Market Overview

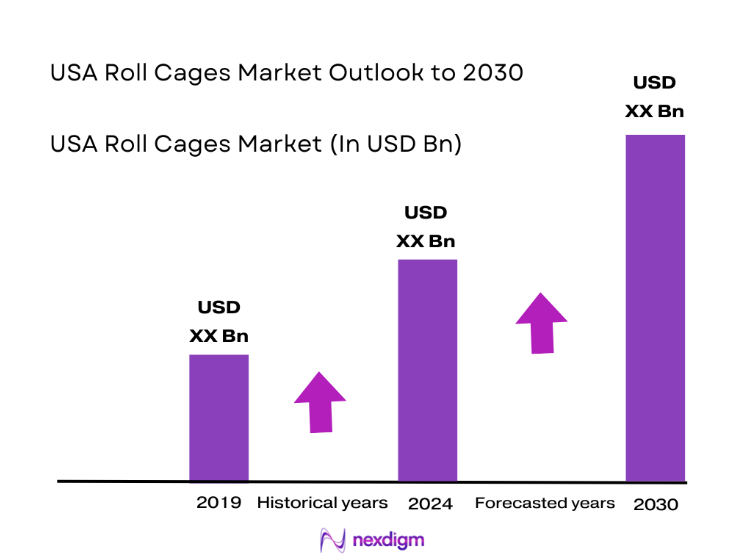

The USA Roll Cages market current size stands at around USD ~ million, supported by consistent demand from motorsports, off-road recreation, and performance vehicle modification ecosystems. Recent activity indicates revenues of USD ~ million and USD ~ million across the latest two-year period, driven by higher participation in track-day events and increased adoption of safety upgrades in utility vehicles. Production volumes remain steady at ~ units annually, reflecting strong aftermarket penetration and stable professional racing demand.

The market shows dominance across states with deep motorsports heritage and advanced fabrication ecosystems, particularly in California, Texas, Florida, and North Carolina. These regions benefit from dense clusters of racing teams, performance workshops, and safety certification bodies. High concentration of off-road culture, strong logistics infrastructure, and favorable small-manufacturer policies further reinforce regional leadership. Mature supplier networks and established distribution channels enable faster customization cycles, making these areas central to innovation and volume growth.

Market Segmentation

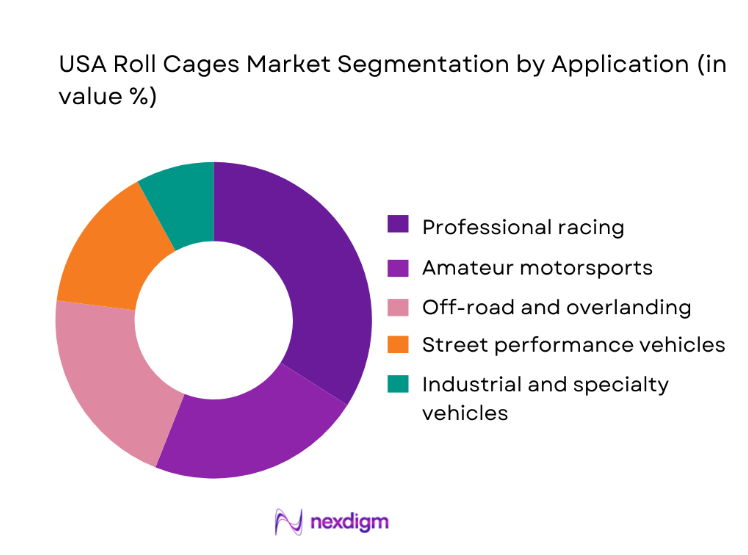

By Application

Professional racing and organized motorsports remain the dominant application segment in the USA Roll Cages market, driven by mandatory safety compliance across sanctioned leagues and continuous upgrades to meet evolving standards. Amateur motorsports and track-day vehicles form the second-largest demand base, supported by rising participation in grassroots racing communities. Off-road and overlanding applications are expanding rapidly as safety awareness grows among recreational users. Street performance vehicles contribute steady demand through custom fabrication projects, while industrial and specialty vehicles maintain a niche but stable requirement for rollover protection solutions in hazardous operating environments.

