Market Overview

The USA Roof Panels market is valued at USD ~billion, driven by a surge in demand for residential and commercial construction. This growth is supported by the increasing adoption of energy-efficient materials and sustainability trends within the building sector. Additionally, technological advancements, such as the integration of solar panels with roof systems, are fueling demand. A shift towards green construction and the ongoing urbanization further drives the market forward. The increasing need for cost-effective, durable, and weather-resistant roofing solutions is also a key factor propelling the market’s growth.

The market is dominated by urbanized regions, particularly cities like New York, Los Angeles, and Chicago, where the demand for high-quality roof panels is significantly high. These cities experience substantial construction activities due to ongoing residential and commercial developments. Moreover, regions with extreme weather conditions, such as Florida and Texas, contribute significantly to the market, as roof panels provide protection from hurricanes and heavy rainfall. These regions’ emphasis on resilient and energy-efficient roofing solutions has made them key players in the market.

Market Segmentation

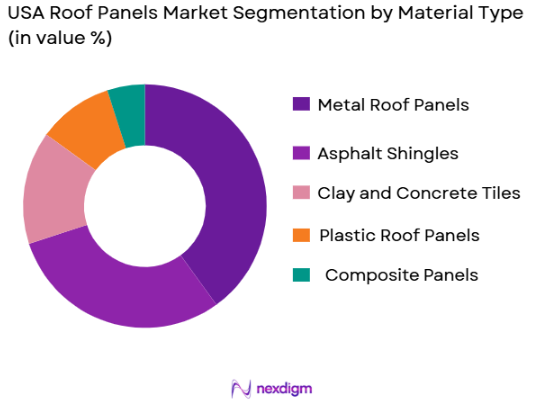

By Material Type

The USA Roof Panels market is segmented into several material types, including metal, asphalt shingles, clay, concrete tiles, and plastic. Among these, metal roof panels dominate the market due to their superior durability, energy efficiency, and ability to withstand extreme weather conditions. These panels are increasingly used in both residential and commercial construction due to their long lifespan and minimal maintenance requirements. Furthermore, metal panels are compatible with sustainable construction practices, contributing to their widespread adoption. Metal roof panels continue to dominate the market due to their significant advantages over other materials, such as long-term durability, energy efficiency, and resistance to harsh weather conditions. These panels, often made of steel or aluminum, are especially popular in commercial and industrial applications due to their fire resistance, low maintenance, and recyclability. Major construction projects in regions like California and Texas, where high durability is essential, are further driving the adoption of metal roof panels.

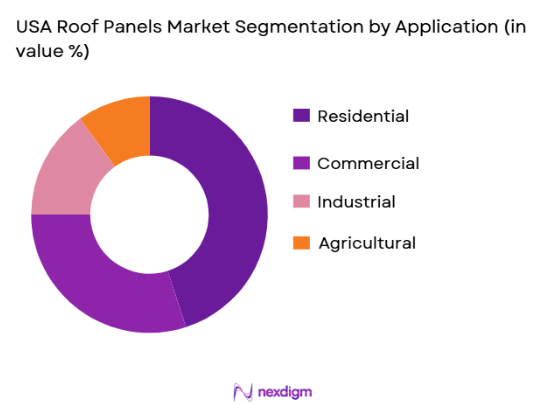

By Application

Roof panels are also segmented by application, including residential, commercial, industrial, and agricultural sectors. The residential sector holds the largest market share, driven by the increasing demand for energy-efficient homes and the growing preference for durable roofing solutions. Metal and asphalt shingles are particularly popular in residential roofing due to their aesthetic appeal and functionality. Additionally, there is a growing trend towards green building certifications that encourage the use of sustainable roofing materials, further driving the demand for energy-efficient roof panels in residential properties. The residential sector is experiencing a shift towards more energy-efficient and sustainable roofing materials. Metal roof panels and asphalt shingles dominate this segment due to their cost-effectiveness and ability to enhance the energy efficiency of homes. Additionally, the growing trend of smart homes is also propelling the adoption of roof panels that integrate with solar energy systems, which is contributing to the popularity of metal roofing solutions among residential homeowners.

Competitive Landscape

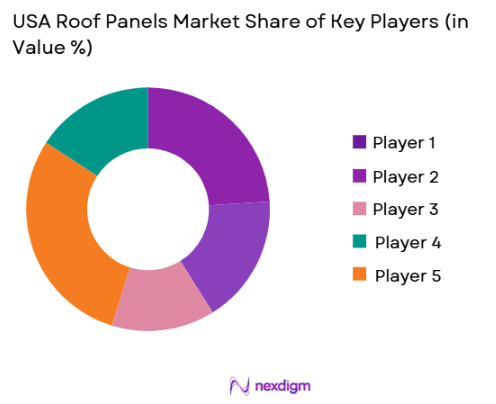

The USA Roof Panels market is highly competitive, with several key players that have a significant influence on market dynamics. The leading companies include Owens Corning, CertainTeed, and Nucor Building Systems, which dominate the market due to their wide range of products and established brand presence. These companies continuously innovate in terms of material technology and product offerings, ensuring they meet the growing demand for energy-efficient and durable roofing solutions.

