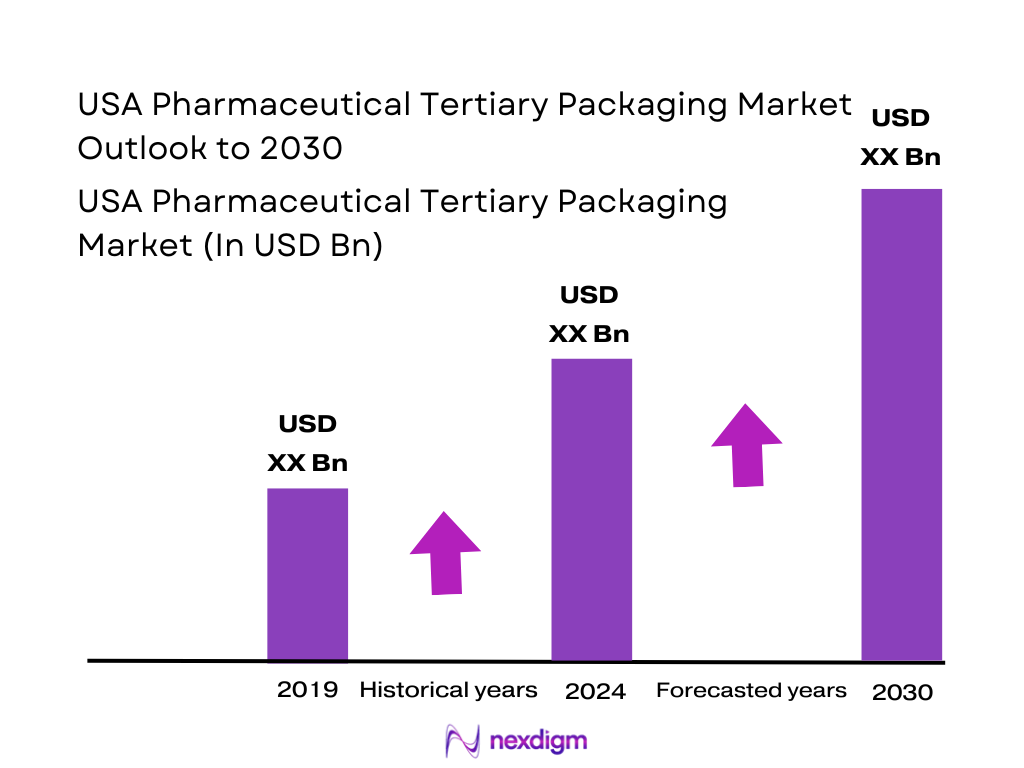

Market Overview

The U.S. pharmaceutical packaging industry is estimated at USD ~ million in 2024, covering primary, secondary, and tertiary packaging. Given that tertiary packaging typically represents a substantial — though minority — share of total packaging spend (as tertiary serves transit, distribution and logistics rather than primary dose containment), the tertiary portion of the U.S. market in 2024 likely constitutes a sizeable multi-billion-dollar sub-segment of that total pool. Growth in drug production (including biologics and injectables), increased cold-chain distribution, rise in direct-to-patient shipping, and expanding e-commerce for pharmaceuticals are driving demand for tertiary packaging solutions, underpinning the overall packaging market value.

The U.S., along with broader North America, remains the dominant region globally for pharmaceutical packaging demand. This dominance is driven by factors such as the concentration of major pharmaceutical manufacturing sites, high per-capita consumption of medicines, robust cold-chain distribution networks, mature regulatory frameworks requiring serialization, tamper-evident packaging and traceability, and a dense 3PL / wholesaler / pharmacy distribution infrastructure that depends heavily on tertiary packaging for safe and compliant transport across domestic and export lanes.

