Market Overview

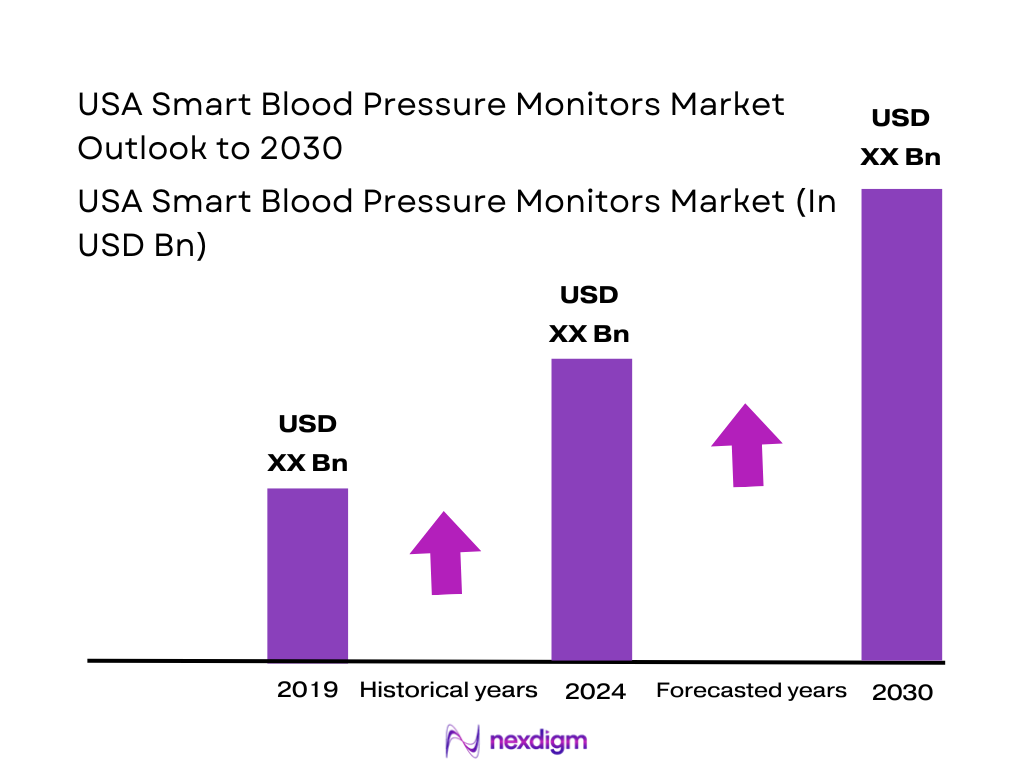

The USA Smart Blood Pressure Monitors Market is valued at USD ~ billion in the prior year and USD ~ billion in the current year, supported by accelerating adoption of digital/connected sphygmomanometers, higher hypertension screening needs, and provider-led home monitoring programs. The demand base is structurally large because ~ million U.S. adults have high blood pressure, which directly expands the addressable population for at-home and remotely supervised BP tracking.

The market is operationally concentrated in major US care-delivery and digital-health hubs where RPM programs, integrated delivery networks, and payer-provider innovation are dense. Boston, San Francisco Bay Area, New York City, Minneapolis–St. Paul, Nashville and Chicago/Los Angeles shape adoption because they combine high chronic-disease caseloads, rapid telehealth/RPM program deployment, and channel intensity through national retailers, pharmacies, and employer health ecosystems.

