Market Overview

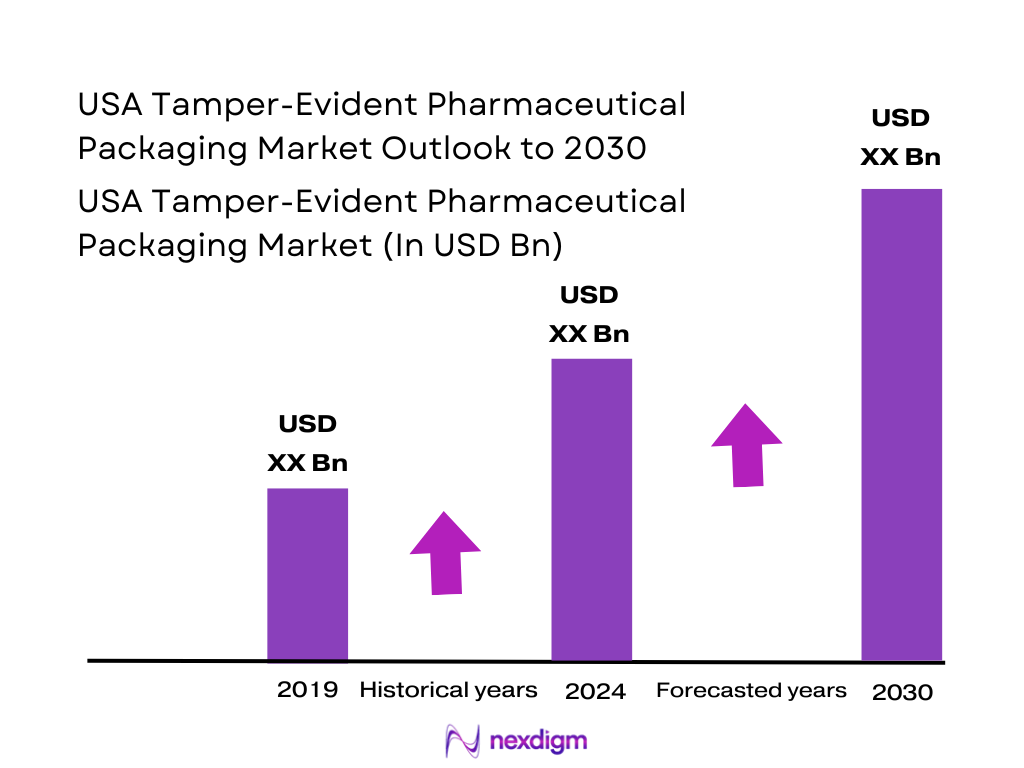

The global tamper-evident pharmaceutical packaging market is valued at USD ~ billion as of 2024, according to a recent industry analysis. This valuation reflects robust demand driven by increasingly stringent regulatory requirements around drug safety, rising concerns over counterfeiting and adulteration, and heightened focus on patient safety and supply-chain integrity. These forces have converged to fuel investment in tamper-evident closures, seals, blister packs, smart packaging and other integrity-preserving packaging formats across the pharmaceutical industry.

The market is dominated by regions such as North America (particularly the United States) and Europe. The United States leads due to its mature pharmaceutical industry, strict regulatory environment (e.g., enforcement of safety and serialization regulations), high consumption of prescription and OTC medications, and strong adoption of tamper-evident packaging by both branded and generic drug manufacturers. Europe similarly benefits from rigorous regulation, high per-capita pharmaceutical consumption, and well-established packaging infrastructure.