Market Segmentation

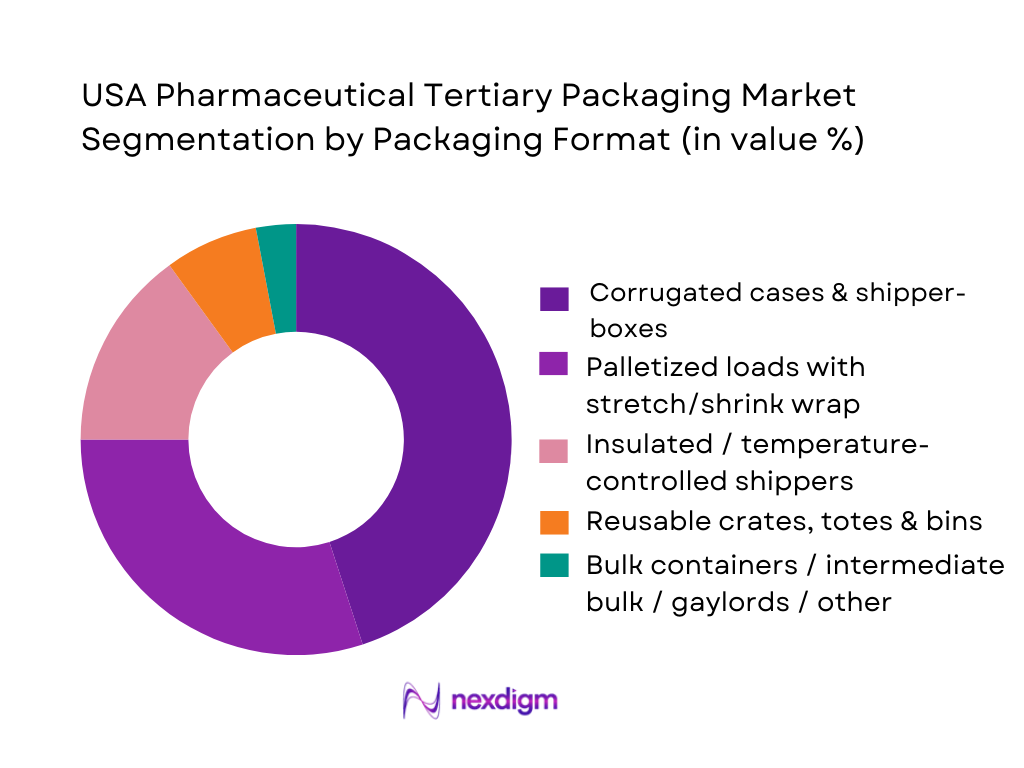

By Packaging Format

The corrugated cases and shipper-boxes segment dominates tertiary packaging demand. This is because the vast majority of oral solid dosage (tablets, capsules) and standard blister-packed medicines continue to be transported from manufacturing plants to wholesalers or distribution centers in case-packs. Corrugated shipper-boxes offer cost-effectiveness, ease of stacking and palletization, and compliance with logistics requirements — making them the default tertiary container for high-volume, high-throughput supply chains. Palletized loads with stretch/shrink wrap follow, thanks to economies of scale for large shipments across DCs and 3PL warehouses. While insulated shippers represent a smaller share, their importance is rapidly growing due to the increasing volume of temperature-sensitive biologics, vaccines, and injectables requiring cold-chain compliance. Reusable totes and bins are used in high-turnover internal distribution (e.g., plant to plant, intra-DC), driven by cost-efficiency and waste reduction. Bulk containers are niche — used primarily for API intermediates, large-volume OTC or raw materials.

