Market Overview

The U.S. smart parking solutions market is valued at USD ~ billion in 2024. The growth of this market is driven by rapid urbanization, increased vehicle ownership, and a surge in demand for smart city solutions. Additionally, technological advancements in IoT, artificial intelligence (AI), and cloud computing are making smart parking systems more efficient, user-friendly, and scalable. As cities struggle with congestion and limited parking spaces, the demand for automated, data-driven parking solutions has risen sharply. The growing push toward sustainability and the integration of electric vehicle (EV) infrastructure also contribute to the market’s expansion.

In the U.S., cities like San Francisco, New York, and Los Angeles dominate the smart parking market due to their high vehicle density, congested streets, and advanced urban infrastructure. These metropolitan areas are heavily investing in smart city technologies, including IoT-based parking solutions, to alleviate traffic congestion, improve parking experience, and reduce environmental impact. The adoption is also fueled by local government initiatives, which seek to create more efficient and sustainable urban environments. High adoption rates in these cities influence the broader market, setting benchmarks for other regions.

Market Segmentation

By Product Type

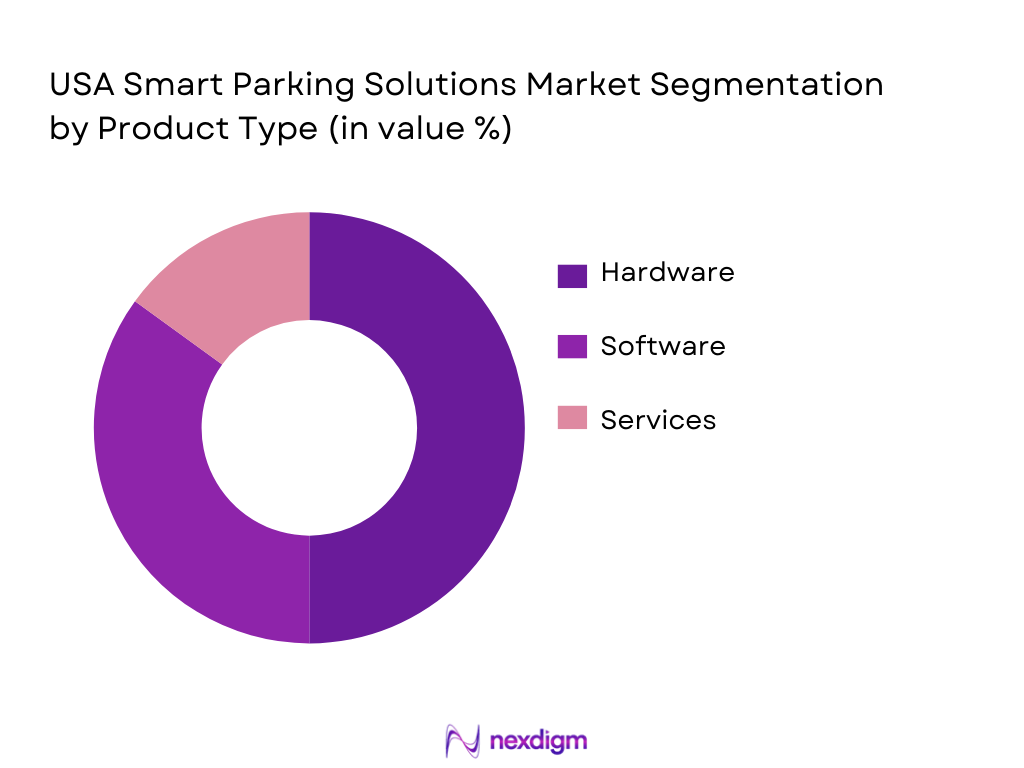

The U.S. smart parking market is primarily segmented by product type into hardware, software, and services. The hardware segment, consisting of sensors, cameras, and smart meters, holds the largest market share. This dominance is driven by the need for real-time data collection, efficient parking space management, and seamless integration with existing infrastructure. Products like ultrasonic sensors, LIDAR systems, and license plate recognition (LPR) cameras are commonly used to monitor parking availability and guide vehicles to open spots.

