Market Overview

The U.S. thermometer market is valued at USD ~ million, and a key driver within this market is the rapid shift toward mercury-free and smart-enabled temperature measurement across home and clinical settings. In the immediately preceding year, the U.S. mercury-free thermometers sub-market alone generated USD ~ million, signaling how quickly demand has concentrated in safer, faster, and more digital-friendly formats. Growth is primarily supported by expanding home monitoring behavior, infection-prevention workflows in care delivery, and consumer preference for app-linked insights, reminders, and family profiles.

Demand concentrates around large metro ecosystems with dense provider networks, higher device retail penetration, and strong digital-health adoption. New York City, Los Angeles, Chicago, Houston, Dallas–Fort Worth, the San Francisco Bay Area, Boston, Seattle, and Washington D.C. influence uptake because they combine high outpatient visit volumes, large pediatric and elderly populations served by integrated delivery networks, and strong omnichannel retail that accelerates connected-device distribution. These metros also host medical innovation clusters and payer and provider pilots that normalize connected vitals for remote and preventive care workflows.

Market Segmentation

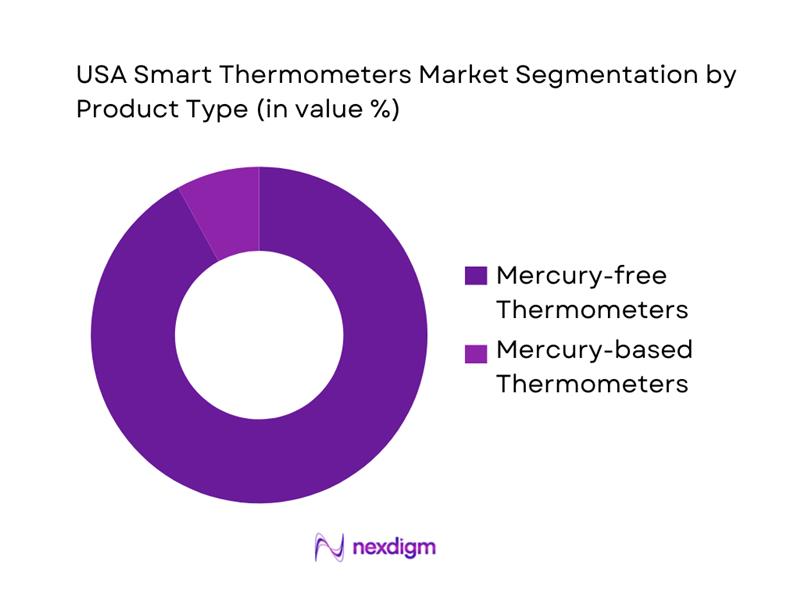

By Product Type

The U.S. smart thermometers market aligns strongly with the broader market’s shift toward mercury-free thermometers, which includes digital and infrared devices that are most compatible with smart features such as companion apps, data storage, and multi-user profiles. In this segmentation, mercury-free thermometers dominate because hospitals, clinics, and households prefer rapid, safe measurement and simplified cleaning protocols. Adoption is reinforced by consumer preference for non-contact use, especially for children, and by institutional purchasing that prioritizes compliance, safety, and ease-of-use. Additionally, smart thermometers are disproportionately launched as mercury-free by design, so innovation concentrates here, widening the gap versus legacy mercury-based formats.

