Market Overview

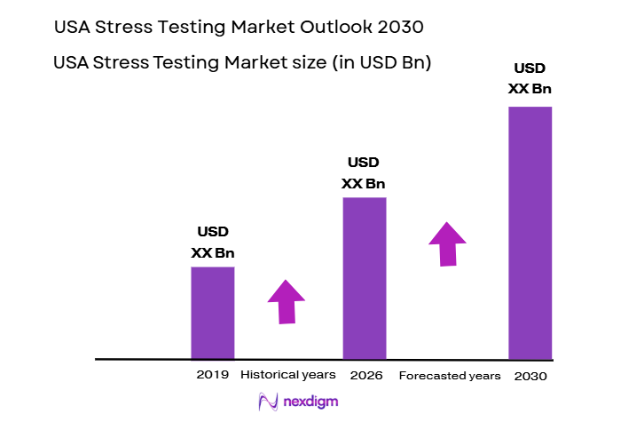

The USA Stress Testing market has shown consistent growth due to increasing regulatory scrutiny and the rising need for risk management solutions in various sectors, including banking, insurance, healthcare, and cybersecurity. The market size for stress testing platforms and services in 2024 is projected to reach USD ~ billion. This growth is fueled by the regulatory frameworks like Basel III and Dodd-Frank, mandating regular stress testing for financial institutions, and the rising need for operational resilience across industries, especially in the wake of global economic uncertainties.

The USA market for stress testing is primarily dominated by cities like New York, Chicago, and San Francisco, owing to the concentration of major financial institutions and tech companies. Additionally, Washington D.C. plays a crucial role due to its proximity to regulatory bodies such as the Federal Reserve and the SEC. The robust regulatory environment in these cities, combined with the presence of major financial institutions, has positioned the USA as a dominant player in the global stress testing market.

Market Segmentation

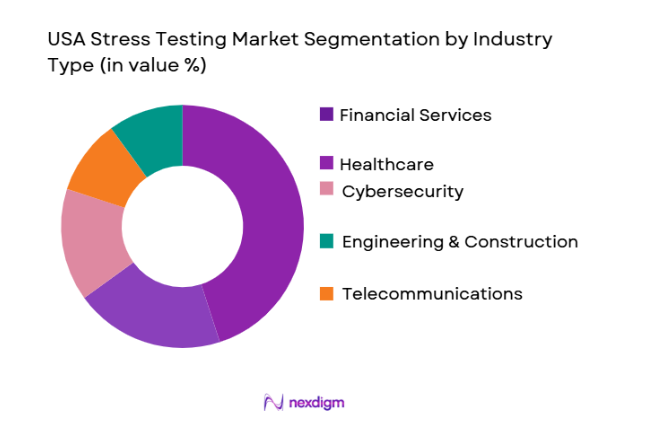

By Industry Type

The USA Stress Testing market is segmented by industry into financial services, healthcare, cybersecurity, and engineering. Among these, the financial services sector leads, driven by stringent regulatory requirements that mandate periodic stress tests on capital adequacy, liquidity, and market risk. Financial institutions, particularly banks and insurance companies, are required to perform stress tests as part of their risk management strategy. This need for compliance with laws like the Dodd-Frank Act and Basel III has made stress testing an integral part of financial operations. As financial institutions are under constant scrutiny, the demand for advanced stress testing tools has risen significantly.

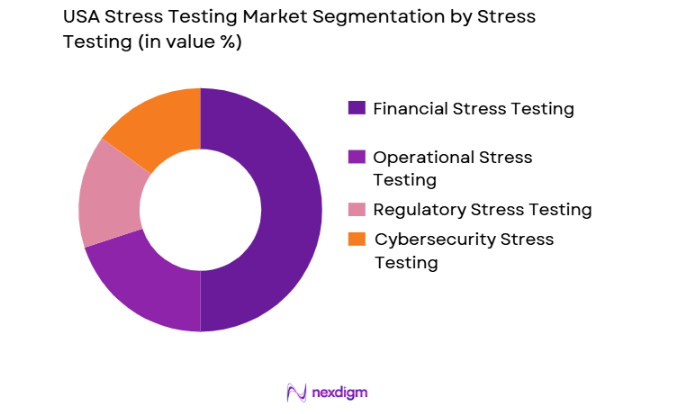

By Stress Testing Type

The market is also segmented by stress testing type, including financial, operational, regulatory, and cybersecurity stress testing. The financial stress testing sub-segment dominates, as it plays a key role in determining the risk exposure of financial institutions. In this sub-segment, financial institutions utilize stress testing to measure capital adequacy and liquidity risks under various economic and market scenarios. The growing complexity of financial markets and economic fluctuations necessitate the continued use of these stress testing tools. The demand for regulatory-compliant stress testing, such as those required by Basel III, further propels the growth in this segment.

