Market Overview

The USA Tailgates market current size stands at around USD ~ million, supported by steady OEM installations of ~ units and aftermarket sales of ~ units across pickup trucks and utility vehicles. Recent periods recorded production volumes near ~ units, with replacement demand accounting for ~ units annually. Investments in powered tailgate modules reached USD ~ million, while system integration across new platforms exceeded ~ systems, reflecting strong momentum in convenience-focused vehicle features.

Regional demand is concentrated in Texas, California, Michigan, and Ohio due to dense pickup ownership, mature automotive supply clusters, and strong aftermarket ecosystems. These regions benefit from established stamping, molding, and mechatronics infrastructure, accelerating product rollouts and customization. High logistics efficiency, skilled labor pools, and supportive vehicle modification regulations further strengthen adoption, making these hubs central to innovation and distribution for tailgate systems nationwide.

Market Segmentation

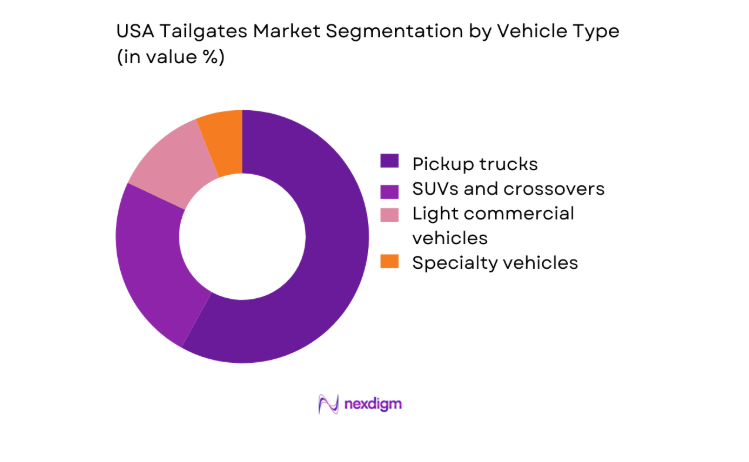

By Vehicle Type

Pickup trucks dominate this segmentation due to their functional reliance on tailgates for cargo handling, worksite utility, and recreational use. Strong demand from lifestyle, construction, and fleet users sustains high replacement and upgrade cycles, with powered and multi-function tailgates increasingly specified in mid-tier trims. SUVs and crossovers follow, driven by liftgate-style tailgates emphasizing convenience and safety. Light commercial vehicles add stable volume through fleet renewals, while specialty vehicles contribute niche but high-value customization demand, particularly in off-road and utility conversions.

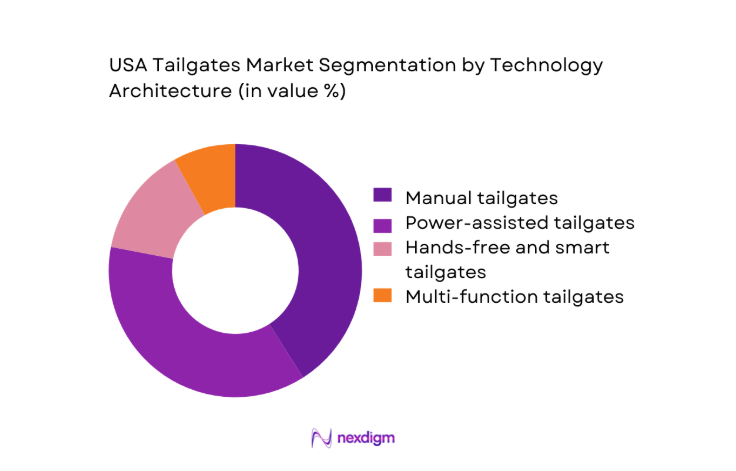

By Technology Architecture

Manual tailgates continue to hold relevance in entry-level and fleet segments due to durability and cost efficiency. However, power-assisted tailgates are rapidly gaining dominance as consumer expectations shift toward convenience and safety. Hands-free and smart tailgates are expanding in premium trims, driven by sensor integration and connected vehicle ecosystems. Multi-function designs, including step-integrated and work-surface tailgates, are increasingly specified in lifestyle-oriented pickups, reinforcing technology-driven differentiation across OEM portfolios.