Market Segmentation

By Packaging Format

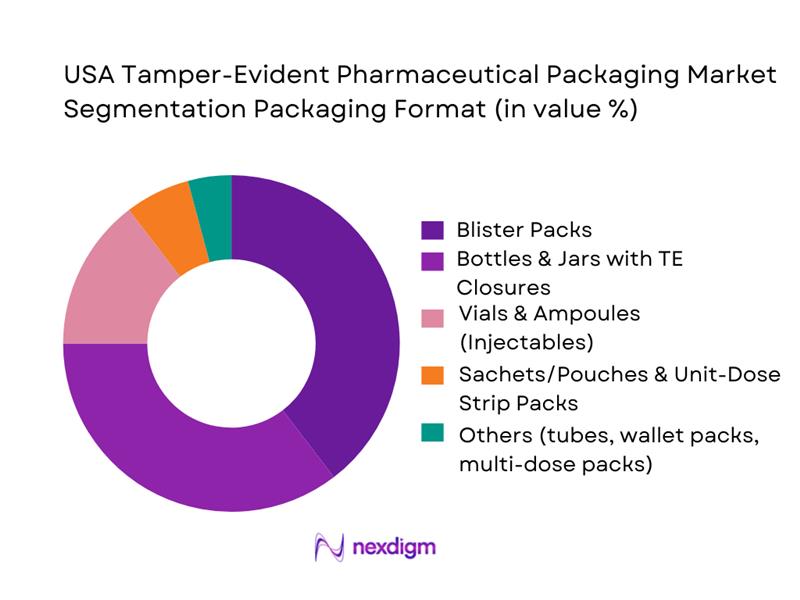

The market is segmented into blister packs, bottles & jars with tamper-evident closures, vials & ampoules (injectables), sachets/pouches or unit-dose strip packs, and other formats (tubes, compliance wallets, multi-dose packs, etc.). Blister packs dominate the 2024 market share at ~38%. This dominance stems from their widespread use for solid oral dose pharmaceuticals (tablets, capsules), particularly for OTC drugs, generics, and over-the-counter medicines, where unit-dose dispensing and visible tamper evidence are critical. Blister technology offers cost-effective production, shelf-stability, barrier protection, and clear visual indication of tampering — all valuable in high-volume oral solids markets. Bottles and jars with TE closures also command substantial share, driven by liquid dosage forms (syrups), multivitamins, and re-closable OTC formats requiring child-resistance and tamper bands or seals, offering convenience along with safety. Injectable formats (vials, ampoules, prefilled syringes) are growing, albeit smaller in share currently, but their share is expected to rise with the growth of biologics and specialty injectables requiring secure primary packaging.

