Market Overview

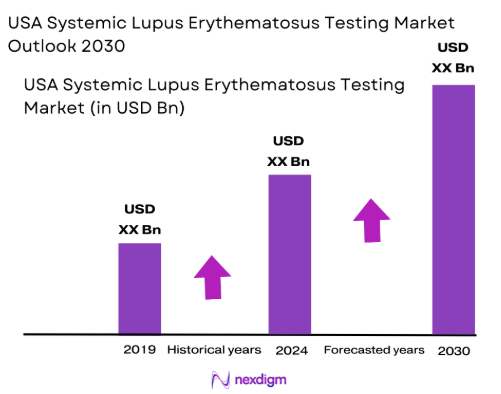

The USA Systemic Lupus Erythematosus (SLE) testing market was valued at USD ~ in 2024, with a forecasted growth trajectory of increasing demand for advanced diagnostic techniques, growing awareness of lupus, and improvements in healthcare infrastructure. The market is primarily driven by a rise in the prevalence of SLE in the U.S., which has led to an increase in diagnostic testing. Additionally, the growing adoption of more sensitive diagnostic tools such as anti-dsDNA, ANA testing, and multiplex testing technologies has fueled market expansion. These diagnostic tests are critical in detecting SLE in its early stages, enabling effective treatment. Increased awareness of autoimmune diseases and advancements in molecular diagnostics are among the contributing factors to market growth.

The dominant regions in the USA SLE testing market include major metropolitan areas such as New York, Los Angeles, and Chicago, which are home to large hospitals, diagnostic labs, and rheumatology centers. These cities have a high density of healthcare facilities offering advanced diagnostic services. Furthermore, these regions benefit from well-established healthcare infrastructures, a large patient pool, and access to cutting-edge technologies. Additionally, states with higher healthcare expenditures, such as California and New York, drive the demand for diagnostic testing due to robust healthcare systems and increasing public and private insurance coverage for autoimmune disease diagnostics.

Market Segmentation

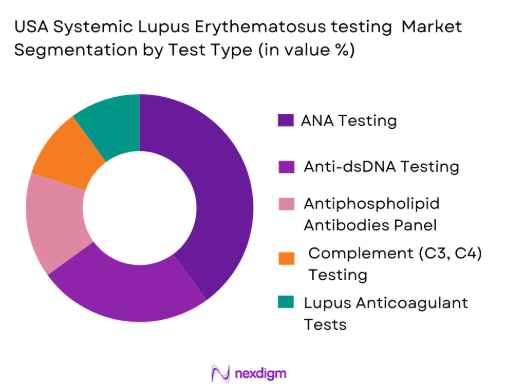

By Test Type

The USA Systemic Lupus Erythematosus testing market is segmented by test type into ANA Testing, Anti-dsDNA Testing, Antiphospholipid Antibodies Panel, Complement (C3, C4) Testing, and Lupus Anticoagulant Tests. Among these, ANA testing dominates the market due to its widespread use as an initial screening test for lupus. The test has a relatively low cost and high sensitivity, which makes it the first choice for physicians when diagnosing suspected autoimmune conditions. Furthermore, ANA testing is recommended by medical guidelines as part of the lupus diagnostic protocol, contributing to its dominance. Given its importance in early diagnosis, ANA testing holds a significant share in the testing market.

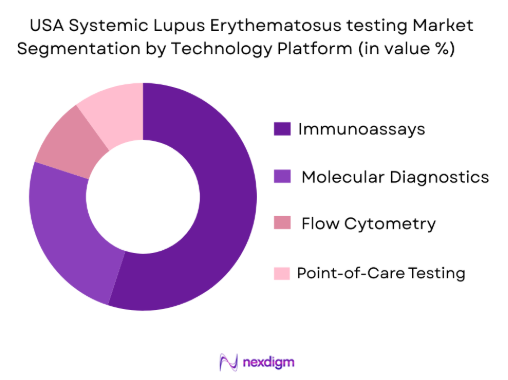

By Technology Platform

The market is also segmented by technology platform into Immunoassays (e.g., ELISA, CLIA), Molecular Diagnostics, Flow Cytometry, and Point-of-Care (POC) Testing. Immunoassays, particularly enzyme-linked immunosorbent assays (ELISA) and chemiluminescent immunoassays (CLIA), dominate the market due to their cost-effectiveness, accuracy, and versatility in testing multiple biomarkers. These platforms provide highly reproducible results, making them ideal for clinical settings and diagnostic labs. Additionally, immunoassays are well-established within diagnostic guidelines, with many hospitals and labs investing in automated immunoassay platforms, further boosting their share in the market.