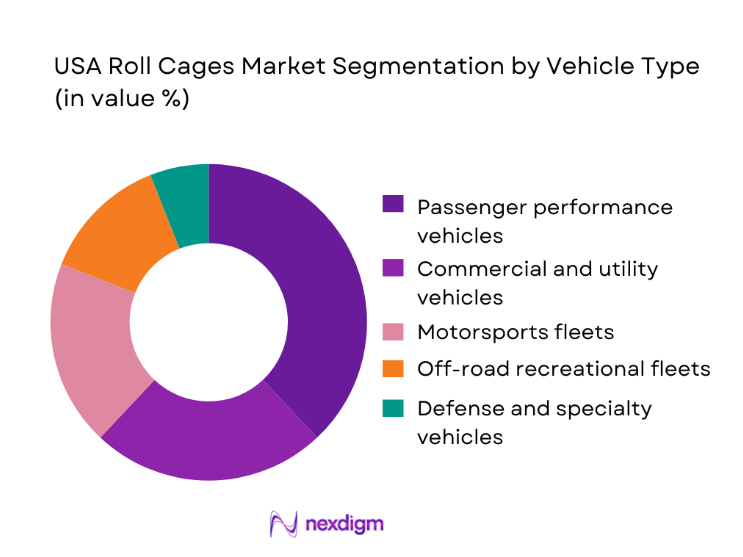

By Vehicle Type

Passenger performance vehicles dominate overall adoption due to high customization rates and strong aftermarket culture in the USA. Commercial and utility vehicles follow closely, particularly in agriculture, construction, and emergency services where rollover risk mitigation is critical. Motorsports fleets remain structurally important despite smaller volumes because of higher specification intensity and certification requirements. Off-road recreational fleets continue to expand as adventure tourism and trail-based activities grow nationwide. Defense and specialty vehicles represent a controlled but strategically important segment, driven by procurement programs focused on crew safety and mission durability.

Competitive Landscape

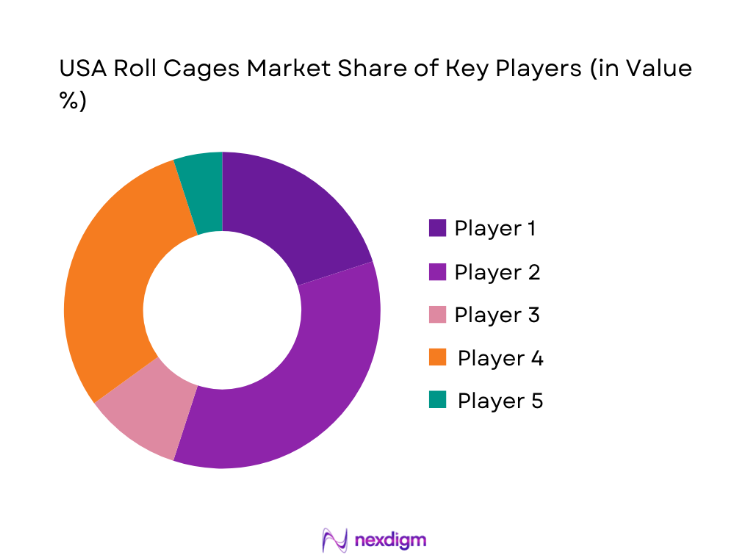

The USA Roll Cages market is moderately fragmented, characterized by a mix of specialized fabricators, performance aftermarket brands, and motorsports-focused safety equipment manufacturers. While a few established players command strong brand recognition in professional racing, a large number of regional workshops and niche suppliers serve customized and application-specific demand. Competition is driven more by engineering depth, certification credibility, and delivery speed than by scale alone, creating space for both premium and value-oriented market positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Auto Power Industries | 1971 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| S&W Race Cars | 1978 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Chassisworks | 1997 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Kirk Racing Products | 1994 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Wolfe Race Craft | 1968 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

