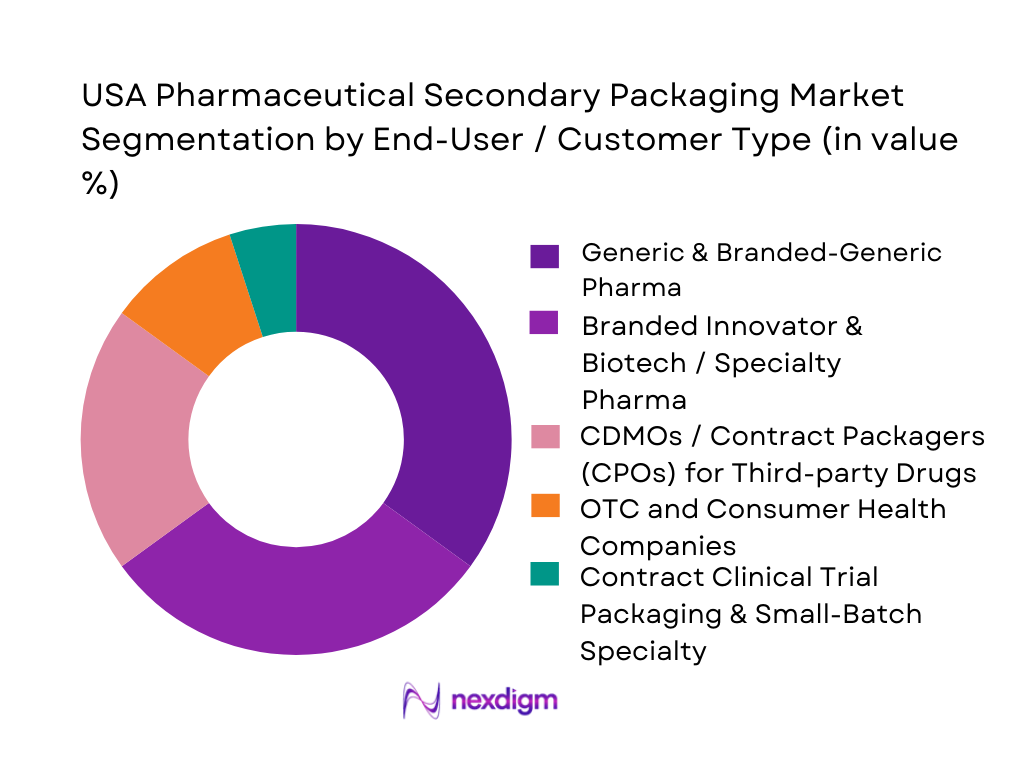

By End-User / Customer Type

In 2024, generics and branded-generic pharmaceutical companies account for the largest share of the U.S. secondary packaging market, because of very high volume of prescriptions, broad product portfolios, frequent packaging changes, and cost-sensitive packaging demands. Following this, branded innovator, biotech, and specialty pharma firms occupy a substantial share — driven by growth in biologics, injectables, prefilled syringes and complex drug–device combos, which require specialized secondary packaging (e.g., kitting, trays, cartons, cold-chain shippers). CDMOs and contract packagers serving multiple pharma clients represent a growing segment due to outsourcing of packaging by both generics and specialty firms, helping manage complexity and compliance. OTC and consumer health companies contribute meaningfully owing to high-volume, retail-oriented packaging. Finally, contract packaging for clinical trials and small-batch specialty drugs occupies a small but growing niche — important for early-stage drugs, orphan therapies, and limited-run products needing tailored secondary packaging and documentation.

