Market Overview

The USA Smartwatches Market is valued at approximately USD ~ billion in 2025, driven by technological advancements, increased health consciousness, and rising adoption across consumer and healthcare segments. The increasing demand for smart wearables offering advanced health features, such as ECG, SpO2, and fitness tracking, is a key factor behind the growth. In addition, advancements in mobile connectivity and seamless integration with smartphones have contributed to the expansion of the market. The rise of tech-savvy consumers and health-oriented individuals has further accelerated the market’s adoption, ensuring a healthy growth trajectory.

The USA Smartwatches Market is dominated by major metropolitan cities such as New York, Los Angeles, and Chicago, where a high concentration of tech-savvy consumers and affluent individuals drives the market demand. Additionally, states like California and New York, known for their early technology adoption, play a pivotal role in shaping market trends. These areas are home to major technology companies and are early adopters of smart wearable technologies, further contributing to the dominance of the market in the region.

Market Segmentation

By Product Type

The USA Smartwatches Market is segmented by product type into companion smartwatches, standalone smartwatches, hybrid smartwatches, and performance smartwatches. Among these, companion smartwatches hold the largest market share in 2024. The popularity of companion smartwatches is driven by their seamless integration with smartphones, offering enhanced functionality for communication, health monitoring, and entertainment. Major players like Apple and Samsung have established strong brand loyalty with their companion models, creating an entrenched presence in the market. Additionally, the demand for smartwatches with more advanced fitness tracking and health monitoring features, which are prevalent in companion devices, further fuels this dominance.

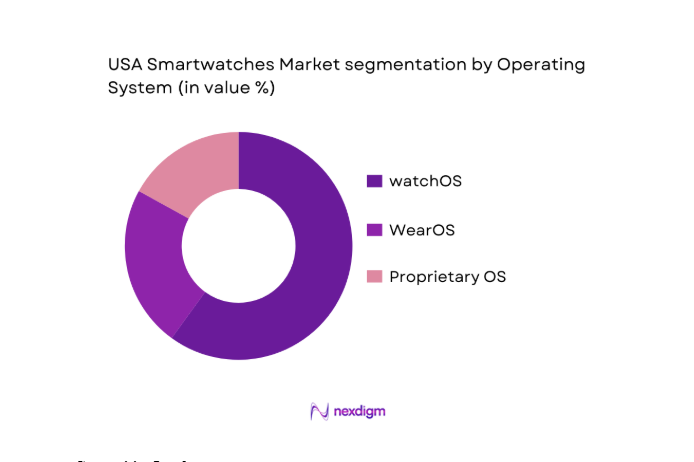

By Operating System

The USA Smartwatches Market is also segmented by operating system, including watchOS, WearOS, and proprietary OS platforms. watchOS dominates the market share in 2024 due to the strong ecosystem integration offered by Apple. The seamless pairing of Apple smartwatches with iPhones, along with exclusive features such as Apple Pay, health data synchronization, and strong brand loyalty, places watchOS as the leading operating system in the market. This dominance is further reinforced by the continuous updates and innovation Apple provides to its software, which enhances the user experience and strengthens customer retention.

Competitive Landscape

The USA Smartwatches Market is highly competitive, dominated by a few major players. Companies like Apple, Samsung, and Garmin lead the market, with Apple securing the top position due to its strong integration with the iOS ecosystem and innovative health features. Samsung, with its WearOS-based devices, competes aggressively through a variety of product offerings and partnerships. Garmin and Fitbit have carved out significant niches in the fitness and health-tracking segment, leveraging their expertise in wearable fitness devices.

| Company | Establishment Year | Headquarters | Key Parameters | Market Share | Product Portfolio | Global Presence | Innovations | R&D Spending | Distribution Channels |

| Apple | 1976 | Cupertino, USA | watchOS, Fitness Tracking, Health | ~ | ~ | Global | ~ | ~ | ~ |

| Samsung | 1938 | Seoul, South Korea | WearOS, Health Features | ~ | ~ | Global | ~ | ~ | ~ |

| Garmin | 1989 | Olathe, USA | Fitness Tracking, GPS Integration | ~ | ~ | Global | ~ | ~ | ~ |

| Fitbit | 2007 | San Francisco, USA | Fitness Features, Health Tracking | ~ | ~ | Global | ~ | ~ | ~ |

| Fossil Group | 1984 | Richardson, USA | Hybrid and Smartwatches | ~ | ~ | North America, Europe | ~ | ~ | ~ |

US Smartwatches Market Analysis

Growth Drivers

Proliferation of Health & Biosensing Features

Health and biosensing features are rapidly becoming integral to smartwatches, with a growing emphasis on wellness and preventive healthcare. The introduction of sensors that track ECG, SpO2, and VO₂ metrics has spurred demand for wearables. In the US, the wearable healthcare devices market is anticipated to be heavily influenced by the increasing adoption of ECG and blood oxygen sensors. By 2024, nearly ~ ECG-enabled smartwatches are projected to be sold annually in the US alone, reflecting a ~ increase in demand for these health-monitoring features from 2022 levels. With the aging population and rising healthcare awareness, these features have become essential in monitoring and managing chronic health conditions. In addition, ~ of consumers report that they would choose wearable devices with health-tracking capabilities, such as ECG, to monitor their health regularly.

