Market Overview

The USA Portable Toilet Rental Market is valued at USD 2.8 billion in 2024 with an approximated compound annual growth rate (CAGR) of 7% from 2024-2030, driven by an increasing demand for sanitation facilities across various sectors, including construction, events, and emergency response. This growth is attributed to ongoing construction projects, outdoor events, and governmental initiatives aimed at improving public sanitation. The market size has continued to expand as companies provide diverse offerings, adapting to the evolving needs of customers for quality and hygiene.

Key cities driving the US Portable Toilet Rental Market include Los Angeles, New York City, and Chicago. These urban areas show increased demand due to their high population density and frequent events, from construction sites to music festivals. Local regulations also emphasize sanitary facilities, driving significant business for portable toilet rentals. Moreover, metropolitan areas often have extensive outdoor activities, creating a consistent need for sanitation solutions.

Heightened environmental awareness and the implementation of stringent regulations have propelled the portable toilet rental market forward. With the allocation of approximately USD 8 billion for addressing environmental issues in urban areas by the federal government, companies providing eco-friendly and compliant portable toilets are well-positioned to grow in response to increasing regulatory demands for sustainable practices.

Market Segmentation

By Product Type

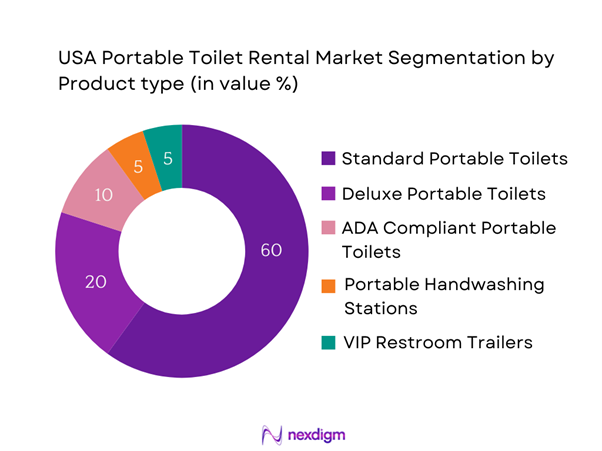

The USA Portable Toilet Rental Market is segmented by product type into standard portable toilets, deluxe portable toilets, ADA compliant portable toilets, portable handwashing stations, and VIP restroom trailers. Among these segments, standard portable toilets currently dominate the market share. Their popularity can be attributed to their cost-effectiveness and versatility, making them suitable for a wide range of applications, including construction sites and public events. Moreover, brand recognition and consumer preferences for established models heighten their market presence.

By End User

The market segmentation by end user includes construction industry, events and festivals, parks and recreation, emergency response, and residential. The construction industry segment leads the market share as ongoing development and infrastructure projects require numerous portable toilets on-site to cater to workers. The necessity for consistent access to sanitation facilities is critical in construction environments, thereby enhancing this segment’s demand compared to others. Such a trend solidifies the construction industry’s pivotal role in the portable toilet rental landscape.

Competitive Landscape

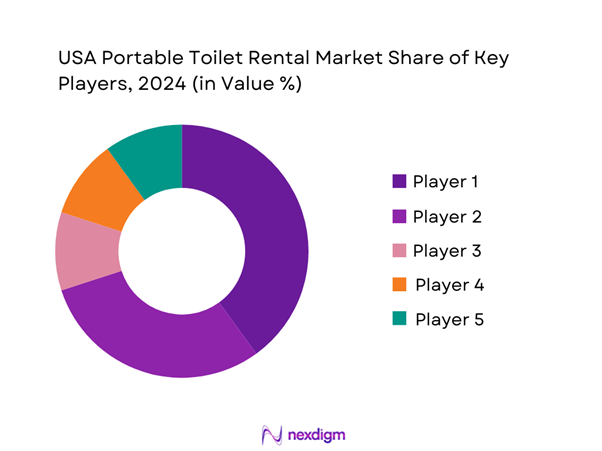

The USA Portable Toilet Rental Market is dominated by several major players, including United Site Services, Waste Management, National Construction Rentals, Honey Bucket, and A Royal Flush. This consolidation reflects a concentrated effort among key companies to establish expansive networks and maintain leadership in service quality and innovation.