Competitive Landscape

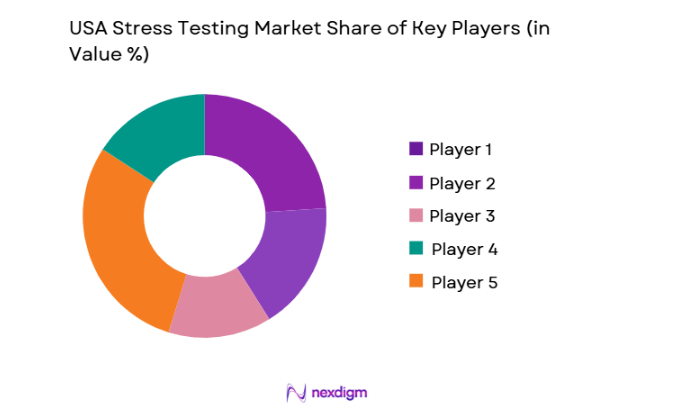

The USA Stress Testing market is dominated by a handful of established players who offer comprehensive solutions across various industries. These players include global firms like Moody’s Analytics, IBM, and S&P Global, as well as specialized vendors such as RiskWatch International and ProRisk. The market’s consolidation is indicative of the high barrier to entry, driven by the need for extensive regulatory knowledge, technology integration, and credibility with financial regulators.

| Company | Establishment Year | Headquarters | Market Focus | Revenue (USD) | Technology Capabilities | Global Presence |

| Moody’s Analytics | 1909 | New York, USA | ~ | ~ | ~ | ~ |

| IBM | 1911 | Armonk, USA | ~ | ~ | ~ | ~ |

| S&P Global Market Intelligence | 1860 | New York, USA | ~ | ~ | ~ | ~ |

| RiskWatch International | 1999 | Florida, USA | ~ | ~ | ~ | ~ |

| ProRisk | 2005 | Texas, USA | ~ | ~ | ~ | ~ |

USA Stress Testing Market Analysis

Growth Drivers

Urbanization

Urbanization in the U.S. is a significant growth driver for the stress testing market. The U.S. Census Bureau reported that over ~% of the U.S. population resided in urban areas by 2025, up from ~% in 2024. The rapid expansion of urban populations has led to an increased demand for stress testing in sectors like transportation, healthcare, and finance. As cities grow, there is a greater need to manage risk and ensure infrastructure resilience, particularly in sectors that directly impact urban dwellers, such as banking and healthcare. Urban areas are under increasing pressure to comply with regulatory requirements, driving market growth for stress testing technologies.

Industrialization

The U.S. industrial sector continues to grow, with manufacturing output increasing by ~% in 2025, as per the U.S. Bureau of Economic Analysis. The expansion in industries such as manufacturing, mining, and energy production creates a need for effective stress testing solutions. These industries are susceptible to operational risks, supply chain disruptions, and regulatory pressures. As companies scale operations, they require sophisticated tools to stress-test financial, operational, and environmental risks. The growth of industries like energy and manufacturing contributes significantly to the rise in demand for stress testing technologies that can handle complex risk assessments.

Restraints

High Initial Costs

The high initial cost of implementing stress testing systems remains a barrier to adoption, particularly for small and medium-sized enterprises (SMEs). The deployment of advanced stress testing tools, which may require substantial investments in software, hardware, and training, can be prohibitive. According to the U.S. Small Business Administration, ~% of small businesses reported financial barriers in 2025, including the high cost of adopting new technologies. Despite the long-term benefits, such costs make it challenging for smaller players to integrate stress testing into their operations, slowing overall market adoption.

Technical Challenges

The complexity of implementing stress testing tools presents another major challenge. The U.S. financial system, for instance, is highly complex and requires specialized stress testing models to simulate various economic conditions. According to the U.S. Federal Reserve, the development and calibration of these models require significant expertise, which is often difficult to find. Additionally, integrating new stress testing tools with legacy systems is a technical hurdle many organizations face. The technical difficulty of ensuring real-time, accurate data for stress scenarios is a key limiting factor for many institutions in the U.S.

Opportunities

Technological Advancements

Technological advancements in artificial intelligence (AI) and machine learning (ML) are creating new opportunities in the stress testing market. These technologies enhance the precision and efficiency of stress testing models, allowing for more accurate predictions of financial, operational, and environmental risks. In 2025, the U.S. banking sector began adopting AI-driven models to simulate a wider range of scenarios, significantly reducing the time required for stress testing. These innovations are enabling organizations to better handle data complexity and increase the accuracy of risk assessments, making the market ripe for further growth as technology advances.

