Market Overview

The USA Special Mission Aircraft market current size stands at around USD ~ million, reflecting sustained procurement and modernization activity across defense and security agencies. Demand during 2024 and 2025 has been driven by mission-critical aerial surveillance, intelligence gathering, and specialized operational requirements. Fleet upgrades, avionics modernization, and multi-mission adaptability continue shaping procurement strategies. The market benefits from long-term defense programs, structured acquisition cycles, and consistent platform replacement needs supporting operational readiness.

The market is concentrated around regions with dense military infrastructure, advanced aerospace manufacturing clusters, and established defense ecosystems. High activity is observed in regions hosting major airbases, systems integrators, and mission system developers. Strong federal funding frameworks, mature supplier networks, and long-standing defense programs reinforce regional dominance. Policy alignment, secure logistics, and interoperability requirements further strengthen localized demand concentration across major defense and homeland security corridors.

Market Segmentation

By Fleet Type

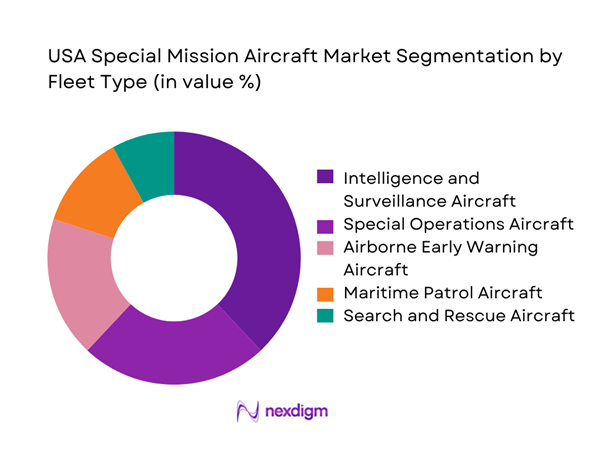

The fleet type segmentation is dominated by intelligence, surveillance, and reconnaissance aircraft due to their continuous deployment across border security, maritime monitoring, and tactical intelligence missions. Special operations aircraft also represent a substantial share, supported by increasing multi-role deployment strategies and modular mission configurations. Airborne early warning platforms maintain steady demand owing to integrated command and control requirements. Maritime patrol aircraft benefit from coastal security investments and enhanced surveillance mandates. Search and rescue platforms maintain moderate penetration, primarily driven by homeland security and disaster response applications.

By Application

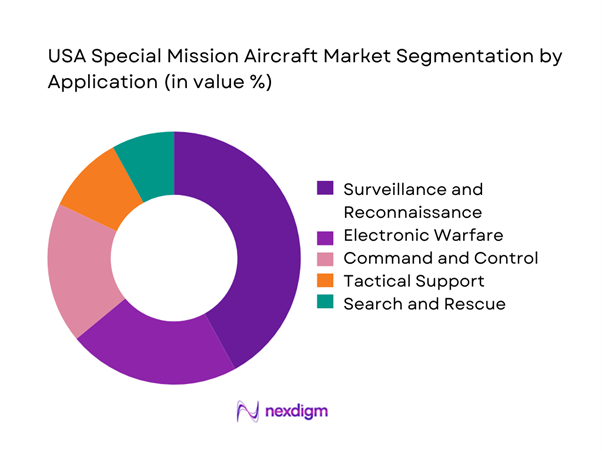

Application-based segmentation shows dominance of surveillance and reconnaissance missions, supported by increasing border monitoring and situational awareness requirements. Electronic warfare and signal intelligence applications continue expanding due to evolving threat environments. Command and control operations account for a stable share driven by network-centric warfare doctrines. Search and rescue and tactical support applications remain niche but critical segments supported by specialized mission demand and interoperability needs.

