Market Overview

The USA Power Window Motors market is valued at USD ~ billion, supported by sustained vehicle production volumes, a large in-use vehicle parc, and near-universal penetration of power window systems across passenger vehicles and light trucks. According to industry data from automotive component trade associations and supplier financial disclosures, more than ~ vehicles were produced domestically, while the total vehicle parc exceeded ~ units, creating strong OEM and aftermarket demand. Replacement cycles driven by motor wear, regulator failures, and electrical faults contributed significantly to recurring demand alongside OEM installations.

The market is dominated by automotive manufacturing and assembly hubs such as Detroit (Michigan), Toledo (Ohio), Arlington (Texas), Louisville (Kentucky), and Spartanburg (South Carolina). These regions host high-volume vehicle assembly plants, Tier-1 body electronics suppliers, and logistics clusters that support door module and window system manufacturing. Additionally, states such as California and Texas drive aftermarket demand due to their large vehicle fleets, extended driving conditions, and higher failure incidence linked to heat exposure and intensive vehicle usage patterns.

Market Segmentation

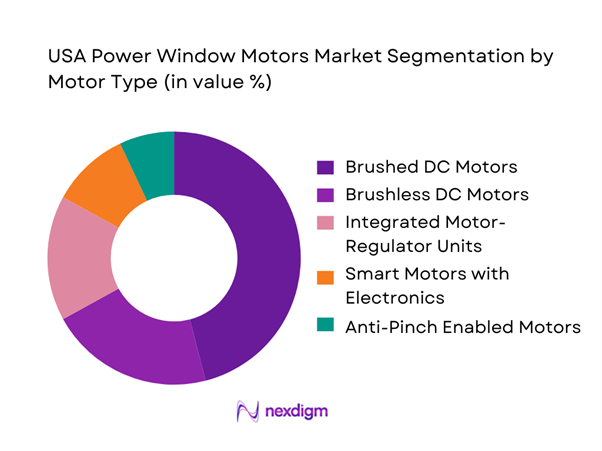

By Motor Type

The USA Power Window Motors market is segmented by motor type into brushed DC motors, brushless DC motors, integrated motor-regulator units, smart motors with control electronics, and anti-pinch enabled motors. Brushed DC motors dominate this segmentation due to their long-established use in automotive body electronics, lower manufacturing cost, and proven reliability in mass-market vehicles. These motors are widely deployed in entry- and mid-segment passenger cars and light trucks, where OEMs prioritize cost efficiency and component standardization. Brushed DC motors are also easier to replace in the aftermarket, supporting strong secondary sales volumes. Their compatibility with existing regulator mechanisms and body control architectures further reinforces dominance despite gradual technology transitions.

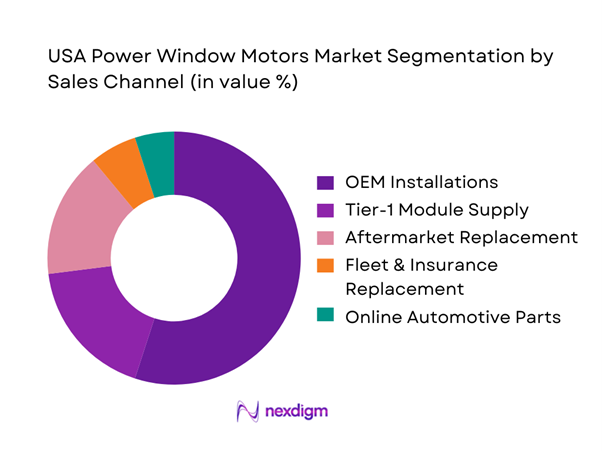

By Sales Channel

The market is segmented into OEM installations, Tier-1 module supply, aftermarket replacement, fleet and insurance replacement, and online automotive parts channels. OEM installations account for the dominant share of the market as power window motors are standard fitment across nearly all passenger vehicles produced in the country. High domestic vehicle output, combined with platform-wide standardization of door systems, ensures consistent bulk procurement by automakers. Long-term supply contracts, predictable volumes, and integration with door modules make OEM channels the primary revenue contributor. Additionally, electrification of vehicle body systems continues to reinforce OEM dependence on specialized motor suppliers.

