Market Overview

Based on a recent historical assessment, the USA search and rescue aircraft market recorded an absolute market size of USD ~billion, supported by confirmed federal budget allocations, fleet sustainment programs, and new acquisition contracts disclosed through the US Department of Defense, US Coast Guard acquisition documentation, and SIPRI-aligned defense expenditure records. Market demand is driven by sustained operational requirements for combat search and rescue, maritime rescue, disaster response, and homeland security missions, alongside the replacement of aging rotary-wing and fixed-wing fleets and the integration of advanced sensors, avionics, and survivability systems.

Based on a recent historical assessment, the United States dominates the search and rescue aircraft ecosystem due to its extensive geographic coverage, global military commitments, and centralized federal procurement structure. Washington DC functions as the primary policy and acquisition hub, while operational and industrial activity is concentrated in Florida, Texas, California, and Arizona due to major air bases, coast guard districts, and aerospace manufacturing facilities. International dominance is reinforced through overseas deployments and allied cooperation frameworks, which sustain continuous operational demand and technology leadership.

Market Segmentation

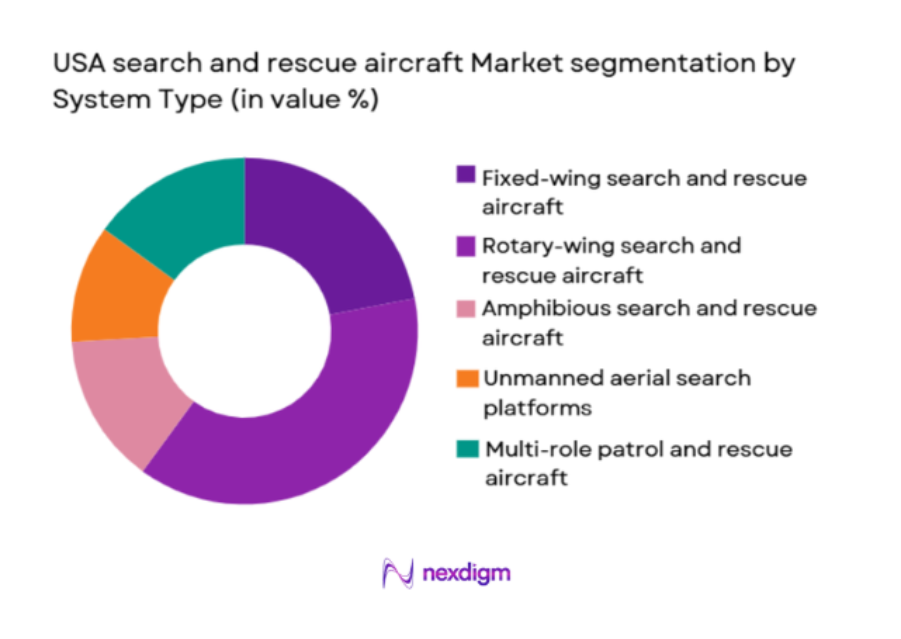

By System Type

USA search and rescue aircraft market is segmented by product type into fixed-wing search and rescue aircraft, rotary-wing search and rescue aircraft, amphibious search and rescue aircraft, unmanned aerial search platforms, and multi-role patrol and rescue aircraft. Recently, rotary-wing search and rescue aircraft have demonstrated a dominant market share due to their unmatched vertical lift capability, hover endurance, and ability to operate in confined or maritime environments. These aircraft are essential for combat recovery, offshore rescues, and disaster response missions where runway access is limited. High deployment frequency across military and coast guard operations drives sustained utilization. Continuous upgrades to sensors, winch systems, and survivability suites further reinforce their operational relevance. Their flexibility across military, civil, and homeland security missions sustains consistent procurement and modernization demand.