By Tamper-Evident Mechanism

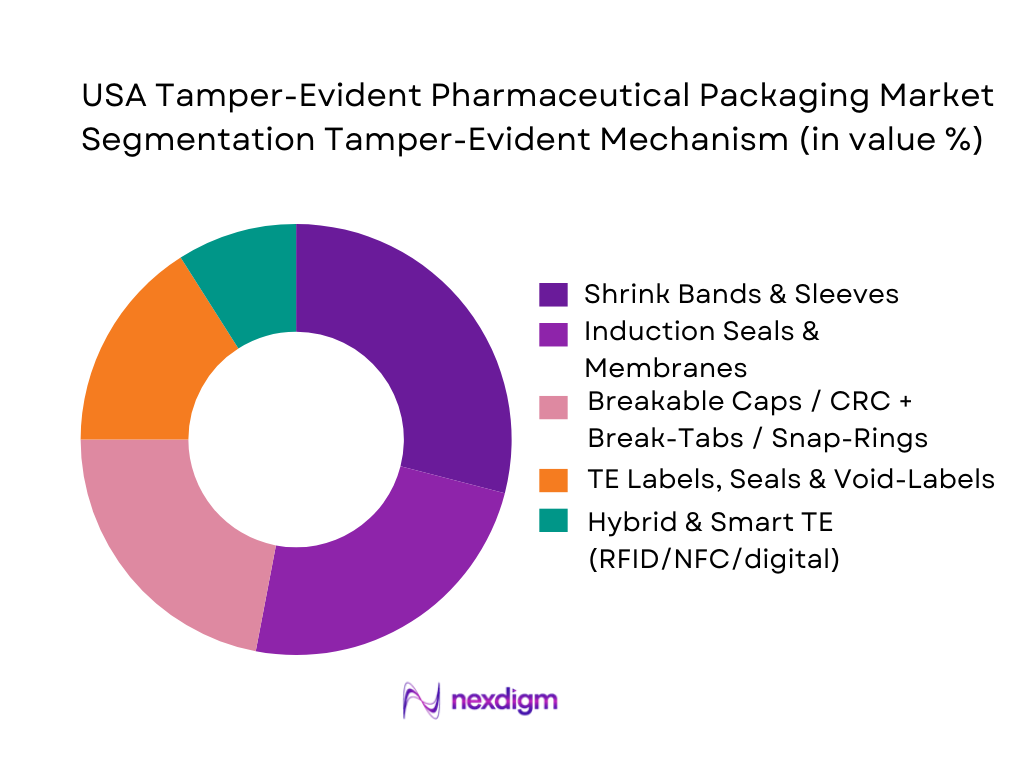

The market segmentation here includes shrink bands and sleeves, induction seals or membrane liners, breakable caps (child-resistant closures with break-tabs or snap-rings), tamper-evident labels/seals/void-labels, and hybrid/smart technology (digital seals, RFID/NFC, track-and-trace features). Among these, shrink bands and sleeves are leading with ~28.7% share in 2024. This is because shrink bands are versatile, relatively low-cost, compatible with a wide variety of containers (bottles, jars, vials), and provide a clear, irreversible tamper indication — which is particularly valued in high-volume oral and liquid pharmaceuticals. Induction seals are also widely used especially for liquid medicines and syrups, where a hermetic barrier plus tamper-evidence are essential for product integrity and stability. Breakable caps/closures remain important especially for re-closable bottles, vials, and child-resistant needs. TE labels and void-labels are commonly used at secondary/tertiary packaging levels and for repackaging operations (e.g. hospital pharmacies, mail-order). While hybrid and smart TE mechanisms currently represent a smaller share, they are gaining traction driven by regulatory serialization requirements, anti-counterfeit demand, and traceability mandates.

Competitive Landscape

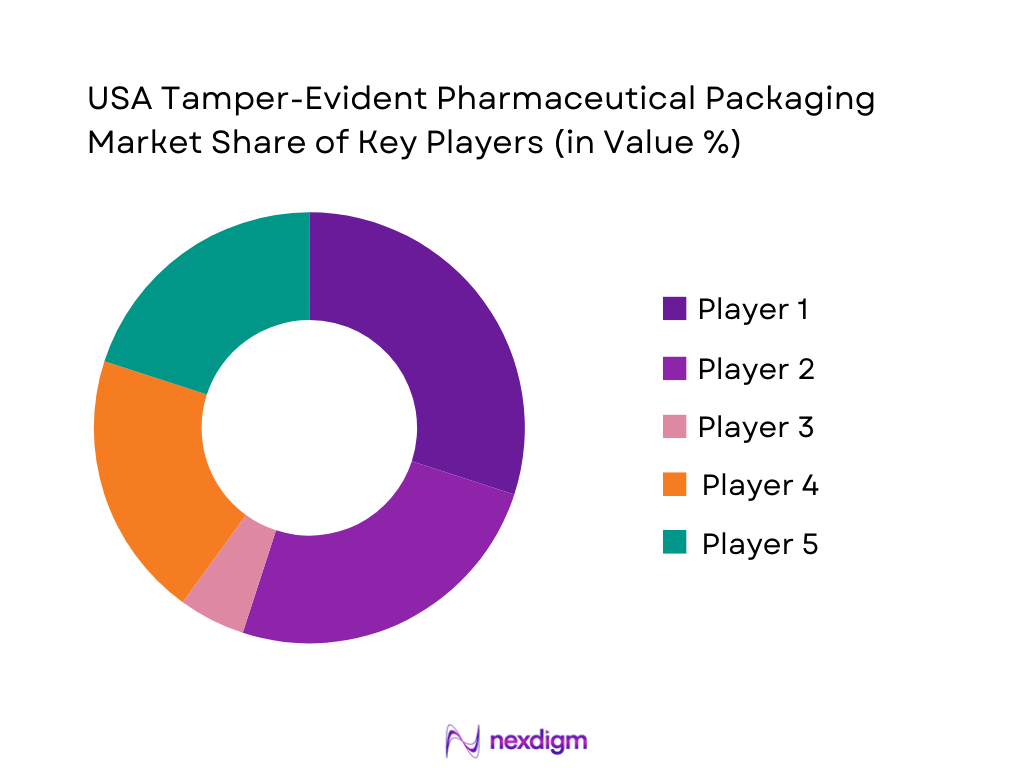

The tamper-evident pharmaceutical packaging market shows a moderate consolidation with a number of global and regional players leading the space. Key players have diversified portfolios across closures, blister & flexible packaging, induction seals, labels, and TE film integration.