USA Roll Cages Market Analysis

Growth Drivers

Rising participation in motorsports and track-day events

The expansion of organized motorsports and recreational track-day programs continues to stimulate steady demand for roll cages across professional and amateur segments. Recent cycles recorded participation growth supported by over ~ registered track-day events annually nationwide, generating consistent equipment upgrades. Safety compliance investments exceeded USD ~ million across racing teams and clubs, while installation volumes reached ~ units through certified workshops. Increased insurance requirements and league-level safety audits further reinforce adoption, making motorsports participation a structural driver for sustained market expansion.

Expansion of off-road and overlanding culture in the US

Off-road recreation and overlanding activities have emerged as a major growth engine, particularly across western and southern states. Equipment spending tied to vehicle safety enhancements surpassed USD ~ million in the latest cycle, with roll cage installations reaching ~ units among recreational fleets. Growth is supported by rising trail network development, organized off-road events exceeding ~ annually, and stronger community-driven safety awareness. This cultural shift toward adventure mobility continues to expand the addressable market beyond traditional racing segments.

Challenges

High cost of custom-fabricated roll cages

The market faces persistent resistance from cost-sensitive buyers due to the premium pricing of custom-engineered solutions. Fabrication expenses often exceed USD ~ million collectively across large workshop networks each year, limiting accessibility for entry-level motorsports and recreational users. Installation time requirements of ~ hours per vehicle further elevate total ownership cost. This financial barrier slows penetration in emerging user groups and constrains volume growth, particularly in regions with limited access to standardized modular cage options.

Regulatory complexity across racing bodies and states

Diverse safety standards across sanctioning bodies and state jurisdictions create operational friction for manufacturers and installers. Compliance management requires continuous certification updates, driving annual administrative spending of USD ~ million across industry participants. Variations in tubing specifications, mounting protocols, and inspection criteria result in fragmented production runs of ~ units per configuration, reducing economies of scale. This complexity increases lead times and raises the risk profile for smaller fabricators entering regulated racing segments.

Opportunities

Growth in electric performance vehicles requiring new safety designs

The rise of electric performance platforms presents a significant opportunity for advanced roll cage engineering. Development programs targeting battery-integrated safety structures attracted investments of USD ~ million in recent innovation cycles. Prototype deployment has already reached ~ systems across pilot fleets, highlighting strong early adoption. As electric drivetrains alter weight distribution and crash dynamics, demand for redesigned rollover protection solutions will expand across racing, track-day, and specialty vehicle applications.

Expansion of women and youth participation in motorsports

Increasing inclusion initiatives are broadening the demographic base of motorsports participants, driving incremental demand for safety equipment. Recent enrollment in youth racing programs surpassed ~ participants, while women-focused racing leagues expanded to ~ active teams nationwide. Equipment procurement linked to these initiatives generated spending of USD ~ million on safety upgrades, including roll cages. This shift supports long-term volume growth by cultivating new buyer segments with high safety compliance expectations.

Future Outlook

The USA Roll Cages market is positioned for steady structural growth through 2030 as motorsports participation broadens and off-road culture becomes more mainstream. Advancements in lightweight materials and modular design will improve accessibility across new user groups. Regulatory harmonization efforts among racing bodies are expected to reduce compliance friction over time. Together, these factors will support a more scalable and innovation-driven market environment across professional, recreational, and specialty vehicle segments.

Major Players

- Auto Power Industries

- S&W Race Cars

- Chassisworks

- Competition Engineering

- Jegs Performance

- Summit Racing Equipment

- Kirk Racing Products

- RPM Roll Bars

- Maximum Motorsports

- Wolfe Race Craft

- Art Morrison Enterprises

- Alston Race Cars

- Roll Cage Components

- Custom Cages

- Safety Devices

Key Target Audience

- Motorsports teams and racing leagues

- Off-road vehicle clubs and associations

- Automotive aftermarket distributors

- Performance vehicle modification workshops

- Electric performance vehicle developers

- Investments and venture capital firms

- National Highway Traffic Safety Administration

- Federal Motor Carrier Safety Administration

Research Methodology

Step 1: Identification of Key Variables

Core demand drivers, application segments, and regulatory frameworks were mapped to define the market scope. Safety compliance requirements and vehicle modification trends were assessed to structure analytical boundaries.