International Collaborations

International collaborations are expanding the U.S. stress testing market by introducing global best practices, technologies, and expertise. In 2025 , the U.S. financial sector participated in joint initiatives with international bodies like the Basel Committee on Banking Supervision to improve stress testing methodologies. Such collaborations enhance the ability of U.S. institutions to adopt standardized models that are globally recognized, increasing efficiency and reliability. Moreover, collaboration with international regulators allows U.S. firms to stay ahead of evolving global risk management standards, further propelling the demand for stress testing systems.

Future Outlook

Over the next five years, the USA Stress Testing market is expected to see continued growth driven by several factors. These include increasing reliance on AI and machine learning for risk analysis, rising demand for compliance with global regulatory standards, and the growing threat of cybersecurity risks. The development of real-time stress testing tools is likely to become a major trend, as organizations seek quicker insights into their operational resilience. Additionally, as economic volatility continues, businesses will increasingly rely on robust stress testing solutions to protect themselves from unforeseen risks and market shocks.

Major Players in the USA Stress Testing Market

- Moody’s Analytics

- IBM

- S&P Global Market Intelligence

- RiskWatch International

- ProRisk

- Fitch Solutions

- Accenture

- Deloitte

- KPMG

- PwC

- Capgemini

- Oracle Financial Services

- AxiomSL

- FIS Global

- SAS Institute

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Financial Institutions

- Healthcare Providers

- Cybersecurity Firms

- Engineering and Construction Firms

- Telecommunications Providers

- Risk Management Departments

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying critical market variables through desk research, utilizing proprietary and public data sources. This step is essential for understanding the market’s dynamic factors, particularly those that influence stress testing adoption in different sectors.

Step 2: Market Analysis and Construction

In this phase, historical market data will be analyzed to establish market size, growth trends, and segmentation. This includes examining the demand for stress testing solutions across different sectors and the integration of technology into stress testing practices.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses will be validated by consulting industry experts. Interviews with executives and decision-makers in the relevant industries will help refine the analysis and ensure the validity of the market data and forecasts.

Step 4: Research Synthesis and Final Output

The final phase consolidates all findings from the previous steps, verifying the market insights and synthesizing the data. Engagement with key industry players will provide additional insights into current trends and future directions, ensuring a comprehensive and actionable market report.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Regulatory Landscape

- Supply Chain and Value Chain Analysis

- Business Cycle

- Market Trends

- Growth Drivers

Increasing Regulatory Pressure and Compliance Requirements

Rising Complexity of Financial and Operational Risks

Technological Advancements in Automation and AI

- Market Challenges

High Costs of Stress Testing Implementation

Data Privacy and Security Concerns in Stress Testing

Integration Challenges with Legacy Systems

- Opportunities

Growing Demand for Cloud-based Stress Testing Solutions

Emerging Use Cases in Healthcare and Cybersecurity

Shift Toward Real-time Stress Testing in Financial Institutions

- Market Trends

Shift Towards Cloud-based and AI-driven Stress Testing Solutions

Focus on Cyber Risk and Climate Change Scenario Testing

Increased Focus on Predictive Analytics for Stress Testing

- Government Regulation

Basel III & Dodd-Frank Impact on Stress Testing Protocols

Data Privacy and Protection Laws Affecting Stress Testing

- SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- Competition Ecosystem

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Industry Segment (in Value %)

Financial Services

Healthcare

Cybersecurity

Engineering and Construction

Telecommunications - By Stress Testing Type (in Value %)

Financial Stress Testing

Operational Stress Testing

Regulatory Stress Testing

Scenario Analysis

Stress Testing Software and Platforms - By Application Channel (in Value %)

On-premises Solutions

Cloud-based Platforms

Hybrid Deployment - By Region (in Value %)

North America

Europe

Asia-Pacific

Middle East and Africa

Latin America

- Market Share of Major Players by Value and Volume

Market Share of Key Players by Industry Segment

Market Share by Stress Testing Solutions - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength and Weakness, Organizational Structure, Revenues and Profit Margins, Distribution Networks, Technological Capabilities, Production Capacity and Innovations)

- SWOT Analysis of Major Players

- Pricing Analysis by Stress Testing Platform/Service Providers

- Detailed Profiles of Major Companies

Moody’s Analytics

S&P Global Market Intelligence

Fitch Ratings

Oracle Financial Services Analytical Applications

IBM Watson

Microsoft Corporation

Stress Test Solutions Inc.

Accenture

KPMG

PwC

Capgemini

Deloitte

Moody’s Analytics

ProRisk

RiskWatch International

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030