Market Overview

The USA pistons market sits within a global piston ecosystem that is valued at about USD ~ billion on a recent baseline and roughly USD 2.60 billion in the latest published assessment. North America generates close to USD 770 million in piston revenue, led by the United States, which produces roughly 69 percent of North American light-vehicle output. This concentration is supported by high light-vehicle sales of more than 15 million units, steady production of SUVs and pickups, and resilient demand from construction, agriculture and industrial engines, all of which underpin domestic piston consumption.

Market Segmentation

By Vehicle / Engine Application

The USA pistons market is segmented by vehicle / engine application into passenger cars & light trucks, heavy commercial vehicles, off-highway equipment, industrial engines & compressors, and motorcycles & powersports. Passenger cars & light trucks command the dominant share, reflecting annual US light-vehicle sales above 15 million units and a structural tilt toward SUVs and pickups that account for more than half of domestic light-duty production.

By Material & Construction

The USA pistons market is segmented by material and construction into cast aluminum pistons, forged aluminum pistons, steel pistons, hypereutectic and composite-alloy pistons, and other niche materials. Cast aluminum pistons dominate due to their favorable cost-to-performance ratio and alignment with the mass-market mix of gasoline passenger cars, SUVs and light trucks, which together represent the majority of US light-vehicle production.

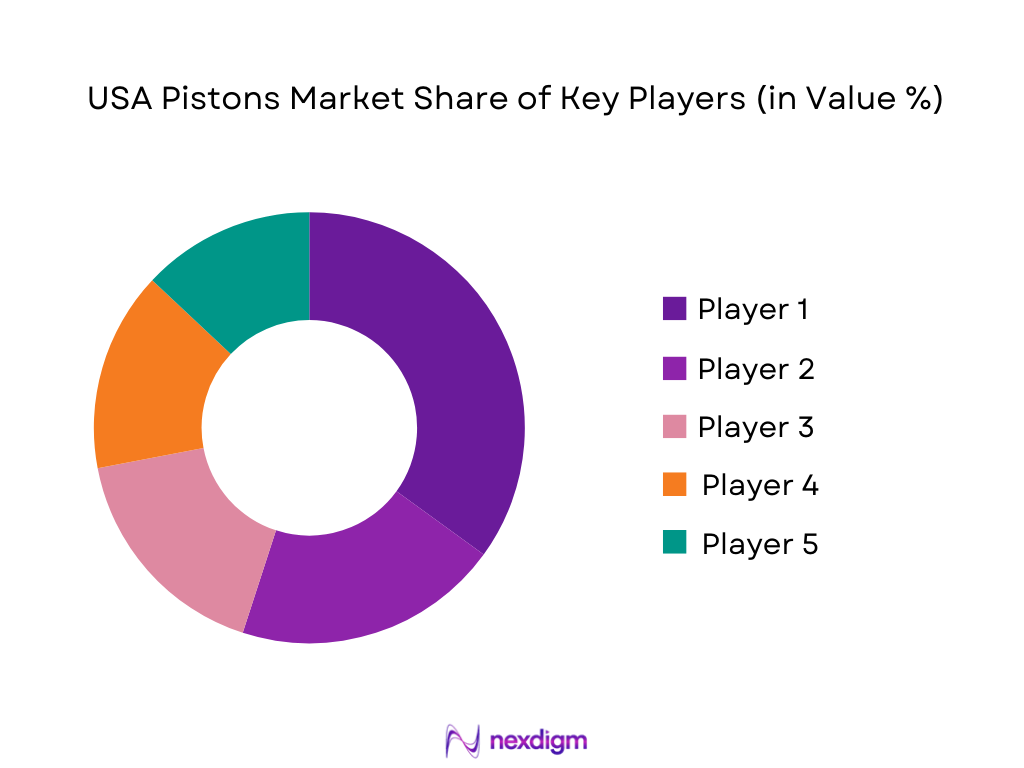

Competitive Landscape

The USA pistons market is characterized by a mix of large global Tier-1 suppliers and specialized performance manufacturers. Global groups such as MAHLE, Tenneco (Federal-Mogul), Rheinmetall Automotive (KS Kolbenschmidt), Aisin and Hitachi Astemo supply pistons to major OEMs across Detroit-3 and international brands, often via North American foundry and machining plants. Alongside them, performance-oriented companies like Wiseco, JE Pistons, CP-Carrillo and Arias serve motorsports, tuning and high-performance rebuild markets. Competition is driven by the ability to supply lightweight materials, advanced low-friction coatings, tight tolerance control and integrated piston-ring-pin systems compatible with downsized, turbocharged and hybridized ICE architectures.