Major global and regional companies dominate, serving large pharmaceutical brand owners, generics manufacturers, packagers (CMOs), and contract fillers, leveraging scale, compliance credentials, and integrated supply-chain capabilities.

| Company | Establishment Year | Headquarters | TE Technology Portfolio (Closures, Blisters, Seals, Films) | Regulatory / Compliance Certifications | U.S. / Global Manufacturing Footprint & Lead Time Capability | Service Offerings (Primary, Secondary TE, Labeling, Serialization, Custom) | Innovation & R&D Investment / Smart-TE Capability |

| Amcor plc | 1860 | Switzerland / Global | ~ | ~ | ~ | ~ | ~ |

| Berry Global Group, Inc. | 1967 | USA | ~ | ~ | ~ | ~ | ~ |

| CCL Industries / CCL Healthcare | 1951 | Canada / Global | ~ | ~ | ~ | ~ | ` |

| West Pharmaceutical Services, Inc. | 1923 | USA | ~ | ` | ~ | ~ | |

| Schreiner MediPharm (Schreiner Group) | 1960s | ~ | ~ | ~ | ~ | ~ | ~ |

USA Tamper-Evident Pharmaceutical Packaging Market Analysis

Growth Drivers

Regulatory and Patient-Safety Drivers

The U.S. continues to lead global health expenditure: recent data show that overall U.S. health care spending reached roughly US$ ~ trillion in 2023, amounting to about US$ ~ per capita. High per-capita health expenditure reflects a robust demand for safe and high-quality pharmaceutical goods — which in turn drives demand for tamper-evident packaging. As health-spending grows and regulators emphasize drug safety and supply-chain integrity, pharmaceutical companies place more focus on tamper-evident closures, seals, and packaging to avoid contamination, counterfeiting, or tampering. This aligns with regulatory scrutiny over drug quality and recalls: for example, according to the latest report from the regulatory body, there was a significant number of Failure Analysis Reports (FARs) related to manufacturing compliance issues in 2023-2024, underscoring the pressure on pharmaceutical firms to ensure safe packaging and prevent tampering.

Product-Mix and Dosage-Form Shifts

The overall U.S. pharmaceutical market is large: total spending on medicines reached approximately US$ ~ billion at net price level in 2023. As the market evolves, there is increasing utilization of liquid formulations, injectables, biologics, and specialty therapies in addition to traditional solid oral dosage forms. These higher-value dosage forms often require secure, sterile, tamper-evident packaging — such as sealed vials, induction-sealed syrups, or child-resistant containers — to ensure product integrity, stability, and patient safety. The shift in product mix towards injectables and sensitive formulations naturally raises demand for advanced TE packaging solutions.

Challenges

Qualification and Validation Complexity

Tamper-evident packaging for pharmaceuticals must comply with stringent regulatory requirements — especially for injectables, biologics, and sterile products. For manufacturers and packagers, integrating TE closures, induction seals, or security labels requires additional validation steps (container-closure integrity, stability testing, compatibility with drug formulations, sterility assurance). In a U.S. environment where regulatory scrutiny is high and failures can trigger recalls, the compliance burden raises complexity: each new TE design or mechanism must undergo rigorous qualification, which can delay time-to-market and add operational overhead.

Cost and Margin Pressure for TE Components

While health-care spending per capita is high, pharmaceutical companies are under increasing pressure to control costs — especially given ongoing scrutiny over drug pricing. The added cost of advanced tamper-evident closures, induction seals, security labels, and specialized packaging increases packaging expenses per unit. For high-volume generics and OTC drugs, even a small increase in per-unit packaging cost can erode margins significantly. This cost-margin pressure poses a challenge for widespread adoption of premium TE components especially in commoditized segments.

Opportunities

Smart and Connected TE Platforms

With increasing digitalization and traceability demands in pharmaceuticals, there is growing opportunity for smart TE packaging — including tamper-evident closures with embedded RFID/NFC chips, QR-code enabled seals, or serialization-linked security labels. These can offer real-time authentication, track-and-trace across the supply chain, and facilitate recall management. Although not yet dominant, smart TE offers potential for stakeholders to differentiate, improve supply-chain transparency, and combat counterfeits — particularly valuable for high-value drugs, biologics, and controlled substances.