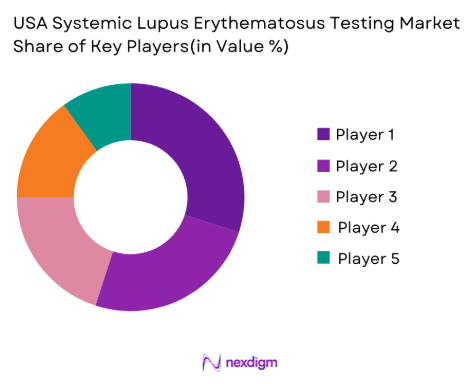

Competitive Landscape

The USA Systemic Lupus Erythematosus (SLE) testing market is characterized by strong competition among major players, including both global diagnostic companies and specialized laboratories. Key players such as Quest Diagnostics, Labcorp, and DiaSorin dominate the market due to their extensive test offerings, broad geographic reach, and reputation for accuracy and reliability in autoimmune diagnostics. The consolidation of these players in the diagnostics space has resulted in enhanced research capabilities, improved diagnostic tools, and greater accessibility of lupus tests to healthcare providers. New entrants and mid-sized players are attempting to differentiate themselves by focusing on niche technologies or point-of-care diagnostics.

| Company | Establishment Year | Headquarters | Testing Portfolio | Market Reach | Technological Innovation | Pricing Strategy | Clinical Accuracy |

| Quest Diagnostics | 1967 | Secaucus, New Jersey, USA | ~ | ~ | ~ | ~ | ~ |

| Labcorp | 1978 | Burlington, North Carolina | ~ | ~ | ~ | ~ | ~ |

| DiaSorin | 1968 | Saluggia, Italy | ~ | ~ | ~ | ~ | ~ |

| Abbott Diagnostics | 1888 | Chicago, Illinois, USA | ~ | ~ | ~ | ~ | ~ |

| Thermo Fisher Scientific | 1956 | Waltham, Massachusetts, USA | ~ | ~ | ~ | ~ | ~ |

USA Systemic Lupus Erythematosus testing Market Analysis

Growth Drivers

Increased Lupus Prevalence, Early Diagnosis, Advancements in Testing Technology

The prevalence of systemic lupus erythematosus (SLE) has steadily risen over the years, especially in the United States. According to the Centers for Disease Control and Prevention (CDC), approximately ~ people in the U.S. have been diagnosed with some form of lupus, and it is estimated that more than 160,000 people suffer from SLE specifically. This growing patient base is pushing the demand for early diagnosis, which can significantly improve patient outcomes. Advancements in testing technology, such as more sensitive anti-dsDNA tests, multiplex assays, and improved ANA tests, are facilitating earlier and more accurate detection. Moreover, healthcare providers are now equipped with faster and more reliable diagnostic methods, improving both detection rates and patient management. The rise in diagnostic accuracy can be attributed to technological innovations, particularly the integration of AI and machine learning in laboratory environments. As the diagnosis of lupus becomes more efficient, more individuals are receiving early intervention, reducing long-term healthcare costs and improving patient quality of life.

Increased Lupus Prevalence, Early Diagnosis, Advancements in Testing Technology

The prevalence of systemic lupus erythematosus (SLE) has steadily risen over the years, especially in the United States. According to the Centers for Disease Control and Prevention (CDC), approximately ~ people in the U.S. have been diagnosed with some form of lupus, and it is estimated that more than 160,000 people suffer from SLE specifically. This growing patient base is pushing the demand for early diagnosis, which can significantly improve patient outcomes. Advancements in testing technology, such as more sensitive anti-dsDNA tests, multiplex assays, and improved ANA tests, are facilitating earlier and more accurate detection. Moreover, healthcare providers are now equipped with faster and more reliable diagnostic methods, improving both detection rates and patient management. The rise in diagnostic accuracy can be attributed to technological innovations, particularly the integration of AI and machine learning in laboratory environments. As the diagnosis of lupus becomes more efficient, more individuals are receiving early intervention, reducing long-term healthcare costs and improving patient quality of life.