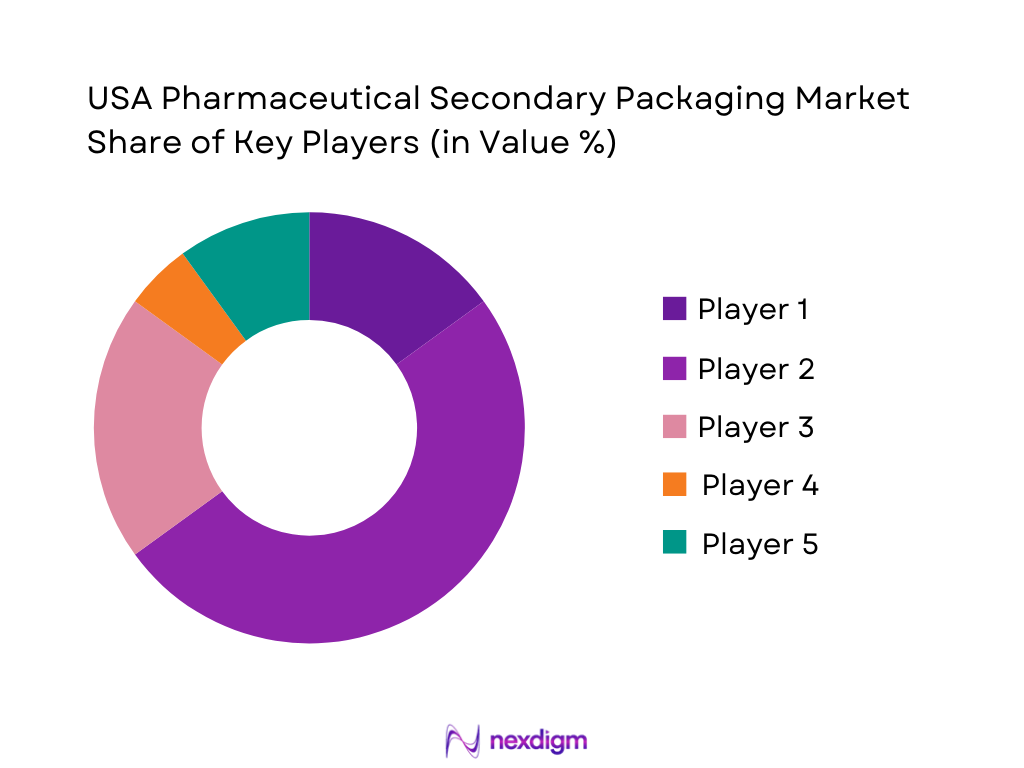

Competitive Landscape

The U.S. pharmaceutical packaging sector — including secondary and contract packaging players — is moderately consolidated, with several major players commanding significant share, alongside many smaller specialized providers. The need for compliance, advanced packaging capabilities (serialization, kitting, cold-chain) and geographic proximity to pharma manufacturing clusters has reinforced dominance of a few established firms. This mix of players demonstrates the diversity in packaging capabilities — from cartons and corrugated shippers to label & leaflet specialists, contract packagers and cold-chain providers. The presence of such specialized firms shows that the competitive landscape caters to broad spectrum of end-users: from high-volume generics to low-volume biologics and clinical batches.

| Company | Establishment Year | Headquarters | Key Service / Strengths | DSCSA & Serialization Capability | Cold-Chain / Temperature-Control Packaging | Multi-format Packaging (Cartons, Shippers, Labels) | Client Type Focus |

| Amcor plc | 1860 (origins) | Zurich, Switzerland (global HQ; major U.S. operations) | ~ | ~ | ~ | ~ | ~ |

| Sonoco Products Company | 1899 | Hartsville, SC, USA | ~ | ~ | ~ | ~ | ~ |

| CCL Industries / CCL Healthcare | 1951 | Toronto, Canada (North America HQ) | ~ | ~ | ~ | ~ | ~ |

| PCI Pharma Services | 1910 (origins) | Philadelphia, PA, USA | ~ | ~ | ~ | ~ | ~ |

| WestRock Company | 1998 (via merger) | Atlanta, GA, USA | ~ | ~ | ~ | ~ | ~ |

USA Pharmaceutical Secondary Packaging Market Analysis

Growth Drivers

Biologics & specialty pipeline

Biologics and specialty medicines are the main volume and complexity drivers for USA pharmaceutical secondary packaging. Per-capita health expenditure in the U.S. was USD ~ in 2022 and rose to about USD ~ in 2023, sustaining investment in high-value specialty therapies. FDA’s Center for Drug Evaluation and Research approved 55 novel drugs in 2023, while to date it has cleared 45 biosimilars across 14 reference products. Each new biologic or biosimilar adds presentations, cartons, inserts and tamper-evident features, expanding SKU counts that must be managed by secondary packagers.