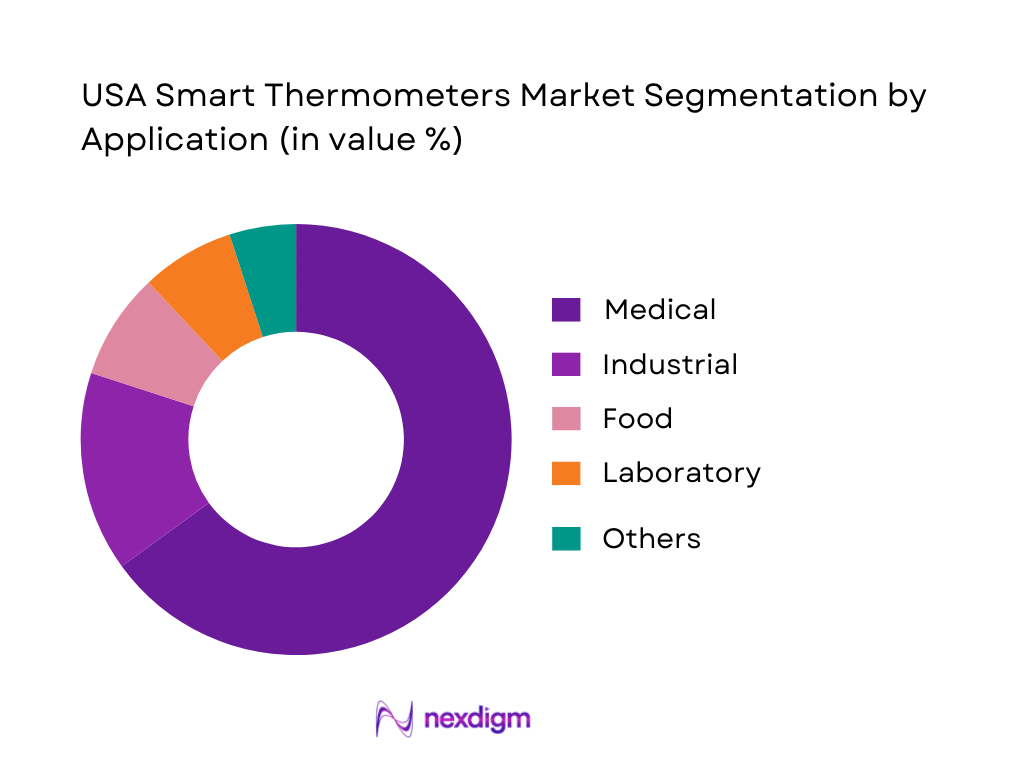

By Application

The market is commonly segmented by application into Medical, Industrial, Food, Laboratory, and Others. In smart thermometers, medical use dominates because connected features add the most value where repeat readings, multi-user tracking, alerts, and documentation matter, especially in households managing children, chronic conditions, or infection episodes. Medical settings also benefit from faster throughput, reduced contact, and streamlined workflows for triage. Meanwhile, industrial and food use-cases adopt temperature tools heavily, but smart-app features typically have lower incremental value than accuracy, calibration, and ruggedness. As a result, the medical application leads adoption of smart experiences and is the category where major brands compete most visibly through retail pharmacy, e-commerce, and provider-aligned sales.

Competitive Landscape

The U.S. smart thermometer space is shaped by a mix of consumer connected-health brands and clinical-grade thermometer leaders. The landscape remains competitive because product differentiation is driven by measurement method, accuracy claims, app experience, data portability, retail placement, and institutional purchasing relationships.

| Company | Established | Headquarters | Primary Thermometer Type | Connectivity Focus | Key Channel Strength | Typical Use-Case Fit | Data / App Experience | Institutional Presence |

| Kinsa | 2012 | San Francisco, CA | ~ | ~ | ~ | ~ | ~ | ~ |

| Exergen | 1980 | Watertown, MA | ~ | ~ | ~ | ~ | ~ | ~ |

| iHealth Labs | 2010 | U.S. presence (California-based operations) | ~ | ~ | ~ | ~ | ~ | ~ |

| Withings | 2008 | Issy-les-Moulineaux, France (U.S. office presence) | ~ | ~ | ~ | ~ | ~ | ~ |

| Braun (Thermometers) | Brand-led | U.S. consumer presence | ~ | ~ | ~ | ~ | ~ | ~ |

USA Smart Thermometers Market Analysis

Growth Drivers

Expansion of Remote Patient Monitoring Programs

The U.S. has the scale and reimbursement infrastructure to keep normalizing home-based vitals capture, including temperature, which supports demand for smart thermometers that can store, trend, and share readings. The economy supports this shift with GDP of USD ~ trillion and GDP per capita of USD ~, creating a large addressable base that can pay for connected home health tools through retail, employer benefits, or coverage pathways. Medicare alone covers ~ people, and Medicare Advantage enrolls ~, which increases the number of beneficiaries managed under plans that operationally benefit from earlier detection and remote monitoring workflows. On the operational side, federal RPM billing rules define measurable thresholds that push consistent device usage, requiring data collection for ~ or more days in a ~ period and defining patient-provider communication in ~ increments. When respiratory viruses surge, temperature becomes a front-line signal, with influenza burden estimates showing ~ flu-related medical visits and ~ hospitalizations in a recent season.

Consumer Demand for App-Based Health Tracking

App-linked thermometers benefit from the broader digital-first consumer environment in the U.S., where high incomes and large-scale connectivity enable households to treat temperature readings as part of an ongoing health record rather than a one-off check. The U.S. resident population is ~, which underpins a massive installed base for family-profile health apps and connected devices that store multi-user histories. Economic capacity also matters for adoption of app-connected devices across retail and e-commerce, with GDP of USD ~ trillion and GDP per capita of USD ~ supporting demand for feature-rich consumer health electronics and subscriptions. App-based tracking becomes more valuable when the healthcare system can accept or integrate patient-generated data. Federal health IT monitoring shows strong progress in app-enabled access to health data, with ~ in ~ non-federal acute care hospitals using APIs to enable patient access and about ~ out of ~ hospitals using HL7 FHIR APIs. Disease burden creates repeated use cases for tracking, with influenza estimates including ~ illnesses and ~ medical visits in a recent season.