In addition, increased awareness and advocacy about lupus among healthcare professionals and the general public are contributing to the rise in diagnoses. Health campaigns and patient education programs, including those by the Lupus Foundation of America, are playing a critical role in increasing the detection rates. As a result, there is a higher likelihood of individuals undergoing appropriate testing earlier in the course of the disease, which further drives market demand for diagnostic solutions.

Market Challenges

High Costs, Limited Reimbursement, Diagnostic Variability

One of the primary challenges in the USA SLE testing market is the high cost of diagnostic tests. A report by the American College of Rheumatology (ACR) highlights that the overall cost of lupus testing, especially when multiple assays are involved, can be prohibitively expensive for many patients. Tests like anti-dsDNA and ANA panels are costly, particularly for individuals without sufficient insurance coverage. The issue of limited reimbursement for diagnostic tests further exacerbates this challenge. Although Medicare covers lupus diagnostic tests for patients over 65, individuals without sufficient insurance coverage often face high out-of-pocket costs. In addition, diagnostic variability is a major concern. Tests can vary widely in terms of accuracy, and there is no universal standard for interpreting results across labs, which can lead to misdiagnosis or delayed diagnosis. This lack of standardization in testing procedures continues to be a significant barrier for clinicians, as it complicates treatment plans and ultimately affects patient outcomes. These factors combined make it difficult for many patients to access timely and accurate diagnostic testing.

High Costs, Limited Reimbursement, Diagnostic Variability

One of the primary challenges in the USA SLE testing market is the high cost of diagnostic tests. A report by the American College of Rheumatology (ACR) highlights that the overall cost of lupus testing, especially when multiple assays are involved, can be prohibitively expensive for many patients. Tests like anti-dsDNA and ANA panels are costly, particularly for individuals without sufficient insurance coverage. The issue of limited reimbursement for diagnostic tests further exacerbates this challenge. Although Medicare covers lupus diagnostic tests for patients over 65, individuals without sufficient insurance coverage often face high out-of-pocket costs. In addition, diagnostic variability is a major concern. Tests can vary widely in terms of accuracy, and there is no universal standard for interpreting results across labs, which can lead to misdiagnosis or delayed diagnosis. This lack of standardization in testing procedures continues to be a significant barrier for clinicians, as it complicates treatment plans and ultimately affects patient outcomes. These factors combined make it difficult for many patients to access timely and accurate diagnostic testing.

Opportunities

Growing Demand for Multi-Panel Tests, Integration with Electronic Health Records

The demand for multi-panel testing for lupus is expanding, driven by advancements in biomarker discovery. Recent trends indicate that clinicians are increasingly opting for multi-panel tests that can screen for a range of autoimmune markers, thus providing a more comprehensive diagnosis. The integration of multi-analyte diagnostic panels, such as combining ANA, anti-dsDNA, and antiphospholipid antibodies into a single test, is seen as an opportunity to streamline the diagnostic process and enhance the detection of SLE at earlier stages. In parallel, the integration of Electronic Health Records (EHR) systems with diagnostic testing platforms is becoming a growing trend in the USA. A report from the HealthIT.gov initiative shows that ~ of U.S. hospitals have now adopted EHR systems, which facilitate faster, more accurate sharing of patient data between healthcare providers, improving the overall efficiency of lupus diagnosis and management. This growing digitalization is expected to enhance the adoption of comprehensive diagnostic panels as part of the routine diagnostic workflow in hospitals and outpatient clinics. The ability to use EHR data to track patient history, monitor trends, and identify patients at risk of developing lupus creates a significant opportunity for improving disease management and outcomes in the years to come.

Growing Demand for Multi-Panel Tests, Integration with Electronic Health Records (EHR)

The demand for multi-panel testing for lupus is expanding, driven by advancements in biomarker discovery. Recent trends indicate that clinicians are increasingly opting for multi-panel tests that can screen for a range of autoimmune markers, thus providing a more comprehensive diagnosis. The integration of multi-analyte diagnostic panels, such as combining ANA, anti-dsDNA, and antiphospholipid antibodies into a single test, is seen as an opportunity to streamline the diagnostic process and enhance the detection of SLE at earlier stages. In parallel, the integration of Electronic Health Records (EHR) systems with diagnostic testing platforms is becoming a growing trend in the USA. A report from the HealthIT.gov initiative shows that ~ of U.S. hospitals have now adopted EHR systems, which facilitate faster, more accurate sharing of patient data between healthcare providers, improving the overall efficiency of lupus diagnosis and management. This growing digitalization is expected to enhance the adoption of comprehensive diagnostic panels as part of the routine diagnostic workflow in hospitals and outpatient clinics. The ability to use EHR data to track patient history, monitor trends, and identify patients at risk of developing lupus creates a significant opportunity for improving disease management and outcomes in the years to come.

