Market Overview

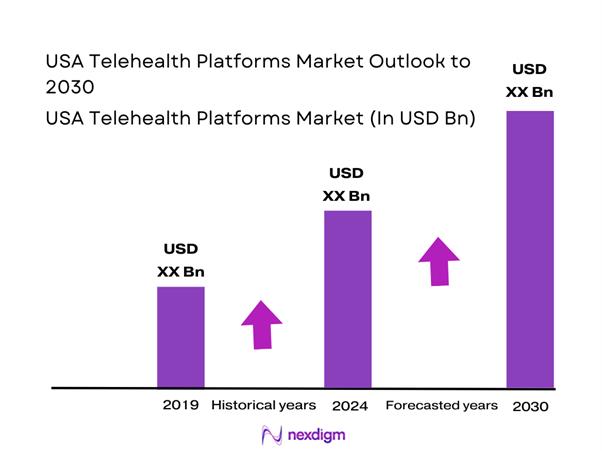

The USA Telehealth Platforms market is valued at USD ~ billion, reflecting the rapid normalization of virtual care as a standard mode of clinical delivery. Telehealth platforms support synchronous and asynchronous interactions, remote monitoring integration, and enterprise workflow management, enabling providers to expand access while optimizing capacity. Demand is driven by chronic disease prevalence, behavioral health needs, and the shift toward value-based care models. Platforms increasingly function as operating systems for virtual-first strategies, embedding clinical, administrative, and financial workflows into unified environments that support scalability and continuity of care.

Major metropolitan regions with dense provider networks and advanced digital infrastructure dominate platform adoption due to higher patient volumes, integrated delivery systems, and payer alignment. Innovation leadership is reinforced by technology ecosystems, health system concentration, and venture-backed innovation clusters that accelerate platform development and deployment. Influence from global technology supply chains and standards bodies shapes platform architecture, cybersecurity posture, and interoperability expectations, even as deployment and revenue generation remain entirely domestic.

Market Segmentation

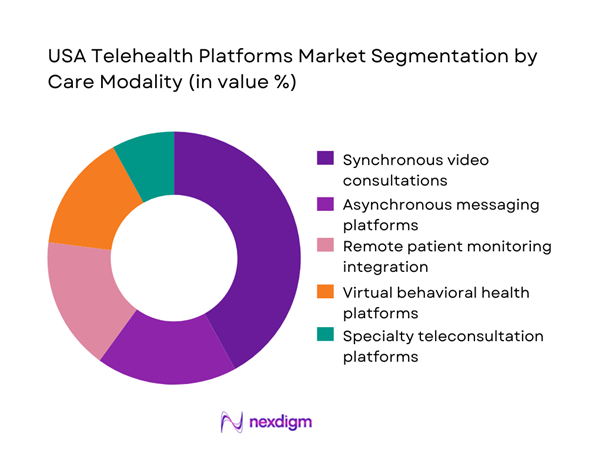

By Care Modality

Synchronous video consultations dominate the market due to their close alignment with traditional clinical encounters and their acceptance across providers, payers, and patients. These platforms enable real-time diagnosis, treatment planning, and continuity of care, making them suitable for primary, specialty, and urgent care use cases. Video-based interactions integrate seamlessly with scheduling, documentation, and billing workflows, supporting reimbursement parity and clinical accountability. Their adaptability across devices and settings reinforces utilization, while patient familiarity accelerates repeat usage. As hybrid care models mature, synchronous platforms act as the anchor modality, around which asynchronous messaging and monitoring services are layered.

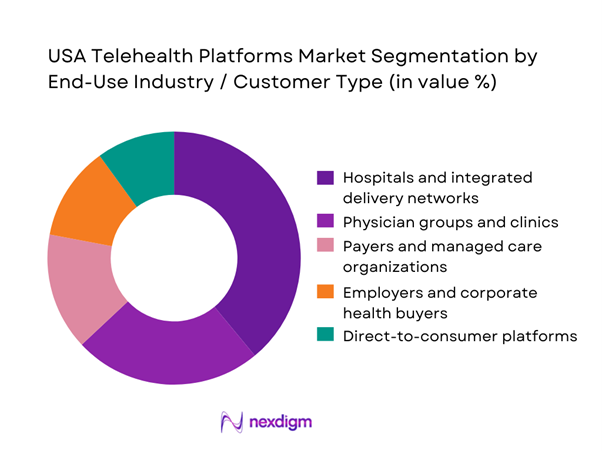

By End-Use Industry / Customer Type

Hospitals and integrated delivery networks represent the largest end-use segment as they deploy telehealth platforms to extend service lines, manage capacity, and support continuity across inpatient and outpatient settings. These buyers prioritize enterprise-grade scalability, security compliance, and deep EHR integration, favoring comprehensive platforms over point solutions. Telehealth enables system-wide standardization of virtual workflows, supports specialty consults, and enhances discharge and follow-up processes. As value-based contracts expand, large providers leverage telehealth platforms to reduce readmissions and improve access, reinforcing their dominance as primary revenue contributors.