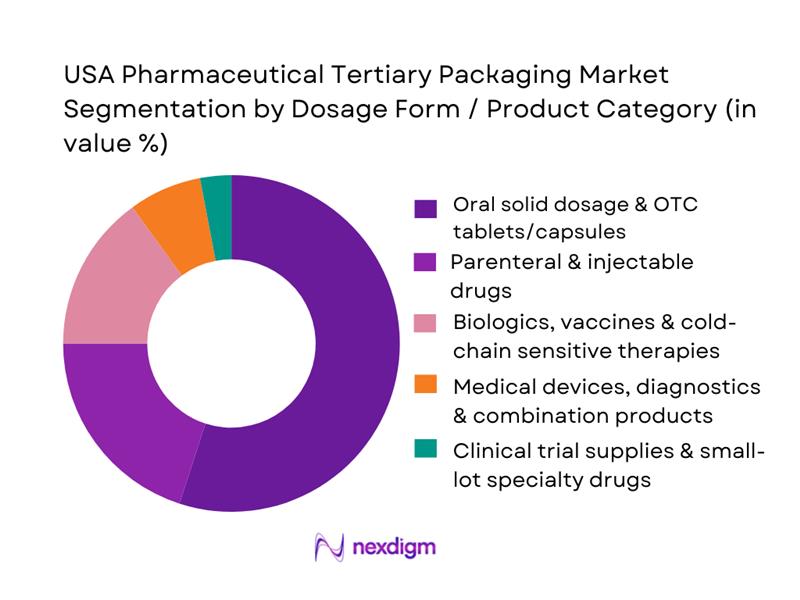

By Dosage Form / Product Category

The oral solid dosage and OTC tablets/capsules segment accounts for the largest share of tertiary packaging demand. This prominence reflects the high volume, stable demand, and recurring distribution cycles for oral medications — which need to be transported in bulk from manufacturing plants to distribution centers and pharmacies. The standardization in case-pack sizes and packaging formats for these products further supports corrugated tertiary packaging. Parenteral and injectable drugs contribute significantly as well, due to the rising use of injectables and generics; however, their volume is lower compared to oral solids, and packaging tends to be more sophisticated (often requiring cold-chain or protective inserts).

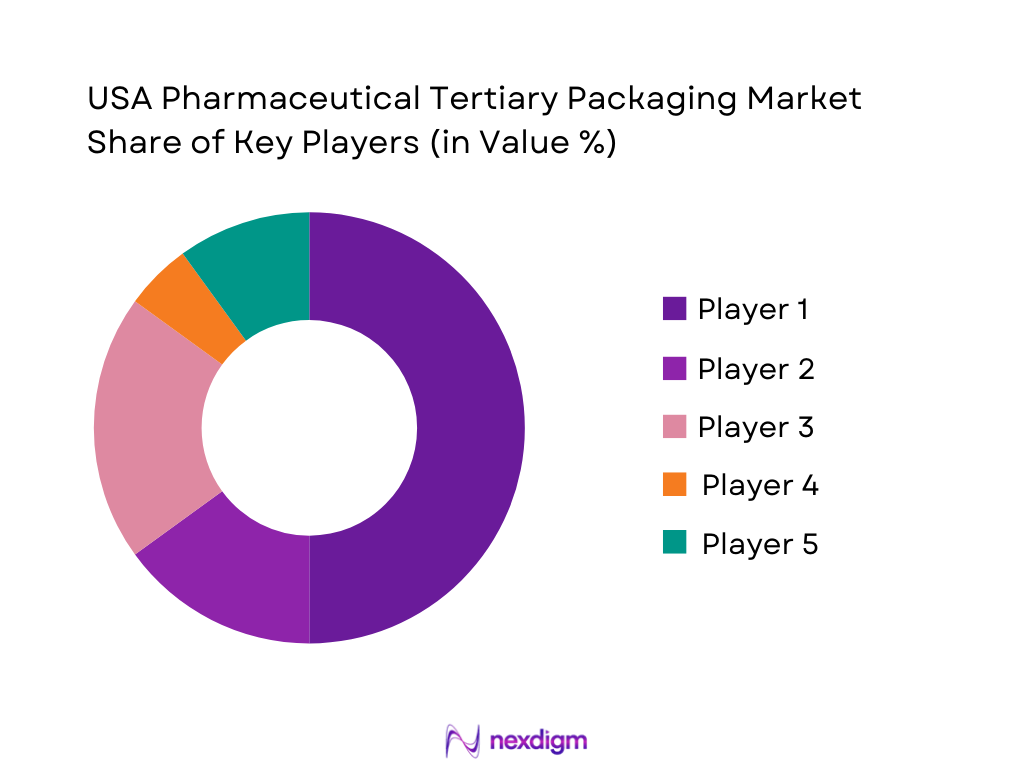

Competitive Landscape

The U.S. pharmaceutical packaging market — including tertiary — is concentrated among established global and regional packaging and conversion firms. Their scale, manufacturing footprint, service offerings (including temperature-controlled packaging, serialization readiness, and supply-chain logistics support) influence placement of tertiary business.