Integration with Telehealth & Remote Monitoring Platforms

The integration of smartwatches with telehealth and remote monitoring platforms is a key factor driving the demand for wearables. The U.S. telehealth market was valued at ~ in 2022 and is expected to grow by ~ annually. This growth is largely attributed to the increasing reliance on remote health monitoring tools to manage chronic diseases, especially following the COVID-19 pandemic. As of 2023, more than 30% of healthcare providers in the U.S. are using wearable devices to monitor patients’ vitals remotely, which has positively impacted smartwatch sales. With the continuing expansion of virtual healthcare services, smartwatches are increasingly being used to monitor patients’ heart rate, blood pressure, and blood oxygen levels, contributing to real-time diagnosis and treatment.

Market Barriers

Battery Life & Sensor Power Economics

One of the key barriers to the widespread adoption of smartwatches is the challenge surrounding battery life, which limits the functionality of advanced features such as ECG and continuous health monitoring. In 2023, more than ~ of U.S. smartwatch users report dissatisfaction with their devices’ battery life, which typically lasts between 18 and 24 hours. This is particularly concerning for consumers who use smartwatches for health monitoring, which requires continuous tracking. As sensor capabilities increase, the power consumption of devices rises, making it challenging for manufacturers to extend battery life while maintaining functionality. The U.S. market is expected to see improvements in battery technology as companies like Apple and Samsung invest heavily in longer-lasting power solutions, but the current limitations still hinder growth.

Data Security & Regulatory Compliance Constraints

As health data collected by wearables becomes more complex, concerns about data security and regulatory compliance are increasing. The use of smartwatches for tracking sensitive health metrics, including ECG, blood pressure, and sleep patterns, raises issues related to data privacy. A 2023 survey found that over ~ of U.S. smartwatch users are concerned about the potential misuse of their health data by third-party applications or service providers. Furthermore, regulatory compliance with the Health Insurance Portability and Accountability Act (HIPAA) remains a challenge for smartwatch manufacturers and healthcare providers. As of 2024, the FDA is strengthening oversight over wearable devices used in medical settings, creating additional hurdles for manufacturers aiming to bring health-focused products to market.

Strategic Opportunities

Enterprise & Insurance Reimbursement Models

The integration of smartwatches into enterprise and insurance reimbursement models represents a significant growth opportunity. In 2023, approximately ~ of U.S. employers provided wearable devices to their employees as part of wellness programs, incentivizing employees to track their health. This figure is expected to increase as businesses recognize the potential cost savings associated with healthier employees. Moreover, insurance companies are beginning to offer discounts to policyholders who wear health-tracking devices. As of 2024, more than ~ of U.S. health insurance plans are providing partial reimbursements for wearables, which is likely to grow as insurance companies acknowledge the long-term savings from preventive care monitoring.

FDA-Certified Medical-Grade Wearables

The rise of FDA-certified medical-grade wearables is a promising strategic opportunity. The FDA is increasingly approving wearable devices for medical use, including ECG monitors and devices for continuous blood glucose monitoring. As of 2024, 15 FDA-approved wearable health devices are commercially available in the U.S., enabling users to track critical health metrics at home. This approval process allows wearables to be used in clinical settings, increasing their credibility and adoption among healthcare professionals. The U.S. market for medical-grade wearables is set to grow as more devices gain FDA approval for tracking chronic conditions like diabetes, cardiovascular diseases, and respiratory issues.

Future Outlook

Over the next 5 years, the USA Smartwatches Market is expected to experience significant growth, driven by continuous innovation in health and fitness features, increased consumer awareness regarding wellness, and greater adoption of wearables in healthcare settings. Advancements such as ECG monitoring, glucose tracking, and blood pressure measurement are expected to further propel market expansion. Moreover, with the integration of 5G connectivity and AI-powered health insights, the demand for advanced smartwatches will continue to rise, solidifying their role in everyday life for both consumers and healthcare providers

Major Players

- Apple

- Samsung Electronics

- Garmin Ltd.