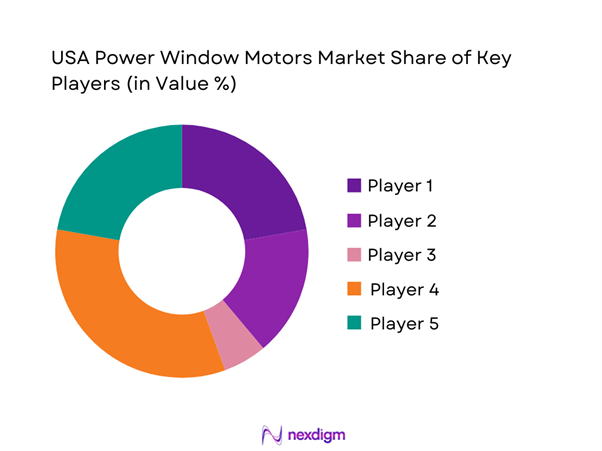

Competitive Landscape

The USA Power Window Motors market is moderately consolidated, dominated by global Tier-1 automotive suppliers and specialized motor manufacturers with long-standing OEM relationships. Companies with vertically integrated motor manufacturing, electronics capability, and regional production footprints exert strong influence over pricing, technology adoption, and platform selection. Barriers to entry remain high due to qualification requirements, safety compliance, and OEM sourcing cycles.

| Company | Established | Headquarters | Core Product Focus | OEM Relationships | Manufacturing Footprint | Technology Capability | Aftermarket Presence |

| Brose Fahrzeugteile | 1908 | Germany | ~ | ~ | ~ | ~ | ~ |

| Johnson Electric | 1959 | Hong Kong | ~ | ~ | ~ | ~ | ~ |

| Denso | 1949 | Japan | ~ | ~ | ~ | ~ | ~ |

| Valeo | 1923 | France | ~ | ~ | ~ | ~ | ~ |

| Nidec | 1973 | Japan | ~ | ~ | ~ | ~ | ~ |

USA Power Window Motors Market Analysis

Growth Drivers

Rising Power Feature Penetration Across All Vehicle Segments

Power-window motor demand in the U.S. is structurally supported by a high-volume new-vehicle pipeline and a large in-use vehicle base where “power windows” have become an expected feature, not a premium add-on. U.S. industry light-vehicle sales totaled ~ units (new vehicles) in the latest reported full-year period, which directly translates into millions of door systems requiring window lift motors and related regulators at the factory stage. On the macro side, the U.S. economy recorded USD ~ million in GDP and USD ~ GDP per capita, sustaining consumer ability to finance vehicles with comfort features and supporting OEM production planning depth. These combined volumes keep power window motor fitment broad-based across passenger cars and light trucks rather than confined to top trims.

SUV and Pickup Dominance Increasing Multi-Motor Per Vehicle Count

U.S. demand skew toward high-content SUVs and pickups increases the motor count per vehicle because these platforms commonly ship with power windows across more door positions and often include additional powered glass (e.g., rear sliding windows in pickups) and higher duty-cycle use cases (family/utility usage). Ford’s internal production reporting shows ~ units of F-Series (F-150) produced year-to-date through the latest published period, illustrating how a single high-volume nameplate can anchor multi-motor door-system demand in the supply chain. At the market level, GM disclosed ~ U.S. industry sales for the year, keeping SUV/pickup-led assembly throughput high. Macro stability—GDP at USD ~ million—supports sustained truck/SUV affordability and fleet replacement cycles that preserve multi-motor penetration in mainstream builds.