Competitive Landscape

The competitive landscape is characterized by a concentrated group of aerospace and defense manufacturers with strong integration capabilities and long-term government relationships. Companies compete on platform reliability, mission system integration, lifecycle support, and compliance with defense standards. Barriers to entry remain high due to certification complexity, capital requirements, and long procurement cycles.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Boeing Defense | 1916 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| General Atomics | 1955 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

USA Special Mission Aircraft Market Analysis

Growth Drivers

Rising demand for intelligence, surveillance, and reconnaissance capabilities

Increasing geopolitical tensions are driving higher deployment of airborne surveillance platforms across strategic operational theaters. Defense agencies prioritize persistent intelligence gathering to improve situational awareness and threat detection accuracy. Advanced sensor integration supports real-time decision making across multiple mission environments. Fleet modernization initiatives emphasize multi-mission flexibility and extended endurance capabilities. Growing reliance on aerial data collection strengthens procurement volumes for specialized aircraft. Interoperability requirements further support consistent investment across platforms. Operational efficiency gains encourage replacement of legacy systems. Strategic doctrine evolution reinforces sustained adoption levels. Mission criticality ensures continuous budget allocation. Long-term security priorities sustain procurement momentum.

Expansion of multi-mission and modular aircraft platforms

Modern defense strategies emphasize platforms capable of executing multiple mission profiles efficiently. Modular payload architectures enable rapid reconfiguration for diverse operational requirements. This flexibility reduces fleet complexity while improving mission responsiveness. Defense planners increasingly favor adaptable platforms over single-purpose aircraft. Modular systems reduce lifecycle costs through upgrade scalability. Integration of advanced avionics enhances operational versatility. Interoperability across allied forces strengthens adoption. Procurement agencies value reduced training and maintenance overhead. Fleet commonality improves logistics efficiency. These factors collectively drive accelerated adoption trends.

Challenges

High acquisition complexity and extended certification timelines

Special mission aircraft require extensive testing and certification before operational deployment. Compliance with stringent defense standards increases development timelines significantly. Integration of advanced sensors adds engineering complexity and validation requirements. Certification delays often impact program schedules and delivery commitments. Regulatory approvals involve multiple agencies and procedural stages. Custom mission configurations further complicate validation processes. Extended timelines affect budget predictability and planning cycles. Program risk increases due to evolving technical requirements. Delays can impact operational readiness. These factors collectively constrain market scalability.

Budget constraints and procurement cycle volatility

Defense procurement cycles are influenced by shifting fiscal priorities and policy decisions. Budget reallocations can delay or reduce planned aircraft acquisitions. Long-term programs face funding uncertainties across fiscal periods. Procurement delays impact production planning and supplier coordination. Cost overruns increase scrutiny on new platform investments. Competing defense priorities affect funding availability. Political transitions influence defense spending continuity. Financial approvals often require multi-year justification processes. Uncertain funding affects vendor investment planning. These challenges limit consistent market expansion.

Opportunities

Integration of advanced sensors and data fusion technologies

Growing emphasis on data-driven warfare creates opportunities for advanced sensor integration. Multi-sensor fusion enhances situational awareness and mission effectiveness. Artificial intelligence supports real-time data processing onboard aircraft. Enhanced analytics improve threat detection accuracy. Upgraded payloads extend mission capability across domains. Interoperable systems enable seamless data sharing across platforms. Sensor miniaturization reduces payload weight constraints. Digital architectures support rapid capability upgrades. These advancements increase platform attractiveness. Technology evolution drives long-term market potential.

Rising demand for maritime and border surveillance missions

Increasing focus on border security strengthens demand for surveillance aircraft. Maritime domain awareness remains a strategic priority for national security. Coastal monitoring requirements drive procurement of specialized aircraft. Persistent surveillance capabilities support law enforcement and defense missions. Extended range platforms improve coverage efficiency. Inter-agency collaboration expands utilization scope. Surveillance aircraft enhance response time and operational readiness. Environmental monitoring adds secondary mission value. Policy emphasis reinforces sustained investment. These factors create favorable growth conditions.

