Market Overview

The USA Teleconsultation Services Market is valued at USD ~ billion, up from USD ~ million in the prior period, reflecting expanding normalization of virtual-first access across payer, employer, and provider channels. Growth is being driven by multi-specialty deployment of synchronous consult workflows, increased routing of low-acuity demand away from physical sites, and higher integration of teleconsultation into care navigation and benefits design. A parallel driver is platform consolidation into broader “virtual care suites” that bundle clinical labor, technology, and utilization management.

Key U.S. hubs driving teleconsultation scale include New York, Boston, and the San Francisco Bay Area due to dense concentrations of payers, integrated delivery networks, digital health builders, and employer headquarters that accelerate procurement cycles and partnership formation. In addition, large Sun Belt metros such as Dallas–Fort Worth and Miami often lead operational scaling due to multi-state provider network buildouts and strong employer-sponsored access programs. These hubs typically dominate because they combine capital access, clinical talent pools, and enterprise health-benefit buyers.

Market Segmentation

By Clinical Specialty / Use-Case

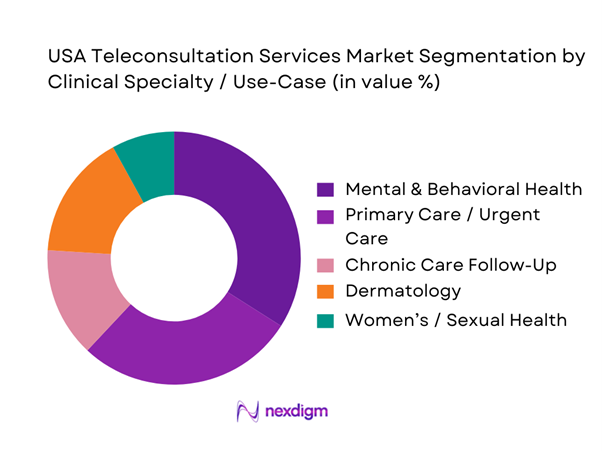

USA Teleconsultation Services Market is segmented by clinical specialty into mental & behavioral health, primary care/urgent care, chronic care follow-up, dermatology, and women’s/sexual health. Mental & behavioral health dominates the segmentation because it is highly compatible with virtual encounter formats, has strong repeat-visit patterns, and is often embedded into employer and payer offerings as a front-door benefit. It also scales efficiently via matched provider capacity and standardized care pathways (therapy, psychiatry, coaching) while maintaining patient continuity. Leading platforms reinforce dominance by investing heavily in network availability, digital intake, and longitudinal engagement, making behavioral teleconsultation the default entry point for many virtual-care users.

By Consultation Modality

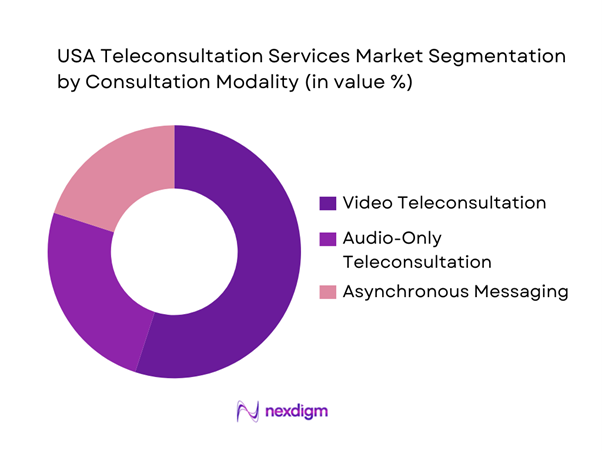

USA Teleconsultation Services Market is segmented by modality into video teleconsultation, audio-only teleconsultation, and asynchronous messaging (chat-based consults). Video teleconsultation holds the dominant position because it best replicates the clinical richness of in-person interactions, supports broader case complexity than text-only workflows, and is the preferred modality for many specialties requiring visual assessment or stronger clinician–patient rapport. Video also integrates more naturally into provider operations (scheduling, documentation, care-team handoffs) and is frequently positioned as the “default” channel inside payer and health-system virtual care pathways. Platform investments in user experience, broadband optimization, and clinical workflow tooling further reinforce video-first utilization.