Step 2: Market Analysis and Construction

Data modeling focused on production flows, installation activity, and aftermarket channel dynamics. Regional demand patterns were evaluated through ecosystem maturity and infrastructure density indicators.

Step 3: Hypothesis Validation and Expert Consultation

Industry practitioners and technical specialists validated assumptions around material trends, certification impacts, and buyer behavior. Feedback loops refined demand projections and risk assessments.

Step 4: Research Synthesis and Final Output

All findings were consolidated into a unified analytical framework, ensuring consistency across segmentation, competitive analysis, and forward-looking insights.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, roll cage taxonomy across motorsport off road and performance safety applications, market sizing logic by vehicle build volume and kit penetration rates, revenue attribution across materials fabrication installation and aftermarket services, primary interview program with motorsport teams fabricators performance shops and distributors, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market evolution

- Usage pathways across racing, off-road, and performance vehicles

- Ecosystem structure of manufacturers, fabricators, and distributors

- Supply chain and aftermarket channel structure

- Regulatory and motorsports safety standards environment

- Growth Drivers

Rising participation in motorsports and track-day events

Expansion of off-road and overlanding culture in the US

Increasing safety regulations in professional racing series

Growth of custom vehicle modification and restomod trends

Demand for enhanced rollover protection in utility vehicles

Adoption of lightweight materials for performance optimization - Challenges

High cost of custom-fabricated roll cages

Regulatory complexity across racing bodies and states

Limited standardization in aftermarket safety components

Installation complexity and skilled labor dependency

Weight and design trade-offs affecting vehicle performance

Liability and certification barriers for small manufacturers - Opportunities

Growth in electric performance vehicles requiring new safety designs

Expansion of women and youth participation in motorsports

Rising demand for modular and bolt-in cage solutions

Integration of smart safety sensors into structural components

Partnerships with OEMs for factory-approved safety upgrades

Export opportunities for premium US-made roll cages - Trends

Shift toward chromoly and lightweight composite materials

Customization and vehicle-specific cage engineering

Increased use of CAD and CNC fabrication technologies

Growth of direct-to-consumer online sales channels

Rising popularity of turnkey safety packages

Sustainability initiatives in metal sourcing and fabrication - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Passenger performance vehicles

Commercial and utility vehicles

Motorsports fleets

Off-road and recreational fleets

Defense and specialty vehicles - By Application (in Value %)

Professional racing

Amateur motorsports

Off-road and overlanding

Street performance and track-day cars

Industrial and specialty vehicle safety - By Technology Architecture (in Value %)

Welded steel roll cages

Bolt-in modular roll cages

Chromoly performance cages

Aluminum lightweight cages

Hybrid material cages - By End-Use Industry (in Value %)

Automotive OEM and Tier suppliers

Motorsports teams and leagues

Aftermarket performance workshops

Defense and emergency services

Industrial vehicle manufacturers - By Connectivity Type (in Value %)

Non-connected passive safety cages

Sensor-integrated safety cage systems

Telematics-enabled vehicle safety frameworks

ADAS-integrated structural safety solutions - By Region (in Value %)

Northeast USA

Midwest USA

South USA

West USA

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (product customization capability, material technology expertise, motorsports certifications, distribution network strength, lead time efficiency, pricing flexibility, aftermarket support quality, brand reputation)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Auto Power Industries

S&W Race Cars

Chassisworks

Competition Engineering

Jegs Performance

Summit Racing Equipment

Kirk Racing Products

RPM Roll Bars

Maximum Motorsports

Wolfe Race Craft

Art Morrison Enterprises

Alston Race Cars

Roll Cage Components

Custom Cages

Safety Devices

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030