Competitive Landscape

The USA Tailgates market reflects a moderately concentrated structure, led by large Tier I suppliers with deep OEM relationships and complemented by specialized component manufacturers serving niche and aftermarket channels. Competitive intensity centers on technology integration, lightweight material innovation, and the ability to scale production across multiple vehicle platforms while meeting evolving regulatory and safety standards.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Magna International | 1983 | Aurora, Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Flex-N-Gate | 1956 | Urbana, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Gestamp | 1997 | Madrid, Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Martinrea International | 2004 | Vaughan, Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Stabilus | 1934 | Koblenz, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

USA Tailgates Market Analysis

Growth Drivers

Rising pickup truck sales and model refresh cycles

Pickup truck production volumes recently exceeded ~ units annually, with tailgate installations aligned closely to each new vehicle build. Platform refresh cycles across major OEMs introduced ~ systems of upgraded tailgate assemblies, supporting steady demand for both standard and advanced configurations. Replacement volumes reached ~ units as older vehicle parc continued to age, sustaining aftermarket activity. Investments of USD ~ million in tooling and automation for tailgate modules further reinforced supply capacity, enabling faster response to evolving consumer preferences without disrupting production continuity.

Growing consumer preference for powered and hands-free tailgates

Consumer adoption of powered tailgates accelerated as installations surpassed ~ systems in recent periods, driven by demand for convenience and safety features. Premium trim penetration resulted in sales of ~ units of hands-free tailgate modules, supported by increased electronic content per vehicle. OEM investments of USD ~ million into sensor integration and control software expanded feature availability beyond luxury segments. This shift enhanced average feature uptake, strengthening the role of tailgates as a differentiating component rather than a purely functional body part.

Challenges

High cost of powered and smart tailgate systems

The average system cost of advanced tailgate assemblies remains at USD ~ million in aggregate procurement spend for OEM programs, limiting penetration in entry-level vehicles. Annual deployment of ~ systems in premium trims highlights the gap between mass-market affordability and technology capability. Suppliers continue to manage material and electronics sourcing valued at USD ~ million, while warranty-related service volumes near ~ units add further financial pressure. These cost dynamics constrain broader adoption despite clear consumer interest.

Weight and durability trade-offs with lightweight materials

Lightweight tailgate programs introduced ~ units using aluminum and composite structures, yet durability testing revealed service incidents across ~ systems in high-load environments. Engineering investments of USD ~ million target reinforcement strategies to balance mass reduction with impact resistance. Fleet operators reported replacement volumes of ~ units linked to material fatigue, underscoring the operational risks of aggressive lightweighting. Achieving optimal performance remains a central technical challenge affecting long-term reliability perceptions.

Opportunities

Penetration of power tailgates in mid-segment pickups

Mid-segment pickup platforms present an addressable volume of ~ units annually, with power tailgate penetration currently limited to ~ systems. OEM expansion plans include investments of USD ~ million to standardize powered features across broader trim ranges. This could unlock incremental demand of ~ units in both factory-fit and dealer-installed packages. As feature costs decline through scale, suppliers are positioned to capture sustained volume growth without dependence on luxury vehicle cycles.

Growth in retrofit solutions for older vehicle parc

The active vehicle parc includes ~ vehicles eligible for tailgate upgrades, creating a sizeable retrofit opportunity. Aftermarket suppliers shipped ~ units of powered tailgate kits in recent periods, supported by installer networks across ~ outlets. Consumer spending on customization reached USD ~ million, signaling strong willingness to enhance vehicle functionality post-purchase. Scalable retrofit solutions can tap into this demand while extending product lifecycles beyond OEM production windows.

Future Outlook

The USA Tailgates market is expected to progress steadily through 2030, driven by continued pickup dominance and rising integration of smart convenience features. OEM standardization of powered tailgates in mid-tier vehicles will reshape baseline specifications. Lightweight materials and modular designs will gain prominence as manufacturers balance efficiency with durability. Aftermarket customization and retrofit demand will remain a strong parallel growth engine, reinforcing long-term market resilience.