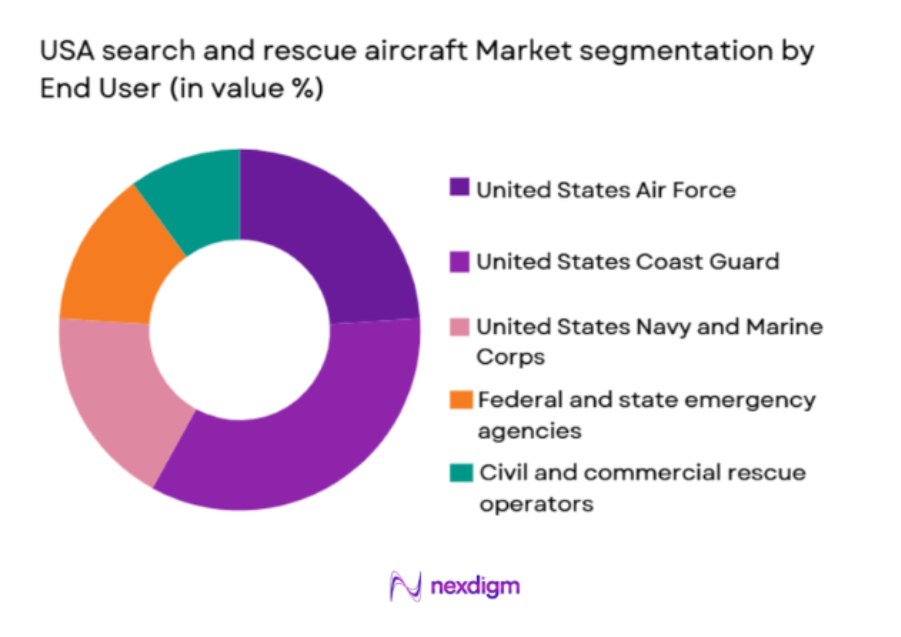

By End User

USA search and rescue aircraft market is segmented by end user into United States Air Force, United States Coast Guard, United States Navy and Marine Corps, federal and state emergency agencies, and civil and commercial rescue operators. Recently, the United States Coast Guard has accounted for the dominant market share due to its continuous maritime patrol, offshore rescue, and disaster response responsibilities across vast coastal regions. High mission tempo necessitates constant aircraft availability, driving fleet sustainment and replacement demand. Coast Guard platforms are optimized for endurance, all-weather operations, and sensor integration, increasing system value. Centralized procurement and long-term modernization programs further reinforce dominance, while expanding climate-related rescue missions sustain consistent operational demand.

Competitive Landscape

The USA search and rescue aircraft market is moderately consolidated, with a limited number of major aerospace manufacturers dominating platform supply through long-term defense and homeland security contracts. Competitive positioning is influenced by platform reliability, mission adaptability, lifecycle support capability, and compliance with stringent military and civil aviation standards.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary SAR Platform |

| Sikorsky Aircraft | 1923 | Stratford, CT | ~ | ~ | ~ | ~ | ~ |

| Boeing Defense | 1916 | St. Louis, MO | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, MD | ~ | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1992 | Grand Prairie, TX | ~ | ~ | ~ | ~ | ~ |

| Leonardo Helicopters | 1948 | Philadelphia, PA | ~ | ~ | ~ | ~ | ~ |

USA Search and Rescue Aircraft Market Analysis

Growth Drivers

Expansion of Military and Homeland Security Search and Rescue Missions:

Expansion of Military and Homeland Security Search and Rescue Missions is a primary growth driver for the USA search and rescue aircraft market because the United States maintains global military operations and expansive domestic security responsibilities that require continuous rescue readiness. Combat search and rescue remains a core military capability for personnel recovery in contested environments. Homeland security missions increasingly involve border surveillance, counter-narcotics operations, and disaster response. Climate-driven emergencies elevate rescue frequency across coastal and inland regions. These missions demand aircraft capable of rapid deployment, endurance, and survivability. Multi-domain operations increase interoperability requirements. Sensor-intensive missions raise aircraft system value. Federal prioritization ensures sustained funding. Together, these factors structurally expand long-term demand.

Modernization and Replacement of Aging SAR Fleets:

Modernization and Replacement of Aging SAR Fleets drives market growth as legacy aircraft face rising maintenance costs and capability gaps. Many SAR platforms have exceeded original design lifespans. Upgrades are required to meet modern safety and mission standards. New aircraft integrate advanced avionics and sensors. Improved fuel efficiency reduces lifecycle costs. Survivability enhancements address contested environments. Regulatory compliance drives replacement timelines. Centralized procurement accelerates acquisition. Long service contracts sustain production. This modernization cycle reinforces continuous market expansion.

Market Challenges

High Acquisition and Lifecycle Sustainment Costs:

High Acquisition and Lifecycle Sustainment Costs challenge the USA search and rescue aircraft market because SAR platforms incorporate specialized avionics, sensors, and structural reinforcements. Initial procurement requires substantial capital allocation. Maintenance involves complex systems and specialized training. Aging fleets increase sustainment burdens. Budget trade-offs affect acquisition schedules. Certification processes elevate costs. Spare part logistics add complexity. Cost overruns risk program delays. These factors constrain procurement flexibility.

Complex Regulatory and Certification Requirements:

Complex Regulatory and Certification Requirements pose significant barriers due to strict military airworthiness and Federal Aviation Administration standards. Certification timelines are lengthy. Modifications require extensive testing. Compliance costs elevate program risk. Multi-agency coordination complicates approvals. Export variants require additional clearances. Documentation burdens increase administrative overhead. Regulatory delays affect delivery schedules. These challenges slow market responsiveness.

Opportunities

Integration of Unmanned and Optionally Piloted SAR Platforms:

Integration of Unmanned and Optionally Piloted SAR Platforms presents a strong opportunity as autonomous systems enhance coverage and reduce risk. Unmanned platforms extend endurance. Optionally piloted aircraft support hazardous missions. Sensor fusion improves detection accuracy. Cost-effective deployment increases mission frequency. Regulatory frameworks are evolving. Interoperability with manned assets improves effectiveness. Investment interest is growing. This opportunity reshapes future SAR capabilities.