Cold-Chain and Specialty Pharma TE Solutions

The growth of biologics, injectable therapies, and temperature-sensitive specialty pharmaceuticals in the U.S. market creates demand for advanced tamper-evident packaging that also accommodates cold-chain requirements and high-value drug integrity. Specialty TE seals for vials, sterile closures for injectables, and packaging compatible with refrigerated logistics provide opportunities for suppliers who can deliver compliant, secure, and reliable packaging. As biologics become a larger share of the U.S. pharmaceutical mix, cold-chain-compatible TE packaging will become increasingly critical, representing a growth hotspot for packaging innovators.

Future Outlook

Over the next several years, the tamper-evident pharmaceutical packaging market is expected to show steady and significant growth, driven by increasing regulatory stringency, the rising prevalence of biologics and complex dosage forms, the expansion of e-commerce and mail-order pharmacies, and growing demand for serialization, traceability, and anti-counterfeit packaging. As drug manufacturers and regulators place greater emphasis on supply-chain integrity and patient safety, investments into advanced TE solutions — including smart labels, RFID/NFC-enabled packaging, induction seals for cold-chain biologics, and recyclable TE materials — will accelerate. Additionally, the shift toward environmentally conscious and sustainable packaging will push innovation in mono-material TE films, recyclable closures, and eco-friendly TE systems.

Major Players

- Amcor plc

- Berry Global Group, Inc.

- CCL Industries / CCL Healthcare

- West Pharmaceutical Services, Inc.

- Schreiner MediPharm

- Huhtamaki

- Constantia Flexibles

- Sonoco Products Company

- ProAmpac

- Essentra Packaging

- AptarGroup, Inc.

- Ecobliss Healthcare

- WestRock Company

- 3M Company

Key Target Audience

- Pharmaceutical manufacturers

- Biopharmaceutical and biologics producers

- Contract Manufacturing Organisations Packagers

- Packaging material and closure suppliers

- Regulatory and drug-safety agencies

- Pharmaceutical distributors, wholesalers, and logistics providers

- Investments and venture capitalist firms evaluating packaging/packaging-tech investments

- Institutional buyers

Research Methodology

Step 1: Identification of Key Variables

We began by constructing an ecosystem map of all major stakeholders in the tamper-evident pharmaceutical packaging market, covering raw-material suppliers (resins, films, laminate converters), packaging converters, pharma brand owners, CMOs/packagers, distributors, regulators, and end-users. Secondary data sources — including industry reports, regulatory databases, trade filings — were used to capture baseline structural variables (pack formats, materials, TE mechanisms, dosage forms, regulatory frameworks).

Step 2: Market Analysis and Historical Data Compilation

Historical data from credible sources (industry reports, global packaging market databases, regulatory filings) were compiled for years leading up to 2024. This included unit volumes, value of packaging shipments, share of tamper-evident formats, and mix by mechanism, material, dosage form, and geography. Where data gaps existed, conservative interpolation and cross-industry analogs (e.g., pharma packaging vs overall tamper-evident packaging) were used with clear assumptions and sensitivity testing.

Step 3: Expert Validation and Industry Interviews

We conducted structured interviews (telephonic and virtual) with experts across pharma packaging value chain — packaging converters, closure suppliers, quality and regulatory heads at pharma companies, contract packagers, and distribution specialists. These consultations provided real-world insights into TE adoption trends, material and cost pressures, supply-chain bottlenecks, regulatory compliance realities, and innovation pipelines.

Step 4: Forecasting and Scenario Modeling

Using the validated base data, a bottom-up forecast model was built projecting demand across packaging formats, mechanisms, materials, and dosage forms under multiple scenarios (baseline growth, regulatory tightening, accelerated biologics adoption, sustainability push). The model projects annual growth, shifts in mix (e.g., rise of smart TE, blister vs bottle, plastic vs film), and emerging opportunities through 2030.