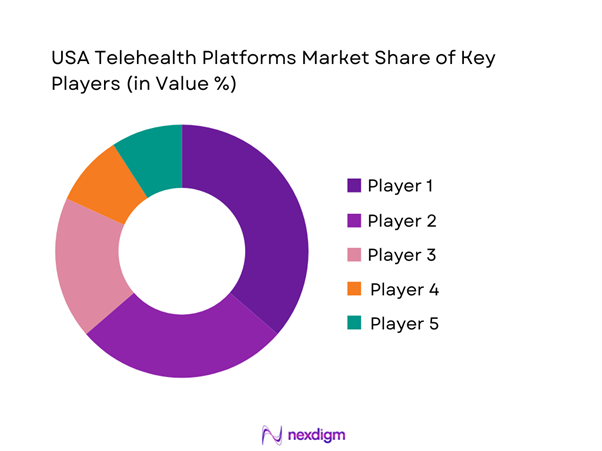

Competitive Landscape

The USA TELEHEALTH PLATFORMS market is dominated by a few major players, including Teladoc Health and global or regional brands like Amwell, MDLIVE, and Doctor On Demand. This consolidation highlights the significant influence of these key companies.

| Company | Est. Year | HQ | Core platform modules | Primary buyer segments | Integration & interoperability | Security / compliance posture | Go-to-market model | Key differentiator |

| Teladoc Health | 2002 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Amwell | 2006 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Included Health (Doctor On Demand) | 2011 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| MDLive (Evernorth) | 2009 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Zoom (for Healthcare) | 2011 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

USA Telehealth Platforms Market Analysis

Growth Drivers

Expansion of virtual-first care models

Virtual-first care strategies adopted by providers, payers, and employers are structurally increasing reliance on telehealth platforms as the primary access layer for healthcare delivery. In these models, virtual visits function as the default point of entry, with in-person care reserved for escalation or procedures. Telehealth platforms enable intake, triage, care navigation, and follow-up within a single digital workflow, reducing unnecessary physical encounters and optimizing clinician capacity. This approach improves access, particularly for behavioral health and primary care, while supporting cost containment and utilization management objectives. As virtual-first models mature, platform investment shifts from experimental spending to core infrastructure funding.

Rising chronic disease burden

The growing prevalence of chronic conditions such as diabetes, cardiovascular disease, and respiratory disorders is driving sustained utilization of telehealth platforms. Chronic care management requires regular check-ins, medication adherence monitoring, and coordination among multiple care providers. Telehealth platforms support these needs through scheduled virtual follow-ups, asynchronous messaging, and integration with remote monitoring tools. This continuous engagement model reduces missed visits and delays in intervention. As healthcare systems move toward proactive and preventive care frameworks, telehealth platforms become essential for managing large chronic populations efficiently, reinforcing long-term demand across provider and payer segments.

Challenges

Clinical workflow integration complexity

Embedding telehealth platforms into existing clinical workflows remains a significant operational challenge, especially for large health systems with fragmented IT environments. Misalignment between telehealth tools and electronic health records, scheduling systems, and documentation processes can increase clinician workload rather than reduce it. Poor integration disrupts care continuity, complicates billing and coding workflows, and weakens clinician adoption. Customization requirements across specialties further add complexity. Without seamless interoperability and workflow alignment, telehealth platforms risk being perceived as parallel systems, slowing enterprise-wide rollout and limiting realized productivity gains.

Data privacy and cybersecurity risk

Telehealth platforms handle sensitive clinical, behavioral, and personal data across cloud-based and distributed environments, elevating exposure to cybersecurity threats. Risks include unauthorized access, data breaches, and vulnerabilities introduced through third-party integrations and connected devices. Maintaining compliance with healthcare privacy standards requires continuous investment in security architecture, monitoring, and governance. For enterprise buyers, security posture and audit readiness are critical procurement criteria. As cyber threats grow more sophisticated, vendors must balance innovation speed with robust protection measures, increasing operational complexity and ongoing compliance costs.

Opportunities

Enterprise platform consolidation

Healthcare organizations are increasingly seeking to reduce vendor fragmentation by consolidating multiple virtual care tools into unified telehealth platforms. Managing numerous point solutions creates integration burdens, data silos, and governance challenges. This trend favors vendors that offer modular platforms capable of supporting urgent care, primary care, behavioral health, and remote monitoring within a single architecture. Consolidation improves data continuity, security oversight, and contract efficiency for buyers. For platform vendors, this creates opportunities to expand wallet share, deepen customer lock-in, and position themselves as long-term strategic partners.