| Company | Establishment Year | Headquarters | Key Packaging Materials / Formats Served | Cold-Chain / Insulated Packaging Capability | Regulatory Compliance & Serialization Support | Reusable / Tote / Pallet Offerings | Value-Added Services (Kitting, Design, Customization) |

| Amcor plc | 1860 (as predecessor) | Zurich, Switzerland (US operations) | ~ | ~ | ~ | ~ | ~ |

| WestRock Company | 2015 (via merger) | Atlanta, GA, USA | ~ | ~ | ~ | ~ | ~ |

| Berry Global Group, Inc. | 1967 | Evansville, IN, USA | ~ | ~ | ~ | ~ | ~ |

| Sealed Air Corporation | 1960 | Charlotte, NC, USA | ~ | ~ | ~ | ~ | ~ |

| Sonoco Products Company | 1899 | Hartsville, SC, USA | ~ | ~ | ~ | ~ | ~ |

USA Pharmaceutical Tertiary Packaging Market Analysis

Growth Drivers

Pharma production growth

Pharmaceutical and medicine manufacturing in the US has been expanding steadily, creating direct demand for tertiary shippers, pallets, stretch wraps and protective packaging. The Federal Reserve’s sectoral output index for NAICS 3254 (pharmaceutical and medicine manufacturing, 2017=100) rose from about 102 in the recent past to 103+ and further above 104 in the latest reading, indicating clear volume growth in finished medicines moving through domestic plants and export corridors. At the same time, US pharmaceutical exports reached roughly USD ~ billion out of a global export pool of about USD ~ billion, underscoring the country’s role as a high-value drug producer whose pallets and cases must withstand long, multi-leg supply chains.

Biologics and vaccine expansion

High-value biologics and vaccines, which are more temperature-sensitive and packaging-intensive than traditional small-molecule tablets, are reshaping tertiary packaging needs. A US government analysis of IQVIA data reports that so-called 351(a) biologics generated about USD ~ billion in drug sales in the country, reflecting the rapid penetration of monoclonal antibodies, cell-based therapies and advanced injectables that require insulated shippers, thermal pallets and robust shock protection in outer packs. In parallel, the US Food and Drug Administration cleared 55 novel drugs in a recent year, many of them specialty or biologic products, adding new SKUs, stability profiles and lane requirements that must be reflected in shipper design, cube optimization and labelling space on tertiary packs.

Market Challenges

Material & freight inflation

Although direct packaging and freight prices are volatile, official price indices show sustained upward pressure on logistics inputs that feed into tertiary carton, pallet and film decisions. The US Bureau of Transportation Statistics reports that the consumer price index for all transportation goods and services rose 1.6 points over a recent 12-month period, contributing nearly one-tenth of overall inflation in the broader CPI basket. Producer price indices compiled by the Bureau of Labor Statistics show the index for long-distance less-than-truckload general freight trucking around 450, up from roughly 410 a year earlier, while the long-distance truckload freight index rose from about 172 to 181 over the same period. These higher freight indices incentivize shippers to reduce cube, tare weight and damage risk in tertiary packaging to avoid paying repeatedly for inefficient loads.

Labor constraints

The US pharmaceutical and medicine manufacturing industry directly employs about 341,770 people across all occupations, with sizable cohorts in production, quality, logistics and warehousing roles, according to the Bureau of Labor Statistics’ occupational estimates for NAICS 325400. Within that total, more than 5,700 professionals work as logisticians and project-management specialists, and about 1,370 transportation, storage and distribution managers coordinate day-to-day physical flows. These headcounts signal a sophisticated but labor-intensive network of plants and DCs that must palletize, wrap and label thousands of SKUs under GMP. However, broader transportation and warehousing sectors already employ around ~ million people, limiting the available pool. This structural tightness encourages adoption of tertiary packaging formats that simplify manual handling, reduce pallet-building complexity and integrate cleanly with semi-automated case packing and conveyorized shipping lines.

Opportunities

Light-weighting of shippers

Sustainability and freight-efficiency pressures are converging to make light-weight, material-optimized tertiary packaging a major opportunity for US pharmaceutical supply chains. US industrial market analysis indicates that from 2020 onward, developers added roughly 2.3 billion square feet of modern logistics space, with 965 million square feet of new warehouses delivered since early 2023 alone and 3PLs accounting for about ~ million square feet of leasing in one recent year. These high-throughput nodes intensify the cost of every additional kilogram of corrugated board, pallet wood or stretch film moved through the system. In parallel, the Producer Price Index for long-distance truckload freight has climbed from about 172 to more than 180 points over the last twelve months, demonstrated by official BLS data, signalling persistent pressure on line-haul economics. Within this context, pharma shippers that redesign outers for reduced board grade, better cube utilization and optimized pallet patterns can lower freight emissions and increase payload per truck or air-cargo unit while maintaining regulatory compliance.