Vaccine and injectable growth

Rising vaccine and injectable volumes are directly increasing demand for cartons, vials-in-trays, labels and specialized secondary shippers. For the 2023–2024 influenza season, manufacturers projected between ~ million and ~ million flu vaccine doses for the U.S. market. For the 2025–2026 season, ~ million doses had already been distributed by early November. Childhood immunization coverage remains high, with 91.4% of U.S. children having received at least three hepatitis B doses. These sustained high-volume injectable programs push continuous requirements for secure, clearly labeled, high-throughput secondary packaging solutions.

Challenges

Margin pressure and cost-to-serve

Secondary packagers sit between rising quality expectations and constrained payer budgets. U.S. health-care spending totaled USD ~ billion in 2023, or USD ~ per capita, representing 17.6% of GDP. At the same time, parcel shipments grew to ~ billion in 2024 while parcel revenue grew more slowly, signalling pricing pressure in delivery networks that pharmaceuticals depend on. This combination of high healthcare spend scrutiny and logistics price competition compresses margins along the pharma value chain, pushing brands to demand more efficient line changeovers, higher line OEE and lower cost-to-serve from secondary packagers without compromising compliance.

Complexity of SKUs and artwork management

Continuous innovation is multiplying SKUs, pack variations and artwork updates that must be controlled on packaging lines. FDA approved 55 novel drugs in 2023, broadly consistent with an average of about 53 new approvals annually over the past decade. CDER reports a cumulative 45 approved biosimilars across 14 reference biologics, each with distinct strength, pack and label requirements. Globally, it records more than 560,000 registered studies and tens of thousands of active or recruiting trials, each potentially requiring blinded kits, comparator packs and protocol-specific artwork. This expanding portfolio significantly raises the burden of artwork version control, carton coding and line-clearance procedures for U.S. secondary packaging operations.

Opportunities

Cold-chain optimized shippers

Biologics, vaccines and temperature-sensitive injectables create a structural opportunity for advanced cold-chain secondary packaging. For U.S. influenza alone, vaccine manufacturers planned between ~ million and ~ million doses for the 2023–2024 season, while ~ million flu doses had already been distributed by early November in the 2025–2026 season. High routine immunization coverage – for example, 91.4% completion of the three-dose hepatitis B series in young children – keeps injectable volumes structurally high. As more monoclonal antibodies, cell and gene therapies and temperature-sensitive formulations enter the market, demand will rise for insulated shippers, phase-change materials, and validated secondary packs that maintain label legibility and digital traceability through extended cold chains.

Small-batch and clinical trial specialization

The scale and complexity of clinical development in the U.S. create a sizeable niche for small-batch, highly flexible secondary packaging. ClinicalTrials.gov lists ~ registered studies globally as of late 2024, with ~ clinical trials recruiting patients in the U.S. and another ~ active but not recruiting as of May 2025. Meanwhile, the World Bank’s global health portfolio totals USD ~ billion across 160 projects, many involving health-system and therapeutic innovations that will rely on trials and pilot programs. These dynamics support specialized packagers that can handle small lot sizes, blinded kits, late-stage customization and protocol-specific labeling, positioning U.S. secondary packaging providers for higher-margin, service-rich clinical and early-launch work.

Future Outlook

Over the next five years, the U.S. pharmaceutical secondary packaging market is expected to continue robust growth driven by rising biologics and specialty-therapy launches, increased outsourcing to CDMOs and contract packaging organizations, growing regulatory compliance (including serialization, aggregation, tamper-evidence), and a higher share of mail-order, e-pharmacy and direct-to-patient distribution channels. Demand for cold-chain packaging for biologics, prefilled syringes, devices, and precision-dose therapies will escalate, along with rising sustainability and lightweighting mandates.

The shift toward patient-centric pack designs, smart and connected packaging (e.g., for adherence tracking), late-stage customization (for regional labeling, language variants), and integration with logistics/3PL services will also shape the secondary packaging market structure, favoring flexible, innovative, and compliance-ready packaging providers.