Challenges

Accuracy Variability by Measurement Site

Smart thermometers span multiple measurement sites, and accuracy can vary based on site physiology, user technique, ambient temperature, and device calibration. This variability becomes a market friction because consumers expect clinical-like reliability while using devices in uncontrolled home environments, often for pediatric or older adults. High illness burden amplifies the consequence of error, with estimates of ~ flu-related medical visits and ~ hospitalizations in a recent season. On the regulatory side, recall history illustrates how product performance issues can arise in temperature monitoring devices, including a recall of a rechargeable wearable smart thermometer intended for continuous temperature monitoring with a multi-month lifecycle until termination in ~. The macro context reinforces the scale of the challenge, with ~ residents and GDP per capita of USD ~ driving both massive adoption potential and high expectations of product quality.

Data Privacy and Cybersecurity Concerns

Smart thermometers increasingly function as data-collecting endpoints, tying temperature readings to user profiles, symptom notes, and sharing features, making privacy and cybersecurity risk a direct adoption barrier. The U.S. regulatory and enforcement environment underscores this, with compliance activity involving ~ cases resolved through corrective actions or technical assistance and ~ cases involving civil money penalties. These counts signal an environment where health data handling failures can trigger sustained enforcement attention, raising compliance costs and slowing partnerships. The macro environment further drives exposure, with an economy of USD ~ trillion and a resident population of ~ increasing the scale of potential impact for any security incident. Connected health acceleration adds to this exposure, as Medicare covers ~ people and RPM billing rules define frequent data flows, increasing the cybersecurity surface area.

Opportunities

Continuous Temperature Monitoring Adoption

Continuous monitoring shifts thermometers from episodic tools to early-signal sensors, particularly for pediatrics, post-acute care, and higher-risk populations. The scale of potential use is large, with Medicare enrollment of ~ and many beneficiaries experiencing repeated clinical contacts where early detection can reduce escalation. Pediatric opportunity is also structurally significant because Medicaid and CHIP cover roughly ~ children, and caregiver demand for low-burden monitoring rises during respiratory virus seasons. Disease burden reinforces the need for earlier detection, with influenza estimates of ~ illnesses, ~ medical visits, and ~ hospitalizations in a recent season. The market shows real product intent for continuous monitoring through wearable smart thermometer products intended for continuous temperature monitoring in young children. Macroeconomic capacity supports this shift, with GDP per capita of USD ~ enabling adoption of higher-feature devices and companion services.

Bundling with Remote Patient Monitoring Kits

Bundling smart thermometers into RPM kits is a market-specific opportunity because temperature data complements core vitals used for triage, infection monitoring, and deterioration detection. Federal RPM billing rules create a structured operational backbone for kits, requiring data collection for ~ or more days in a ~ period and defining management in ~ increments, favoring standardized deployments. Medicare’s scale strengthens the commercial logic, with ~ people enrolled and ~ in Medicare Advantage. Interoperability progress supports kit bundling, with ~ in ~ non-federal acute care hospitals using APIs to enable app-based patient access and many using FHIR APIs. The burden of febrile illness reinforces the value of kits that include temperature, with estimates of ~ flu-related medical visits and ~ hospitalizations in a recent season.

Future Outlook

Over the forecast horizon, the U.S. smart thermometers market is expected to expand steadily as connected health becomes more routine in home care and outpatient workflows. Growth will be supported by rising preference for non-contact measurement, increased family health management behavior, and integration opportunities with broader remote monitoring stacks. Brands will compete more on accuracy positioning, app experience, multi-device ecosystems, and distribution. Regulatory attention to medical-device claims and data handling will shape go-to-market strategies for app-enabled thermometers.

Major Players

- Kinsa

- Exergen

- iHealth Labs

- Withings

- Braun

- Omron

- Medline Industries

- Welch Allyn

- 3M

- Microlife

- Terumo

- America Diagnostics

- Briggs Healthcare

- Innovo Medical

Key Target Audience

- Head of Product Strategy, Consumer Health Devices

- Head of Digital Health Partnerships, Retail Pharmacy Chains

- Director of Supply Chain & Procurement, Hospital Systems

- Head of Value Analysis / Sourcing, Group Purchasing Organizations

- Head of Remote Patient Monitoring Programs, Provider Networks

- Head of Reimbursement & Payer Strategy, Health Managed Care Organizations

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

We begin by mapping the U.S. smart thermometer ecosystem across manufacturers, retail channels, clinical buyers, and digital-health enablers. This is supported by structured secondary research using credible market databases and industry publications. The objective is to define the variables that move demand, including device type, connectivity, channels, clinical adoption pathways, and consumer behavior triggers.