Design-for-recycling and circular formats

Circular-economy and ESG mandates are pushing pharmaceutical supply chains toward tertiary solutions that are easier to recover and recycle at hospitals, wholesalers and mail-order hubs. The American Forest & Paper Association reports that in 2022, about 68 % of all paper consumed in the US was recycled, and corrugated cardboard—dominant in pharma shipping cases—achieved a recycling rate of 93.6 %, with roughly ~ million tons of paper recovered overall. In contrast, the US Plastics Pact’s 2022 annual report finds that member companies placed around ~ million metric tons of plastic packaging on the US market, with only 47.7 % of it considered reusable, recyclable or compostable and recycled content averaging 9.4 %. This gap between high-performing fiber-based tertiary materials and lagging plastic formats highlights opportunities for redesigned shippers, mono-material protective packs, reusable totes and pallet systems that align with hospital and wholesaler sorting realities while still meeting GDP and DSCSA requirements.

Future Outlook

Over the coming years, the U.S. pharmaceutical tertiary packaging market is expected to strengthen significantly. Growth will be driven by increasing production and distribution of biologics, injectables, and high-value therapies; expanding demand for temperature-controlled logistics; rising e-commerce and direct-to-patient models; and greater regulatory emphasis on serialization, tamper evidence, and supply-chain traceability. Meanwhile, sustainability pressures and material cost volatility will push converters toward lightweight corrugated designs, reusable pallet/tote systems, and recyclable materials — creating value-add opportunities for packaging providers who combine compliance, sustainability, and logistics efficiency in their offerings.

Major Players

- Amcor plc

- WestRock Company

- Berry Global Group, Inc.

- Sealed Air Corporation

- Sonoco Products Company

- International Paper Company

- DS Smith plc

- Smurfit Kappa Group plc

- Graphic Packaging International, LLC

- Packaging Corporation of America

- Veritiv Corporation

- CCL Industries

- Huhtamaki Oyj

- AptarGroup, Inc.

Key Target Audience

- Procurement & supply-chain heads

- 3PL and cold-chain logistics providers

- Contract packers and tertiary packaging converters

- Hospital systems, IDN group purchasing organizations, and large retail pharmacy chains

- Investment and venture capitalist firms

- Government and regulatory bodies

- Pharmaceutical distributors and wholesalers

- Large mail-order pharmacy businesses

Research Methodology

Step 1: Identification of Key Variables

Initial research constructed an ecosystem map comprising major stakeholders — pharmaceutical manufacturers, converters, contract packagers, 3PLs, wholesalers, pharmacies, and logistics operators. Secondary data sources (industry reports, public financials, regulatory filings), and packaging-industry databases were used to define variables such as packaging format, material type, dosage-form handled, shipping lane type, and cold-chain requirements.

Step 2: Market Analysis and Construction

Historical data from packaging market reports (primary, secondary, tertiary) was collected. Packaging spend was allocated across packaging levels (primary, secondary, tertiary) based on typical ratios derived from industry studies and trade data. Volume estimates (e.g., shipper-cases, pallet-loads) were generated using standard conversion ratios for dosage forms, shipment frequencies, and logistic cycles.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses — such as share of tertiary relative to total packaging, growth rate drivers, increase in insulation-pack demand — were validated via interviews (via telephone or virtual calls) with packaging-engineering heads of pharma companies, 3PL logistics managers, contract packers, and corrugated/plastic converters. Their operational experiences and supply-chain insights helped calibrate volume-to-value assumptions.

Step 4: Research Synthesis and Final Output

A bottom-up approach (aggregating tertiary packaging demand from individual supply-chain lanes) was cross-checked with top-down sizing (based on total packaging spend) to ensure consistency. Discrepancies were reconciled via sensitivity analysis. The final output includes validated revenue and volume estimates, segmentation by format, material and dosage form, competitive landscape, and forecast scenarios.