| Company | Establishment Year | Headquarters (Global) | Primary US Piston Focus Segment | US Manufacturing / Engineering Presence* | Core Piston Materials / Technologies | Notable US End-Market Exposure |

| MAHLE GmbH | 1920 | Stuttgart, Germany | ~ | ~ | ~ | ~ |

| Tenneco Inc. (Federal-Mogul) | 1940 (group origin) | Northville, Michigan, USA | ~ | ~ | ~ | ~ |

| Rheinmetall Automotive (KS Kolbenschmidt) | 1909 | Neckarsulm, Germany | ~ | ~ | ~ | ~ |

| Aisin Corporation | 1965 | Kariya, Japan | ~ | ~ | ~ | ~ |

| Wiseco Performance Products | 1941 | Mentor, Ohio, USA | ~ | ~ | ~ | ~ |

USA Pistons Market Analysis

Growth Drivers

ICE Vehicle Parc Expansion

The USA pistons market is anchored by a very large internal-combustion vehicle parc that continues to generate high piston demand. Federal Highway Administration data show about 284 million registered motor vehicles in the country, based on the latest completed registration statistics, with the vast majority still powered by gasoline and diesel engines. In parallel, the U.S. Energy Information Administration reports gasoline demand averaging 8.9 million barrels per day in both 2023 and 2024, while vehicle miles traveled reached 9.0 billion miles per day in 2024, the highest on record.

New Engine Production Pipelines

New engine production and powertrain refresh cycles in the U.S. continue to sustain OEM piston demand even as electrification grows. The Bureau of Labor Statistics shows 1,018,800 employees in motor vehicles and parts manufacturing on an annual-average basis in 2024, including 302,000 in motor vehicle manufacturing and 553,300 in motor vehicle parts manufacturing, which covers engine and piston suppliers. At the same time, motor vehicle and parts dealers employ about 2,050,400 people, and 381,100 work in motor vehicle and parts wholesaling, indicating a large distribution backbone capable of absorbing ongoing engine programs.

Market Challenges

Electrification Impact on ICE Platforms

Electrification is starting to erode long-term ICE engine volumes, challenging piston demand, even though ICE remains dominant in the near term. EPA data show that electric and plug-in electric vehicles rose from 6.7% of U.S. production in 2022 to 11.5% in 2023, with the agency projecting 14.8% for 2024. EIA further reports that the combined share of hybrid, plug-in hybrid and battery electric vehicles reached 18.7% of new light-duty sales in the second quarter of 2024, up from 17.8% in the first quarter, with hybrids alone climbing to 9.6%.

Volatile Aluminium & Steel Input Costs

Piston manufacturing is heavily exposed to volatility in aluminium and steel prices. The Federal Reserve’s “Global price of Aluminium” series shows the price at about $2,549 per metric ton in January 2025, rising to $2,551 in March, then dipping to $2,368 in May, before climbing again to $2,526 in June 2025, illustrating swings of nearly $200 per ton in a few months. Over longer horizons, aluminium prices in 2022–2024 remained significantly above many pre-2010 averages. In parallel, the Producer Price Index for steel wire, stainless steel stood at 175.3 (2017=100) in July 2023, still elevated relative to historic norms.

Market Opportunities

Downsized Turbocharged Engines

Downsized turbocharged ICE engines offer a critical opportunity for advanced piston technologies in the U.S. market. EPA and EIA data together show that OEMs are improving real-world efficiency: new-vehicle fuel economy reached 27.1 mpg in 2023, with a projection of 28 mpg in 2024, while vehicle miles traveled climbed to 9.0 billion miles per day in 2024 even as gasoline demand held at 8.9 million barrels per day. This decoupling of miles from fuel use implies higher specific power, greater turbocharging and elevated cylinder pressures in smaller displacement engines, placing more thermal and mechanical load on pistons, ring lands and pins. Piston suppliers that can deliver lightweight, low-friction, high-temperature designs—through advanced alloys, gallery cooling, anodized ring grooves and DLC-coated pins—are well-positioned to win content per engine as OEMs chase stringent efficiency targets while preserving performance in high-volume truck, SUV and crossover segments.