Step 2: Market Analysis and Construction

Historical market movement is compiled to understand the baseline demand environment and category transitions, especially the shift toward mercury-free formats. Category signals are triangulated with product-level adoption indicators such as channel availability, institutional purchasing emphasis, and consumer usage patterns that influence repeat buying.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on segment dominance and channel drivers are validated using expert consultations with stakeholders across device brands, retail buyers, and healthcare operations. This step is designed to confirm what is driving demand in practice beyond what is visible in published datasets.

Step 4: Research Synthesis and Final Output

Insights are synthesized into a report structure that aligns market sizing with segment logic, competitive benchmarking, and commercialization pathways. Outputs are cross-checked for consistency using bottom-up logic where possible and aligned to the most credible, publicly verifiable market figures.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Scope Boundary Consumer vs Clinical vs Remote Monitoring, Inclusion and Exclusion of Wearables and Telethermographic Functions, Abbreviations, Data Triangulation Framework, Market Sizing Approach Top Down and Bottom Up, Primary Research Approach Providers Payors Retail OEMs Distributors, Secondary Research Approach, Validation Through Regulatory and Standards Mapping, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Expansion of Remote Patient Monitoring Programs

Consumer Demand for App-Based Health Tracking

Pediatric and Caregiver Preference for No-Touch Devices

Provider Focus on Early Detection

Retail Availability and Reimbursement Eligibility - Challenges

Accuracy Variability by Measurement Site

Data Privacy and Cybersecurity Concerns

Interoperability Gaps

Regulatory Classification Complexity

Calibration and Post-Market Surveillance Issues - Opportunities

Continuous Temperature Monitoring Adoption

Bundling with Remote Patient Monitoring Kits

AI-Driven Fever Analytics

Hospital-at-Home Models

Employer and School Health Programs - Trends

Shift Toward Longitudinal Temperature Monitoring

Integration of Device and App Ecosystems

Growth of No-Touch Thermometers

Cybersecurity-by-Design Focus

Subscription and Service-Based Models - Regulatory and Policy Landscape

- Standards and Testing Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (In Value %)

Smart Digital Contact Thermometers

Smart Tympanic Thermometers

Smart Temporal Artery Thermometers

Smart Non-Contact Infrared Forehead Thermometers

Continuous Temperature Monitoring Devices - By Measurement Technology and Sensing Method (In Value %)

Thermistor-Based Clinical Electronic Thermometers

Infrared Sensor-Based Thermometers

Heat-Flux or Continuous Estimation Sensing

Multi-Sensor Hybrid Devices - By Connectivity and Data Transmission (In Value %)

Bluetooth-Enabled

Wi-Fi Enabled

Cellular-Enabled

Offline Smart - By End User (In Value %)

Households and Caregivers

Hospitals and Inpatient Settings

Ambulatory Care Centers and Clinics

Long-Term Care Facilities and Assisted Living

Schools and Community Screening Programs - By Use Case or Application (In Value %)

Fever Detection and Acute Infection Triage

Remote Patient Monitoring and Post-Discharge Surveillance

Chronic Care Monitoring

Maternal Health and Fertility Tracking

Immunocompromised and Oncology Home Monitoring - By Distribution Channel (In Value %)

Retail Pharmacies and Drug Stores

Mass Merchandisers and Club Stores

E-Commerce Platforms

Home Medical Equipment Providers

Provider and Health System Procurement

- Market Share of Major Players by Value and Volume

Market Share by Product Type

Market Share by Distribution Channel - Cross Comparison Parameters (Regulatory Status, Measurement Site Options, Sensor Technology, Accuracy Specifications, Read Time and Usability, Connectivity and App Capabilities, Interoperability Readiness, Data Security Controls, Commercial Footprint)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs

- Detailed Profiles of Major Companies

Kinsa

Withings

iHealth Labs

Kaz USA

Exergen Corporation

Omron Healthcare

Welch Allyn

BD

Medline Industries

McKesson Corporation

FridaBaby

Beurer North America

Microlife USA

Geratherm Medical

- Market Demand and Utilization Patterns

- Purchasing Power and Budget Allocations

- Workflow Integration

- Training and Usability Sensitivity

- Needs, Desires and Pain Points

- Decision-Making Process

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030