| Company | Establishment Year | Headquarters | Product Range | Market Focus | Production Capacity | Technological Innovation |

| Owens Corning | 1938 | Toledo, Ohio | ~ | ~ | ~ | ~ |

| CertainTeed (Saint-Gobain) | 1904 | Malvern, PA | ~ | ~ | ~ | ~ |

| Nucor Building Systems | 1989 | Charlotte, NC | ~ | ~ | ~ | ~ |

| TAMKO Building Products | 1944 | Joplin, Missouri | ~ | ~ | ~ | ~ |

| Atlas Roofing Corporation | 1982 | Meridian, MS | ~ | ~ | ~ | ~ |

USA Hydrogen Fuel Cell Vehicles Market Overview: Data Points

Growth Drivers

Urbanization

Urbanization in the USA is a significant factor driving the adoption of hydrogen fuel cell vehicles (FCVs). According to the U.S. Census Bureau, approximately ~% of the population resides in urban areas as of 2025, and this number is projected to increase. Urban centers tend to have higher levels of vehicle emissions, making hydrogen fuel cell vehicles an attractive solution for reducing air pollution. With local governments in cities like California’s Los Angeles pushing for zero-emissions vehicle adoption, urbanization supports the demand for eco-friendly, fuel-efficient vehicles like hydrogen-powered ones, driving market growth.

Industrialization

Industrial activities in the USA continue to grow, with industries like manufacturing, logistics, and transportation forming the backbone of the economy. Hydrogen fuel cell vehicles are seen as a solution for industries seeking to meet sustainability goals while maintaining operational efficiency. According to the U.S. Bureau of Economic Analysis, industrial production in the U.S. grew by ~% in 2025. This expansion fuels the need for hydrogen-powered commercial vehicles, particularly in industries like freight and long-haul transportation, where hydrogen fuel cells provide an efficient alternative to diesel engines.

Restraints

High Initial Costs

One of the primary barriers to the widespread adoption of hydrogen fuel cell vehicles is their high initial cost. According to the U.S. Department of Energy, the cost of producing hydrogen-powered vehicles is significantly higher compared to traditional gasoline-powered vehicles. The cost of hydrogen fuel cell stacks, along with the need for specialized infrastructure, contributes to this high cost. As of 2025, the cost of a hydrogen vehicle can be up to 2.5 times that of a comparable electric vehicle. This initial investment can be prohibitive for consumers, particularly in the face of lower upfront costs for other clean vehicle technologies, such as battery electric vehicles.

Technical Challenges

Hydrogen fuel cell technology faces several technical challenges that impede the growth of the market. These challenges include hydrogen storage, fuel cell efficiency, and the lack of infrastructure for refueling. As of 2025, the lack of widespread hydrogen refueling stations remains a significant issue. According to the U.S. Department of Energy, there were only 55 hydrogen refueling stations in the U.S. as of 2024, which are primarily concentrated in California. The absence of a nationwide refueling network is a major obstacle to the adoption of hydrogen fuel cell vehicles, particularly for long-distance travel. Overcoming these technical challenges will be crucial for market growth.

Opportunities

Technological Advancements

Technological advancements in hydrogen fuel cell technology are paving the way for future growth in the market. As of 2025, companies like Toyota and Hyundai have made significant strides in improving the efficiency and cost-effectiveness of hydrogen fuel cells. These advancements are expected to make hydrogen vehicles more affordable and practical. The U.S. Department of Energy is also investing in research to develop new hydrogen storage solutions that could make fuel cells more efficient and less expensive. Such innovations are opening up opportunities for wider adoption and enhancing the appeal of hydrogen-powered vehicles in both commercial and passenger segments.

International Collaborations

International collaborations are becoming an important opportunity for the hydrogen fuel cell vehicle market. In 2025, the U.S. signed a memorandum of understanding (MoU) with Japan to promote hydrogen fuel cell vehicles. This collaboration facilitates the sharing of technology, regulatory frameworks, and infrastructure development. By partnering with countries that are already leaders in hydrogen technology, the U.S. can accelerate its market adoption and reduce costs associated with the technology. The expanding global network of hydrogen fuel cell vehicle manufacturers is creating opportunities for the U.S. market to capitalize on the growing demand for green transportation solutions worldwide.

Future Outlook

The USA Roof Panels market is expected to experience substantial growth in the coming years. Driven by advancements in energy-efficient technologies and increasing demand for sustainable construction, the market is poised for expansion. Over the next five years, the adoption of green building materials, including solar-integrated roof panels and recyclable materials, will significantly contribute to market growth. Additionally, with rising awareness about climate change and the need for resilient infrastructure, more homeowners and businesses will opt for roof panels that offer better durability and energy savings.