By Technology

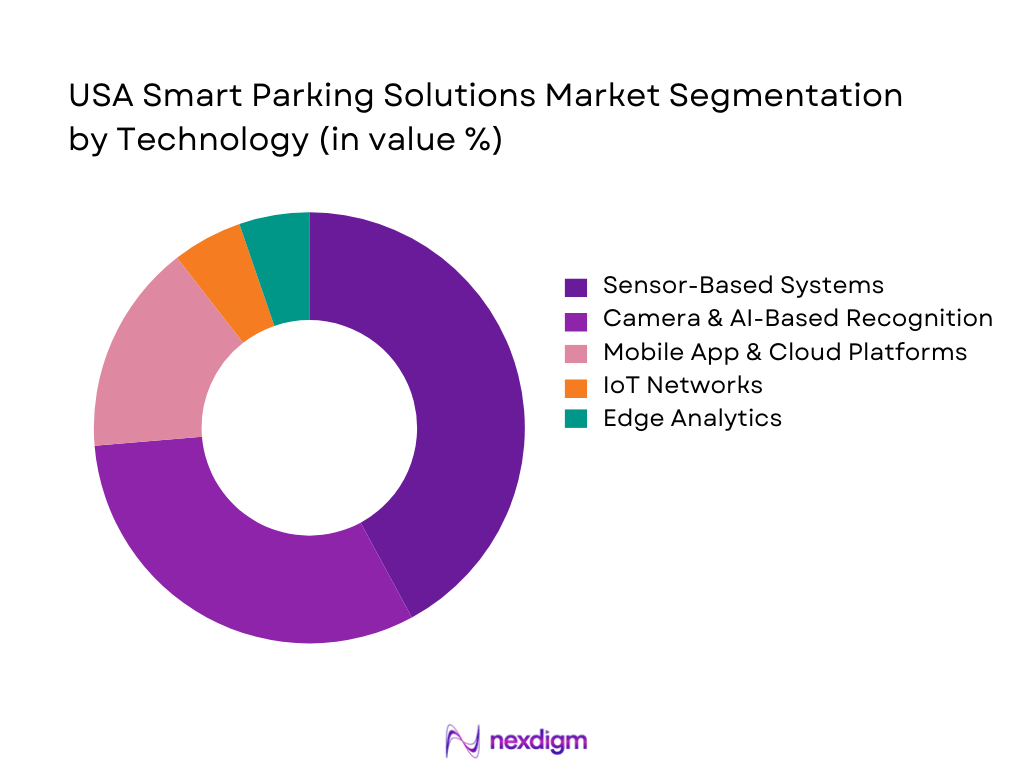

The technology segment includes sensor-based systems, camera and AI-based recognition, mobile app and cloud platforms, IoT networks, and edge analytics. Sensor-based systems dominate the market due to their wide application in real-time parking space management. These systems leverage ultrasonic, magnetic, and infrared sensors to provide accurate, real-time occupancy data. The growing adoption of wireless communication technologies and IoT infrastructure further boosts the segment’s dominance.

Competitive Landscape

The U.S. smart parking market is dominated by a few major players offering innovative products and services. These companies range from established global firms like Siemens and Cisco to specialized startups providing unique parking solutions. The competitive environment is characterized by rapid technological advancements, strategic partnerships, and a focus on integrating smart city ecosystems. These companies are investing heavily in R&D to enhance sensor technology, mobile app integration, and cloud-based solutions to cater to the growing demand for efficient and sustainable urban mobility solutions.

| Company | Establishment Year | Headquarters | Product Portfolio | Technology | Key Partnerships | Target Market |

| Cisco Systems Inc. | 1984 | San Jose, CA | ~ | ~

|

~

|

~

|

| ParkMobile | 2008 | Atlanta, GA | ~

|

~

|

~

|

~

|

| Flowbird Group | 2007 | Paris, France | ~

|

~

|

~

|

~

|

| ParkAssist | 2001 | New York, NY | ~

|

~

|

~

|

~

|

| Smart Parking Ltd. | 2004 | Melbourne, Australia | ~

|

~

|

~

|

~

|

USA Smart Parking Solutions Market Analysis

Growth Drivers

Urbanization

The growth of the U.S. smart parking solutions market is closely tied to rapid urbanization and the rising population density in metropolitan areas. In 2024, the United States has a total population of ~ people, of which ~ % reside in urban areas, according to World Bank and UN data. This concentration creates acute demand for efficient use of limited urban space, amplifying stress on traditional parking infrastructure, and driving investment in sensor‑based, real‑time smart parking systems. The expanding urban populace, particularly in large cities with congested traffic corridors, necessitates automated parking solutions that reduce search time, optimize space, and enhance traffic mobility.