- Executive Summary

- Research Methodology (Research Design and Scope, Data Sources and triangulation, Market Sizing and Forecasting Approach, Assumptions, Limitations and Sensitivity Checks, Stakeholder Interview Framework)

- Definition and Scope

- Role of Tamper-Evident Packaging in the U.S. Pharma Supply Chain

- Evolution of Tamper-Evident Requirements and DSCSA-driven Serialization

- Business Cycle: From Resin/Foil to Packaged Medicinal Product

- Supply Chain and Value Chain Structure

- Growth Drivers

Regulatory and Patient-Safety Drivers

Product-Mix and Dosage-Form Shifts

Channel and Delivery Shifts

Brand-Protection and Anti-Counterfeit Initiatives - Challenges

Qualification and Validation Complexity

Cost and Margin Pressure for TE Components

Sustainability and Design-for-Recycling Constraints

Accessibility vs Security - Opportunities

Smart and Connected TE Platforms

Cold-Chain and Specialty Pharma TE Solutions

Compliance and Adherence Packs

Design, Co-development and Full-Service Partnerships - Trends

High-Speed TE Application and Robotics

Late-Stage Customization and Serialized TE

Eco-Design of TE

Human-Centric Design and Usability - Regulatory and Compliance Landscape

- Technology and Innovation

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- Industry SWOT Analysis

- Risk and Scenario Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Packaging Level, 2019-2024

- By Customer Type, 2019-2024

- By Packaging Level (in Value %)

Primary Containers

Secondary Cartons

Tertiary and Shipping Units

Clinical-Trial and Investigational Packs

Patient and Adherence Kits - By Packaging Format (in Value %)

Blister Packs

Bottles & Jars

Vials & Ampoules

Prefilled Syringes & Pens

Pouches, Strip Packs and Sachets - By Tamper-Evident Mechanism (in Value %)

Breakable Rings, Bridges and Bands

Induction-Seal and Membrane Solutions

Shrink Sleeves and Neck Bands

TE Labels, Seals and Tapes

Carton-Integrated TE Features - By Material Type (in Value %)

Plastics for TE Components

Glass + TE Assemblies

Paperboard and Cartonboard

Aluminum and Foil-based Solutions

Multilayer Laminates and Specialty Films - By Dosage Form (in Value %)

Solid Oral Dose

Liquid Oral Dose

Injectable and Parenteral

Ophthalmic and Otic Products

Topical, Dermal and Transdermal - By Customer and End-User Type (in Value %)

Research-based and Innovator Pharma

Generics and Value Players

Biotech and Biologics Players

CDMOs/CMOs and Clinical-Pack Specialists

Hospital, Retail and Mail-Order Pharmacies - By Distribution and Sales Channel (in Value %)

Direct Strategic Supply to Top Pharma/ Biopharma

Converter and Distributor Networks

CMO/Packager-led Sourcing

Online, Catalog and Specialty Channels

- Competitive Structure and Market Concentration

- Cross Comparison Parameters (Technology portfolio depth in caps/closures, blisters, labels and cartons; DSCSA-ready serialization and track-and-trace integration; dosage-form and container coverage breadth; FDA/cGMP/ISO 15378 and CPSC compliance footprint; smart/NFC/RFID and digital authentication capabilities; U.S. manufacturing & converting footprint and lead times; cold-chain and biologics TE readiness; sustainability and recyclability profile of TE solutions)

- Market Share Analysis

Strategic Positioning and Competitive Mapping - SWOT Analysis of Key Competitors

- Detailed Profiles of Major Companies

Amcor plc

Berry Global Group, Inc.

CCL Industries / CCL Healthcare

Constantia Flexibles

WestRock Company

Sonoco Products Company

Huhtamaki

Essentra Packaging

ProAmpac

Schreiner MediPharm

West Pharmaceutical Services, Inc.

AptarGroup, Inc.

Ecobliss Healthcare

Catalent Pharma Solutions

- Innovator and Specialty Pharma Use-Cases

- Generics and High-Volume Oral Solids

- OTC and Consumer-Health Brands

- Hospital, Institutional and IDN Requirements

- Clinical Trials and Investigator Sites

- By Value, 2025-2030

- By Volume, 2025-2030

- By Packaging Level, 2025-2030

- By Customer Type, 2025-2030