Market Segmentation

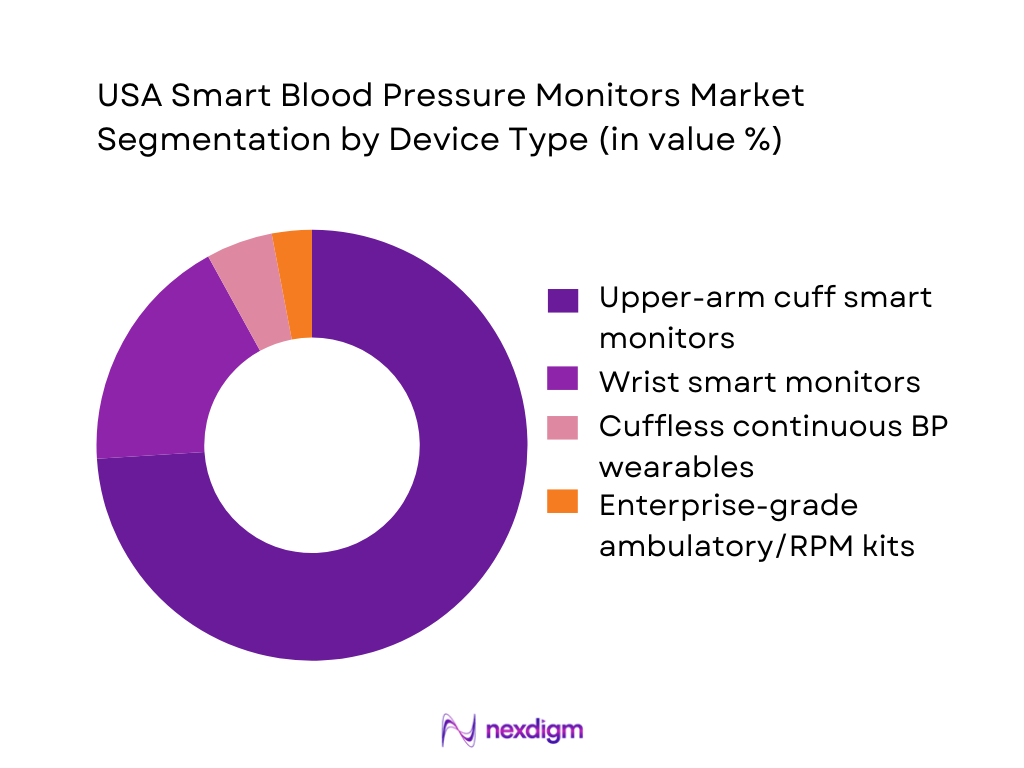

By Device Type

The USA Smart Blood Pressure Monitors Market is segmented by device type into upper-arm cuff smart monitors, wrist smart monitors, cuffless continuous BP wearables, and enterprise-grade ambulatory/RPM kits. In the US, upper-arm cuff smart monitors dominate because they are the most clinically accepted home format, align with provider expectations for reliable readings, and are easiest to standardize at scale for RPM enrolment. They are also preferred in cardiometabolic pathways because clinicians can interpret trends more confidently when readings are taken in a validated posture and cuff position.