Multi-Role Aircraft Procurement for Cost Efficiency:

Multi-Role Aircraft Procurement for Cost Efficiency offers opportunity by combining SAR with patrol and logistics roles. Shared platforms reduce fleet complexity. Training efficiencies improve readiness. Modular payloads expand mission scope. Budget optimization encourages adoption. Inter-agency cooperation increases utilization. Exportable configurations broaden demand. This opportunity supports sustainable growth.

Future Outlook

Over the next five years, the USA search and rescue aircraft market is expected to grow steadily, supported by fleet replacement programs, increasing disaster response requirements, and homeland security priorities. Technological development will emphasize endurance, sensor fusion, and survivability. Regulatory support for modernization will remain strong. Demand will be reinforced by joint-force interoperability and climate-driven mission expansion.

Major Players

- Sikorsky Aircraft

- Boeing Defense

- Lockheed Martin

- Airbus Helicopters

- Leonardo Helicopters

- Bell Textron

- Northrop Grumman

- Textron Aviation

- MD Helicopters

- L3Harris Technologies

- General Atomics Aeronautical Systems

- Raytheon Technologies

- Kaman Aerospace

- Sierra Nevada Corporation

- Elbit Systems of America

Key Target Audience

- Defense ministries

- Homeland security agencies

- Coast guard authorities

- Emergency management agencies

- Military aviation commands

- Aerospace manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including fleet size, mission profiles, procurement contracts, and upgrade programs were identified using official defense acquisition and aviation safety documentation.

Step 2: Market Analysis and Construction

Market sizing was constructed through bottom-up aggregation across platforms and agencies, aligned with validated budgetary and delivery data.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with aerospace engineers, SAR operators, and defense procurement specialists.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a structured market model ensuring analytical rigor and strategic relevance.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of military and homeland security SAR missions

Modernization of aging SAR aircraft fleets

Increasing frequency of natural disasters and emergencies

Advancements in long range sensing and avionics

Interoperability requirements across joint forces - Market Challenges

High acquisition and lifecycle maintenance costs

Complex certification and regulatory compliance

Integration challenges with legacy platforms

Skilled workforce and pilot training constraints

Budget prioritization across defense and civil agencies - Market Opportunities

Replacement of legacy rotary and fixed wing fleets

Integration of unmanned systems in SAR missions

Multi role aircraft procurement for cost efficiency - Trends

Adoption of advanced ISR sensor integration

Growing use of unmanned and optionally piloted platforms

Emphasis on extended range and endurance

Digital mission management and data fusion

Inter agency coordination and shared assets - Government Regulations & Defense Policy

Federal aviation safety and airworthiness standards

Defense and homeland security modernization mandates

Policies supporting disaster response readiness

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed wing search and rescue aircraft

Rotary wing search and rescue aircraft

Amphibious search and rescue aircraft

Unmanned search and rescue aerial platforms

Multi role patrol and rescue aircraft - By Platform Type (In Value%)

Military dedicated SAR aircraft

Coast guard SAR aircraft

Civil aviation SAR aircraft

Homeland security and border SAR aircraft

Disaster response and emergency SAR aircraft - By Fitment Type (In Value%)

New aircraft procurement

Mid life upgrade and retrofit

Mission specific sensor and avionics integration

Engine and propulsion upgrade fitment

Life extension and survivability enhancement fitment - By EndUser Segment (In Value%)

United States Air Force

United States Coast Guard

United States Navy and Marine Corps

Federal and state emergency agencies

Civil and commercial rescue operators - By Procurement Channel (In Value%)

Direct federal government procurement

Defense acquisition and modernization programs

Inter agency procurement frameworks

Commercial and civil aviation contracts

Foreign military sales and allied cooperation - By Material / Technology (in Value %)

Advanced composite airframes

Long range avionics and navigation systems

Electro optical infrared sensor suites

Advanced propulsion and fuel efficiency technologies

Secure communication and mission management systems

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (range, endurance, payload capacity, sensor capability, mission flexibility, operating cost, upgrade potential, interoperability, lifecycle support) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Boeing Defense

Sikorsky Aircraft

Leonardo Helicopters

Airbus Defence and Space

Bell Textron

Northrop Grumman

Textron Aviation

MD Helicopters

L3Harris Technologies

General Atomics Aeronautical Systems

Raytheon Technologies

Kaman Aerospace

Sierra Nevada Corporation

Elbit Systems of America

- Military users emphasize rapid response and survivability

- Coast guard focuses on maritime endurance and reliability

- Emergency agencies prioritize all weather capability

- Civil operators demand cost efficient and versatile platforms

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035