Major Players

- Amcor plc

- Sonoco Products Company

- CCL Industries / CCL Healthcare

- PCI Pharma Services

- WestRock Company

- Graphic Packaging International

- Sharp Services LLC

- Aphena Pharma Solutions

- Legacy Pharma Solutions

- Wasdell Packaging Group

- Reed-Lane Inc.

- Jones Healthcare Group

- Cardinal Health – Packaging & Serialization Services

- Amcor’s specialized division for healthcare & pharma packaging

Key Target Audience

- Pharmaceutical & biotech manufacturers

- Contract Development Organizations

- Biologics and Specialty Drug developers

- OTC and Consumer Health product manufacturers

- Mail-order pharmacies, e-pharmacies and direct-to-patient specialty pharmacies

- Cold-chain logistics providers and 3PLs engaged in pharmaceutical distribution

- Investors and venture-capital firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We started by mapping the full pharmaceutical secondary-packaging ecosystem in the United States, including all relevant stakeholders: converters, contract packers, CDMOs, labeling specialists, logistics/3PLs, biologics/bottled drug manufacturers, and end-user pharmacies & hospitals. We compiled a list of key variables — packaging format, material type, end-user type, functional requirements (e.g., cold-chain, serialization), regulatory compliance, distribution channel, and pack volume/complexity.

Step 2: Market Analysis and Construction

We collected and analyzed historical data on U.S. pharmaceutical packaging spending, demand for packaging services, drug production volumes (by dosage form), and pharmaceutical shipment data. Using a bottom-up approach, we aggregated capacity and revenue data from major packaging companies, contract packers, and CDMOs, and cross-validated with publicly disclosed revenues and industry reports.

Step 3: Hypothesis Validation and Expert Consultation

We developed hypotheses regarding growth drivers (e.g., biologics trend, outsourcing, regulatory demands) and validated them through expert interviews with packaging-service providers, procurement leads at pharmaceutical manufacturers, and supply-chain managers at distributors. These consultations helped refine assumptions about pack complexity, changeover frequency, cold-chain demand, and outsourcing rates.

Step 4: Research Synthesis and Final Output

Finally, we synthesized the data: combining bottom-up capacity/revenue modeling with top-down pharmaceutical demand projections, adjusting for packaging mix shifts (towards biologics, injectables, cold-chain, kitting). This produced a validated estimate of the 2024 market size and a forecast through 2030, with segment-level breakdowns and competitive landscape analysis.

- Executive Summary

- Research Methodology & Market Taxonomy (Market Definitions & Scope Delineation, USA Pharma & Biologics Packaging Taxonomy, Secondary vs Primary vs Tertiary Boundary Conditions, Data Sources & Triangulation Approach, Bottom-Up Volume Build-Up by SKU & Pack Format, Top-Down Validation Using Pharma Output & Rx/OTC Volumes, Assumptions on Outsourcing Penetration & Line Utilization, Forecasting Approach & Scenario Design, Limitations & Data Gaps)

- Definition, Scope & Classification of Secondary Packaging in USA Pharma

- Role of Secondary Packaging Across Pharma, Biologics, Vaccines & Specialty Drugs

- Evolution of USA Pharma Secondary Packaging

- Serialized, Patient-Centric Packs

- Industry Structure, Stakeholder Ecosystem & Value Chain

- Business Cycle, Capacity Expansion Patterns & Capex/Opex Intensity

- Growth Drivers

Biologics & specialty pipeline

Vaccine and injectable growth

DSCSA and global traceability mandates

e-commerce and mail-order pharmacies

Outsourcing to CPOs and CDMOs - Challenges

Margin pressure and cost-to-serve

Complexity of SKUs and artwork management

Regulatory and audit burden

Capex for serialization & automation

Labor and skills shortage on packaging lines - Opportunities

Cold-chain optimized shippers

Small-batch and clinical trial specialization

Digital printing and late-stage customization

Connected devices and digital-therapy-linked packs

Sustainable substrates and coatings - Trends

Complex carton geometries

Multi-panel and booklet labels

Smart indicators and sensors

Vendor-managed inventory and postponement

Just-in-time kitting - Regulatory & Compliance Landscape

- Technology & Automation Landscape

- Sustainability & ESG Lens

- Stakeholder Ecosystem & Partnership Models

- Porter’s Five Forces Analysis of USA Pharmaceutical Secondary Packaging

- SWOT Analysis of the USA Secondary Packaging Market

- Historical & Current Market Value, 2019-2024

- Historical & Current Market Volume, 2019-2024

- Pack-Count & SKU Density Analysis, 2019-2024

- Installed Secondary Packaging Line Capacity & Utilization, 2019-2024

- Contribution of Contract Packaging vs In-House Packaging to Total Market Size, 2019-2024