Major Players

- Magna International

- Flex-N-Gate

- Gestamp

- Martinrea International

- Stabilus

- AISIN Corporation

- ZF Friedrichshafen

- Brose Fahrzeugteile

- Forvia

- Plastic Omnium

- CIE Automotive

- Kongsberg Automotive

- Valeo

- Toyoda Gosei

- Hyundai Mobis

Key Target Audience

- Automotive OEM procurement and platform strategy teams

- Tier I automotive component suppliers

- Aftermarket accessory manufacturers and distributors

- Fleet operators and commercial vehicle upfitters

- Automotive dealerships and service networks

- Investments and venture capital firms

- U.S. Department of Transportation and National Highway Traffic Safety Administration

- State-level transportation and vehicle modification regulatory agencies

Research Methodology

Step 1: Identification of Key Variables

Core variables included vehicle production volumes, tailgate installation rates, technology adoption levels, and aftermarket penetration. Demand-side factors such as consumer convenience preferences and fleet usage patterns were mapped. Supply-side inputs covered material sourcing, component integration, and manufacturing capacity. Regulatory and safety compliance variables were also incorporated.

Step 2: Market Analysis and Construction

Historical performance indicators were aligned with current deployment trends to construct a consistent market baseline. OEM platform strategies and trim-level feature distributions were analyzed to estimate technology mix. Aftermarket channel dynamics and installer networks were evaluated. This stage established the quantitative and qualitative framework for scenario modeling.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through structured interactions with industry stakeholders across manufacturing, distribution, and service. Feedback refined demand elasticity, cost sensitivity, and technology acceptance patterns. Regulatory implications and safety compliance considerations were cross-checked. Iterative reviews ensured alignment between market realities and analytical outcomes.

Step 4: Research Synthesis and Final Output

All validated inputs were synthesized into a coherent market narrative. Quantitative estimates were aligned with qualitative insights to ensure consistency. Scenario outcomes were stress-tested for feasibility. The final output integrates strategic implications for OEMs, suppliers, and investors, delivering a decision-oriented market perspective.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, tailgate system taxonomy across manual power and multifunction designs, market sizing logic by vehicle production and tailgate content value, revenue attribution across modules materials and electronics, primary interview program with OEMs Tier 1 suppliers and aftermarket channels, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Usage and replacement pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and safety environment

- Growth Drivers

Rising pickup truck sales and model refresh cycles

Growing consumer preference for powered and hands-free tailgates

Increased focus on cargo convenience and vehicle usability

Expansion of aftermarket customization and accessories demand

OEM push toward feature differentiation in mid-range vehicles

Rising adoption of multi-function tailgate designs - Challenges

High cost of powered and smart tailgate systems

Weight and durability trade-offs with lightweight materials

Supply chain dependency on stamped and molded components

Complex integration with vehicle electronics platforms

Warranty and reliability concerns in harsh use environments

Aftermarket fitment and compatibility limitations - Opportunities

Penetration of power tailgates in mid-segment pickups

Growth in retrofit solutions for older vehicle parc

Integration of tailgates with vehicle digital ecosystems

Lightweight composite tailgate adoption for fuel efficiency

Customization demand in lifestyle and off-road segments

Fleet-specific durable tailgate solutions - Trends

Shift toward multi-function tailgates with work-surface features

Rising use of aluminum and composite materials

Integration of proximity sensors and gesture control

OEM-standardization of powered tailgates in SUVs

Design convergence between tailgates and liftgates

Increased focus on noise reduction and soft-close mechanisms - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Retail vehicle owners

Commercial fleets

Rental and leasing fleets - By Application (in Value %)

Pickup trucks

SUVs and crossovers with liftgates

Light commercial vehicles

Specialty and off-road vehicles - By Technology Architecture (in Value %)

Manual tailgates

Power-assisted tailgates

Hands-free and smart tailgates

Multi-function and step-integrated tailgates - By End-Use Industry (in Value %)

Automotive OEM production

Automotive aftermarket and accessories

Fleet upfitting and customization

Commercial vehicle body builders - By Connectivity Type (in Value %)

Non-connected tailgates

CAN-enabled electronic tailgates

Smart and IoT-enabled tailgates - By Region (in Value %)

Northeast

Midwest

South

West

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio depth, power tailgate capability, OEM contract coverage, manufacturing footprint, material technology expertise, pricing competitiveness, aftermarket presence, innovation pipeline)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Magna International

Flex-N-Gate

Gestamp

Martinrea International

AISIN Corporation

ZF Friedrichshafen

Brose Fahrzeugteile

Stabilus

Forvia (Faurecia)

Plastic Omnium

CIE Automotive

Kongsberg Automotive

Valeo

Toyoda Gosei

Hyundai Mobis

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030