Major Players in the USA Roof Panels Market

- Owens Corning

- CertainTeed (Saint-Gobain)

- Nucor Building Systems

- TAMKO Building Products

- Atlas Roofing Corporation

- Metal Sales Manufacturing Corporation

- MBCI (Metal Building Components Inc.)

- ATAS International, Inc.

- Boral Roofing

- Johns Manville

- GAF Materials Corporation

- Sika AG

- DuraLife

- RHEINZINK America, Inc.

- Euroclad

Key Target Audience

- Roofing Contractors

- Construction Firms

- Building Material Suppliers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., U.S. Department of Energy, U.S. Environmental Protection Agency)

- Energy Efficiency and Green Building Organizations

- Real Estate Developers

- Architectural and Design Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Roof Panels Market. This step uses secondary research to gather data from credible sources like industry reports, government publications, and company filings to understand market dynamics and identify critical variables.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data on the USA Roof Panels Market, evaluating product penetration, market growth trends, and identifying key influencers such as regulatory factors and material cost trends. This also includes evaluating regional growth factors and market share across different product types.

Step 3: Hypothesis Validation and Expert Consultation

Develop market hypotheses and validate them through consultations with industry experts via phone interviews, surveys, and focus groups. This provides deeper insights into industry challenges and opportunities, allowing for a refined market analysis.

Step 4: Research Synthesis and Final Output

The final phase involves cross-referencing collected data and insights with manufacturers and key industry participants to validate product trends, technological advancements, and market outlooks. This ensures the report provides accurate, actionable insights for stakeholders.

- Executive Summary

- Research Methodology(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Market Definition and Scope

- Market Genesis and Evolution

- Technology and Material Advancements in Roof Panels

- Historical Market Trends and Developments

- Key Market Drivers and Challenges

- Growth Drivers

Increasing Demand for Energy-Efficient Roof Panels

Advancements in Roofing Materials Technology

Expansion of Green Building and Sustainable Construction

Rising Demand for Residential and Commercial Roofing Solutions - Market Challenges

High Initial Installation Costs for Advanced Roof Panels

Fluctuating Prices of Raw Materials

Supply Chain and Logistics Issues

- Opportunities

Growing Adoption of Solar Roof Panels

Innovative Coating Technologies for Roof Panels

Emerging Markets in the Retrofit and Renovation Sector - Trends

Smart Roof Panels with IoT Integration

Modular Roof Panel Designs for Faster Installation

Sustainability Trends: Focus on Recyclable and Eco-friendly Materials - Government Regulations

Energy Efficiency Standards and Building Codes

Fire and Safety Regulations for Roof Materials

Environmental Impact Regulations (e.g., LEED Certification)

- Porter’s Five Forces Analysis

- SWOT Analysis of Market Key Players

- Market Competition and Industry Ecosystem

- Market Size by Value, 2019-2025

- Market Size by Volume, 2019-2025

- Average Price Analysis by Product Category, 2019-2025

- By Material Type (In Value %)

Metal Roof Panels

Asphalt Shingles

Clay and Concrete Tiles

Plastic Roof Panels

Composite Roof Panels - By Application (In Value %)

Residential Construction

Commercial Buildings

Industrial Structures

Agricultural Buildings

Government and Institutional Buildings - By Roof Panel Type (In Value %)

Standing Seam Panels

Corrugated Panels

R-Panel

Shingle Roof Panels

Interlocking Panels

- By Region (In Value %)

Northeast Region

Midwest Region

South Region

West Region

Pacific and Alaska Region - By End-User Industry (In Value %)

Residential Sector

Commercial Sector

Industrial Sector

Agriculture Sector

Government & Infrastructure

- Market Share Analysis

- Cross Comparison Parameters(Company Overview, Recent Developments, Business Strategies, Financial Performance, Manufacturing Capacity, Market Penetration, Distribution Network, Technological Innovations, Strategic Partnerships, Market Focus Areas)

- SWOT Analysis of Leading Companies

- Pricing and Profitability Analysis

- Detailed Company Profiles

Owens Corning

Kingspan Group

Nucor Building Systems

CertainTeed (Saint-Gobain)

TAMKO Building Products

Boral Roofing

Metal Sales Manufacturing Corporation

MBCI (Metal Building Components Inc.)

ATAS International, Inc.

Atlas Roofing Corporation

DuraLife

GAF Materials Corporation

Sika AG

John Manville (Berkshire Hathaway)

RHEINZINK America, Inc.

- Demand and Utilization by End-User Sectors

- Purchasing Power and Decision-Making Process

- Key Drivers for Roof Panel Adoption in Residential and Commercial Sectors

- Government Initiatives and Incentives Driving Market Growth

- Market Size Forecast by Value, 2025-2030

- Market Volume Forecast, 2025-2030

- Average Price Forecast, 2025-2030