| Company Name | Establishment Year | Headquarters | Number of Service Units | Coverage Area | Revenue | Fleet Size | Customer Satisfaction Rating |

| United Site Services | 1994 | Frisco, TX | – | – | – | – | – |

| Waste Management | 1978 | Houston, TX | – | – | – | – | – |

| National Construction Rentals | 1962 | Los Angeles, CA | – | – | – | – | – |

| Honey Bucket | 1995 | Woodinville, WA | – | – | – | – | – |

| A Royal Flush | 1993 | Bay City, MI | – | – | – | – | – |

USA Portable Toilet Rental Market Analysis

Growth Drivers

Increasing Events and Festivals

The USA has seen a marked increase in the number of outdoor events and festivals, with the National Association of Broadcasters (NAB) noting a rise in event participation from approximately 100 million attendees in 2022 to around 120 million in 2024. This surge drives demand for portable sanitation solutions, as event organizers require adequate facilities to cater to large crowds. Moreover, the outdoor entertainment sector, valued at USD 158 billion, is projected to expand, further bolstering the need for portable toilets to accommodate a growing audience base.

Growth in Construction Activities

The construction industry in the USA is experiencing robust growth, with the value of new construction put in place reaching USD 1.54 trillion in 2022, as reported by the U.S. Census Bureau. This upward trajectory is expected to continue, driven by infrastructure enhancement plans and federal investments in construction projects, leading to an estimated 5% increase in labor demand across the industry. The rising number of construction projects necessitates greater availability of sanitary facilities, creating ongoing demand for portable toilet rentals to provide essential restroom access at work sites.

Market Challenges

Seasonal Demand Fluctuations

The portable toilet rental market is significantly subject to seasonal fluctuations, primarily driven by outdoor events and weather conditions. During peak seasons, such as summer, the demand spikes, but this can drop by nearly 40% in the winter when fewer outdoor events occur. This weakens revenue for many service providers, leading to challenges in maintaining consistent operations. Furthermore, relying on seasonal income can complicate financial planning and operational efficiency for rental firms during off-peak periods.

Competition from Alternatives

The market faces growing competition from alternative sanitation solutions, such as mobile restroom trailers and luxury portable units that cater to high-end events. Approximately 12% of events reported using higher-end facilities in 2023, presenting a challenge for traditional portable toilet providers to maintain market share. Furthermore, the rise of alternative sanitation solutions is attributed to changing consumer preferences, with an increasing number of event planners opting for premium services that enhance the attendee experience. This competitive landscape necessitates continuous innovation and adaptation by traditional providers in order to stay relevant.

Opportunities

Development of Eco-Friendly Options

There is a growing opportunity within the USA portable toilet rental market to develop eco-friendly sanitation solutions, given the increasing consumer preference for sustainable practices. In 2023, approximately 28% of consumers indicated a willingness to pay more for environmentally friendly rental options. The environmental sector is experiencing significant investment, with around USD 60 billion allocated towards sustainable infrastructure initiatives, promoting the incorporation of green technologies and materials in portable toilet design. As awareness of environmental impact grows, companies offering innovative eco-friendly options are likely to experience substantial growth in the coming years.

Growth in Outdoor Recreation

The outdoor recreation sector is on the rise, with the Outdoor Industry Association reporting that Americans spent over USD 800 billion on outdoor activities in 2022, a figure expected to climb as more individuals engage in wilderness activities. The elevation of public interest in parks, camping, and other outdoor events signifies a growing demand for portable sanitation solutions to accommodate participants. Consequently, the drive towards outdoor recreation is expected to yield consistent growth for the portable toilet rental market. The trend is bolstered by the government’s investment of USD 1.7 billion in improving public recreational spaces, further endorsing the need for portable toilets in wide-ranging settings.

Future Outlook

Over the next few years, the USA Portable Toilet Rental Market is expected to exhibit robust growth, driven by increasing urbanization, a rise in construction activities, and sustained demand for sanitation solutions in outdoor events. The market’s future will largely benefit from innovations in product offerings, focusing on hygiene, sustainability, and efficiency, which will facilitate further market penetration. As consumer awareness concerning sanitation standards increases, the industry is likely to adapt swiftly to meet evolving regulations and client expectations.