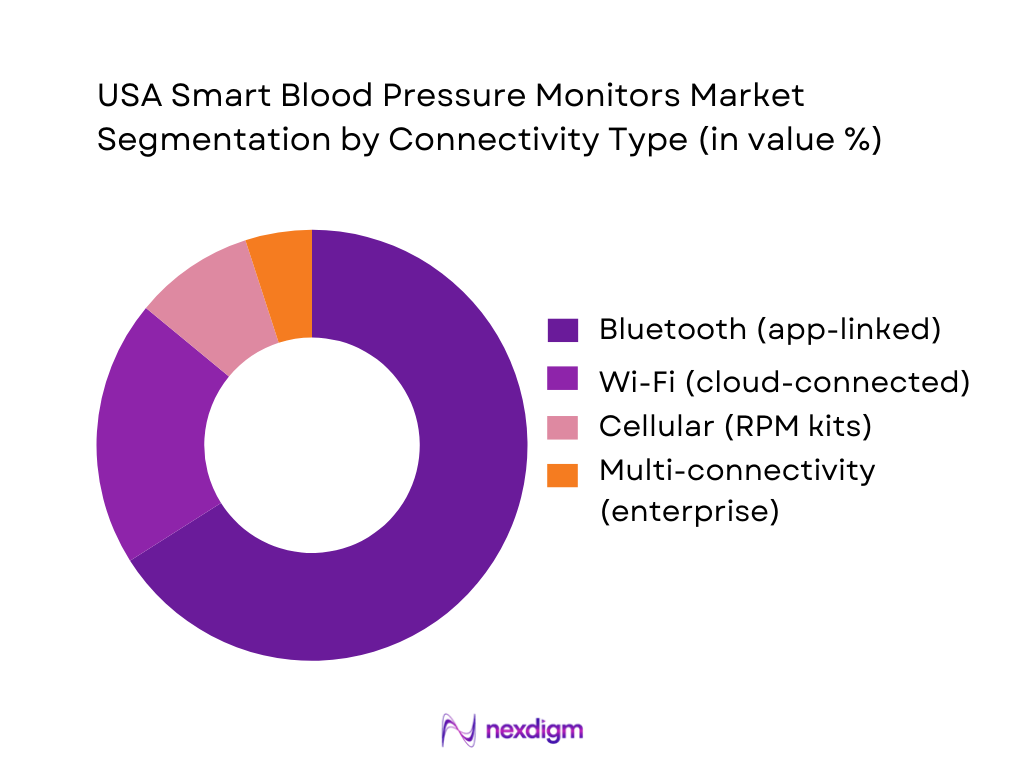

By Connectivity & Data Workflow

The market is segmented by connectivity into Bluetooth app-linked monitors, Wi-Fi cloud-connected monitors, cellular RPM-connected monitors, and multi-connectivity enterprise devices. Bluetooth-based monitors dominate because they are cost-efficient to deploy, easy for consumers to pair with smartphones, and fit mass retail/e-commerce buying behavior. Bluetooth also integrates naturally into digital health apps where users can store readings, share summaries, and support physician follow-ups. Wi-Fi and cellular options are expanding faster in RPM contexts where the goal is “hands-off transmission” and reduced patient friction, but Bluetooth remains the broadest installed base across consumer-led adoption.

Competitive Landscape

The USA Smart Blood Pressure Monitors Market is competitive but structurally led by a small group of brands that combine clinically trusted BP measurement, strong consumer distribution, and connected ecosystems that can extend into RPM and chronic-care workflows. The market’s consolidation is visible in national retail/pharmacy listings and in digital health device stacks used for hypertension and cardiometabolic management, where a handful of players repeatedly appear in consumer top-sellers and provider/RPM deployments.

| Company | Est. Year | HQ | Core Smart BP Focus | Connectivity Options | App / Data Ecosystem Strength | Clinical / Regulatory Readiness | RPM / EHR Integration Readiness | US Channel Strength | Enterprise Program Fit |

| Omron Healthcare | 1933 | Kyoto, Japan / US presence | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Withings | 2008 | Issy-les-Moulineaux, France | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| iHealth Labs | 2010 | California, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Qardio | 2012 | California, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin | 1989 | Kansas, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

USA Smart Blood Pressure Monitors Market Analysis

Growth Drivers

Expansion of RPM reimbursement pathways

Remote Patient Monitoring (RPM) reimbursement has become a structural catalyst for smart blood pressure monitors because hypertension is a high-volume, longitudinal condition where repeated measurements are clinically actionable and billable in routine workflows. The U.S. macro backdrop supports provider investment in RPM tooling: the United States recorded USD ~ in GDP and USD ~ GDP per capita, enabling large payer/provider operating budgets and digital transformation programs. On the clinical-need side, CDC reports ~ adults with high blood pressure and ~ deaths where high blood pressure was a primary or contributing cause—numbers that make BP monitoring one of the most “reimbursable-at-scale” RPM use cases. These volumes push health systems and physician groups to standardize connected BP cuffs for documentation, escalation, and longitudinal tracking across Medicare Advantage, ACO-aligned populations, and chronic-care pathways that reward avoiding downstream events.

Rising chronic disease management outside hospitals

Smart BP monitors fit the U.S. shift toward home-based and community-based chronic disease management because hypertension control depends on readings—not episodic inpatient measurements. The U.S. care setting shift is reinforced by demographic scale: the Census Bureau’s Vintage estimates place the U.S. resident population at ~, expanding the absolute pool of adults aging into higher cardiovascular-risk cohorts and increasing the operational burden on ambulatory networks. The macroeconomic capacity to fund decentralized care is also large, and hypertension’s burden is visible in CDC mortality totals. In this environment, payers and systems increasingly prefer home BP capture to support earlier medication titration, post-discharge follow-up, and avoidance of preventable events—use cases where connected cuffs become the “default device” rather than an optional consumer gadget.

Market Challenges

Clinical validation and trust gaps

Trust is a gating factor because BP readings directly influence medication titration and escalation decisions; inaccurate readings can create clinical risk and liability. The U.S. hypertension burden is massive, and the outcome burden is severe, meaning clinicians are cautious about device-grade and protocol adherence. Even in a high-capacity macroeconomy , health systems often require evidence that a device performs reliably across real-world conditions. The challenge is not only the sensor but also the end-to-end measurement protocol: rest time, posture, cuff positioning, repeated measures, and automated averaging. When devices are sold D2C without structured onboarding, “bad data” can flood clinician inboxes and reduce confidence—slowing enterprise deployments unless vendors provide clinical validation packages, training workflows, and data-quality signals that clinicians can trust.