Hydrogen & Alternative Fuel ICE Adoption

Hydrogen and alternative-fuel ICE programs create a forward-looking niche for specialized piston solutions. Industry data compiled by U.S. hydrogen advocacy groups indicate 54 retail hydrogen refueling stations operating in the United States in 2024, with at least 50 additional stations in various planning or construction stages, heavily concentrated in California. EIA also reports that petroleum distillate demand in 2024 averaged 3.8 million barrels per day, increasingly supplemented by 310,000 barrels per day of biodiesel and renewable diesel, up from 110,000 barrels per day in 2019, illustrating a structural shift toward low-carbon liquid fuels.

Future Outlook

Over the next forecast cycle, the USA pistons market is expected to grow moderately rather than exponentially, tracking the plateauing but still-large park of internal-combustion vehicles. Global piston demand is projected by Grand View Research to rise from roughly USD 2.60 billion to about USD 3.37 billion, reflecting an annualized expansion in the mid-single digits, with North America one of the key contributing regions. ICE engines will remain dominant in US pickups, SUVs, heavy-duty trucks, construction equipment and agricultural machinery, even as electrification advances in passenger cars.

Major Players

- MAHLE GmbH

- Tenneco Inc. (including Federal-Mogul piston brands)

- Rheinmetall Automotive AG (KS Kolbenschmidt)

- Aisin Corporation

- Hitachi Astemo (Hitachi Automotive Systems)

- TPR Co., Ltd.

- Shriram Pistons & Rings Ltd.

- ART Metal Mfg Co., Ltd.

- Riken Corporation

- Wiseco Performance Products

- JE Pistons

- CP-Carrillo (CP Pistons & Carrillo Industries)

- Arias Pistons

- Capricorn Automotive

- Ross Racing Pistons

Key Target Audience

- Light-Vehicle OEM Powertrain and Purchasing Teams (passenger cars, SUVs, pickups)

- Commercial Vehicle and Heavy-Duty Engine Manufacturers (on-highway truck and bus OEMs)

- Off-Highway and Agricultural Equipment OEMs (construction, mining, agriculture machinery makers)

- Tier-1 and Tier-2 Engine Component Suppliers (integrated piston-ring-pin and cylinder-liner providers)

- Independent Engine Rebuilders, Machine Shops and Aftermarket Distributors

- Motorsport Teams, Performance Tuners and Specialty Vehicle Builders

- Investment and Venture Capital Firms (evaluating powertrain suppliers and performance-parts platforms)

- Government and Regulatory Bodies (e.g., U.S. Department of Transportation, Environmental Protection Agency, National Highway Traffic Safety Administration)

Research Methodology

Step 1: Identification of Key Variables

The first step involves constructing a detailed ecosystem map of the USA pistons market, covering global and domestic piston manufacturers, engine and vehicle OEMs, off-highway and industrial engine builders, aftermarket channels and raw-material suppliers. This is supported by deep desk research across proprietary and public databases, trade statistics, vehicle-production data and powertrain-mix analyses. The output is a set of core variables such as vehicle-build volumes, engine architectures, piston-per-engine ratios and aftermarket rebuild rates that underpin market sizing.

Step 2: Market Analysis and Construction

In this phase, historical and current data for global, North American and USA piston demand are compiled and reconciled. Global and regional revenue numbers from syndicated research are cross-checked against US light-vehicle and heavy-duty production, engine-build statistics and equipment-fleet data to construct a coherent revenue and volume model. The market is then segmented by vehicle / engine application, material, end-user segment and sales channel, with each segment tied back to underlying mechanical demand drivers such as engine displacement and duty cycle.

Step 3: Hypothesis Validation and Expert Consultation

Model outputs and working hypotheses—such as the dominance of passenger cars & light trucks or cast aluminum pistons—are validated through structured interviews and computer-assisted telephone discussions with OEM powertrain engineers, purchasing managers, aftermarket distributors and machine-shop operators. These expert inputs help refine assumptions on piston replacement intervals, penetration of advanced materials, pricing differentials between OEM and aftermarket channels, and the impact of hybrid and EV adoption on ICE piston demand.

Step 4: Research Synthesis and Final Output

Finally, insights from the bottom-up demand model and expert validation are synthesized into a cohesive narrative and quantitative forecast. Scenario analysis is applied to reflect alternative pathways for electrification, fuel-economy regulation and heavy-duty diesel policy. The result is a fully triangulated view of the USA pistons market, including current size, segment-wise structure, competitive positioning and a forecast trajectory through the end of the projection period, with clear documentation of data sources, assumptions and limitations.

