Market Overview

The USA Road Sign Recognition Systems market has experienced significant expansion, driven by the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicle technologies. In 2024, the market size is valued at approximately USD ~ billion, fueled by the rising demand for intelligent transportation systems, government regulations mandating safety technologies in vehicles, and advancements in artificial intelligence (AI) and machine learning for better image recognition accuracy. The integration of road sign recognition systems with other ADAS features, such as lane departure warning and adaptive cruise control, also contributes to the growth. Furthermore, the increasing emphasis on road safety and infrastructure improvements has accelerated market expansion.

The USA remains a key leader in the road sign recognition systems market, with dominance in urban areas like San Francisco, New York, and Detroit. These cities are influential due to their progressive approach to smart city initiatives and the widespread deployment of ADAS and autonomous driving technologies. California leads the market due to its stringent vehicle safety regulations and support for innovation in autonomous vehicles. Detroit, as the automotive capital, continues to foster collaboration between major automakers and technology companies, driving the adoption of road sign recognition systems.

Market Segmentation

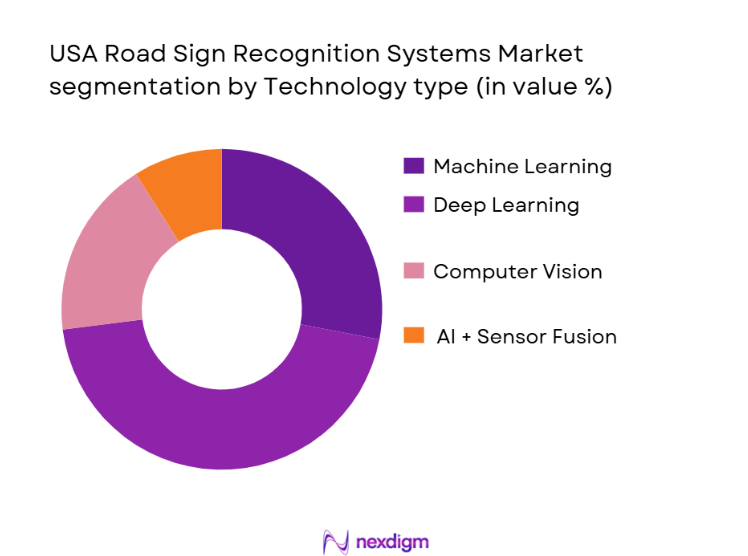

By Technology Type

The USA Road Sign Recognition Systems market is segmented by technology type, which includes Machine Learning (ML), Deep Learning (DL), Computer Vision (CV), and AI combined with Sensor Fusion. Deep Learning has dominated the market share in recent years, driven by its ability to process vast amounts of data with high accuracy. This technology is especially crucial for recognizing complex road signs in varying conditions, such as poor lighting or adverse weather. Major automotive manufacturers like Tesla and Ford leverage deep learning for superior detection accuracy in their ADAS systems, further driving its adoption. These advanced algorithms outperform traditional methods, ensuring high levels of reliability and precision, which are critical for safety in autonomous driving applications.

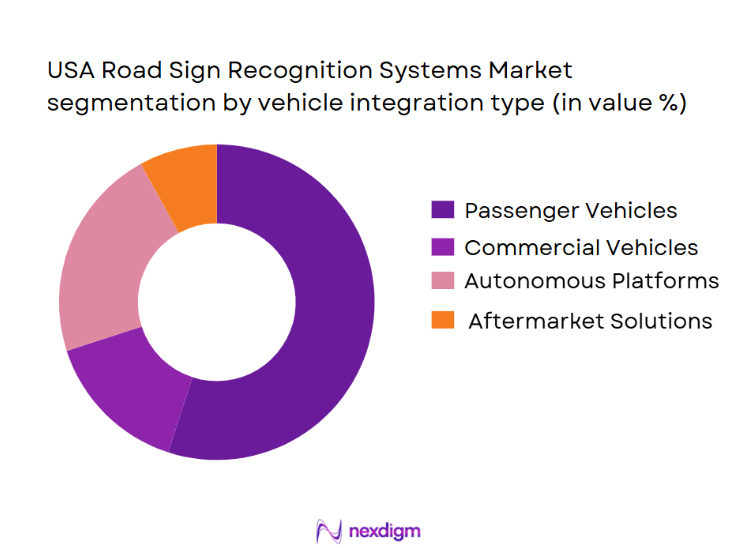

By Vehicle Integration Type

The market is also segmented by vehicle integration type, including passenger vehicles, commercial vehicles, autonomous platforms, and aftermarket solutions. The passenger vehicle segment leads in market share due to the increasing penetration of ADAS features in consumer cars. Automakers are prioritizing road sign recognition systems to meet regulatory standards for vehicle safety, which is a key factor driving the demand for these systems. Additionally, consumer interest in enhanced safety features in everyday vehicles further fuels this segment’s growth. As the technology evolves and becomes more affordable, it is expected that the aftermarket solutions for road sign recognition will also see notable growth in the coming years, particularly for retrofitting older vehicles.