Future Outlook

The USA Special Mission Aircraft market is expected to maintain steady expansion through 2035, supported by defense modernization programs and evolving mission requirements. Technological advancements in sensors, connectivity, and data processing will continue shaping procurement strategies. Increased focus on interoperability and multi-mission capabilities will influence future platform development. Long-term defense planning and sustained security priorities are expected to underpin stable demand.

Major Players

- Boeing Defense

- Lockheed Martin

- Northrop Grumman

- L3Harris Technologies

- General Atomics

- Raytheon Technologies

- Textron Aviation Defense

- Sierra Nevada Corporation

- Gulfstream Aerospace

- Leonardo DRS

- Saab

- Thales Defense

- Airbus U.S. Space & Defense

- Elbit Systems of America

- Collins Aerospace

Key Target Audience

- United States Department of Defense

- United States Air Force

- United States Navy

- Department of Homeland Security

- U.S. Customs and Border Protection

- Defense acquisition agencies

- Aerospace system integrators

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market boundaries were defined through platform classification, mission scope identification, and operational role mapping. Key performance indicators and deployment parameters were established to ensure analytical consistency.

Step 2: Market Analysis and Construction

Data was analyzed through program-level assessment, platform deployment tracking, and capability mapping. Demand patterns were evaluated across operational and regional dimensions.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through structured consultations with defense procurement specialists and aviation domain experts. Assumptions were refined using operational insights and program benchmarks.

Step 4: Research Synthesis and Final Output

All findings were consolidated through triangulation methods, ensuring coherence across qualitative and quantitative inputs before final report development.

- Executive Summary

- Research Methodology (Market Definitions and platform scope alignment, Mission-specific aircraft classification and taxonomy mapping, Bottom-up fleet and program-based market sizing, Revenue attribution by OEMs and system integrators, Primary interviews with defense procurement and program officials, Triangulation using budget documents and contract databases, Assumptions based on fleet lifecycle and upgrade cycles)

- Definition and Scope

- Market evolution

- Operational and mission usage landscape

- Ecosystem and value chain structure

- Supply chain and integration framework

- Regulatory and defense acquisition environment

- Growth Drivers

- Challenges

- Opportunities

- Trends

- Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Platforms, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Intelligence, Surveillance, and Reconnaissance Aircraft

Airborne Early Warning and Control Aircraft

Signals Intelligence Aircraft

Maritime Patrol Aircraft

Special Operations Aircraft

Search and Rescue Aircraft - By Application (in Value %)

Border and Maritime Surveillance

Electronic Warfare and Intelligence Gathering

Battlefield Management and Command Control

Search and Rescue Operations

Special Operations Support - By Technology Architecture (in Value %)

Manned Special Mission Aircraft

Optionally Piloted Aircraft

Modular Mission System Platforms

Sensor-Fused Multi-Role Platforms - By End-Use Industry (in Value %)

US Department of Defense

Homeland Security Agencies

US Coast Guard

Intelligence and Security Agencies - By Connectivity Type (in Value %)

Line-of-Sight Data Links

Beyond Line-of-Sight SATCOM

Secure Tactical Data Links

Multi-Band Encrypted Communication Systems - By Region (in Value %)

Northeast United States

Midwest United States

Southern United States

Western United States

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Platform capability, Mission system integration, Payload flexibility, Program scale, Contract backlog, Technology maturity, Aftermarket support, Defense certification compliance)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Boeing Defense, Space & Security

Lockheed Martin Corporation

Northrop Grumman Corporation

L3Harris Technologies

Raytheon Technologies

General Atomics Aeronautical Systems

Gulfstream Aerospace

Bombardier Defense

Textron Aviation Defense

Sierra Nevada Corporation

Saab AB

Leonardo DRS

Airbus U.S. Space & Defense

Elbit Systems of America

Thales Defense & Security

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Platforms, 2026–2035

- By Average Selling Price, 2026–2035