Competitive Landscape

The USA Teleconsultation Services Market is influenced by a relatively concentrated set of scaled platforms and enterprise virtual-care vendors, alongside payer-owned and provider-led offerings. Large players typically differentiate through clinician network depth, multi-state coverage, payer contracting strength, and the ability to embed teleconsultation into benefits, care navigation, and health-system workflows. Competitive intensity is highest in mental health and primary care routing, while premium differentiation is emerging in specialty access, longitudinal chronic programs, and tightly integrated hybrid care models.

| Company | Establishment Year | Headquarters | Core Care Model | Primary Buyer Channel | Clinical Breadth | Provider Network Strategy | Integration Depth | Compliance / Posture |

| Teladoc Health | 2002 | New York, NY | ~ | ~ | ~ | ~ | ~ | ~ |

| Amwell | 2006 | Boston, MA | ~ | ~ | ~ | ~ | ~ | ~ |

| MDLive (Evernorth/Cigna) | 2009 | Miramar, FL | ~ | ~ | ~ | ~ | ~ | ~ |

| Doctor On Demand | 2013 | San Francisco, CA | ~ | ~ | ~ | ~ | ~ | ~ |

| Included Health | 2011 | San Francisco, CA | ~ | ~ | ~ | ~ | ~ | ~ |

USA Teleconsultation Services Market Analysis

Growth Drivers

Provider Capacity Constraints

U.S. teleconsultation demand is being structurally pulled by capacity gaps in brick-and-mortar care, especially primary care and behavioral health triage. As of June 30, there were ~ designated primary care HPSAs covering nearly ~ residents, and HRSA estimated the system would need ~ additional primary care physicians to remove those shortage designations—an access deficit that teleconsultation workflows (virtual queueing, e-triage, asynchronous follow-ups) are increasingly used to absorb. On the utilization side, CMS claims data shows that ~ Medicare FFS Part B beneficiaries used telehealth in one year and ~ did so in the following year—evidence that “virtual capacity” remains operationally relevant beyond pandemic peaks and is now part of standard care routing for older and disabled cohorts. Macro fundamentals keep the pressure on: the U.S. economy is operating at scale with GDP of USD ~ trillion and population of ~, which expands absolute care demand and makes “capacity per clinician-hour” a board-level KPI for large provider groups.

Mental Health Demand Load

Teleconsultation growth is increasingly anchored in behavioral health and crisis-linked outpatient demand, where speed-to-appointment matters as much as clinical depth. The CDC reports ~ suicide deaths in the country, and CDC’s suicide data page also frames the scale of suicidal behavior with ~ adults seriously thinking about suicide, ~ making a plan, and ~ attempts—a volume signal that pushes payers and providers toward higher-throughput modalities (telepsychiatry, therapy, medication management check-ins, and stepped-care pathways). Within Medicare FFS Part B claims, telehealth remains a used channel at scale (millions of beneficiaries per year), which is operationally important because Medicare intersects heavily with comorbid depression/anxiety, pain, and caregiver stress patterns that often present first as “consultation needs” rather than procedures. Macro conditions reinforce this: the system is supporting care demand for a ~ population and an economy with USD ~ trillion GDP, where mental health affects labor participation, disability claims, and downstream medical utilization—making virtual-first triage and continuity consults a practical capacity multiplier rather than a niche add-on.

Challenges

Reimbursement Volatility

Teleconsultation in the U.S. remains sensitive to policy and payment-rule timelines, creating operational risk for provider groups and platforms that staff virtual panels and invest in workflow redesign. HHS’s telehealth policy updates explicitly show that key Medicare flexibilities (such as allowing many Medicare telehealth services to be furnished broadly, including from the home) are extended only through specific end dates, which forces organizations to plan around renewal cycles and potential reversion of originating-site and eligible-provider rules. This volatility matters because claims-scale use is large: CMS reports ~ Medicare FFS Part B telehealth users in one year and ~ in 2023,—any reimbursement contraction would impact millions of beneficiary-care pathways and provider revenue integrity. The macro environment amplifies the stakes: with USD ~ trillion in national health spending, payers and regulators are simultaneously trying to expand access and constrain utilization growth, which can translate into shifting coverage criteria for teleconsultation modalities (video vs audio, behavioral vs non-behavioral, site-of-service constraints). For operators, this pushes investment toward reimbursement-resilient models (hybrid scheduling, specialty mix, employer contracts) but it remains a real market constraint.