- By Secondary Packaging Format (in Value %)

Folding Cartons

Corrugated Shippers & Shelf-Ready Trays

Labels & Sleeves

Inserts, Leaflets, Medication Guides & eIFU Bridging Packs

Blister Wallets, Compliance Packs & Calendar Packs - By Primary Packaging Packed (in Value %)

Bottles

Blister Packs

Vials

Prefilled Syringes & Cartridges

Ampoules & Glass Containers

- By Dosage Form & Drug Type (in Value %)

Solid Oral Dose Pharmaceuticals

Injectables & Parenteral Drugs

Biologics, Biosimilars & Cell/Gene Therapies

Vaccines & Temperature-Sensitive Specialty Products

Topical, Transdermal & Dermatology Products - By End-Use Customer Type (in Value %)

Global Innovator Pharma Companies

Mid-Size & Specialty Pharma Companies

Generic Pharmaceutical Manufacturers

Biotech & Cell/Gene Therapy Developers

OTC, Consumer Health & Nutraceutical Brand Owners - By Packaging Function & Feature (in Value %)

Tamper-Evident & Anti-Counterfeit Secondary Packaging

Child-Resistant & Senior-Friendly Packs

Serialization & Aggregation-Ready Packs

Cold Chain & Temperature-Controlled Shippers & Overpacks

Patient-Adherence & Calendar-Based Packaging - By Distribution & Fulfilment Channel (in Value %)

In-House Pharma & Biotech Packaging Operations

Contract Packaging Organizations

3PLs, Wholesalers & Distribution Centers with Value-Added Packaging

Hospital Pharmacies, IDNs & Health System Repackers

Retail Pharmacy Chains, Mail-Order & ePharmacies - By USA Pharma Manufacturing & Distribution Region (in Value %)

Northeast Pharma & Biotech Corridor

Midwest & Great Lakes Pharma Manufacturing Cluster

South & Southeast

West Coast Biotech & Specialty Pharma Cluster

Puerto Rico & Other Specialized Pharma Packaging & Manufacturing Locations

- Market Share Analysis of Major Players by Value, Volume & Pack-Count

- Cross Comparison Parameters (Company Overview, Packaging Format Portfolio Breadth, DSCSA Serialization & Aggregation Capability, Cold Chain & Specialty Handling Capability, Quality & Regulatory Certifications, US Manufacturing & Distribution Footprint, Sustainability & Eco-Design Initiatives, Technology & Digital Integration in Packaging Lines)

- Competitive Positioning by Customer Segment, Dosage Form & Pack Complexity

- Pricing, Service Level & Lead-Time Benchmarks Across Key Competitors

- Detailed Profiles of Major Companies

PCI Pharma Services

Sharp Services

Praxis Packaging Solutions

Pharma Packaging Solutions

CCL Healthcare

WestRock Healthcare & Pharmaceutical Packaging

Nosco, Inc.

Amcor

Berry Global

Gerresheimer

Sonoco ThermoSafe

Sealed Air

Peli BioThermal

Cold Chain Technologies

- End-User Demand & Utilization Patterns

- Packaging Budget Allocation, Cost-to-Serve & Total Cost of Ownership View

- Outsourcing Penetration, Preferred Engagement Models & Contract Structures

- Regulatory, Quality & Audit Expectations from Secondary Packaging Partners

- Pain Points, Service Gaps & Innovation Needs Across Commercial & Clinical Packaging

- Historical & Current Market Value, 2025-2030

- Historical & Current Market Volume, 2025-2030

- Pack-Count & SKU Density Analysis, 2025-2030

- Installed Secondary Packaging Line Capacity & Utilization, 2025-2030

- Contribution of Contract Packaging vs In-House Packaging to Total Market Size, 2025-2030