Challenges

Motor Failure Rates Due to Thermal and Load Stress

Window motors are exposed to thermal cycling (door cavities, solar loading) and mechanical load spikes (frozen seals, misaligned regulators, high-friction tracks). Heat intensity is a practical stress amplifier: the contiguous U.S. average annual temperature reached ~°F for the warmest year on record, ~°F above the long-term average—conditions that increase thermal soak frequency for parked vehicles and can compound lubricant breakdown, plastic gear wear, and electrical resistance issues in door modules. From a compliance perspective, FMVSS 118 testing emphasizes controlled closure behavior and anti-pinch performance, which raises the quality bar for motor consistency under load. With the economy at USD ~ million GDP, high vehicle utilization persists, keeping duty-cycle stress elevated across the installed base.

Supply Chain Dependency on Rare Earth Magnets

High-torque, compact motors increasingly rely on rare-earth permanent magnets, exposing window-motor supply chains to import concentration and material processing bottlenecks. Public documentation of rare-earths market and supply fundamentals continues to flag U.S. dependence on global processing flows, with China’s role frequently highlighted in critical-mineral narratives. When upstream disruptions occur, they can ripple into automotive subcomponents that use magnet materials—tightening lead times and raising qualification risk for Tier-1 motor suppliers. This challenge sits alongside a high-throughput vehicle market: ~ U.S. industry sales create steady pull for motorized door systems, so even short interruptions can create backlogs. Macro resilience (GDP USD ~ million) helps absorb shocks, but it does not remove exposure to concentrated supply chains for strategic inputs used in compact motor designs.

Opportunities

Smart Motor Integration with ADAS and Body Control

A major growth pathway is migrating from “dumb” window motors to smart, networked actuators that integrate with body control modules for diagnostics (stall detection, over-current events), safety behavior (anti-pinch repeatability), and feature logic (global close, child lock strategies, remote closure rules). Regulatory attention around powered-window control behavior under FMVSS 118 provides a consistent framework that rewards robust sensing and control integration rather than commodity-only designs. The U.S. new-vehicle pipeline remains large—~ industry sales—so OEM adoption of smarter window actuation can scale quickly across platforms once validated. Macro fundamentals support the electronics content shift: U.S. GDP at USD ~ million and GDP per capita at USD ~ enable continued consumer acceptance of feature-rich trims and OEM investment in controller-centric architectures. The opportunity is therefore “content uplift per vehicle” even when unit sales are stable.

Lightweight High-Torque Motor Development

The opportunity in lightweight, high-torque window motors is driven by OEM priorities to reduce mass, improve energy efficiency (especially relevant in electrified vehicles), and maintain performance under higher friction loads from laminated glass, tighter seals, and NVH countermeasures. Climate realities also support durability-focused torque design: an average annual temperature of ~°F across the contiguous U.S. implies more frequent thermal soak conditions that can harden seals and raise peak loads during actuation events—making torque margin and materials resilience more valuable. At the same time, parts cost pressure is visible in U.S. motor vehicle parts producer price trends, pushing suppliers toward designs that reduce material intensity while maintaining output. With GDP at USD ~ million, U.S. OEM programs can fund re-engineering cycles that favor differentiated, validated motor designs over commodity replacements.

Future Outlook

Over the next five years, the USA Power Window Motors market is expected to maintain stable growth supported by gradual technology upgrades rather than volume expansion. OEMs are increasingly shifting toward integrated door modules and electronically controlled motors to improve safety and user experience. Meanwhile, the aging vehicle fleet will continue to sustain aftermarket demand. Electrification of body systems and software-driven control architectures will shape product development strategies for leading suppliers.

Major Players

- Brose Fahrzeugteile

- Johnson Electric

- Denso

- Valeo

- Nidec

- Bosch

- Continental

- Magna International

- Mitsuba Corporation

- Mabuchi Motor

- Ametek

- Kongsberg Automotive

- Aisin

- SHIROKI

Key Target Audience

- Automotive OEMs and vehicle manufacturers

- Tier-1 automotive body electronics suppliers

- Tier-2 electric motor manufacturers

- Automotive aftermarket distributors and retailers

- Fleet operators and mobility service providers

- Insurance-linked vehicle repair networks

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping the power window motor ecosystem, identifying OEMs, Tier-1 suppliers, and aftermarket stakeholders. Secondary research sources and proprietary automotive databases are used to define variables influencing demand, pricing, and technology adoption.