Industrialization

While smart parking solutions are not directly a manufacturing output, broader industrial activity in the United States supports the adoption of automated infrastructure systems, including smart parking. The U.S. industrial sector achieved an all‑time high real output in manufacturing of USD ~ trillion in 2024, reflecting robust production capabilities that underpin the supply of electronic hardware, IoT devices, and sensor technologies essential for smart parking deployment. This strong manufacturing base enables faster development and deployment of advanced parking hardware such as high‑resolution cameras and IoT sensors, thus improving both supply reliability and innovation. Additionally, increased industrial production encourages infrastructure upgrades in urban zones and commercial centers where industrial activity is concentrated, thereby accelerating the integration of smart parking technologies.

Restraints

High Initial Costs

One of the prominent restraints on widespread adoption of smart parking solutions in the U.S. is the high upfront investment required for infrastructure deployment. Although precise installation costs vary by city size and technology type, advanced sensor networks, cameras, and real‑time data platforms represent significant capital expenditure for municipalities and private developers. This financial burden is compounded by the need for integration with existing urban infrastructure and ongoing maintenance. In ecosystems where alternative transportation options command large infrastructure funding—such as the USD ~ trillion private infrastructure assets under management in 2024—allocating budget to smart parking can be deprioritized in favor of other mobility or social infrastructure projects. As a result, smaller cities with tighter budget constraints may delay or limit smart parking investments due to these substantial initial costs.

Technical Challenges

Technical challenges also impede the seamless rollout of smart parking solutions across U.S. cities. Integrating real‑time sensor data, cloud platforms, and mobile application ecosystems requires robust digital infrastructure and high levels of interoperability between disparate systems. The complexity of managing linked networks of IoT devices can strain local IT departments, particularly where legacy systems predominate. Furthermore, smart parking deployment must align with broader digital infrastructure readiness; for instance, although ~ % of Americans used the internet in 2024, a high connectivity baseline, meshing heterogeneous wireless and backend systems continues to present implementation obstacles. These technical challenges elevate project timelines and require specialized expertise, which can deter municipalities from pursuing aggressive smart parking initiatives without clear implementation of blueprints and skilled workforce support.

Opportunities

Technological Advancements

Technological innovation offers significant opportunities for the U.S. smart parking market. The adoption of Internet of Things (IoT), artificial intelligence (AI), and real‑time data analytics considerably enhances system capabilities—and the broader technological ecosystem in the U.S. supports these innovations. For example, U.S. internet usage stood at ~ % of the population in 2024, providing a strong foundation for digital smart parking services and mobile app integration that improve user experience. Moreover, advancements in sensor technology and low‑power wide‑area networks (LPWAN) reduce long‑term operational costs and improve reliability of vehicle detection systems. These technologies enable predictive parking availability, dynamic guidance, and integration with other smart city platforms, fostering broader adoption. As U.S. cities and private developers seek to modernize infrastructure, this technological foundation presents a substantial growth avenue for smart parking solutions.

International Collaborations

International collaborations create another promising opportunity for the U.S. smart parking market by facilitating technology transfer and scaling best practices globally. As cities worldwide grapple with urban congestion, partnerships between U.S. firms and global smart city technology providers accelerate the adoption of proven parking solutions. For instance, U.S. smart parking developers are increasingly engaging with international counterparts to co‑develop sensor technologies and AI‑driven systems that have been successfully deployed in high‑density urban centers in Europe and Asia. Such cross‑border partnerships can lead to shared R&D efforts, harmonized standards, and access to global supply chains, ensuring the U.S. market benefits from cutting‑edge innovations refined internationally. These collaborations bolster technological maturity and offer cost‑effective solutions tailored to urban challenges faced by major U.S. cities.

Future Outlook

Over the next five years, the U.S. smart parking market is poised to grow significantly, driven by the continued adoption of smart city technologies, a shift toward eco-friendly transportation, and advancements in IoT and AI. Governments and municipalities are increasingly recognizing the value of smart parking solutions to address urban congestion, improve traffic flow, and reduce environmental impact. Additionally, the integration of electric vehicle (EV) charging infrastructure with parking solutions will further fuel market growth. As more cities adopt smart technologies, the demand for real-time parking data, dynamic pricing, and automated parking management will escalate.

Major Players in the Market

- Cisco Systems Inc.

- ParkMobile

- Flowbird Group

- ParkAssist

- Smart Parking Ltd.