Interstate Licensure Barriers

Teleconsultation scales fastest when clinicians can serve patients across state lines, but U.S. licensure remains state-based, producing friction in staffing models, on-call coverage, and multi-state patient retention. The practical outcome is that large virtual-care programs must maintain state-by-state credentialing operations, compact participation strategies, and compliance guardrails—raising operational complexity exactly when HRSA shortage indicators show the need for flexible capacity deployment: ~ primary care HPSAs affecting nearly ~ residents and requiring ~ additional primary care physicians to remove shortage designations. In a market where Medicare FFS Part B still shows millions of telehealth users annually, cross-state restrictions can become a hard scaling ceiling for specialty consults (dermatology, neurology, endocrinology), especially for rural-border communities. Macro context matters because the U.S. is a continental-scale economy (USD ~ trillion GDP) with large internal mobility; care-seeking does not neatly match state lines, so licensure friction directly shapes addressable virtual panels and network design.

Opportunities

Hospital-at-Home Expansion

Hospital-at-home programs expand the role of teleconsultation from “visit replacement” to “clinical command center,” where virtual physician coverage, remote rounding, escalation decisions, and specialist consults become integral to acute care delivered at home. CMS stated about ~ AHCAH discharges had occurred as of April and ~ hospitals were approved to participate, indicating real operational scale; CMS program data also shows that ~ hospitals were included but only ~ reported at least one discharge, which highlights the opportunity: teleconsultation vendors and health systems can help convert approvals into active throughput by providing standardized virtual staffing, pathways, and monitoring coordination. This is a “future growth” opportunity backed by current counts: the installed base of approved hospitals and cumulative discharges creates a buyer pool actively experimenting with hybrid acute models. Macro demand is supportive because the U.S. has ~ people and persistent provider shortages; shifting appropriate acute episodes to home settings while maintaining physician oversight via teleconsultation is one of the few scalable options to relieve inpatient bed pressure without building new bricks-and-mortar capacity.

Specialty Teleconsultation Scaling

Specialty teleconsultation (dermatology, neurology, endocrinology, oncology second opinions, maternal-fetal medicine triage) can scale faster than general primary care telehealth because it often fits well into consultative workflows: referral intake, chart review, targeted virtual assessment, and clear care-plan output back to the local clinician. The opportunity is supported by current, claims-scale utilization infrastructure: CMS shows ~ Medicare FFS Part B telehealth users in one year and ~ in 2023, meaning coverage and beneficiary behavior already support high-volume virtual consult routing in a major payer segment. Access gaps remain pronounced (HRSA shortage designations covering nearly ~ residents), and specialty access is typically more constrained than primary care in many rural and mid-sized markets—creating a strong business case for hub-and-spoke specialty networks that use teleconsultation as the front door and reserve in-person capacity for procedures. Macro conditions (U.S. GDP USD ~ trillion) support continued investment in specialty capacity models (health systems, payers, and employers) that can reduce delays, improve care coordination, and lower avoidable acute utilization—without relying on future market-size claims to justify investment.

Future Outlook

Over the next five years, the USA Teleconsultation Services Market is expected to expand as teleconsultation becomes a default routing layer for low-acuity care, behavioral access, and follow-up management. Growth will be shaped by tighter payer utilization management, deeper enterprise workflow integration, and increasing consumer expectations for “same-day digital access.” Platform differentiation will shift from simple visit delivery toward measurable clinical resolution, downstream cost impact, and integrated hybrid pathways that coordinate virtual and in-person care seamlessly.

Major Players

- Teladoc Health

- Amwell

- MDLive

- Doctor On Demand

- Included Health

- Talkspace

- BetterHelp

- Amazon Clinic

- CVS Health Virtual Care

- Optum Virtual Care

- Kaiser Permanente Telehealth

- One Medical

- PlushCare

- Sesame

Key Target Audience

- Health systems and integrated delivery networks

- Health insurers and managed care organizations

- Self-insured employers and benefits decision-makers

- Digital health platforms and virtual care operators

- Provider groups and specialty practices

- Pharmacy and retail health operators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We begin by mapping the teleconsultation ecosystem across payers, health systems, employer buyers, clinician networks, and platform vendors. Secondary research is used to define the market boundary, service taxonomy, and demand drivers. This step identifies revenue pools and operational levers that shape utilization and unit economics.