- Executive Summary

- Research Methodology (Market Definitions & Scope, Abbreviations & Glossary, Market Sizing & Forecasting Approach, Data Sources & Triangulation, Primary Research Design, Key Assumptions & Limitations)

- Definition & Classification of Tertiary Packaging in Pharma Logistics

- Role of Tertiary Packaging Across US Pharma Supply Chain

- Evolution of US Pharma Distribution & Impact on Tertiary Pack Demand

- Interlinkages with Primary & Secondary Packaging, 3PL Networks and Wholesaler Business Models

- Ecosystem Mapping

- Growth Drivers

Pharma production growth

Biologics and vaccine expansion

e-pharmacy & mail-order penetration

Cold-chain infrastructure build-out

Automation in DCs - Market Challenges

Material & freight inflation

Labor constraints

Warehouse space

Damage & spoilage

Compliance overhead - Opportunities

Light-weighting of shippers

Design-for-recycling

Reusable asset pools

Automation-ready case dimensions

Digital track-and-trace - Key Market Trends

SKU proliferation

Smaller lot sizes

Serialization at shipper level

DTP models

Integrated shipper-plus-thermal solutions - Regulatory & Compliance Landscape

- Sustainability & Circularity

- Supply Chain & Value Chain Analysis

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume of Tertiary Packaging Materials, 2019-2024

- By Number of Shipper Cases & Palletized Pharma Shipments, 2019-2024

- By Packaging Level, 2019-2024

- By Domestic vs Export-Oriented Pharma Flows, 2019-2024

- By Tertiary Packaging Format (in Value %)

Regular Slotted Corrugated Cases & Shelf-Ready Shippers

Palletized Stretch- and Shrink-Wrapped Loads

Insulated & Temperature-Controlled Shippers

Reusable Plastic Totes, Crates & Bins

Bulk Bins / Gaylord Containers & Other Transit Packs - By Material Type (in Value %)

Corrugated & Solid Fiberboard Solutions

Rigid Plastics & Composite Pallets

Flexible Films & Wraps for Palletization

Wood-Based Skids, Crates & Bracing

Hybrid & Specialty Materials - By Pharmaceutical Dosage Form (in Value %)

Oral Solid Dosage & Consumer Health SKUs

Parenteral & Injectable Drugs

Vaccines, Biologics & Cell/Gene Therapies

Medical Devices, Diagnostics & Combination Products

Clinical Trial Supplies & Specialty / Orphan Drugs - By End-User Type (in Value %)

Innovator Pharma & Biotech Manufacturers

Generic Pharma Manufacturers

CDMOs/CMOs & Contract Packagers

Wholesalers, Distributors & 3PLs

Retail Chains, Mail-Order & Specialty Pharmacies - By Supply Chain Function & Channel (in Value %)

Plant-to-DC & Inter-Facility Transfers

Domestic Line-Haul & Regional Distribution Centers

Cold-Chain Distribution for Temperature-Sensitive Products

Direct-to-Patient & Home-Delivery Models

Government, Institutional and IDN Hospital Supply - By Region (in Value %)

Northeast

Midwest

South

West

- Market Share of Major Players by Value & Volume

Market Share of Major Players by Tertiary Packaging Format - Cross Comparison Parameters (Company scale in US pharma & healthcare accounts, share of revenue from healthcare & life sciences, breadth of tertiary format portfolio, temperature-controlled & cold-chain capability depth, DSCSA/serialization-ready & regulatory labelling solutions, sustainability credentials & recycled-content offering, US manufacturing & logistics footprint, value-added design/kitting/late-stage customization services)

- Strategic Positioning & Go-to-Market Models

- SWOT Analysis of Leading Players

- Pricing Analysis by SKU Attributes

- Detailed Profiles of Major Companies

WestRock Company

International Paper Company

Amcor plc

DS Smith Plc

Smurfit Kappa Group plc

Graphic Packaging International, LLC

Packaging Corporation of America

Sonoco Products Company

Berry Global Group, Inc.

Sealed Air Corporation

Pactiv Evergreen Inc.

CCL Industries Inc.

Huhtamaki Oyj

Veritiv Corporation

- Demand Patterns by End-User Segment

- Procurement Approaches & Contract Structures

- Compliance & Quality Expectations

- Automation & Warehouse Operations Interface

- Pain Points & Unmet Needs

- By Value, 2025-2030

- By Volume of Tertiary Packaging Materials, 2025-2030

- By Number of Shipper Cases & Palletized Pharma Shipments, 2025-2030

- By Packaging Level, 2025-2030

- By Domestic vs Export-Oriented Pharma Flows, 2025-2030