- Siemens AG

- Nedap NV

- Amano Corporation

- Streetline

- T2 Systems

- SKIDATA

- Parkopedia

- VIA Technologies

- ParkMe

- Conduent

Key Target Audience

- City Planners and Municipalities

- Government Agencies

- Urban Mobility Providers

- Technology Solution Providers

- Real Estate Developers

- Transportation Infrastructure Firms

- Investments and Venture Capitalist Firms

- Parking Operators and Management Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. smart parking market. Extensive desk research is conducted using secondary and proprietary databases to gather industry-level information. This phase aims to identify the critical variables that influence market dynamics, including urban congestion, government policies, and technological advancements.

Step 2: Market Analysis and Construction

Historical data is compiled and analyzed to assess market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Additionally, service quality statistics are evaluated to ensure the reliability of the market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts representing various companies. These consultations provide operational and financial insights directly from industry practitioners, helping to refine the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with major smart parking providers to acquire detailed insights into product segments, sales performance, and consumer preferences. This engagement serves to validate and complement the statistics derived from a bottom-up approach, ensuring a comprehensive analysis.

- Executive Summary

- Research Methodology (Market Definition & Smart Parking System Taxonomy (Hardware, Software, Services), Data Sources & Validation Approach (Primary + Secondary), Market Sizing Logic & Forecasting Technique, Adjustments for Adoption Rates & Technology Diffusion, Assumptions on Vehicle Penetration & Urbanization, Limitations and Sensitivity Analysis)

- Smart Parking Market Evolution & Rapid Adoption Drivers

- Market Genesis: From Manual Parking to IoT‑Enabled Solutions

- U.S. Urban Mobility Challenges & Smart Parking Relevance

- Business Models in Smart Parking (B2G, B2B, B2C)

- Value Chain, Supply Dynamics & Partner Ecosystems

- Market Drivers

Urbanization

Congestion

EV Integration - Market Challenges

Infrastructure Cost

Data Privacy

Integration Hurdles - Market Opportunities

Analytics

AI Forecasting

Smart City Funding - Strategic Trends

Real‑Time Guidance

Demand Pricing

ADR/AI - Enabling Public Policy & Incentives

Smart City Grants

Curb Policies

- By Value, 2019-2025

- By Volume, 2019 -2025

- By Average Price of Platforms/Services, 2019 -2025

- By Component (In Value %)

Hardware (Sensors, LIDAR, LPR Cameras, Smart Meters)

Software (Parking Guidance, Booking/Reservation, Analytics)

Services (Installation, Maintenance, Managed Services - By Technology (In Value %)

Sensor‑Based Systems (Ultrasonic, Magnetic, Infrared)

Camera & AI‑Based Recognition (LPR, Vision AI)

Mobile App & Cloud Platforms (Reservation + Payment)

IoT & Beacon/Networking Systems

Edge & Cloud Analytics Integration - By Solution Type (In Value %)

On‑Street Smart Parking

Off‑Street Smart Parking

Integrated Curb Management

Electric Vehicle Parking Integration (with charging)

Dynamic Pricing & Demand‑Responsive Systems - By End‑User (In Value %)

Municipal & Smart Cities

Commercial (Retail, Offices, Malls)

Transport Hubs (Airports, Stations)

Residential & Multi‑Family Communities

Healthcare & Education

- Market Share Breakdown — Component & Solution Basis

- Cross‑Comparison Parameters (Company Business Model (Direct/Platform/SaaS), Global vs U.S. Footprint (Deployment Geography), Product Portfolio Breadth (Sensors, AI, Analytics, R&D Intensity & Innovation Index, Strategic Alliances & Smart City Contracts, Channel Network & Integration Partners, Pricing Model & Revenue Streams (Software + Recurring Services), Customer Install Base & Retention Metrics)

- Detailed Profiles of Key Industry Players

ParkMobile (USA)

SpotHero (USA)

Cisco Systems Inc. (USA)

Flowbird Group (France/USA)

Nedap NV (Netherlands/USA)

Amano Corporation (Japan/USA)

Siemens AG (Germany/USA)

Robert Bosch Engineering & Business Solutions (Germany/USA)

ParkAssist (USA)

CivicSmart (USA)

Deteq Inc. (USA)

SWARCO AG (Austria/USA)

Smart Parking Ltd (Australia/USA)

Streetline (USA)

ParkHelp (Spain/USA)

- Adoption Patterns by End‑User Segment

- Pain Points & Buying Criteria

- Decision Process & Budget Allocation

- Willingness to Pay & ROI Benchmarks

- Technology Maturity & Integration Challenges

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030