Competitive Landscape

The USA Road Sign Recognition Systems market is highly competitive, with several key players driving innovation in this sector. Major players include both automotive manufacturers and technology firms specializing in AI and machine learning solutions. The dominance of global players such as Mobileye (Intel), Bosch, and Continental highlights the growing importance of advanced technology integration in vehicle safety systems. These companies, alongside others like Denso and Valeo, are heavily investing in AI-driven road sign recognition technologies that can be seamlessly integrated into both new and existing vehicles. The competitive landscape is also characterized by strategic partnerships and acquisitions to enhance product portfolios and increase market share.

| Company | Establishment Year | Headquarters | Technology Strength | Market Segment | Partnerships | Revenue (USD) | Regional Focus | Product Portfolio |

| Mobileye (Intel) | 1999 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Bosch | 1886 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Continental | 1871 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Denso | 1949 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Valeo | 1923 | France | ~ | ~ | ~ | ~ | ~ | ~ |

USA Road Sign Recognition Systems Market Analysis

Growth Drivers

Government Mandates and Safety Regulations

The USA government has introduced stringent regulations that require the integration of advanced driver assistance systems (ADAS) in vehicles. These regulations, aimed at improving road safety, are driving the adoption of road sign recognition systems. As a result, automakers are increasingly incorporating road sign recognition as part of the broader ADAS suite to comply with safety standards and consumer expectations.

Technological Advancements in AI and Machine Learning

The rapid development of artificial intelligence (AI) and machine learning (ML) technologies is significantly enhancing the accuracy and reliability of road sign recognition systems. These advancements allow for better detection and interpretation of road signs under various driving conditions, such as low visibility or inclement weather. The improvement in processing power and algorithm optimization is making these systems more cost-effective and efficient, accelerating their adoption across the automotive industry.

Market Challenges

High Integration Costs

Integrating road sign recognition systems into vehicles requires a significant investment in hardware, software, and sensor technologies. The cost of advanced vision sensors, cameras, and AI processors can be prohibitive, especially for smaller automakers and suppliers. This financial barrier limits the widespread adoption of these systems in lower-tier and budget vehicles.

Environmental Factors Affecting System Performance

Road sign recognition systems face challenges in performing optimally under various environmental conditions, such as fog, rain, snow, or low light. Variations in road sign designs and weather-induced visual obstructions can lead to inaccuracies in recognition, which could potentially compromise the safety and effectiveness of ADAS. These challenges pose significant hurdles in achieving consistent and reliable system performance across all conditions.

Opportunities

Expansion of Smart Cities and Infrastructure Development

The ongoing development of smart cities and intelligent transportation systems (ITS) in the USA presents a significant opportunity for road sign recognition systems. As cities invest in digitizing and automating their infrastructure, the demand for real-time traffic monitoring and intelligent road sign management solutions is increasing. This creates an opportunity for system manufacturers to integrate road sign recognition technology into smart city frameworks, enhancing traffic flow and road safety.

Growing Adoption of Autonomous Vehicles

As autonomous vehicles (AVs) continue to evolve, the demand for robust road sign recognition systems becomes even more critical. Autonomous vehicles rely heavily on real-time data and accurate sign recognition to navigate roads safely. As the number of AVs increases, manufacturers and tech companies are focusing on enhancing these systems, creating new business opportunities and driving market growth in the road sign recognition sector.

Future Outlook

Over the next 5 years, the USA Road Sign Recognition Systems market is expected to see substantial growth. Key drivers include continued advancements in machine learning and computer vision, coupled with regulatory pressures demanding more safety features in vehicles. The growth of autonomous vehicles and smart city initiatives, which require seamless integration of road sign recognition systems, will play a pivotal role in shaping the market’s future trajectory. Furthermore, as the technology becomes more affordable, wider adoption across vehicle types—from passenger to commercial vehicles—is anticipated.

Major Players

- Mobileye (Intel)

- Bosch

- Continental

- Denso

- Valeo

- ZF Friedrichshafen AG

- Aptiv PLC

- Magna International

- Veoneer

- NVIDIA Corporation

- Texas Instruments

- Luminar Technologies

- Garmin Ltd.

- Sony Corporation

- Hyundai Mobis

Key Target Audience

- Automotive Manufacturers (OEMs)

- Autonomous Vehicle Developers

- Tier-1 and Tier-2 Suppliers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (NHTSA, FHWA, SAE)

- Infrastructure and Smart City Developers

- Fleet Management Companies

- Automotive Aftermarket Suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves defining the scope of road sign recognition systems by identifying key market variables such as technology types, vehicle integration segments, and geographic regions. This step ensures comprehensive coverage of all aspects of the market through primary and secondary research sources.