Interoperability with EHR & care platforms

Interoperability is a commercialization bottleneck because U.S. providers expect patient-generated health data (PGHD) to flow into EHRs, care-management platforms, and claims/quality reporting systems without custom work per client. The scale problem is national: a population of ~ plus ~ adults with high BP generates enormous potential measurement volume, which makes “manual upload” or “PDF-by-email” operationally impossible. In a high-output economy, provider CIOs still enforce strict integration standards—preferring APIs, standardized data models, and secure identity matching—because fragmented integrations create recurring IT costs and security exposure. As a result, device vendors face long sales cycles unless they can support common integration patterns and reduce implementation friction. Without this, smart BP monitors remain consumer tools rather than becoming enterprise-standard devices embedded into hypertension pathways, hospital-at-home protocols, and payer RPM programs.

Opportunities

Medicare & Medicaid RPM scale-up

The opportunity is expansion of hypertension-focused RPM at government-program scale because Medicare and Medicaid populations include a high concentration of cardiovascular risk and complex chronic disease, where timely BP interventions can prevent downstream events and utilization. The “why now” is supported by national burden indicators: ~ adults with high blood pressure and ~ deaths involving high BP create strong policy and payer incentives for scalable control programs. With the U.S. economy at GDP USD ~ and GDP per capita USD ~, federal and state programs operate at the financial scale needed to support device distribution, care-management staffing, and platform integration—provided vendors can meet procurement, interoperability, and security expectations. For smart BP monitor suppliers, the growth lever is not future forecasting; it is current program logic: government payers increasingly favor measurable, protocolized chronic-disease management, and BP is among the most straightforward metrics to capture frequently with low patient burden. Vendors that can deliver enterprise-grade deployment kits are positioned to convert policy attention into sustained volume.

Employer-sponsored hypertension programs

Employers represent a scalable channel because U.S. working-age populations face hypertension risk and employers have direct incentives to reduce absenteeism, improve productivity, and manage health benefit costs through preventive programs that are measurable and coachable. The national-scale need is clear: ~ adults have high blood pressure, and the uncontrolled cohort includes ~ adults at 140/90 mmHg or higher—a pool large enough that many employers will have thousands of eligible members even in mid-sized workforces. The macro base supports employer spend on digital health benefits, and BP monitoring is operationally attractive because it can be deployed via mail-to-home kits and managed through wellness portals and nurse coaching. The market opportunity is to position smart cuffs as part of an employer hypertension “bundle”, with outcomes reported at program level. Vendors that can prove secure data handling and easy integration with benefits platforms will be favored in employer procurement cycles.

Future Outlook

Over the next five years, the USA Smart Blood Pressure Monitors Market is expected to expand steadily as RPM becomes more embedded in chronic care, more payers and health systems operationalize hypertension pathways, and consumers continue shifting routine vitals monitoring to the home. The most durable growth will come from programmatic deployment models and from devices that minimize friction—automatic transmission, better coaching, and tighter integration into care teams. Key direction of travel in the U.S. will be shaped by CMS-aligned RPM workflows, rising expectations on data security and device validation, and convergence with broader cardiometabolic monitoring stacks (weight, ECG screening, activity, and adherence tools). RPM billing guidance and code-based structures keep reinforcing the use of connected devices for physiological monitoring (including blood pressure), which strengthens institutional demand for scalable smart cuffs and connected kits.

Major Players

- Omron Healthcare

- Withings

- iHealth Labs

- Qardio

- Garmin

- A&D Medical

- Welch Allyn

- Microlife

- SunTech Medical

- American Diagnostics Corporation

- Beurer

- ForaCare

- Kaz

- Spacelabs Healthcare

Key Target Audience

- Investments and venture capitalist firms

- Health system executives

- Primary care networks and physician group operators

- Remote Patient Monitoring program operators & virtual care providers

- Health insurers & payer care-management teams

- Pharmacy chains & retail health operators

- Employer health & benefits program owners

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We start by mapping the U.S. ecosystem across OEMs, retail channels, RPM vendors, provider systems, and payers. Desk research and database screening are used to define key variables such as device type, connectivity model, validation signals, and channel pathways. The goal is to lock the market’s “smart monitor” boundaries and the drivers that govern adoption.

Step 2: Market Analysis and Construction

We compile historical market data, linking category growth to U.S. hypertension prevalence, home monitoring adoption, and RPM program expansion. We analyze channel intensity across e-commerce, pharmacies, and institutional procurement to construct demand pools. This phase also checks care-pathway usage (self-measurement vs programmatic RPM deployment).