Future Outlook

Over the next five years, the USA Systemic Lupus Erythematosus (SLE) testing market is expected to grow significantly, driven by advancements in diagnostic technology, increased awareness of autoimmune diseases, and a growing patient population. The rise of precision medicine and the integration of digital health tools, such as artificial intelligence (AI) for test interpretation, are anticipated to improve the accuracy and speed of lupus diagnostics. Additionally, as more healthcare systems adopt automated testing platforms, the demand for SLE diagnostics will further increase. Government policies supporting healthcare access and insurance coverage for autoimmune disease diagnostics will also play a role in driving market growth.

Major Players

- Quest Diagnostics

- Labcorp

- DiaSorin

- Abbott Diagnostics

- Thermo Fisher Scientific

- Siemens Healthineers

- Bio-Rad Laboratories

- Roche Diagnostics

- Cepheid (Danaher)

- ARUP Laboratories

- Mayo Clinic Laboratories

- Stanford Health Care Clinical Labs

- Becton Dickinson

- Illumina

- Myriad Genetics

Key Target Audience

- Diagnostic Laboratories

- Hospitals & Healthcare Providers

- Pharmaceutical Companies

- Medical Device Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Automated Diagnostic Systems Providers

- Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing an ecosystem map encompassing all key stakeholders within the SLE testing market. The focus is on identifying market drivers, barriers, and the specific variables influencing demand, such as the prevalence of lupus and advancements in testing technologies.

Step 2: Market Analysis and Construction

Historical data related to the SLE testing market will be compiled to assess trends in test volume, market penetration, and testing methodologies. The study will examine growth patterns and assess the diagnostic market’s ability to meet increasing demand.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through in-depth interviews with key players in the SLE testing industry. This will include consultations with industry experts, clinical practitioners, and laboratory managers to refine market assumptions.

Step 4: Research Synthesis and Final Output

The final research phase will involve synthesizing the data from secondary research and expert interviews to produce a comprehensive analysis of the SLE testing market. The final report will validate all key findings and offer actionable insights for industry stakeholders.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations used in the report, Market sizing and forecasting approach, Data triangulation methodology, Limitations and assumptions)

- Definition and Scope

- Market Dynamic

- Historical Overview

- Timeline

- Growth Drivers

Increased lupus prevalence

Early diagnosis

Advancements in testing technology

- Market Challenges

High costs

limited reimbursement

diagnostic variability - Opportunities

Growing demand for multi-panel tests

Integration with electronic health records (EHR) - Trends

Technological innovations

Personalized medicine

AI and automation in diagnostics

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Test Type (In value %)

ANA Testing

Anti-dsDNA Testing

Antiphospholipid Antibodies Panel

Complement Testing - By Technology Platform (In value %)

Immunoassays

Molecular Diagnostics

Flow Cytometry

Point-of-Care Testing - By Testing Setting (In value %)

Hospital/Clinical Labs

Independent Diagnostic Labs

Outpatient Centers and Retail Labs

Direct-to-Consumer Testing - By Payer Type (In value %)

Medicare/Medicaid

Private Insurance

Self-Pay/Out-of-Pocket

- Market Share of Major Players

- Cross Comparison Parameters (Company Overview, Product/Service Offering, Testing Technology Platforms, Clinical Test Accuracy, Distribution Network and Reach, Reimbursement Support & Pricing Strategy, R&D Investment & Innovation, Partnerships and Collaborations)

- SWOT Analysis of Key Players

- Pricing Analysis

- Porter’s Five Forces

- Detailed Profiles

Quest Diagnostics

Labcorp

DiaSorin

Abbott Diagnostics

Siemens Healthineers

Bio-Rad Laboratories

Roche Diagnostics

Thermo Fisher Scientific

Cepheid (Danaher)

ARUP Laboratories

Mayo Clinic Laboratories

Stanford Health Care Clinical Labs

Becton Dickinson

Illumina

Myriad Genetics

- Market Demand and Utilization

- Purchasing Power

- Regulatory Requirements

- Needs, Desires, and Pain Points

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Price, 2026-2030