Step 2: Market Analysis and Construction

Historical vehicle production, vehicle parc data, and component penetration rates are analyzed to construct bottom-up market estimates. OEM sourcing volumes and replacement frequencies are evaluated to validate revenue calculations.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through structured interviews with motor manufacturers, OEM procurement professionals, and aftermarket distributors. These interactions provide insights into technology trends and procurement strategies.

Step 4: Research Synthesis and Final Output

Data from primary and secondary sources are triangulated to finalize market size, segmentation, and competitive positioning, ensuring consistency, accuracy, and industry relevance.

- Executive Summary

- Research Methodology (Market Definitions and Technical Scope, Product Inclusion–Exclusion Matrix, OEM vs Aftermarket Boundary Assumptions, Vehicle Production–Parc Linking Logic, Motor Penetration Assumptions by Vehicle Class, Bottom-Up Volume Build Using Door-Level Fitment, ASP Normalization Logic, Supply–Demand Reconciliation, Primary Interviews with Tier-1s, OEM Purchasing Heads, Aftermarket Distributors, Limitations and Forward-Looking Assumptions)

- Definition and Scope

- Market Evolution and Technology Adoption Path

- Vehicle Electrification Linkage and Body Electronics Integration

- Industry Business Cycle and Replacement Dynamics

- Automotive Body Control System Value Chain Analysis

- Growth Drivers

Rising Power Feature Penetration Across All Vehicle Segments

SUV and Pickup Dominance Increasing Multi-Motor Per Vehicle Count

Electrification of Body Functions

Increasing Vehicle Average Age Supporting Replacement Demand - Challenges

Motor Failure Rates Due to Thermal and Load Stress

Supply Chain Dependency on Rare Earth Magnets

ASP Pressure from OEM Cost Reduction Programs

Counterfeit Aftermarket Motors - Opportunities

Smart Motor Integration with ADAS and Body Control

Lightweight High-Torque Motor Development

EV-Specific Window Motor Platforms - Trends

Shift Toward BLDC Motors

Noise, Vibration, and Harshness Optimization

Modular Door System Integration - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Motor ASP, 2019–2024

- By Technology Architecture (in Value %)

Brushed DC Power Window Motors

Brushless DC Power Window Motors

Integrated Motor-Regulator Assemblies

Anti-Pinch Enabled Motors

Smart Motors with LIN/CAN Interface - By End-Use Industry (in Value %)

Passenger Cars

SUVs and Crossovers

Light Commercial Vehicles

Electric Vehicles

Fleet and Utility Vehicles - By Application (in Value %)

OEM Fitment

Tier-1 Module Supply

Aftermarket Replacement

Fleet and Insurance-Driven Replacement

Online Automotive Parts Platforms - By Connectivity Type (in Value %)

Standalone Motor Systems

Body Control Module Integrated Motors

Smart Door Module Integrated Motors

Anti-Pinch Sensor Embedded Motors

Software-Upgradable Window Control Motors - By Region (in Value %)

West Coast

Midwest

Southern States

Northeast

Mountain States

- Market Share Analysis by Value and Volume

- Cross Comparison Parameters (Product Portfolio Breadth, Motor Torque Range, Noise Rating, Motor Life Cycles, Smart Control Capability, OEM Relationships, Manufacturing Footprint, Cost Positioning)

- SWOT Analysis of Major Players

- Pricing Analysis by Motor Configuration and Vehicle Class

- Detailed Company Profiles

Brose Fahrzeugteile

Johnson Electric

Denso

Mitsuba Corporation

Nidec

Valeo

Aisin

Magna International

Bosch

Continental

Mabuchi Motor

Ametek

Kongsberg Automotive

SHIROKI

IFB Automotive

- OEM Purchasing Behavior and Sourcing Strategy

- Aftermarket Replacement Demand Patterns

- Fleet and Commercial Operator Requirements

- Pain Point Analysis (failure rates, noise issues, warranty claims)

- Decision-Making and Supplier Selection Criteria

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Motor ASP, 2025–2030