AI-driven clinical automation

The integration of artificial intelligence into telehealth platforms presents significant opportunities to enhance efficiency and differentiation. AI-enabled features such as automated triage, symptom assessment, clinical documentation support, and care pathway recommendations reduce administrative burden on clinicians. These tools improve visit throughput, consistency of care, and patient experience. As workforce shortages persist, automation becomes a critical lever for scaling virtual care delivery. Vendors that successfully embed explainable, clinically aligned AI into workflows can deliver measurable productivity gains, strengthening their value proposition to enterprise healthcare buyers.

Future Outlook

The market is expected to evolve toward consolidated, enterprise-grade platforms that support hybrid care delivery, value-based outcomes, and automation at scale. Strategic differentiation will center on interoperability depth, AI enablement, and the ability to align virtual care with longitudinal population health strategies.

Major Players

- Teladoc Health

- Amwell

- MDLIVE

- Doctor On Demand

- Included Health

- Talkspace

- PlushCare

- Zocdoc

- Brightside Health

- eClinicalWorks

- Epic Systems

- Oracle Health

- CareCloud

Key Target Audience

- Hospitals and integrated delivery networks

- Physician groups and specialty clinics

- Payers and managed care organizations

- Employer-sponsored health program buyers

- Digital health platform providers

- Investments and venture capitalist firms

- Government and regulatory bodies (USA-specific)

- Healthcare IT system integrators

Research Methodology

Step 1: Identification of Key Variables

Platform revenue streams, care modalities, deployment models, and buyer segments were identified to define the analytical scope and boundaries of the market.

Step 2: Market Analysis and Construction

Demand drivers, adoption patterns, and service mix dynamics were analyzed to construct a consistent market framework aligned with care delivery models.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were tested through structured discussions with platform vendors, healthcare providers, and procurement stakeholders to validate directional insights.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a cohesive narrative, integrating segmentation, competition, and strategic implications into a client-ready deliverable.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Telehealth Platform Usage and Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- USA Healthcare Service Delivery Architecture

- Growth Drivers

Expansion of virtual-first care models

Rising chronic disease burden

Provider capacity optimization needs

Consumer demand for convenient access

Payer reimbursement normalization - Challenges

Clinical workflow integration complexity

Data privacy and cybersecurity risk

Provider adoption resistance

Fragmented reimbursement structures

Platform differentiation saturation - Opportunities

Enterprise platform consolidation

Value-based care enablement

AI-driven triage and automation

Rural and underserved population reach

Employer-sponsored virtual care expansion - Trends

Platform convergence with EHR ecosystems

Virtual behavioral health scaling

Hybrid care delivery standardization

Remote monitoring integration

Consumer-grade user experience design - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Platform License & Subscription Revenues, 2019–2024

- By Services & Implementation Revenues, 2019–2024

- By Care Modality (in Value %)

Synchronous video consultations

Asynchronous messaging platforms

Remote patient monitoring integration

Virtual behavioral health platforms

Specialty teleconsultation platforms - By Clinical Focus Area (in Value %)

Primary care platforms

Mental and behavioral health platforms

Chronic disease management platforms

Acute and urgent care platforms

Specialty care platforms - By Technology / Platform Type (in Value %)

Standalone telehealth platforms

EHR-integrated telehealth modules

Cloud-native telehealth suites

Mobile-first telehealth platforms

AI-enabled clinical workflow platforms - By Deployment / Delivery Model (in Value %)

Cloud-based SaaS

Hybrid cloud deployment

Enterprise on-premise - By End-Use Industry / Customer Type (in Value %)

Hospitals and integrated delivery networks

Physician groups and clinics

Payers and managed care organizations

Employers and corporate health buyers

Direct-to-consumer platforms - By Region (in Value %)

Northeast

Midwest

South

West

- Competition ecosystem overview

- Cross Comparison Parameters (platform scalability, EHR interoperability depth, clinical workflow integration, security compliance posture, AI-enabled automation, reimbursement support capability, specialty coverage breadth, enterprise deployment flexibility)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Teladoc Health

Amwell

MDLIVE

Doctor On Demand

American Well

Included Health

Talkspace

Brightside Health

PlushCare

Zocdoc

eClinicalWorks

Epic Systems

Oracle Health

CareCloud

SimplePractice

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Platform License & Subscription Revenues, 2025–2030

- By Services & Implementation Revenues, 2025–2030