Step 2: Market Analysis and Construction

In this phase, historical market data will be analyzed to evaluate growth trends, adoption rates, and technological advancements in the road sign recognition space. The analysis will be complemented by customer usage data from OEMs and commercial vehicle fleets to construct a market model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be refined and validated by conducting in-depth interviews with key industry experts, including engineers, policymakers, and decision-makers from major automotive firms. These consultations will provide operational insights and data on market needs and adoption drivers.

Step 4: Research Synthesis and Final Output

The final phase involves compiling the research findings into a detailed report, integrating expert inputs, and reviewing technological trends, competitive forces, and regulatory influences. This ensures a well-rounded market forecast and actionable insights for stakeholders.

- Executive Summary

- Research Methodology (Definitions & Scope, Data Sources, Primary & Secondary Research Frameworks, Statistical Modelling Techniques, Forecasting Methodology, Data Quality Controls, Market Sizing & Validation Logic, Assumptions & Limitations)

- Market Definition & Scope

- Market Genesis & Technology Evolution

- Regulatory & Safety Standards Overview

- Road Sign Recognition System Ecosystem

- Vision Systems Value Chain

- System Functional Architecture

- Market Drivers

Regulatory Push for Road Safety & ADAS Mandates

Expansion of Autonomous & Connected Vehicles

Smart City & Intelligent Transportation System Deployments

Demand for RealTime Sign Interpretation under Adverse Conditions

Cost Efficiency Improvements in Vision Components - Market Challenges

High Integration & Compliance Certification Costs

Algorithmic Complexity & False Detection Risks

Infrastructure Compatibility & Data Integration Barriers

Cybersecurity & Data Privacy Limitations - Market Opportunities

V2X Enabled Road Sign Communication

AIDriven Predictive Recognition Systems

PublicPrivate Smart Infrastructure Collaborations

Retrofitting Existing Vehicle Fleets

Aftermarket SaaS Vision Solutions - Market Trends

Shift to Deep Learning & Edge AI Architectures

Sensor Fusion Standardization (MultiModal Recognition)

Growth of SoftwareFirst and OTA Update Models

Integration with HD Mapping & Navigation Systems

Use of Synthetic & Augmented Training Data - Government Regulations & Standards

USA Road Safety Regulations (Mandatory ADAS Suites)

International Standards Impacting US OEMs (ISO, SAE)

Data & Vision System Certification Requirements

Compliance for Autonomous & Connected Road Technologies

- Market Size 2019-2025

- Unit Volume Installed Base 2019-2025

- Average Selling Price Trends 2019-2025

- Revenue by End Use 2019-2025

- By Technology Type (In Value %)

Machine Learning Recognition

Deep Learning Models

Computer Vision Algorithms

AI with Sensor Fusion - By Component (In Value %)

Vision Cameras

Sensors

Processors/ECUs

Embedded Software & Middleware - By Vehicle Integration Type (In Value %)

Passenger Vehicles

Commercial Vehicles

Autonomous Platforms

Aftermarket Solutions - By Application Use Case (In Value %)

OnVehicle Detection Systems

Smart Traffic Management Infrastructure

Roadside Monitoring & Compliance Systems

Fleet Safety & Telematics Integration - By Deployment Model (In Value %)

OEM Embedded Systems

Tier1 / Tier2 Supplier Modules

Aftermarket Vision Kits & Retrofit Solutions

- Market Share Breakdown – Value & Units (OEM vs Tier1 vs Software)

- Competitive Intensity and Market Concentration

- Strategic Positioning & Road Sign Recognition Capabilities

- Cross Comparison Parameters (Market Specific)

Technology Readiness Level (TRL)

Recognition Accuracy (Benchmark vs RealWorld Test Results)

Sensor & Camera Resolution Standards

Compute Efficiency (TOPS/Watt for Edge AI)

Software Update / OTA Capability

Integration Partnerships (OEM & Infrastructure)

Certification & Compliance Achievements

Data Annotation & Training Dataset Scale - Strategic Profiles of Major Competitors

Robert Bosch GmbH

Continental AG

DENSO Corporation

Aptiv PLC

Mobileye (Intel)

ZF Friedrichshafen AG

HELLA GmbH & Co. / FORVIA

Magna International Inc.

NVIDIA Corporation (Drive Platforms)

Valeo SA

Panasonic Holdings

Hitachi Astemo

Veoneer / SSW

Ford Motor Company – ADAS Division

General Motors – Super Cruise & Safety Tech - Competitive Benchmarking & SWOT

Comparative Technology Readiness

Strength, Weakness, Opportunity, Threat Analysis

Pricing, Cost Structure & ASP Comparison

- Market Demand and Utilization

- End User Requirements and Preferences

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements for End Users

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Market Forecast 2026-2030

- Technology Adoption Trajectory 2026-2030

- Penetration by Vehicle Tier & Application Domain 2026-2030