- Fitbit (Acquired by Google)

- Fossil Group

- Huawei Technologies

- Amazfit

- Xiaomi

- Withings

- Whoop

- Oura

- Polar

- Suunto

- TAG Heuer

- LG Electronics

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Smartwatch OEMs

- Technology Innovators and AI Solution Providers

- Healthcare Providers and Clinics

- Fitness and Wellness Centers

- Insurance Companies

- Retailers and Distribution Partners

Research Methodology

Step 1: Identification of Key Variables

This phase focuses on identifying the key drivers influencing the USA Smartwatches Market, including technological advancements, consumer behavior, and regulatory requirements. Secondary research sources and databases are leveraged to understand market dynamics, competitive forces, and key trends.

Step 2: Market Analysis and Construction

Historical data is compiled and analyzed to understand past performance, including product adoption, pricing trends, and revenue growth. The market’s overall trajectory is also assessed, and customer feedback is collected to validate findings. This step helps develop reliable forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including executives from major smartwatch manufacturers, healthcare professionals, and tech analysts, are consulted to validate the initial hypotheses. These insights refine market analysis and ensure alignment with current industry realities.

Step 4: Research Synthesis and Final Output

Finally, primary and secondary research findings are synthesized to develop an accurate, comprehensive market report. Insights on product categories, market trends, and consumer adoption patterns are presented, and strategic recommendations are made for stakeholders.

- Executive Summary

- Research Methodology (Market Definitions & Standardization, Functional Scope, Primary Research Protocols, Quantification Methods, Data Normalization & Forecasting Algorithms, Research Limitations & Quality Control)

- Smartwatch Value Chain & Ecosystem Players

- Historical Evolution & Innovation Inflection Points

- USA Consumer & Enterprise Adoption Dynamics

- Regulatory & Standards Landscape

- Disruption Forces: AI, On‑device Analytics, Edge Health Monitoring

- Growth Catalysts

Proliferation of Health & Biosensing Features (ECG, SpO2, VO₂ metrics)

Integration with Telehealth & Remote Monitoring Platforms

Smartphone Ecosystem Lock‑ins & Upgrades

Demand for Personal Analytics & Preventive Care - Market Barriers

Battery Life & Sensor Power Economics

Data Security & Regulatory Compliance Constraints

Consumer Price Sensitivity & Upgrade Cycles

Fragmented OS & App Ecosystem - Strategic Opportunities

Enterprise & Insurance Reimbursement Models

FDA‑Certified Medical‑Grade Wearables

Subscription Services & Value‑Added Health Insights

Cross‑device AI Insights & Predictive Wellness - Emerging Trends

On‑device Machine Learning for Health Prognostics

Integration with AR/VR Wearables

Cross‑platform APIs & Data Monetization

Platform‑locked Value Bundling

- Market Value (2019–2025)

- Unit Shipments & Installed Base (2019–2025)

- Average Selling Price Trends (2019–2025)

- Price‑Tier Revenue Bands (2019–2025)

- By Product Category (In Value %)

Companion Smartwatches

Standalone Cellular Smartwatches

Hybrid Smartwatches

Performance / Sports‑centric Devices

Premium / Luxury Smartwatches - By Operating System Stack (In Value %)

watchOS

Wear OS & Forked Variants

Proprietary OS Platforms

Third‑party Integrations - By Connectivity Protocols (In Value %)

Bluetooth‑Only

Bluetooth + Cellular

Wi‑Fi + eSIM Enabled Devices - By Price Band (In Value %)

Budget (≤$199)

Mid‑Tier ($200–$399)

Upper Mid ($400–$699)

Premium ($700+) - By End‑User / Usage Context (In Value %)

Consumer – Daily Wear

Health & Wellness Users

Athletes & Performance Segment

Enterprise / Corporate Wellness

Clinical & Remote Patient Monitoring

- Market Share – Revenue & Units (Leading OEMs)

- Cross‑Comparison Parameters (Operating System Share, Health Sensor Set, Connectivity Profile, Price Tier Strength, Retail Penetration Rate, Warranty & Service, Software Ecosystem, Developer Support, Subscription Revenue Streams, MedTech Approvals, Average Battery Longevity, Distribution Reach, ASP by Segment, Replacement Cycle Insight)

- SWOT of Key Competitors

- SKU Pricing Matrix by Competitor

- Detailed Profile of Major Players

Apple Inc.

Samsung Electronics

Google (Fitbit)

Garmin Ltd.

Fossil Group Inc.

Amazfit (Zepp Health)

Xiaomi Corporation

Mobvoi

Withings

TAG Heuer

Polar

Whoop

Oura

Suunto

- Adoption Patterns

- Purchase Funnels & Channel Influence

- Usage Intensity & Feature Prioritization

- Switching & Upgrade Cycles

- Pain Points & Value Drivers

- Forecast Revenue & Unit Shipments – 2025–2030

- Future ASP Trajectory – 2025–2030

- Adoption Curve Scenarios – 2025–2030

- Health Feature Penetration Projections – 2025–2030

- Enterprise & Clinical Adoption Forecasts – 2025–2030