Step 2: Market Analysis and Construction

We compile historical market signals and build the market model by triangulating platform revenues, buyer-channel adoption, and service line mix. The analysis includes normalization for modality and specialty differences, along with validation of how teleconsultation is embedded into benefits and clinical workflows. Output is structured to reflect buyer-led demand formation.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses using expert interviews with payer executives, provider operations leaders, virtual-care platform managers, and clinical directors. These discussions are conducted via structured interviews to refine assumptions around utilization, network capacity, pricing models, and contracting patterns. Insights are used to reconcile differences across data sources.

Step 4: Research Synthesis and Final Output

We synthesize findings into a consistent market narrative supported by triangulated sizing and segmentation logic. Cross-checks are performed against regulatory developments, enterprise adoption patterns, and platform strategy shifts. The final deliverable is reviewed for internal consistency across market size, segmentation, competition, and outlook.

- Executive Summary

- Research Methodology (Market Definitions and Scope, Industry Abbreviations, Teleconsultation Service Taxonomy, Market Sizing Framework, Bottom-Up Revenue Aggregation, Top-Down Demand Validation, Reimbursement Mapping Logic, Primary Interview Structure with Providers, Payers and Platforms, Data Triangulation Model, Assumptions and Limitations)

- Definition and Scope

- Market Evolution and Care-Delivery Shift

- Structural Role of Teleconsultation in the US Healthcare System

- Industry Lifecycle and Maturity Assessment

- Teleconsultation Value Chain and Stakeholder Flow

- Growth Drivers

Provider Capacity Constraints

Mental Health Demand Load

Chronic Disease Management Burden

Cost Containment Pressures

Care Access Gaps - Challenges

Reimbursement Volatility

Interstate Licensure Barriers

Clinical Quality Standardization

Data Privacy Compliance

Provider Burnout Risk - Opportunities

Hospital-at-Home Expansion

Specialty Teleconsultation Scaling

Employer Health Cost Optimization

Rural Access Programs - Trends

Hybrid Care Models

AI-Assisted Triage

Asynchronous Care Adoption

Integrated EHR-Telehealth Workflows - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Consultation Volumes, 2019–2024

- By Average Reimbursement per Encounter, 2019–2024

- By Platform Monetization Model, 2019–2024

- By Fleet Type (in Value %)

General Primary Care Teleconsultations

Specialty Care Teleconsultations

Mental & Behavioral Health Consultations

Chronic Care Follow-Up Consultations

Acute Episodic and Urgent Virtual Visits - By Application (in Value %)

Video-Based Teleconsultation

Audio-Only Teleconsultation

Chat-Based or Asynchronous Consultation

Hybrid Tele-In-Person Care Models - By Technology Architecture (in Value %)

Hospital-Based Teleconsultation

Physician Group and Clinic-Led Teleconsultation

Direct-to-Consumer Virtual Care Platforms

Employer-Sponsored Virtual Care Programs - By Connectivity Type (in Value %)

Fee-for-Service Reimbursement

Value-Based and Outcome-Linked Payments

Subscription-Based Consumer Plans

Employer and B2B Contracted Models

Cash-Pay and Self-Pay Models - By End-Use Industry (in Value %)

Patients and Individual Consumers

Hospitals and Health Systems

Physician Practices

Employers and Corporate Buyers

Government and Public Health Programs - By Region (in Value %)

Northeast

Midwest

South

West

- Market Share Analysis by Revenue and Consultation Volume

- Cross Comparison Parameters (Platform Clinical Breadth, Average Consultation Resolution Rate, Provider Network Size, State Licensure Coverage, Payer Contracting Depth, EHR Integration Capability, Pricing and Monetization Model, Data Security and Compliance Infrastructure)

- SWOT Analysis of Major Players

- Pricing and Reimbursement Benchmarking

- Detailed Profiles of Major Companies

Teladoc Health

Amwell

MDLive

Doctor On Demand

PlushCare

Included Health

Talkspace

BetterHelp

Ro

Sesame

Amazon Clinic

CVS Health Virtual Care

UnitedHealth Group

Kaiser Permanente Telehealth

One Medical

- Demand Intensity and Consultation Frequency

- Budget Allocation and Cost Avoidance Impact

- Workflow Integration and Adoption Barriers

- Needs, Expectations and Pain-Point Mapping

- Care Decision-Making and Channel Preference

- By Value, 2025–2030

- By Consultation Volumes, 2025–2030

- By Reimbursement Mix, 2025–2030