- Executive Summary

- Research Methodology (Market Definitions & Scope, Piston Taxonomy by Application, Engine Platform Coverage, Sampling Frame by OEM / Tier-1 / Aftermarket, Data Sources & Triangulation, Demand Modeling by Vehicle Parc & Engine Production, Price & Volume Normalization, Assumptions, Limitations)

- Definition, Scope & Product Classification

- Role of Pistons in ICE Powertrains and Engine Architectures

- Market Genesis, Evolution and Technology Milestones

- USA Piston Supply Chain and Value Chain Mapping

- Industry Cost Structure and Margin Pool Overview

- Growth Drivers

ICE Vehicle Parc Expansion

New Engine Production Pipelines

Truck & SUV Mix

Aftermarket Replacement Cycles

Performance & Motorsports Demand - Market Challenges

Electrification Impact on ICE Platforms

Volatile Aluminum & Steel Input Costs

Tightening Emission & Efficiency Constraints

High Capex for Foundry & Forging

Skilled Labor Shortage - Market Opportunities

Downsized Turbocharged Engines

Hydrogen & Alternative Fuel ICE Adoption

Lightweight & Low-Friction Designs

Premium & Performance Aftermarket

Localization & Near-Shoring - Emerging Technology & Product Trends

Aluminium vs Steel Piston Migration

3D-Printed & Additively Manufactured Pistons

Thermal Barrier & Low-Friction Coatings

Integrated Cooling Galleries

Surface Texturing - Regulatory Framework

Emission & Fuel Economy Norms

Noise & Durability Standards

Material & Safety Regulations

Environmental & Waste Management Compliance

Trade & Local Content Rules - Porter’s Five Forces Analysis

- SWOT Analysis – USA Pistons Industry

- By Value, 2019-2024

- By Volume (Units), 2019-2024

- Average Realization per Piston, 2019-2024

- By Vehicle / Equipment Type (in Value %)

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

Two-Wheelers & Powersports

Off-Highway Construction & Agriculture - By Engine & Combustion Platform (in Value %)

Spark-Ignition Gasoline Engines

Compression-Ignition Diesel Engines

Flex-Fuel & Alternative Fuel Engines

Natural Gas Engines

Hydrogen Internal Combustion Engines - By Piston Material & Construction (in Value %)

Cast Aluminum Pistons

Forged Aluminum Pistons

Steel Pistons

Hypereutectic Alloy Pistons

Articulated & Gallery-Cooled Pistons - By Sales Channel (in Value %)

OEM Factory-Fit Supply

Tier-1 Module Supply

Independent Aftermarket

OEM-Branded Service Channels

Remanufactured Engine Builder Supply - By Application & Duty Cycle (in Value %)

High-Speed Light-Duty Engines

Medium-Duty Commercial Engines

Heavy-Duty Long-Haul Engines

Stop-Start Urban Duty Engines

High-Boost Turbocharged Engines - By Region within USA (in Value %)

Midwest Manufacturing Belt

South & Sunbelt Automotive Corridor

West & Pacific States

Northeast & Mid-Atlantic

Central & Mountain States

- Market Share Analysis of Major Players

- Market Share by Key Segments

- Cross Comparison Parameters for Major Players (Company Overview & Ownership; Product Portfolio by Piston Type, Material & Engine Platform; Domestic Manufacturing Footprint & Installed Capacity; OEM vs Aftermarket Revenue Mix; Technology & R&D Capabilities in Lightweight Designs, Coatings & Additive Manufacturing; Key OEM & Tier-1 Customer Relationships; Distribution, Installer & Engine Rebuilder Network Strength; Participation in Motorsports & Performance Segments)

- Strategic Initiatives & Competitive Strategies

- Detailed Profiles of Major Companies

MAHLE GmbH / MAHLE Aftermarket Inc.

Tenneco Inc. (Federal-Mogul Powertrain)

Rheinmetall Automotive AG (KS Kolbenschmidt)

Aisin Corporation

Hitachi Astemo Ltd.

NPR (Nippon Piston Ring Co. Ltd.)

RIKEN Corporation

TPR Co., Ltd.

Shriram Pistons & Rings Ltd.

Wiseco Performance Products

JE Pistons

CP-Carrillo (CP Pistons Carrillo Industries Inc.)

Diamond Racing Pistons

Arias Pistons Ltd.

Burgess-Norton Manufacturing Co., Inc.

- Passenger Vehicle & Light Truck OEMs

- Commercial Vehicle & Off-Highway OEMs

- Independent Aftermarket Distributors & Retailers

- Engine Rebuilders, Machine Shops & Performance Tuners

- End-User Needs, Pain Points & Decision Criteria

- By Value, 2025-2030

- By Volume (Units), 2025-2030

- Average Realization per Piston, 2025-2030