Major Players

- United Site Services

- Waste Management

- National Construction Rentals

- Honey Bucket

- A Royal Flush

- Portable Restroom Trailers, LLC

- Big John’s Portable Toilets

- Johnny on the Spot

- Septic

- Recology

- Peoria Portable Toilet Rentals

- All American Waste

- Blue Star Porta Potty

- A-1 Portable Toilets

- Portable Sanitation Services

Key Target Audience

- Construction Companies

- Event Organizers

- Municipalities (Public Works Departments)

- Environmental Agencies (Environmental Protection Agency)

- Investments and Venture Capitalist Firms

- Emergency Management Agencies (Federal Emergency Management Agency)

- Parks and Recreation Departments

- Facility Management Firms

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping the ecosystem of the USA Portable Toilet Rental Market by identifying all key stakeholders, including suppliers, manufacturers, service providers, and end-users. This foundational step incorporates extensive desk research using a combination of secondary and proprietary databases to gather comprehensive information regarding market dynamics and trends. The primary objective is to determine essential variables impacting the market.

Step 2: Market Analysis and Construction

This phase involves compiling historical data on the USA Portable Toilet Rental Market, including rental volumes, population density in high-demand areas, and the growth of construction and event sectors. A thorough assessment of service quality metrics will also be conducted to ensure reliable and accurate revenue estimates. This multifaceted approach provides a clear understanding of market performance and opportunities for growth.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through consultations with industry experts through structured interviews, delivering insights on operational and financial endeavors from experienced professionals. These experts will include representatives from leading rental service providers, municipal authorities, and event organizers. Their evaluations will help to refine the data and confirm market dynamics.

Step 4: Research Synthesis and Final Output

The final step involves engaging with various entities in the portable toilet rental space to gather specific insights regarding market trends, customer behavior, and key performance indicators. This engagement will substantiate the figures derived from the bottom-up approach, ensuring a coherent and validated analysis of the USA Portable Toilet Rental Market that aligns with industry expectations.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Industry Overview

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Events and Festivals

Growth in Construction Activities

Environmental Regulations - Market Challenges

Seasonal Demand Fluctuations

Competition from Alternatives - Opportunities

Development of Eco-Friendly Options

Growth in Outdoor Recreation - Trends

Innovations in Design and Technology

Increasing Focus on Hygiene Standards - Government Regulation

Compliance with Health and Safety Standards

Local Zoning and Licensing Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Revenue, 2091-2024

- By Volume of Rentals, 2019-2024

- By Average Rental Price, 2019-2024

- By Product Type (In Value %)

Standard Portable Toilets

– Single-Unit Non-Flushing Models

– Construction Site Basic Units

Deluxe Portable Toilets

– Flushing Models

– Units with Sink and Mirror

ADA Compliant Portable Toilets

– Wheelchair-Accessible Units

– Oversized Entry & Handrails

Portable Handwashing Stations

– Foot Pump Operated

– Multi-User Sink Stations

VIP Restroom Trailers

– Climate-Controlled Luxury Trailers

– Multi-Stall High-End Units - By End User (In Value %)

Construction Industry

Events and Festivals

Parks and Recreation

Emergency Response

Residential - By Region (In Value %)

New York

Pennsylvania

Massachusetts

Illinois

Ohio

Michigan

Texas

Florida

Georgia

California

Arizona

Washington - By Rental Duration (In Value %)

Short-term Rentals

– Daily and Weekend Events

– Emergency or Temporary Needs

Long-term Rentals

– Monthly Construction Contracts

– Park and Recreation Installations - By Distribution Channel (In Value %)

Direct Sales

Online Platforms

Rental Agencies

- Market Share of Major Players on the Basis of Revenue/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Financial Performance, Market Position, Fleet Size, Customer Service Ratings, Innovation Capability, Distribution Channels, Number of Dealers and Distributors, Margins, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Service Providers

- Detailed Profiles of Major Companies

United Site Services

Waste Management, Inc.

National Construction Rentals

Porta Potty Rental Company

Septic Services

Honey Bucket

Big John’s Portable Toilets

A Royal Flush

Portable Restroom Trailers, LLC

All American Waste

Peoria Portable Toilet Rentals

Johnny on the Spot

Potty Time Rentals

Blue Star Porta Potty

Bear Rental

- Market Demand and Utilization

- Pricing and Budget Allocations

- Regulatory Compliance and Expectations

- Consumer Needs Analysis

- Decision-Making Factors

- By Revenue, 2025-2030

- By Volume of Rentals, 2025-2030

- By Average Rental Price, 2025-2030