Step 3: Hypothesis Validation and Expert Consultation

We validate adoption and procurement hypotheses through CATIs with stakeholders across OEM distribution, pharmacy category managers, RPM program leaders, and provider operational teams. These discussions generate practical inputs on device selection criteria, adherence frictions, and integration requirements. Findings are used to refine segment shares and competitive positioning.

Step 4: Research Synthesis and Final Output

We synthesize primary insights with secondary sources to finalize market sizing, segmentation, and competitive benchmarking. The output is validated via triangulation across vendor signals, published market studies, and policy/reimbursement references. Final deliverables emphasize decision-grade insights for market entry, partnerships, and product strategy.

- Executive Summary

- Research Methodology (Market Definition & Inclusion Criteria, Scope Delimitations, Device Classification Logic, US-Centric Assumptions, Abbreviations, Bottom-Up Installed Base Estimation, Top-Down Healthcare Spend Mapping, Primary Interview Coverage Across Providers–Payers–OEMs, Data Triangulation Framework, Sensitivity & Bias Checks, Limitations & Forward Inference)

- Definition, Scope and Device Taxonomy

- Evolution of Blood Pressure Monitoring: From Clinic-Centric to Connected Care

- Role of Smart BP Monitors in US Preventive, Chronic & Home-Based Care

- Business Cycle Analysis

- Value Chain & Data Flow Mapping

- Growth Drivers

Expansion of RPM reimbursement pathways

Rising chronic disease management outside hospitals

Physician workload optimization & task shifting

Consumer adoption of connected health ecosystems - Market Challenges

Clinical validation and trust gaps

Interoperability with EHR & care platforms

Patient adherence & long-term engagement issues

Data privacy, security & compliance burden - Market Opportunities

Medicare & Medicaid RPM scale-up

Employer-sponsored hypertension programs

AI-driven hypertension risk stratification

Multi-parameter chronic care platforms - Trends

FDA-cleared connected monitoring

AI-assisted BP trend interpretation

Cuff-less continuous BP development

Integration with digital therapeutics - Regulatory & Reimbursement Landscape

- SWOT Analysis

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- Competitive Intensity & Substitution Threat Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- Installed Base, Active Connected Devices & Dormant Units, 2019-2024

- Average Realization by Device Class & Connectivity Tier, 2019-2024

- New Installations vs Replacement & Upgrade Demand Split, 2019-2024

- By Device Architecture (in Value %)

Upper-arm cuff smart monitors

Wrist-based smart monitors

Cuff-less / sensor-based BP solutions

Hybrid BP + vitals monitoring devices - By Connectivity & Data Stack (in Value %)

Bluetooth-only devices

Wi-Fi enabled devices

Cellular-enabled RPM devices

Multi-connectivity enterprise devices - By End-Use Clinical Setting (in Value %)

Home healthcare & self-monitoring

Remote Patient Monitoring (RPM) programs

Primary care & physician clinics

Hospitals & integrated delivery networks

Employer & population health programs - By Distribution & Go-To-Market Channel (in Value %)

DTC / e-commerce platforms

Pharmacies & retail chains

Provider-led procurement

Payer-sponsored RPM deployments

Enterprise digital health partnerships - By User Demographics & Risk Profile (in Value %)

Hypertension management patients

Cardiovascular & renal risk cohorts

Geriatric & assisted-living populations

Pregnancy & maternal health users

Fitness-aware & preventive health users

- Market Share Analysis of Major Players

- Cross Comparison Parameters (FDA clearance & clinical validation depth, RPM & CPT reimbursement readiness, EHR / EMR interoperability strength, Data security & HIPAA compliance architecture, AI analytics & hypertension insights capability, Subscription & service monetization model, US provider & payer partnership footprint, Scalability across population health programs)

- Competitive Benchmarking Matrix

- Pricing & Monetization Model Analysis

- Detailed Company Profiles

Omron Healthcare

Withings

iHealth Labs

Qardio

A&D Medical

Welch Allyn (Hillrom / Baxter)

Microlife

Beurer

ForaCare

VivaLNK

Aktiia

BodyTrace

Current Health

BioTelemetry

- Demand Patterns by Care Setting

- Budget Ownership & Procurement Decision Flow

- Clinical Workflow Integration Requirements

- Pain Points Across Patients, Clinicians & Administrators

- Buying Criteria & Vendor Selection Logic

- By Value, 2025-2030

- By Volume, 2025-2030

- Installed Base, Active Connected Devices & Dormant Units, 2025-2030

- Average Realization by Device Class & Connectivity Tier, 2025-2030

- New Installations vs Replacement & Upgrade Demand Split, 2025-2030